Key Insights

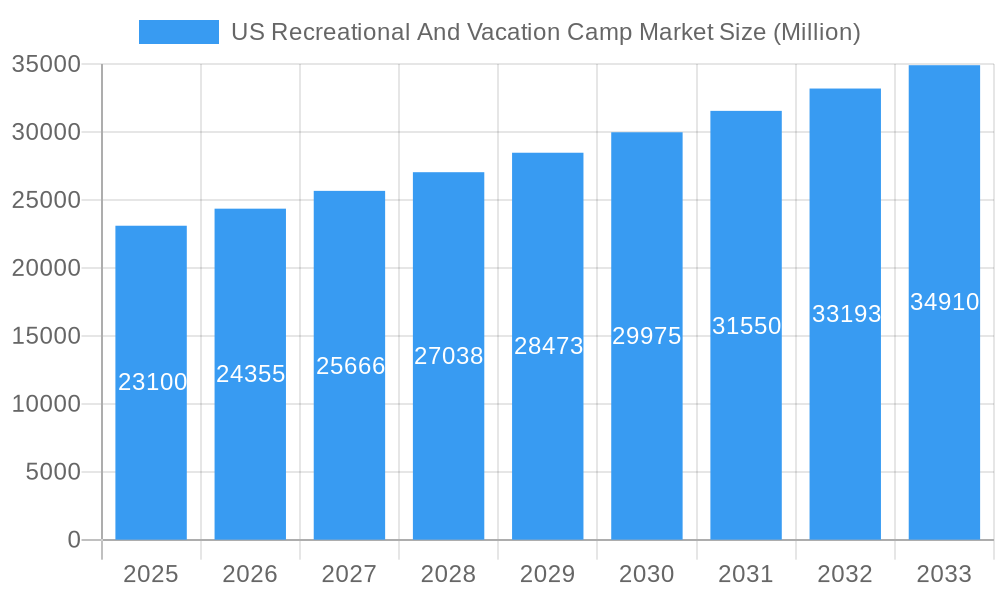

The US recreational and vacation camp market, valued at $23.10 billion in 2025, is projected to experience robust growth, exceeding a 5% CAGR through 2033. This expansion is driven by several key factors. Firstly, a rising disposable income, coupled with a growing preference for experiential travel and outdoor activities, fuels demand for diverse camp options catering to children and adults alike. The market segments encompassing leisure, adventure, and educational camps all contribute significantly to this growth. The increasing popularity of wellness tourism further boosts the market, with resorts offering holistic experiences attracting a wider demographic. Furthermore, the strong emphasis on family bonding and creating lasting memories contributes to the rising popularity of family-oriented camp experiences. However, potential constraints include seasonality, fluctuating fuel prices impacting travel costs, and the need for continuous investment in infrastructure and safety measures to maintain high standards. Competitive pressures also exist among established players like Great Wolf Lodge, Expedia Group, and niche operators offering unique experiences. Regional variations are anticipated, with the Northeast and West potentially showing stronger growth due to established tourism infrastructure and diverse natural landscapes.

US Recreational And Vacation Camp Market Market Size (In Billion)

The market's segmentation plays a vital role in understanding its growth trajectory. The "leisure camp" segment, offering relaxed activities and family-friendly environments, forms a substantial portion of the market. Adventure camps, targeting thrill-seekers, and educational camps, focusing on learning and skill development, cater to distinct demographics, each contributing significantly to the overall market size. The adult segment is witnessing increased growth, reflecting a shift towards adventure travel and wellness retreats amongst adults. Geographic segmentation reveals regional variations in market penetration and growth potential. The robust presence of established players and new entrants ensures market competitiveness, driving innovation and enhancing the overall customer experience. The market's future growth trajectory is intrinsically tied to economic conditions, evolving travel trends, and continued investment in infrastructure and safety standards within the camping sector.

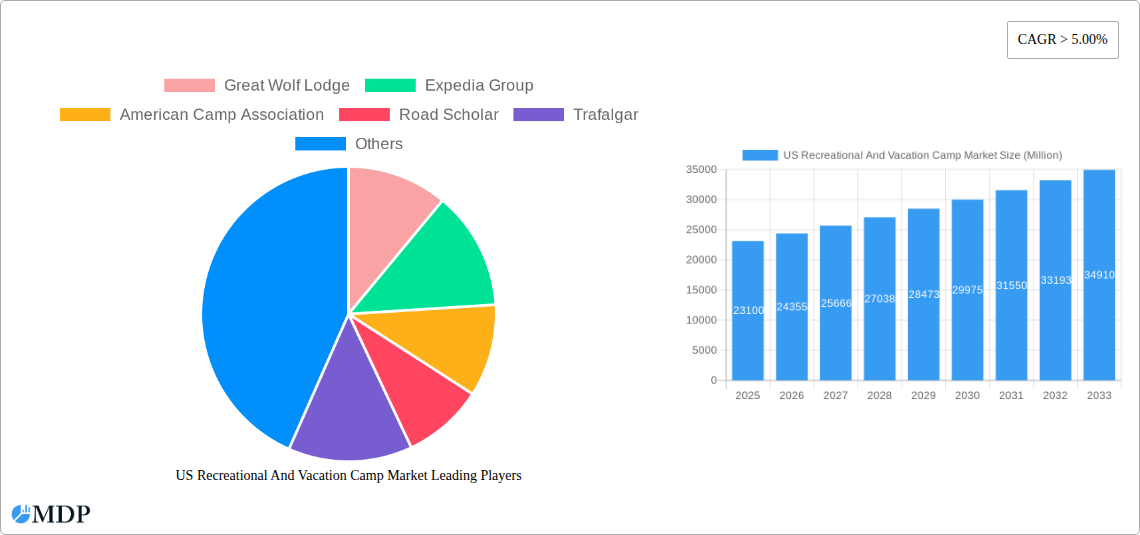

US Recreational And Vacation Camp Market Company Market Share

US Recreational and Vacation Camp Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Recreational and Vacation Camp market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry stakeholders, investors, and anyone seeking to understand the growth trajectory of this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

US Recreational And Vacation Camp Market Market Dynamics & Concentration

The US recreational and vacation camp market exhibits a moderately concentrated landscape with several large players and numerous smaller, niche operators. Market share is primarily distributed amongst established brands, with the top 5 players accounting for approximately xx% of the total revenue in 2024. Innovation in camp experiences, fueled by technological advancements and evolving consumer preferences, is a key driver of growth. Stringent safety regulations and environmental protection laws form the regulatory framework, influencing operational costs and sustainability practices. Substitute activities, such as staycations or international travel, pose competitive threats, influencing market share dynamics. End-user preferences are shifting towards unique, personalized experiences, impacting service offerings and pricing strategies. The market has witnessed xx M&A deals in the historical period (2019-2024), indicating consolidation and strategic expansion within the industry.

- Market Concentration: Top 5 players hold xx% market share (2024).

- Innovation Drivers: Technological advancements (e.g., online booking platforms, virtual reality experiences).

- Regulatory Framework: Stringent safety and environmental regulations.

- Product Substitutes: Staycations, international travel, other leisure activities.

- End-User Trends: Demand for personalized and unique experiences.

- M&A Activity: xx deals in 2019-2024.

US Recreational And Vacation Camp Market Industry Trends & Analysis

The US recreational and vacation camp market is experiencing robust growth, driven by increasing disposable incomes, a growing preference for outdoor activities, and a rising demand for educational and experiential travel. The market is also witnessing technological disruptions, with online booking platforms and digital marketing strategies transforming the way camps are marketed and booked. Consumer preferences are shifting towards sustainable and eco-friendly camps, driving the adoption of green initiatives within the industry. Competitive dynamics are shaped by pricing strategies, brand loyalty, and the unique offerings of each camp. The market penetration of online booking systems is steadily increasing, while the adoption of technology-driven activities is also influencing the growth of certain segments.

- Market Growth Drivers: Rising disposable incomes, increasing demand for outdoor activities, growing interest in experiential travel.

- Technological Disruptions: Online booking platforms, digital marketing, virtual reality experiences.

- Consumer Preferences: Demand for sustainable and personalized experiences.

- Competitive Dynamics: Pricing strategies, brand loyalty, unique service offerings.

- CAGR (2025-2033): xx%

- Market Penetration (Online Bookings): xx% (2024)

Leading Markets & Segments in US Recreational And Vacation Camp Market

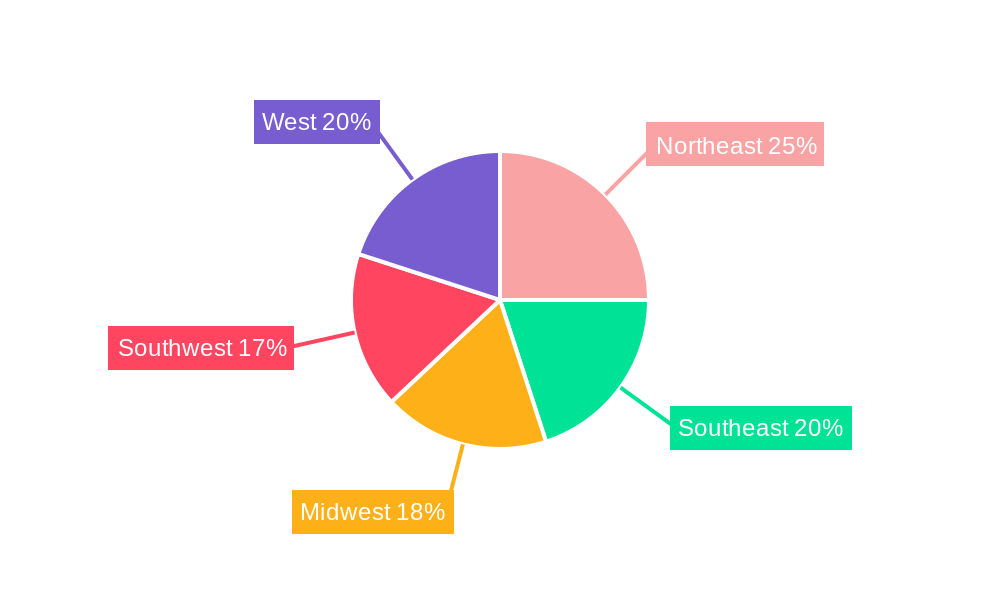

The Northeast region of the US holds a significant share of the recreational and vacation camp market, driven by a high density of population, established infrastructure, and a diverse range of camp offerings. The Children segment accounts for the largest market share by application, reflecting the strong demand for summer camps and other recreational programs for young people. Within the type segment, Leisure camps hold the largest market share, reflecting the broad appeal of recreational activities.

Key Drivers:

- Northeast Region: High population density, established infrastructure, diverse offerings.

- Children Segment: Strong demand for summer camps and youth programs.

- Leisure Camps: Broad appeal of recreational activities.

Dominance Analysis:

The dominance of the Northeast is attributable to its large population base and strong tourism infrastructure. The high demand for children's camps reflects cultural trends and the growing recognition of the importance of outdoor activities for children's development. The wide appeal of leisure camps indicates a significant focus on recreational activities and relaxation within the market.

US Recreational And Vacation Camp Market Product Developments

Recent product innovations in the US recreational and vacation camp market include the integration of technology into camp activities, such as virtual reality experiences and esports programs. These advancements enhance the appeal of camps to a broader audience and provide more engaging and educational opportunities. Many camps are focusing on niche markets and unique experiences to differentiate themselves from competitors, reflecting evolving consumer preferences for personalized adventures.

Key Drivers of US Recreational And Vacation Camp Market Growth

The US recreational and vacation camp market's growth is fueled by several key factors. Increasing disposable incomes enable more families to afford camp experiences. The growing awareness of the importance of outdoor recreation for physical and mental well-being drives demand for both children’s and adults’ camps. Technological advancements, such as online booking systems and virtual reality experiences, are enhancing the overall camp experience. Favorable government policies supporting outdoor recreation also contribute to the market’s expansion.

Challenges in the US Recreational And Vacation Camp Market Market

The US recreational and vacation camp market faces challenges, including seasonality and fluctuating demand, affecting operational profitability. Competition from alternative leisure activities and the cost of regulatory compliance also pose significant hurdles for camp operators. Supply chain disruptions can impact the availability of essential goods and services, while maintaining adequate staffing levels can also be challenging.

Emerging Opportunities in US Recreational And Vacation Camp Market

The market offers several opportunities for expansion. The integration of technology into camp experiences can enhance engagement and attract a broader clientele. Strategic partnerships with other businesses in the tourism sector can create wider reach and access to new customers. Expansion into niche markets, such as adventure camps or eco-friendly camps, can capture growing consumer segments.

Leading Players in the US Recreational And Vacation Camp Market Sector

- Great Wolf Lodge

- Expedia Group

- American Camp Association

- Road Scholar

- Trafalgar

- Centre Parcs

- Outward Bound USA

- Camp Bow Wow

- Adventure Camps by Adventures on the George

- Canyon Ranch Wellness Resorts

- Young Men's Christian Association

Key Milestones in US Recreational And Vacation Camp Market Industry

- January 2024: Online reservations opened for Minnewaska State Park Preserve's Sam F. Pryor III Campground, boosting accessibility and potentially increasing bookings.

- January 2024: Registrations opened for UC Berkeley's esports-focused summer camp, reflecting the growing interest in technology-integrated youth programs and potentially expanding the market's reach.

Strategic Outlook for US Recreational And Vacation Camp Market Market

The US recreational and vacation camp market presents a strong potential for growth. Strategic investments in technology and infrastructure, coupled with a focus on sustainable and personalized experiences, are key to maximizing market share and profitability. Expansion into niche segments and strategic partnerships can unlock new growth opportunities and ensure the long-term success of camp operators.

US Recreational And Vacation Camp Market Segmentation

-

1. Type

- 1.1. Leisure Camp

- 1.2. Adventure Camp

- 1.3. Educational Camp

-

2. Application

- 2.1. Children

- 2.2. Adults

US Recreational And Vacation Camp Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Recreational And Vacation Camp Market Regional Market Share

Geographic Coverage of US Recreational And Vacation Camp Market

US Recreational And Vacation Camp Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Wellness and Relaxation; Adventure and Recreation Activities Driving the Market

- 3.3. Market Restrains

- 3.3.1. High Operating Cost Barrier to the Market

- 3.4. Market Trends

- 3.4.1. Tourism Industry Acting as a Catalyst to the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Recreational And Vacation Camp Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leisure Camp

- 5.1.2. Adventure Camp

- 5.1.3. Educational Camp

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Children

- 5.2.2. Adults

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Recreational And Vacation Camp Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Leisure Camp

- 6.1.2. Adventure Camp

- 6.1.3. Educational Camp

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Children

- 6.2.2. Adults

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Recreational And Vacation Camp Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Leisure Camp

- 7.1.2. Adventure Camp

- 7.1.3. Educational Camp

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Children

- 7.2.2. Adults

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Recreational And Vacation Camp Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Leisure Camp

- 8.1.2. Adventure Camp

- 8.1.3. Educational Camp

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Children

- 8.2.2. Adults

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Recreational And Vacation Camp Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Leisure Camp

- 9.1.2. Adventure Camp

- 9.1.3. Educational Camp

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Children

- 9.2.2. Adults

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Recreational And Vacation Camp Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Leisure Camp

- 10.1.2. Adventure Camp

- 10.1.3. Educational Camp

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Children

- 10.2.2. Adults

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Great Wolf Lodge

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Expedia Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 American Camp Association

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Road Scholar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trafalgar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Centre Parcs

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Outward Bound USA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Camp Bow Wow**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adventure Camps by Adventures on the George

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Canyon Ranch Wellness Resorts

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Young Men's Christan Association

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Great Wolf Lodge

List of Figures

- Figure 1: Global US Recreational And Vacation Camp Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Recreational And Vacation Camp Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America US Recreational And Vacation Camp Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Recreational And Vacation Camp Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Recreational And Vacation Camp Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Recreational And Vacation Camp Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Recreational And Vacation Camp Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Recreational And Vacation Camp Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America US Recreational And Vacation Camp Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America US Recreational And Vacation Camp Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South America US Recreational And Vacation Camp Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America US Recreational And Vacation Camp Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Recreational And Vacation Camp Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Recreational And Vacation Camp Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe US Recreational And Vacation Camp Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe US Recreational And Vacation Camp Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe US Recreational And Vacation Camp Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe US Recreational And Vacation Camp Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Recreational And Vacation Camp Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Recreational And Vacation Camp Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa US Recreational And Vacation Camp Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa US Recreational And Vacation Camp Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa US Recreational And Vacation Camp Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa US Recreational And Vacation Camp Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Recreational And Vacation Camp Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Recreational And Vacation Camp Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific US Recreational And Vacation Camp Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific US Recreational And Vacation Camp Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific US Recreational And Vacation Camp Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific US Recreational And Vacation Camp Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Recreational And Vacation Camp Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global US Recreational And Vacation Camp Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Recreational And Vacation Camp Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Recreational And Vacation Camp Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the US Recreational And Vacation Camp Market?

Key companies in the market include Great Wolf Lodge, Expedia Group, American Camp Association, Road Scholar, Trafalgar, Centre Parcs, Outward Bound USA, Camp Bow Wow**List Not Exhaustive, Adventure Camps by Adventures on the George, Canyon Ranch Wellness Resorts, Young Men's Christan Association.

3. What are the main segments of the US Recreational And Vacation Camp Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Wellness and Relaxation; Adventure and Recreation Activities Driving the Market.

6. What are the notable trends driving market growth?

Tourism Industry Acting as a Catalyst to the Market.

7. Are there any restraints impacting market growth?

High Operating Cost Barrier to the Market.

8. Can you provide examples of recent developments in the market?

January 2024: Reservations started online for Minnewaska’s only campground (Sam F. Pryor III) in Shawangunk, beginning each year in March. It is just 94 miles north of New York City and sits on the Shawangunk ridge at over 2,000 feet (610 meters) above sea level, surrounded by rolling hills and rocky terrain, offering plenty of room for hiking, biking, and taking in the views.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Recreational And Vacation Camp Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Recreational And Vacation Camp Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Recreational And Vacation Camp Market?

To stay informed about further developments, trends, and reports in the US Recreational And Vacation Camp Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence