Key Insights

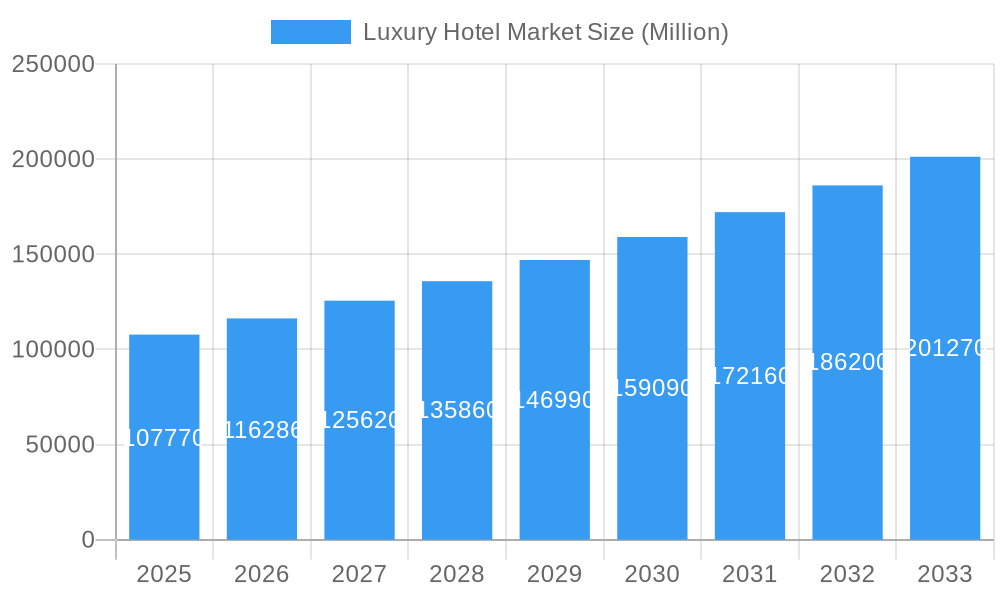

The global luxury hotel market, valued at $107.77 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.90% from 2025 to 2033. This expansion is fueled by several key factors. Increased disposable incomes in emerging economies, coupled with a rising preference for experiential travel and luxury services, are significantly boosting demand. The growing popularity of curated travel experiences, personalized services, and unique amenities offered by luxury hotels further contributes to market growth. Furthermore, strategic partnerships between luxury hotel brands and high-end travel agencies are expanding market reach and enhancing customer loyalty. The segment is witnessing innovation in sustainable practices and technology integration, further solidifying its appeal to environmentally conscious and tech-savvy travelers. Competition among established luxury hotel chains is intensifying, leading to continuous improvements in service quality, amenities, and guest experiences.

Luxury Hotel Market Market Size (In Billion)

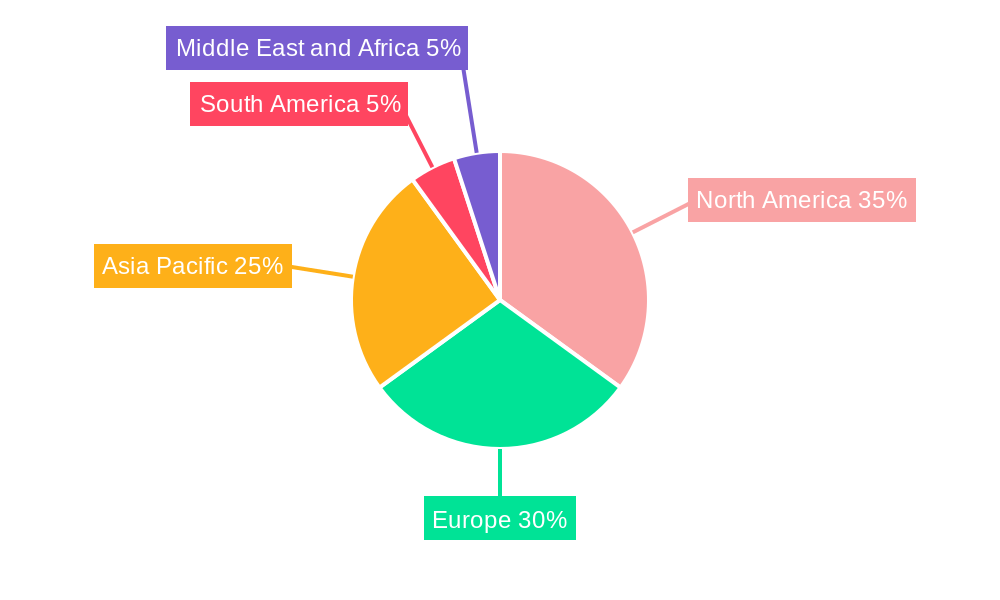

Geographical distribution reveals North America and Europe as dominant regions, but Asia-Pacific is expected to witness the most significant growth due to rapid economic development and a burgeoning middle class with increasing discretionary spending. However, macroeconomic instability, geopolitical uncertainties, and potential fluctuations in currency exchange rates pose significant challenges to the consistent market growth. Nevertheless, the luxury hotel sector is well-positioned to continue its upward trajectory, capitalizing on evolving consumer preferences and the ongoing quest for exceptional travel experiences. The increasing focus on wellness and personalized experiences will continue to drive innovation within the sector, ensuring its continued success in the years to come. The diverse range of service types, including business hotels, airport hotels, suite hotels, resorts, and other specialized offerings, caters to a broad spectrum of luxury travelers, ensuring market diversification and resilience.

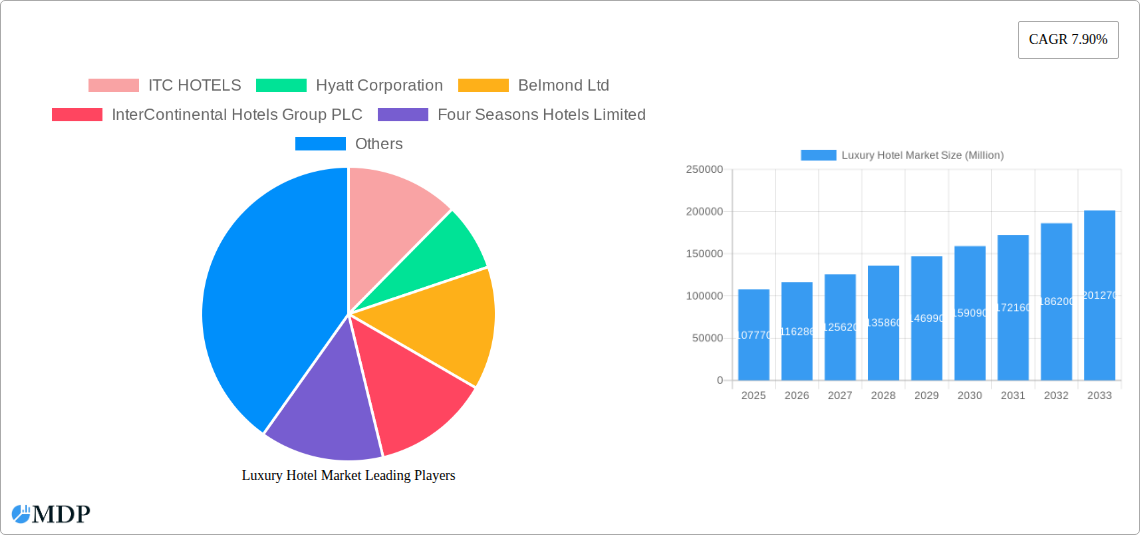

Luxury Hotel Market Company Market Share

Luxury Hotel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global luxury hotel market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market dynamics, key trends, leading players, and future growth opportunities, with a detailed forecast spanning from 2019 to 2033. The study period is 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period is 2019-2024. This report uses Million for all values.

Luxury Hotel Market Market Dynamics & Concentration

The luxury hotel market is characterized by high concentration, with a few major players commanding significant market share. The market share of the top 5 players is estimated at xx%. Innovation, primarily driven by technological advancements in guest experience and operational efficiency, plays a crucial role. Regulatory frameworks vary across regions, impacting operational costs and expansion strategies. Product substitutes, such as luxury villas and private rentals, pose a moderate competitive threat. End-user trends, including a growing preference for personalized experiences and sustainable practices, shape product development and marketing strategies. Mergers and acquisitions (M&A) activity remains significant, with xx M&A deals recorded in the last 5 years.

- Market Concentration: High, with top 5 players holding approximately xx% of the market share.

- Innovation Drivers: Technological advancements in guest experience, operational efficiency, and sustainable practices.

- Regulatory Frameworks: Vary significantly across regions, impacting operating costs and expansion.

- Product Substitutes: Luxury villas and private rentals present a moderate competitive threat.

- End-User Trends: Increasing demand for personalized experiences and sustainable travel options.

- M&A Activity: Significant, with xx major deals concluded in the past five years.

Luxury Hotel Market Industry Trends & Analysis

The luxury hotel market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising disposable incomes in emerging markets, increased preference for luxury travel experiences, and technological advancements improving guest experiences. Technological disruptions, such as the rise of online booking platforms and personalized service technologies, are reshaping the competitive landscape. Consumer preferences shift toward personalized experiences, wellness offerings, and sustainability initiatives. Intense competition among established players necessitates continuous innovation and strategic partnerships. Market penetration in key regions is steadily increasing, with xx% saturation in North America and xx% in Asia-Pacific as of 2024.

Leading Markets & Segments in Luxury Hotel Market

The Asia-Pacific region currently dominates the luxury hotel market, driven by robust economic growth, expanding middle class, and increasing tourism. Within this region, China and Japan are key drivers. Europe follows as a significant market, particularly in Western Europe due to its established tourism infrastructure and high-spending tourists. Among service types, Resorts and Business Hotels hold the largest market share, each accounting for approximately xx% of the total market in 2024.

- Key Drivers in Asia-Pacific:

- Rapid economic growth and expanding middle class.

- Significant growth in inbound and outbound tourism.

- Development of sophisticated tourism infrastructure.

- Key Drivers in Europe:

- Well-established tourism industry with long-standing history.

- High concentration of luxury brands and destinations.

- Strong spending power of European and international tourists.

- Dominant Service Types: Resorts and Business Hotels.

Luxury Hotel Market Product Developments

Recent product innovations in the luxury hotel market focus on enhancing guest experience through personalized services, technological integration, and sustainable practices. This includes smart room technologies, personalized concierge services via mobile apps, and the integration of wellness and fitness facilities. These developments improve guest comfort, streamline operations, and enhance competitive positioning.

Key Drivers of Luxury Hotel Market Growth

Several factors contribute to the growth of the luxury hotel market. These include: increasing disposable incomes, especially in emerging economies, boosting travel and leisure spending; growing preference for luxurious and personalized travel experiences; and technological advancements that personalize service and enhance operational efficiency. Favorable government regulations promoting tourism also contribute to market growth.

Challenges in the Luxury Hotel Market Market

The luxury hotel market faces several challenges, including intense competition, economic fluctuations that can affect discretionary spending, and increasing operating costs like labor and energy. Supply chain disruptions can affect the availability of goods and services. Moreover, stringent regulatory compliance requirements can pose operational hurdles. These factors can negatively impact profitability and market expansion.

Emerging Opportunities in Luxury Hotel Market

Several opportunities exist for growth in the luxury hotel market. Leveraging technological advancements for personalized guest experiences creates a competitive edge. Strategic partnerships with luxury brands and travel agencies expand market reach. Expansion into emerging markets with rising disposable incomes presents substantial growth potential. Focus on sustainable practices and wellness offerings caters to evolving consumer preferences.

Leading Players in the Luxury Hotel Market Sector

- ITC HOTELS

- Hyatt Corporation

- Belmond Ltd

- InterContinental Hotels Group PLC

- Four Seasons Hotels Limited

- Rosewood Hotels & Resorts

- Shangri-La International Hotel Management Ltd

- Marriott International Inc

- Ritz-Carlton Hotel Company LLC

- Accor SA

Key Milestones in Luxury Hotel Market Industry

- November 2020: Accor and Ennismore announced a merger to create a leading lifestyle hospitality operator, significantly impacting the competitive landscape.

- February 2020: Hamilton Hotel Partners and Pyramid Hotel Group merged, expanding their asset management portfolio to 141 hotels and 32,000 rooms across eight countries.

Strategic Outlook for Luxury Hotel Market Market

The luxury hotel market is poised for continued growth, driven by increasing demand for high-end travel experiences and technological advancements enhancing guest satisfaction. Strategic partnerships, expansion into new markets, and a focus on sustainable practices will be key to success. The market shows strong potential for sustained growth and attractive investment opportunities.

Luxury Hotel Market Segmentation

-

1. Service Type

- 1.1. Business Hotels

- 1.2. Airport Hotels

- 1.3. Suite Hotels

- 1.4. Resorts

- 1.5. Other Service Types

Luxury Hotel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. Japan

- 3.4. India

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Luxury Hotel Market Regional Market Share

Geographic Coverage of Luxury Hotel Market

Luxury Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. Increasing Digitization of Services and Online Booking on Apps and Websites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotels

- 5.1.2. Airport Hotels

- 5.1.3. Suite Hotels

- 5.1.4. Resorts

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotels

- 6.1.2. Airport Hotels

- 6.1.3. Suite Hotels

- 6.1.4. Resorts

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotels

- 7.1.2. Airport Hotels

- 7.1.3. Suite Hotels

- 7.1.4. Resorts

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotels

- 8.1.2. Airport Hotels

- 8.1.3. Suite Hotels

- 8.1.4. Resorts

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. South America Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Hotels

- 9.1.2. Airport Hotels

- 9.1.3. Suite Hotels

- 9.1.4. Resorts

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Hotels

- 10.1.2. Airport Hotels

- 10.1.3. Suite Hotels

- 10.1.4. Resorts

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ITC HOTELS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyatt Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Belmond Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 InterContinental Hotels Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Four Seasons Hotels Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rosewood Hotels & Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shangri-La International Hotel Management Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marriott International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ritz-Carlton Hotel Company LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ITC HOTELS

List of Figures

- Figure 1: Global Luxury Hotel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 7: Europe Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Europe Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Asia Pacific Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Asia Pacific Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: South America Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: South America Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Middle East and Africa Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Middle East and Africa Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Luxury Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 19: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Australia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 27: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 32: Global Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Hotel Market?

The projected CAGR is approximately 7.90%.

2. Which companies are prominent players in the Luxury Hotel Market?

Key companies in the market include ITC HOTELS, Hyatt Corporation, Belmond Ltd, InterContinental Hotels Group PLC, Four Seasons Hotels Limited, Rosewood Hotels & Resorts, Shangri-La International Hotel Management Ltd*List Not Exhaustive, Marriott International Inc, Ritz-Carlton Hotel Company LLC, Accor SA.

3. What are the main segments of the Luxury Hotel Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Digitization of Services and Online Booking on Apps and Websites.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

In November 2020, Paris-based hotel company Accor and London-based hospitality firm Ennismore entered exclusive negotiations to form what they are claiming will be the world's leading lifestyle operator in the hospitality sector. Through this all-share merger, a new autonomous asset-light entity will combine the Hoxton, Gleneagles, Delano, SLS, Mondrian, SO/, Hyde, Mama Shelter, 25h, 21c Museum Hotels, Tribe, Jo&Joe, and Working From brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Hotel Market?

To stay informed about further developments, trends, and reports in the Luxury Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence