Key Insights

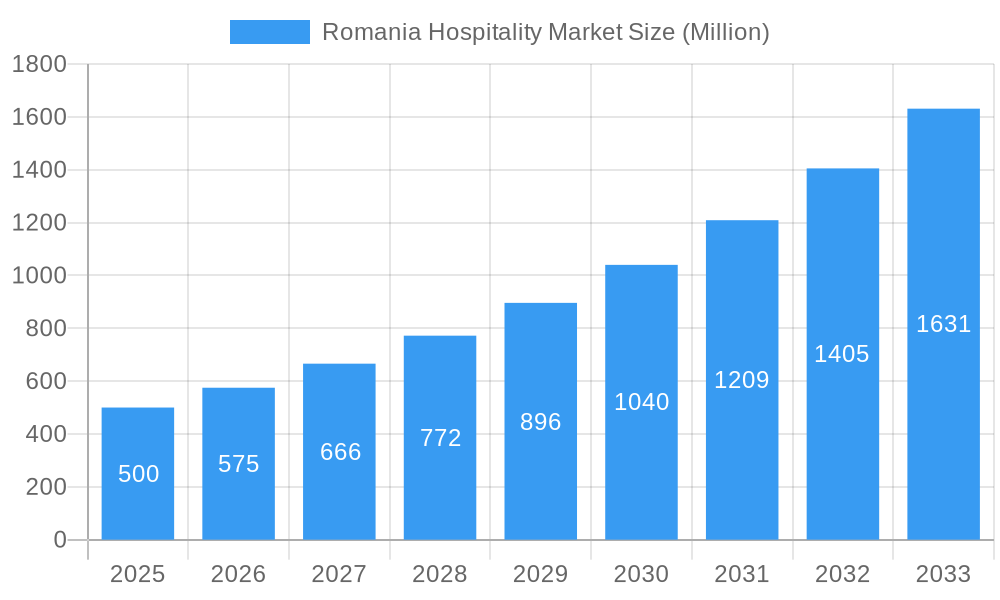

The Romanian hospitality market, valued at approximately €2 billion in 2024, is projected for substantial growth with a Compound Annual Growth Rate (CAGR) of 15% through 2033. This expansion is driven by a significant increase in inbound tourism, attracted by Romania's rich cultural heritage and developing destinations. Rising disposable incomes are also boosting domestic travel and leisure spending. Enhanced infrastructure, including improved transportation, further supports accessibility for both international and domestic visitors. The market is segmented by hotel type and category, with diverse growth patterns reflecting consumer preferences and price sensitivity.

Romania Hospitality Market Market Size (In Billion)

Challenges include seasonal fluctuations in tourism and increasing competition from alternative accommodations like short-term rental platforms. To address these, hotels are prioritizing service enhancement, digital presence, and technology adoption to meet evolving traveler demands. Leading international players such as InterContinental Hotels Group, Accor Hotels, and Hilton Worldwide, alongside local chains like Ana Hotels, are actively influencing the market through expansion and strategic collaborations. The forecast period (2024-2033) offers significant growth opportunities for the Romanian hospitality sector with effective challenge management.

Romania Hospitality Market Company Market Share

Romania Hospitality Market Report: 2019-2033

Uncover the lucrative opportunities and challenges shaping Romania's dynamic hospitality sector. This comprehensive report provides an in-depth analysis of the Romanian hospitality market, covering market size, segmentation, key players, and future growth projections from 2019 to 2033. Benefit from actionable insights to inform your strategic decision-making and capitalize on emerging trends. Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033; Historical Period: 2019-2024.

Romania Hospitality Market Market Dynamics & Concentration

The Romanian hospitality market, valued at xx Million in 2025, exhibits a moderately concentrated landscape. Key players like InterContinental Hotels Group, Accor Hotels, Hilton Worldwide, and Radisson Hotel Group hold significant market share, although a large number of independent hotels also contribute substantially. Market concentration is influenced by several factors:

- Innovation Drivers: Technological advancements like contactless check-in, mobile key access (as demonstrated by JW Marriott Bucharest Grand Hotel's upgrade), and integrated guest services are driving efficiency and improving guest experience, creating a competitive advantage for early adopters.

- Regulatory Frameworks: Government regulations related to tourism, licensing, and labor impact market operations. Changes in these frameworks can significantly impact investment and expansion plans.

- Product Substitutes: The rise of alternative accommodations like Airbnb presents a competitive challenge to traditional hotels, particularly in the budget segment.

- End-User Trends: Growing domestic and international tourism, fueled by Romania's rich cultural heritage and increasing affordability, drives demand. Preferences are shifting towards experiences over just accommodation, creating opportunities for hotels offering unique amenities and services.

- M&A Activities: The number of mergers and acquisitions (M&A) in the Romanian hospitality sector remains relatively low (xx deals in the past five years), suggesting consolidation opportunities for larger players. Market share analysis indicates that the top 5 players account for approximately xx% of the market.

Romania Hospitality Market Industry Trends & Analysis

The Romanian hospitality market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors contribute to this growth:

- Market Growth Drivers: Increased tourist arrivals, rising disposable incomes, and government initiatives promoting tourism are major drivers. The expansion of Bucharest and other key cities also provides opportunities for new hotel development.

- Technological Disruptions: The adoption of digital technologies, including online booking platforms, revenue management systems, and personalized guest services, is transforming the industry. This increased efficiency also contributes to reducing operational costs.

- Consumer Preferences: Demand is increasing for experiential travel, sustainable tourism, and personalized services. Hotels catering to these evolving preferences are gaining a competitive edge.

- Competitive Dynamics: The market is characterized by a mix of international and domestic players, creating a competitive landscape. Competition is intensifying with the entry of new players and the expansion of existing ones. Market penetration for chain hotels is estimated at xx%, leaving room for further expansion.

Leading Markets & Segments in Romania Hospitality Market

Bucharest is the dominant market within the Romanian hospitality sector, attracting the highest number of tourists and business travelers. However, other major cities, including Cluj-Napoca, Timisoara, and Constanta, also show significant growth potential. Segment analysis reveals the following:

- By Type: Chain hotels hold a larger market share compared to independent hotels due to brand recognition, loyalty programs, and established distribution networks. However, independent hotels benefit from local character and bespoke experiences, maintaining a sizeable market share.

- By Hotel Category: The upscale and luxury hotel segment displays strong growth prospects due to increasing demand for high-end services and experiences. However, mid-scale and budget hotels cater to a broader range of travelers, demonstrating significant market penetration.

Key Drivers:

- Economic policies: Government incentives and investments in tourism infrastructure positively influence market growth.

- Infrastructure development: Improvements in transportation networks and accessibility enhance tourism appeal.

Romania Hospitality Market Product Developments

Recent product innovations focus on enhancing guest experience and operational efficiency. Contactless mobile access, smart room technologies, and personalized service offerings are gaining traction. The integration of sustainable practices is also becoming an important differentiator. These developments are improving market fit by responding to evolving consumer preferences and enhancing hotel competitiveness.

Key Drivers of Romania Hospitality Market Growth

Several factors are driving the growth of the Romanian hospitality market:

- Technological advancements: Improved online booking platforms, revenue management systems, and contactless services enhance efficiency and guest experience.

- Economic growth: Rising disposable incomes and increased tourism spending fuel demand for hospitality services.

- Favorable regulatory environment: Government support for tourism and infrastructure development creates a conducive business environment.

Challenges in the Romania Hospitality Market Market

The Romanian hospitality sector faces several challenges:

- Seasonality: Tourism is concentrated in certain months, leading to fluctuating occupancy rates and revenue streams.

- Competition: Intense competition from both domestic and international hotel chains and alternative accommodations puts pressure on pricing and profitability.

- Workforce development: Finding and retaining qualified personnel in the hospitality industry can be challenging.

Emerging Opportunities in Romania Hospitality Market

Strategic partnerships between hotels and local businesses, promoting cultural experiences, and expanding into niche segments like eco-tourism represent significant growth opportunities. Leveraging technology to enhance personalization and efficiency presents significant opportunities to increase market share and profitability.

Leading Players in the Romania Hospitality Market Sector

- InterContinental Hotels Group

- Continental Hotels

- Accor Hotels

- Ramada Bucharest Parc Hotel

- JW Marriott

- Hilton Worldwide

- Ana Hotels

- Radisson Hotel Group

- Relais & Chateaux

- Grand Hotel Italia

- Hotel PRIVO

Key Milestones in Romania Hospitality Market Industry

- November 2022: JW Marriott Bucharest Grand Hotel implemented contactless mobile access and enhanced guest security, showcasing technological advancements in the luxury segment.

- March 2023: Accor's Mercure Hotels brand announced a new 40-key hotel in Bucharest, reflecting continued expansion in the Romanian market.

Strategic Outlook for Romania Hospitality Market Market

The Romanian hospitality market is poised for continued growth, driven by rising tourism, economic development, and technological advancements. Strategic investments in infrastructure, sustainable practices, and innovative guest experiences will be key to success in this dynamic market. Focusing on niche tourism segments and leveraging technology to enhance efficiency and personalized service will be crucial for maximizing long-term growth potential.

Romania Hospitality Market Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Hotel Category

- 2.1. Upscale and Luxury Hotels

- 2.2. Mid-Scale Hotels

- 2.3. Budget and Economy Hotels

Romania Hospitality Market Segmentation By Geography

- 1. Romania

Romania Hospitality Market Regional Market Share

Geographic Coverage of Romania Hospitality Market

Romania Hospitality Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Tourist Arrivals; Quality and Service Standards

- 3.3. Market Restrains

- 3.3.1. Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens

- 3.4. Market Trends

- 3.4.1. Increasing Tourist Arrivals is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Hotel Category

- 5.2.1. Upscale and Luxury Hotels

- 5.2.2. Mid-Scale Hotels

- 5.2.3. Budget and Economy Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 InterContinental Hotels Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Other Prominent Players in Romania**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Hotels

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Accor Hotels

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ramada Bucharest Parc Hotel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JW Marriott

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hilton Worldwide

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ana Hotels

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Radisson Hotel Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Relais & Chateaux

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Grand Hotel Italia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hotel PRIVO

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 InterContinental Hotels Group

List of Figures

- Figure 1: Romania Hospitality Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Romania Hospitality Market Share (%) by Company 2025

List of Tables

- Table 1: Romania Hospitality Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Romania Hospitality Market Revenue billion Forecast, by Hotel Category 2020 & 2033

- Table 3: Romania Hospitality Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Romania Hospitality Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Romania Hospitality Market Revenue billion Forecast, by Hotel Category 2020 & 2033

- Table 6: Romania Hospitality Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Hospitality Market?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Romania Hospitality Market?

Key companies in the market include InterContinental Hotels Group, Other Prominent Players in Romania**List Not Exhaustive, Continental Hotels, Accor Hotels, Ramada Bucharest Parc Hotel, JW Marriott, Hilton Worldwide, Ana Hotels, Radisson Hotel Group, Relais & Chateaux, Grand Hotel Italia, Hotel PRIVO.

3. What are the main segments of the Romania Hospitality Market?

The market segments include Type, Hotel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Tourist Arrivals; Quality and Service Standards.

6. What are the notable trends driving market growth?

Increasing Tourist Arrivals is Driving the Market.

7. Are there any restraints impacting market growth?

Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens.

8. Can you provide examples of recent developments in the market?

March 2023: Accor's Mercure Hotels brand is continuing its strong expansion in Romania with the signing of a site in the capital city of Bucharest. The 40-key hotel will operate in a fully refurbished building on Dimitrie Cantemir Boulevard, close to Unirii Square and the old city center. Amenities will include a restaurant, a bar, and a conference room, which is divided into two separate meeting rooms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Hospitality Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Hospitality Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Hospitality Market?

To stay informed about further developments, trends, and reports in the Romania Hospitality Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence