Key Insights

The Switzerland hospitality industry, valued at 5.38 million in 2025, is projected to experience steady growth, driven by factors such as increasing tourism, particularly from high-spending leisure travelers and business delegates drawn by Switzerland's reputation for luxury and efficiency. The country's robust economy, political stability, and breathtaking landscapes contribute significantly to this positive outlook. The market is segmented by type (chain vs. independent hotels) and by service level (budget, mid-scale, luxury, and service apartments), reflecting the diverse offerings catering to a wide range of visitor preferences. While challenges such as seasonality and potential economic downturns exist, the industry's adaptability and focus on sustainable practices suggest resilience. The presence of established international brands like Marriott, Accor, and IHG, alongside local players, indicates a competitive but dynamic market landscape. Future growth will likely be influenced by the ongoing evolution of sustainable tourism, the integration of technology in hotel operations (e.g., contactless check-in, AI-powered services), and the adaptation to changing consumer preferences.

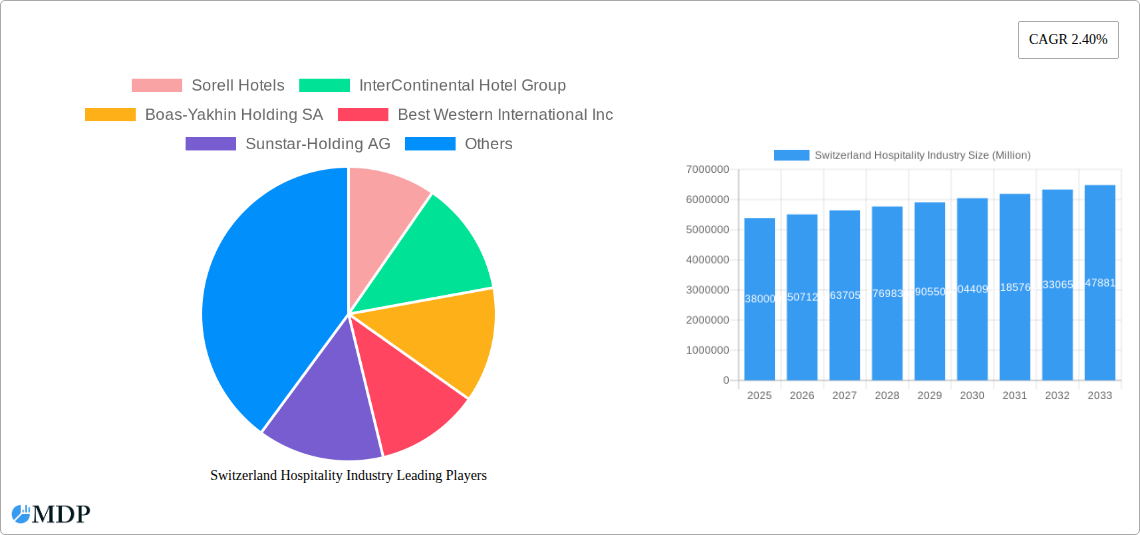

Switzerland Hospitality Industry Market Size (In Million)

Considering a CAGR of 2.40%, the market is poised for sustained expansion. This growth projection assumes consistent tourism influx, continued investment in hotel infrastructure, and effective management of external factors. The luxury hotel segment is anticipated to experience above-average growth due to Switzerland's allure as a luxury destination. Conversely, the budget and economy segments may exhibit slightly lower growth rates, though still positive, reflecting price sensitivity in a sector with many options. The service apartment segment will likely see growth as business travel and extended stays become more common. Competitive pressures will encourage innovation and differentiation strategies among established and emerging hotel players. The continued success of the industry hinges on maintaining high service standards, adapting to evolving traveler needs and expectations, and proactively addressing any environmental concerns.

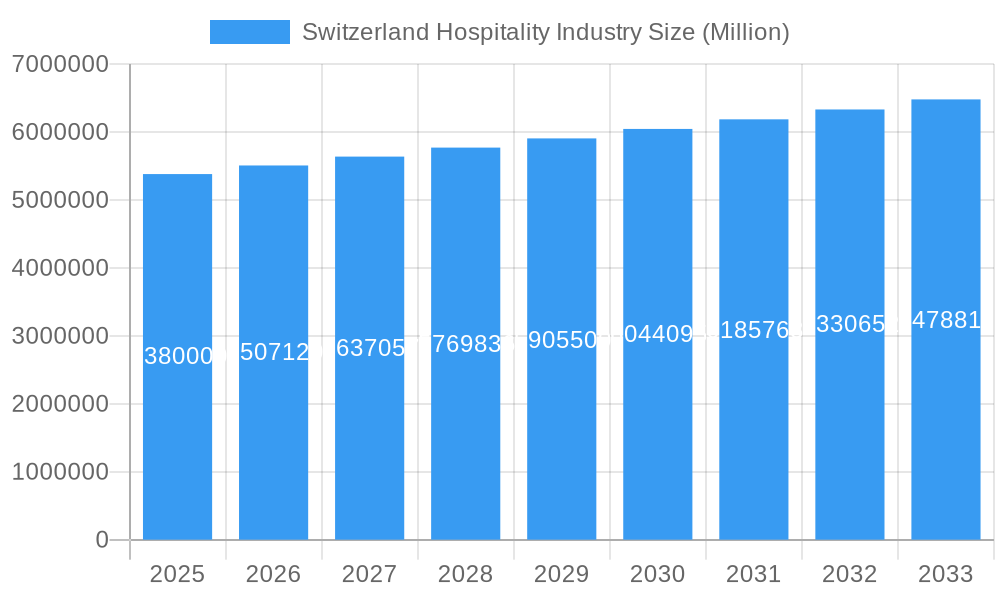

Switzerland Hospitality Industry Company Market Share

Switzerland Hospitality Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Switzerland hospitality industry, covering market dynamics, trends, leading players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for investors, industry stakeholders, and strategic decision-makers. The report analyzes a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Switzerland Hospitality Industry Market Dynamics & Concentration

The Swiss hospitality market, valued at xx Million in 2025, demonstrates a complex interplay of factors driving its growth and concentration. Market concentration is moderate, with a few large chains like InterContinental Hotel Group, Marriott International Inc, and Accor SA holding significant market share, but a substantial number of independent hotels also contribute significantly. Innovation is driven by technological advancements in booking systems, customer relationship management (CRM), and personalized services. The regulatory framework, while generally supportive of tourism, imposes certain restrictions on building and operating hotels, especially in ecologically sensitive areas. Product substitutes, such as Airbnb and other short-term rental platforms, present a growing competitive challenge. End-user trends reveal a rising demand for sustainable and experiential travel, influencing hotel offerings and operational practices.

- Market Share: InterContinental Hotel Group: xx%; Marriott International Inc: xx%; Accor SA: xx%; Independent Hotels: xx%. (These figures represent estimates)

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, with a projected increase to xx deals during the forecast period (2025-2033). The majority of these deals involved smaller independent hotels being acquired by larger chains.

Switzerland Hospitality Industry Industry Trends & Analysis

The Swiss hospitality market is characterized by several key trends. Significant market growth drivers include increasing inbound tourism, driven by Switzerland's reputation as a premier tourist destination, and rising disposable incomes both domestically and internationally. Technological disruptions, such as online travel agencies (OTAs) and the rise of personalized travel experiences via data analytics, are reshaping the industry. Consumer preferences are shifting towards sustainable and experiential travel, with increased demand for eco-friendly hotels and unique local experiences. Competitive dynamics are intensified by the rise of alternative accommodation platforms and the expansion of international hotel chains.

Leading Markets & Segments in Switzerland Hospitality Industry

The Zurich region is the dominant market within Switzerland's hospitality industry, driven by its status as a major financial center and a popular tourist destination. The luxury hotel segment is particularly strong in this region, commanding premium pricing due to high demand and the availability of upscale facilities.

Key Drivers of Zurich Dominance:

- Strong economic activity and high disposable incomes.

- Excellent transportation infrastructure, including Zurich Airport.

- Abundant cultural attractions and scenic beauty.

- A robust business tourism sector.

Segment Analysis: While the luxury hotel segment holds a prominent position, the mid-range and budget segments are also vital, catering to a wider range of travelers. The serviced apartment segment is experiencing growth, driven by the increasing popularity of extended-stay travel and business travelers.

Switzerland Hospitality Industry Product Developments

Recent product innovations include smart room technology, enhanced personalization through CRM systems, and the integration of sustainable practices into hotel operations. Hotels are increasingly incorporating local experiences and cultural immersion into their offerings to meet evolving consumer preferences. These innovations focus on improving operational efficiency, customer satisfaction, and brand differentiation.

Key Drivers of Switzerland Hospitality Industry Growth

Several factors contribute to the growth of the Swiss hospitality industry: a strong and stable economy, sustained inbound tourism fueled by Switzerland's unique appeal, and ongoing infrastructure development that improves accessibility and enhances the overall tourist experience. The adoption of technological advancements also boosts efficiency and customer engagement, fostering continued expansion.

Challenges in the Switzerland Hospitality Industry Market

Challenges faced include the high cost of operations in Switzerland, intense competition from both established chains and alternative accommodations, and the need to adapt to evolving consumer expectations regarding sustainability and technology. Furthermore, seasonality continues to impact profitability, leading to operational adjustments and the need for year-round strategies.

Emerging Opportunities in Switzerland Hospitality Industry

Long-term growth is supported by leveraging technology for personalized experiences, forming strategic alliances with local businesses to offer curated experiences, and expanding into emerging markets within Switzerland to diversify revenue streams and cater to a broader range of travelers.

Leading Players in the Switzerland Hospitality Industry Sector

- Sorell Hotels

- InterContinental Hotel Group

- Boas-Yakhin Holding SA

- Best Western International Inc

- Sunstar-Holding AG

- Radisson Hotel Group

- Marriott International Inc

- H Hotels

- Accor SA

- Hotels by Fassbind

Key Milestones in Switzerland Hospitality Industry Industry

- May 2023: IHG announced an extension of its Multiple Development Agreement with Tristar GmbH, expanding its presence in Northern Europe, including Switzerland, to 60 hotels by 2035. This signifies a substantial investment and commitment to growth in the Swiss market.

- March 2023: Radisson Hotel Group entered the Swiss serviced apartment market with the opening of the Radisson Hotel & Suites Zurich in the Glattpark district. This marks a strategic move to tap into the growing extended-stay segment.

Strategic Outlook for Switzerland Hospitality Industry Market

The future of the Swiss hospitality industry is bright, with promising growth prospects driven by the continuous influx of tourists and the ongoing development of innovative hospitality offerings. By focusing on technological advancements, targeted marketing strategies, and the development of sustainable practices, industry players can unlock significant growth opportunities and maintain a competitive edge in this dynamic market.

Switzerland Hospitality Industry Segmentation

-

1. Type

- 1.1. Service Apartments

- 1.2. Chain Hotels

- 1.3. Independent Hotels

-

2. Segment

- 2.1. Budget and Economy

- 2.2. Mid and Upper Mid-scale

- 2.3. Luxury

Switzerland Hospitality Industry Segmentation By Geography

- 1. Switzerland

Switzerland Hospitality Industry Regional Market Share

Geographic Coverage of Switzerland Hospitality Industry

Switzerland Hospitality Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Online bookings Boosting the Market; Increasing Revenue from Business Travel Driving the Market

- 3.3. Market Restrains

- 3.3.1. Seasonal Demand

- 3.4. Market Trends

- 3.4.1. Rising Online bookings Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Hospitality Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Service Apartments

- 5.1.2. Chain Hotels

- 5.1.3. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy

- 5.2.2. Mid and Upper Mid-scale

- 5.2.3. Luxury

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sorell Hotels

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 InterContinental Hotel Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Boas-Yakhin Holding SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Best Western International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sunstar-Holding AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Radisson Hotel Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marriott International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 H Hotels**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Accor SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hotels by Fassbind

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sorell Hotels

List of Figures

- Figure 1: Switzerland Hospitality Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Switzerland Hospitality Industry Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Switzerland Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Switzerland Hospitality Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Switzerland Hospitality Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Switzerland Hospitality Industry Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Switzerland Hospitality Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Hospitality Industry?

The projected CAGR is approximately 2.40%.

2. Which companies are prominent players in the Switzerland Hospitality Industry?

Key companies in the market include Sorell Hotels, InterContinental Hotel Group, Boas-Yakhin Holding SA, Best Western International Inc, Sunstar-Holding AG, Radisson Hotel Group, Marriott International Inc, H Hotels**List Not Exhaustive, Accor SA, Hotels by Fassbind.

3. What are the main segments of the Switzerland Hospitality Industry?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Online bookings Boosting the Market; Increasing Revenue from Business Travel Driving the Market.

6. What are the notable trends driving market growth?

Rising Online bookings Boosting the Market.

7. Are there any restraints impacting market growth?

Seasonal Demand.

8. Can you provide examples of recent developments in the market?

May 2023: IHG announced the extension of its Multiple Development Agreement across Northern Europe with Tristar GmbH. The agreement sees the partnership grow to 60 hotels with IHG Hotels & Resorts by 2035, with developments planned in Germany, Austria, Switzerland, Poland, and Italy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Hospitality Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Hospitality Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Hospitality Industry?

To stay informed about further developments, trends, and reports in the Switzerland Hospitality Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence