Key Insights

The Malaysian hospitality sector is projected for robust growth, with an estimated market size of $1.31 billion by 2024, and a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This expansion is driven by increasing tourism, rising disposable incomes, and supportive government initiatives. The industry is diversifying, with growing demand for both chain and independent hotels, catering to various traveler segments. Budget and economy segments show consistent demand, while mid and upper-mid scale segments are experiencing accelerated growth due to traveler preference for enhanced value. The luxury segment, characterized by high per-customer spending and unique experiences, remains important. Serviced apartments are also gaining traction for longer stays, particularly among business travelers and families.

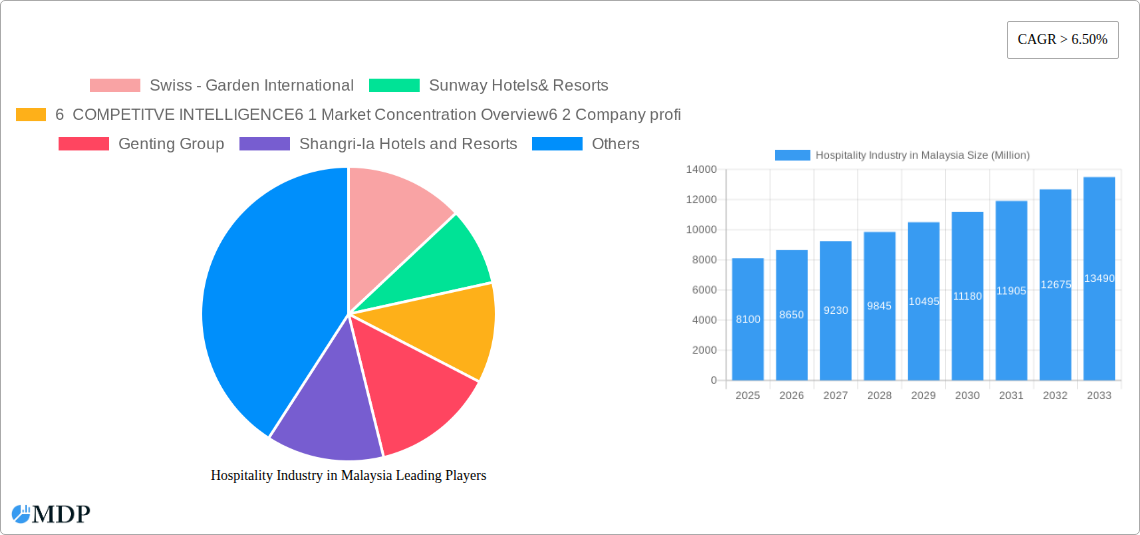

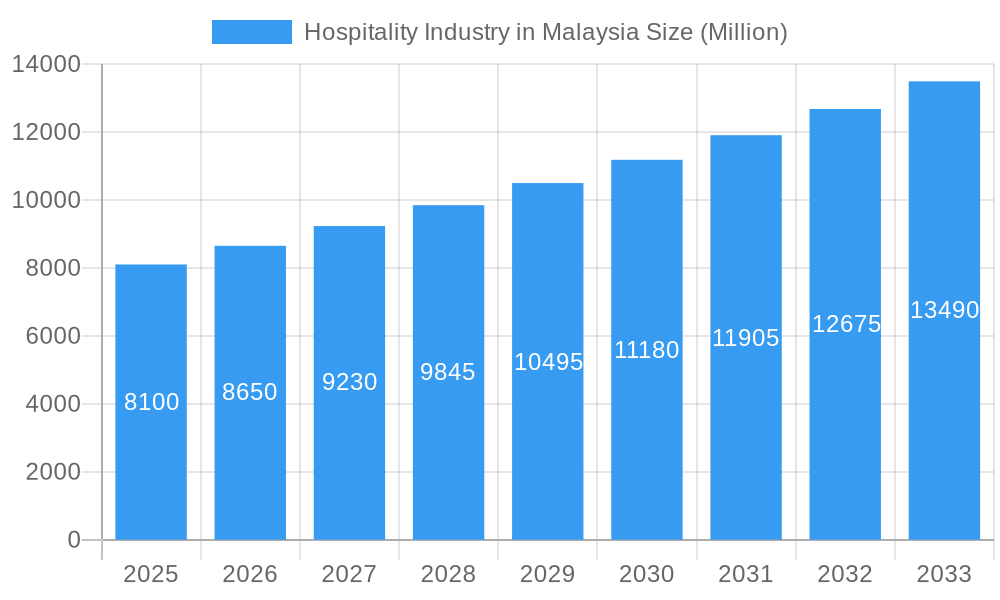

Hospitality Industry in Malaysia Market Size (In Billion)

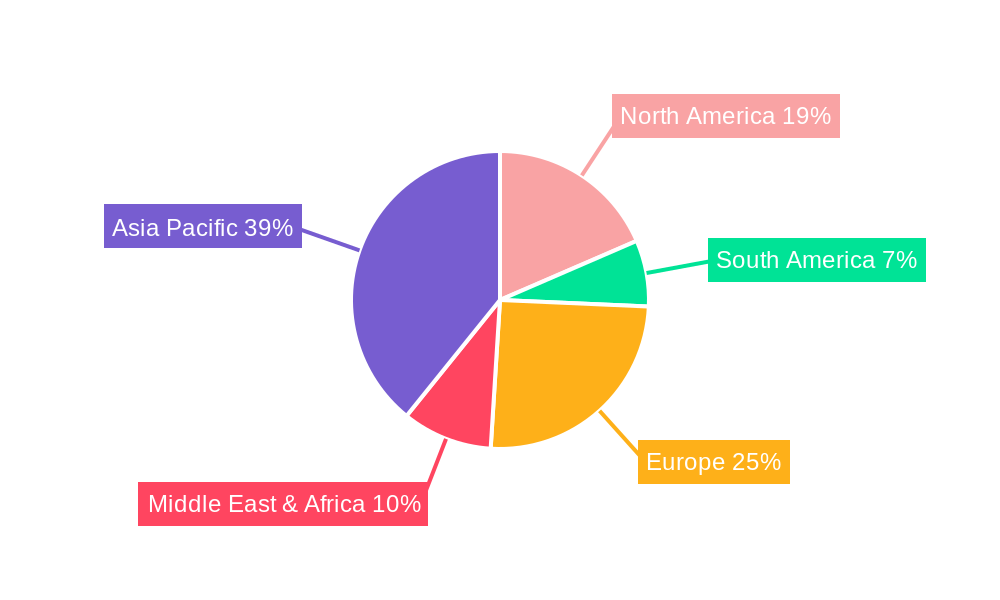

The Asia Pacific region is anticipated to lead market share, propelled by key economies and strong domestic tourism. North America and Europe will remain significant markets with mature growth. Emerging markets in the Middle East and Africa offer long-term potential, contingent on infrastructure development. Growth drivers include medical tourism, eco-tourism, cultural heritage tours, and the MICE sector. Challenges include intense competition, the need for service innovation, and adapting to evolving traveler preferences, particularly in digital adoption and sustainability. Key industry players, both international and local, must adopt strategic agility.

Hospitality Industry in Malaysia Company Market Share

This report provides a comprehensive analysis of the Malaysian hospitality industry, detailing market dynamics, trends, competitive landscape, and future growth opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2024, it is an essential resource for hotel investors, operators, hospitality management professionals, and industry stakeholders looking to leverage the growing Malaysian tourism and accommodation sector. Optimized with high-traffic keywords such as Malaysia hospitality market, hotel industry Malaysia, tourism forecast Malaysia, luxury hotels Malaysia, budget hotels Malaysia, and hotel investment Malaysia, this report ensures maximum visibility.

Hospitality Industry in Malaysia Market Dynamics & Concentration

The Malaysian hospitality market is characterized by a moderate level of concentration, with major international and domestic players vying for dominance. Key drivers of innovation include the increasing demand for personalized experiences, sustainable tourism practices, and smart hotel technologies. The regulatory framework, while supportive of tourism growth, necessitates adherence to evolving standards for safety, licensing, and labor. Product substitutes, such as short-term rental platforms and serviced apartments, are influencing traditional hotel models. End-user trends reveal a growing preference for experiential stays, wellness offerings, and technologically integrated accommodations. Mergers and acquisition (M&A) activities, though not at extreme levels, signal strategic consolidation and expansion efforts. For example, the past few years have seen several domestic hotel groups acquiring smaller independent properties to expand their portfolio and market share. The market share of top players is estimated to be around XX%, with M&A deal counts averaging XX per year over the historical period.

Hospitality Industry in Malaysia Industry Trends & Analysis

The Malaysian hospitality industry is poised for significant expansion, driven by a robust recovery in international tourism and a sustained surge in domestic travel. The Compound Annual Growth Rate (CAGR) for the forecast period is projected at an impressive XX%, with market penetration expected to reach XX% by 2033. Key growth drivers include government initiatives to boost tourism, enhanced air connectivity, and the diversification of tourist attractions beyond traditional city centers. Technological disruptions are revolutionizing guest experiences, from AI-powered chatbots for customer service to contactless check-in/check-out systems and personalized in-room amenities. Consumer preferences are shifting towards authentic cultural experiences, eco-friendly accommodations, and wellness-focused retreats. The competitive dynamics are intensifying, with both established global brands and agile local operators adapting to these evolving demands. The hotel occupancy rates in the historical period fluctuated between XX% and XX%, with a steady upward trend anticipated. The average daily rate (ADR) is also projected to increase by XX% annually.

Leading Markets & Segments in Hospitality Industry in Malaysia

Kuala Lumpur remains the dominant region in Malaysia's hospitality sector, attracting the highest volume of business and leisure travelers, thereby driving significant demand for all hotel segments.

- Chain Hotels: These command a substantial market share due to their brand recognition, standardized service quality, and loyalty programs, attracting both international and domestic travelers. Their dominance is further amplified by strategic location in prime urban centers and at key transport hubs.

- Independent Hotels: While smaller in individual scale, they offer unique, localized experiences and often cater to niche markets, contributing to the diversity of the Malaysian hospitality landscape.

- Budget and Economy Hotels: This segment experiences consistent demand from backpackers, budget-conscious families, and domestic travelers, particularly in high-traffic tourist areas and secondary cities. Infrastructure development and increased domestic travel are key drivers.

- Mid and Upper Mid-Scale Hotels: These segments benefit from the growing middle class and corporate travel, offering a balance of comfort, amenities, and value. The expansion of business districts and convention centers fuels their growth.

- Luxury Hotels: Catering to high-net-worth individuals and a premium segment of international tourists, luxury hotels are characterized by exceptional service, opulent amenities, and prime locations, often in iconic urban areas or exclusive resort destinations.

- Service Apartments: Their popularity is surging due to demand from extended-stay business travelers, families, and those seeking more space and home-like amenities, often strategically located near business hubs and expatriate residential areas.

Hospitality Industry in Malaysia Product Developments

Recent product developments highlight a strong focus on enhancing guest experiences through technology and localized offerings. The opening of Le Meridien Petaling Jaya with its mid-century modern design and European accents exemplifies a trend towards unique, thematic hotel experiences catering to discerning travelers. Marriott International's planned openings of Fairfield Kuala Lumpur Jalan Pahang and Four Points by Sheraton Desaru indicate a strategic expansion into diverse market segments and geographical locations. These developments underscore a commitment to innovation in room design, dining concepts, and exclusive guest events, aiming to differentiate brands and capture specific market niches. The competitive advantage lies in offering integrated services, personalized digital interactions, and curated local experiences.

Key Drivers of Hospitality Industry in Malaysia Growth

The Malaysian hospitality industry is propelled by several key factors. Technologically, the adoption of AI, IoT, and mobile applications enhances operational efficiency and guest personalization. Economically, a recovering global economy and a growing domestic disposable income fuel travel demand. Regulatory support, including favorable tourism policies and investment incentives, plays a crucial role. Furthermore, significant infrastructure developments, such as airport expansions and new transportation networks, improve accessibility and convenience for tourists. The government's commitment to promoting Malaysia as a top tourist destination through strategic marketing campaigns also significantly bolsters growth.

Challenges in the Hospitality Industry in Malaysia Market

Despite its promising outlook, the Malaysian hospitality industry faces several challenges. Regulatory hurdles, including complex licensing procedures and evolving environmental standards, can impact operational flexibility. Supply chain issues, particularly for imported goods and specialized services, can affect profitability and service delivery. Intense competitive pressures from both established international brands and emerging local players necessitate continuous innovation and cost management. Labor shortages and the need for skilled talent development remain a persistent concern, impacting service quality. Economic volatility and currency fluctuations can also deter international tourist spending.

Emerging Opportunities in Hospitality Industry in Malaysia

Emerging opportunities for the Malaysian hospitality industry are abundant, driven by several catalysts. Technological breakthroughs in AI and sustainable energy solutions present avenues for enhanced guest experiences and reduced operational costs. Strategic partnerships between hotels, airlines, and local tourism operators can create attractive package deals and expand market reach. The growing demand for niche tourism, such as ecotourism, wellness retreats, and cultural immersion experiences, offers significant potential for specialized offerings. Furthermore, the untapped potential in less-explored regions of Malaysia presents opportunities for expansion and diversification of the hospitality landscape.

Leading Players in the Hospitality Industry in Malaysia Sector

- Swiss - Garden International

- Sunway Hotels& Resorts

- Genting Group

- Shangri-la Hotels and Resorts

- Hilton Worldwide

- Tune Hotels

- Marriott International Inc

- Accor SA

- Berjaya Hotels & Resorts

- Hotel Seri Malaysia

Key Milestones in Hospitality Industry in Malaysia Industry

- July 2021: American multinational hotel chain operator Marriott International, Inc announced its plan to open Fairfield Kuala Lumpur Jalan Pahang and Four Points by Sheraton Desaru (Johor).

- June 2022: LE MERIDIEN Hotels & Resorts opened Le Meridien Petaling Jaya in Petaling Jaya, featuring a mid-century modern design with European accents. This new hotel offers 300 stylish, modern rooms with unique dining options and exclusive hotel-guest events.

Strategic Outlook for Hospitality Industry in Malaysia Market

The strategic outlook for the Malaysian hospitality market is exceptionally strong, driven by continued economic recovery and a sustained influx of international and domestic tourists. Growth accelerators include investments in sustainable tourism, digital transformation for enhanced guest engagement, and the development of unique, experiential offerings. The market is poised for further expansion in mid-scale and luxury segments, catering to evolving consumer demands. Strategic opportunities lie in leveraging Malaysia's rich cultural heritage and natural beauty to develop differentiated tourism products. Collaboration with government bodies and industry associations will be crucial for navigating regulatory landscapes and driving collective growth.

Hospitality Industry in Malaysia Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Budget and Economy Hotels

- 2.2. Mid and Upper Mid-Scale Hotels

- 2.3. Luxury Hotels

- 2.4. Service Apartments

Hospitality Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Malaysia Regional Market Share

Geographic Coverage of Hospitality Industry in Malaysia

Hospitality Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector

- 3.3. Market Restrains

- 3.3.1. High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector

- 3.4. Market Trends

- 3.4.1. Smart Tourism in Malaysia to Offer Lucrative Growth Prospects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Budget and Economy Hotels

- 5.2.2. Mid and Upper Mid-Scale Hotels

- 5.2.3. Luxury Hotels

- 5.2.4. Service Apartments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Budget and Economy Hotels

- 6.2.2. Mid and Upper Mid-Scale Hotels

- 6.2.3. Luxury Hotels

- 6.2.4. Service Apartments

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Budget and Economy Hotels

- 7.2.2. Mid and Upper Mid-Scale Hotels

- 7.2.3. Luxury Hotels

- 7.2.4. Service Apartments

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Budget and Economy Hotels

- 8.2.2. Mid and Upper Mid-Scale Hotels

- 8.2.3. Luxury Hotels

- 8.2.4. Service Apartments

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Budget and Economy Hotels

- 9.2.2. Mid and Upper Mid-Scale Hotels

- 9.2.3. Luxury Hotels

- 9.2.4. Service Apartments

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Budget and Economy Hotels

- 10.2.2. Mid and Upper Mid-Scale Hotels

- 10.2.3. Luxury Hotels

- 10.2.4. Service Apartments

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Swiss - Garden International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sunway Hotels& Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genting Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shangri-la Hotels and Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hilton Worldwide

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hotel Seri Malaysia**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tune Hotels

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Marriott International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Berjaya Hotels & Resorts

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Swiss - Garden International

List of Figures

- Figure 1: Global Hospitality Industry in Malaysia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Malaysia Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Malaysia Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Malaysia Revenue (billion), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Malaysia Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Malaysia?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Hospitality Industry in Malaysia?

Key companies in the market include Swiss - Garden International, Sunway Hotels& Resorts, 6 COMPETITVE INTELLIGENCE6 1 Market Concentration Overview6 2 Company profiles, Genting Group, Shangri-la Hotels and Resorts, Hilton Worldwide, Hotel Seri Malaysia**List Not Exhaustive, Tune Hotels, Marriott International Inc, Accor SA, Berjaya Hotels & Resorts.

3. What are the main segments of the Hospitality Industry in Malaysia?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism in the United Arab Emirates Bolsters the Growth in Hospitality Sector; The Rise in the Mice Industry in the United Arab Emirates Drives the Hospitality Sector.

6. What are the notable trends driving market growth?

Smart Tourism in Malaysia to Offer Lucrative Growth Prospects.

7. Are there any restraints impacting market growth?

High Rentals in the United Arab Emirates Pose a Restraint to the Hospitality Sector.

8. Can you provide examples of recent developments in the market?

In June 2022, LE MERIDIEN Hotels & Resorts opened Le Meridien Petaling Jaya in Petaling Jaya featuring a mid-century modern design with European accents. This new hotel offers 300 stylish, modern rooms with unique dining options and exclusive hotel-guest events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence