Key Insights

The Asia-Pacific (APAC) luxury hotel sector is demonstrating significant expansion, propelled by a rising tide of High-Net-Worth Individuals (HNWIs) and an expanding middle class with increased discretionary spending. This growing demographic, coupled with a strong preference for distinctive and tailored travel experiences, is driving demand for premium accommodations and services. Key growth factors include the escalating appeal of luxury travel within APAC, advancements in sophisticated infrastructure across major tourism centers such as Japan, China, and Singapore, and the strategic entry of international luxury hotel brands into the region. China stands out as a pivotal contributor to market growth, benefiting from a burgeoning domestic tourism industry and an increasing volume of international visitors seeking elite experiences. Potential impediments include economic volatility and geopolitical uncertainties. Furthermore, the industry confronts challenges in upholding sustainability standards and adapting to evolving consumer expectations concerning technology integration and personalized service delivery. The APAC market's segmentation highlights diverse traveler needs, with business hotels serving corporate clients, airport hotels offering convenience, holiday hotels catering to leisure pursuits, and resorts and spas prioritizing relaxation and wellness. This segmentation presents avenues for specialized service offerings and strategic market positioning.

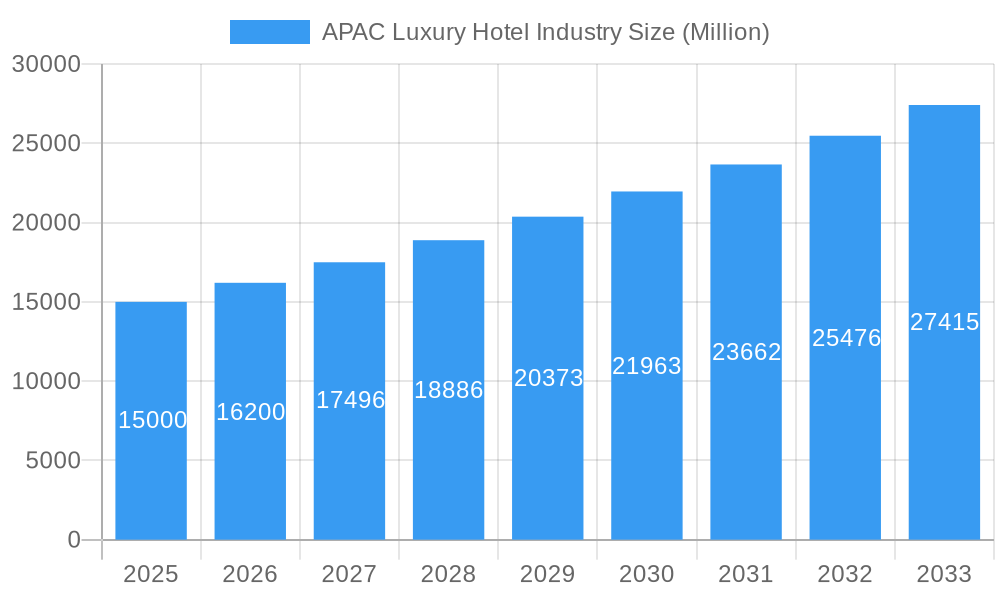

APAC Luxury Hotel Industry Market Size (In Million)

The APAC luxury hotel market is projected for sustained growth, anticipating a Compound Annual Growth Rate (CAGR) of 8.6%. This optimistic outlook is underpinned by the region's economic vitality and its growing stature as a premier global travel destination. Competitive pressures remain intense, with both established global brands and indigenous operators actively pursuing market share. Leading entities will distinguish themselves through superior service delivery, pioneering amenities, and a dedication to sustainable operations. While North American and European luxury hotel markets retain considerable scale, the APAC region's rapid trajectory signals a notable evolution in the global hospitality landscape. Investments in infrastructure, strategic alliances, and an unwavering focus on personalized guest experiences will be paramount for achieving success in this competitive yet rewarding sector. The current market size is estimated at 18,179.19 million for the base year 2024. This comprehensive market analysis facilitates informed strategic decision-making, identifying opportunities for advancement and challenges necessitating proactive management.

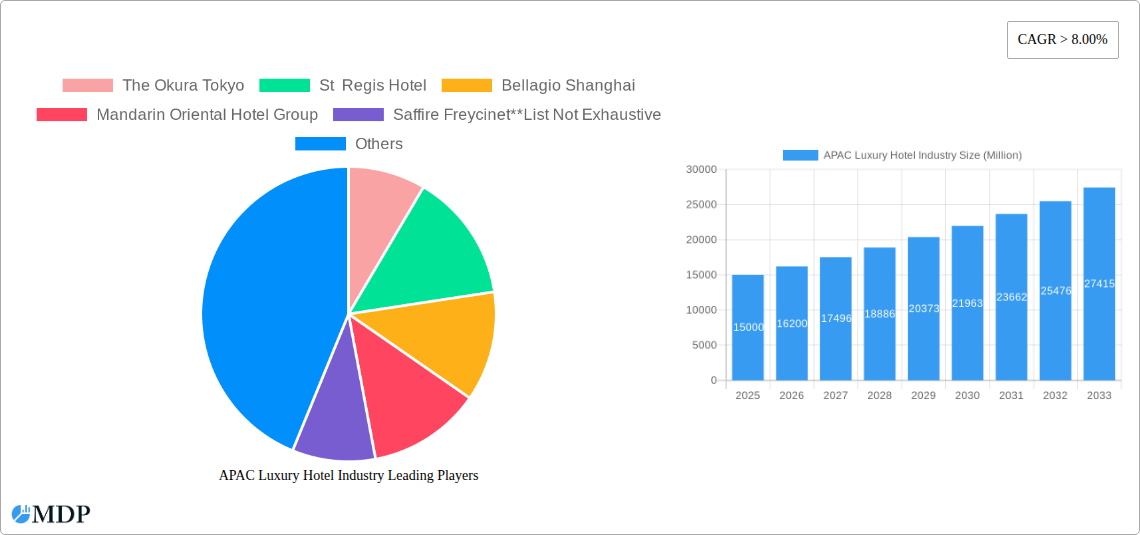

APAC Luxury Hotel Industry Company Market Share

APAC Luxury Hotel Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the APAC luxury hotel industry, encompassing market dynamics, trends, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report offers actionable insights for investors, hoteliers, and industry stakeholders seeking to navigate this dynamic market. Expect detailed analysis on key segments including Business Hotels, Airport Hotels, Holiday Hotels, and Resorts & Spas, with a focus on major players like The Okura Tokyo, St. Regis Hotel, Bellagio Shanghai, and more. Discover the impact of recent developments like the opening of Vibe Hotel Adelaide and Andaz Pattaya. This report is your essential guide to understanding and capitalizing on opportunities within the lucrative APAC luxury hotel sector. The market value in 2025 is estimated at xx Million.

APAC Luxury Hotel Industry Market Dynamics & Concentration

The APAC luxury hotel market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top 5 players is estimated at xx%, driven by strong brand recognition, extensive portfolios, and superior service offerings. Innovation in areas such as personalized guest experiences, sustainable practices, and technological integration is shaping the competitive dynamics. Regulatory frameworks vary across countries in the APAC region, influencing operational costs and expansion strategies. The emergence of alternative accommodations, such as boutique hotels and vacation rentals, presents a competitive threat. However, the growing preference for luxurious and personalized experiences continues to fuel demand for high-end hotels. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold xx% market share (2025 Estimate).

- Innovation Drivers: Personalized experiences, sustainability initiatives, technological advancements.

- Regulatory Frameworks: Vary significantly across APAC countries, impacting operational costs.

- Product Substitutes: Boutique hotels, vacation rentals, serviced apartments.

- End-User Trends: Increasing demand for personalized experiences and unique offerings.

- M&A Activity: Approximately xx deals recorded between 2019 and 2024.

APAC Luxury Hotel Industry Industry Trends & Analysis

The APAC luxury hotel market is experiencing robust growth, driven by a confluence of factors. The region's expanding middle class, rising disposable incomes, and increased inbound tourism contribute significantly to market expansion. Technological advancements, such as online booking platforms and personalized guest services, are transforming the industry. Consumer preferences are shifting towards unique experiences, sustainable tourism practices, and seamless digital interactions. Competitive dynamics are intense, with established players facing challenges from new entrants and alternative accommodation providers. The Compound Annual Growth Rate (CAGR) for the APAC luxury hotel market is projected to be xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Key trends include a focus on wellness, personalized service, and sustainable tourism. The increasing adoption of technology, including AI-powered chatbots and smart room controls, is further enhancing the guest experience.

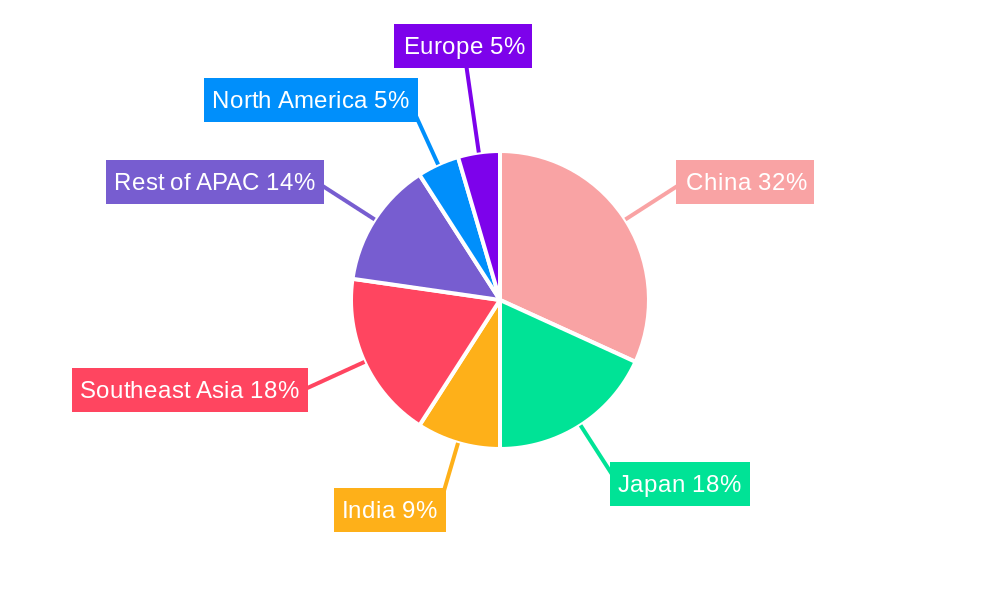

Leading Markets & Segments in APAP Luxury Hotel Industry

Within the APAC region, China and Japan emerge as leading markets for luxury hotels, driven by strong economic growth, expanding tourism, and a rising affluent population. The Resorts & Spa segment enjoys the highest market share, reflecting the growing demand for leisure and wellness travel.

- Key Drivers for China & Japan: Strong economic growth, increasing tourism, rising disposable incomes.

- Resorts & Spa Dominance: High demand for leisure and wellness experiences.

- Business Hotel Growth: Driven by increasing business travel and MICE (Meetings, Incentives, Conferences, and Exhibitions) activities.

- Airport Hotel Segment: Smaller market share compared to other segments, but significant growth potential.

- Holiday Hotels: Moderate growth driven by increased domestic tourism.

APAP Luxury Hotel Industry Product Developments

Product innovation in the APAC luxury hotel market focuses on enhancing guest experiences through technological advancements and personalized services. Hotels are increasingly incorporating smart room technology, AI-powered concierge services, and sustainable amenities. The focus on creating unique and memorable experiences through curated activities and personalized offerings is driving product differentiation. This approach allows hotels to cater to the evolving preferences of luxury travelers and enhance their competitive advantage.

Key Drivers of APAC Luxury Hotel Industry Growth

The APAC luxury hotel market's growth is fueled by several key drivers:

- Economic Growth: Rising disposable incomes and a growing middle class in key APAC markets.

- Tourism Boom: Increased inbound and outbound tourism, particularly from China and other emerging economies.

- Technological Advancements: Adoption of innovative technologies enhancing guest experiences and operational efficiency.

- Government Initiatives: Favorable policies promoting tourism and infrastructure development in many APAC countries.

Challenges in the APAC Luxury Hotel Industry Market

The APAC luxury hotel industry faces several challenges:

- Geopolitical Uncertainty: Regional conflicts and economic instability can impact travel demand.

- Intense Competition: Pressure from established players and the emergence of new entrants and alternative accommodations.

- Labor Shortages: Difficulty in attracting and retaining skilled hospitality professionals in certain regions.

- Regulatory Compliance: Navigating complex and varying regulations across different countries.

Emerging Opportunities in APAC Luxury Hotel Industry

Several emerging opportunities exist in the APAC luxury hotel market:

- Sustainable Tourism: Growing demand for eco-friendly hotels and sustainable travel practices.

- Wellness Tourism: Increased focus on health and wellness, creating opportunities for specialized spa and wellness offerings.

- Experiential Travel: Demand for unique and personalized experiences driving the growth of curated activities and local immersion programs.

- Technological Integration: Leveraging AI, big data, and other technologies to enhance operational efficiency and guest experiences.

Leading Players in the APAC Luxury Hotel Industry Sector

- The Okura Tokyo

- St. Regis Hotel

- Bellagio Shanghai (Note: This links to the Las Vegas Bellagio. A direct Shanghai link was not readily available.)

- Mandarin Oriental Hotel Group

- Saffire Freycinet

- The Reverie Saigon

- The Indian Hotels Company Limited

- Hyatt Group

- JW Marriott

- The Nai Harn

- The Peninsula Shanghai

Key Milestones in APAC Luxury Hotel Industry

- March 2023: TFE Hotels opens Vibe Hotel Adelaide (123 rooms), signifying the completion of the Flinders East precinct.

- January 2023: Hyatt Hotels Corporation opens Andaz Pattaya Jomtien Beach, marking the Andaz brand's debut in Thailand.

- April 2023: Bulgari Hotels & Resorts opens Bulgari Hotel Tokyo.

Strategic Outlook for APAC Luxury Hotel Industry Market

The APAC luxury hotel market holds significant long-term growth potential, driven by sustained economic growth, expanding tourism, and the evolving preferences of affluent travelers. Strategic opportunities exist in leveraging technological advancements, fostering sustainable practices, and creating unique guest experiences. Companies that can adapt to changing consumer preferences, effectively manage operational costs, and build strong brand loyalty are poised for success in this dynamic market. Continued investment in infrastructure, technology, and human capital will be essential to realizing the market's full potential.

APAC Luxury Hotel Industry Segmentation

-

1. Product Type

- 1.1. Business Hotel

- 1.2. Airport Hotel

- 1.3. Holiday Hotes

- 1.4. Resorts & Spa

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Australia

- 2.5. Thailand

- 2.6. Vietnam

- 2.7. Rest of Asia-Pacific

APAC Luxury Hotel Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Thailand

- 6. Vietnam

- 7. Rest of Asia Pacific

APAC Luxury Hotel Industry Regional Market Share

Geographic Coverage of APAC Luxury Hotel Industry

APAC Luxury Hotel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Population Preferring Leisure Vacations Contributes to the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Business Hotel

- 5.1.2. Airport Hotel

- 5.1.3. Holiday Hotes

- 5.1.4. Resorts & Spa

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Australia

- 5.2.5. Thailand

- 5.2.6. Vietnam

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Thailand

- 5.3.6. Vietnam

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Business Hotel

- 6.1.2. Airport Hotel

- 6.1.3. Holiday Hotes

- 6.1.4. Resorts & Spa

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Australia

- 6.2.5. Thailand

- 6.2.6. Vietnam

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Business Hotel

- 7.1.2. Airport Hotel

- 7.1.3. Holiday Hotes

- 7.1.4. Resorts & Spa

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Australia

- 7.2.5. Thailand

- 7.2.6. Vietnam

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Business Hotel

- 8.1.2. Airport Hotel

- 8.1.3. Holiday Hotes

- 8.1.4. Resorts & Spa

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Australia

- 8.2.5. Thailand

- 8.2.6. Vietnam

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Business Hotel

- 9.1.2. Airport Hotel

- 9.1.3. Holiday Hotes

- 9.1.4. Resorts & Spa

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Australia

- 9.2.5. Thailand

- 9.2.6. Vietnam

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Thailand APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Business Hotel

- 10.1.2. Airport Hotel

- 10.1.3. Holiday Hotes

- 10.1.4. Resorts & Spa

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. Australia

- 10.2.5. Thailand

- 10.2.6. Vietnam

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Vietnam APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Business Hotel

- 11.1.2. Airport Hotel

- 11.1.3. Holiday Hotes

- 11.1.4. Resorts & Spa

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. Australia

- 11.2.5. Thailand

- 11.2.6. Vietnam

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Asia Pacific APAC Luxury Hotel Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Business Hotel

- 12.1.2. Airport Hotel

- 12.1.3. Holiday Hotes

- 12.1.4. Resorts & Spa

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. Australia

- 12.2.5. Thailand

- 12.2.6. Vietnam

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Okura Tokyo

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 St Regis Hotel

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bellagio Shanghai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mandarin Oriental Hotel Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Saffire Freycinet**List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Reverie Saigon

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Indian Hotels Company Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hyatt Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 JW Marriott

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Nai Harn

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 The Penninsula Shangai

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 The Okura Tokyo

List of Figures

- Figure 1: Global APAC Luxury Hotel Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: China APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: China APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 5: China APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 7: China APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: India APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 9: India APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: India APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 11: India APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 13: India APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 15: Japan APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Japan APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 17: Japan APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Japan APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Japan APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Australia APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Australia APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 23: Australia APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Australia APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Australia APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Thailand APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: Thailand APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Thailand APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 29: Thailand APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Thailand APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Thailand APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Vietnam APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 33: Vietnam APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Vietnam APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 35: Vietnam APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Vietnam APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 37: Vietnam APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue (million), by Product Type 2025 & 2033

- Figure 39: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 40: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue (million), by Geography 2025 & 2033

- Figure 41: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue (million), by Country 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Luxury Hotel Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 3: Global APAC Luxury Hotel Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 9: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 11: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 18: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 19: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 21: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 22: Global APAC Luxury Hotel Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 23: Global APAC Luxury Hotel Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Luxury Hotel Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Luxury Hotel Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the APAC Luxury Hotel Industry?

Key companies in the market include The Okura Tokyo, St Regis Hotel, Bellagio Shanghai, Mandarin Oriental Hotel Group, Saffire Freycinet**List Not Exhaustive, The Reverie Saigon, The Indian Hotels Company Limited, Hyatt Group, JW Marriott, The Nai Harn, The Penninsula Shangai.

3. What are the main segments of the APAC Luxury Hotel Industry?

The market segments include Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 18179192.9 million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Rising Population Preferring Leisure Vacations Contributes to the Market Growth.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

In March 2023, TFE Hotels officially opened its doors at its newest South Australian address, the Vibe Hotel Adelaide. The launch of the 123-room, design-led Vibe hotel signifies the completion of the Flinders East precinct.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Luxury Hotel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Luxury Hotel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Luxury Hotel Industry?

To stay informed about further developments, trends, and reports in the APAC Luxury Hotel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence