Key Insights

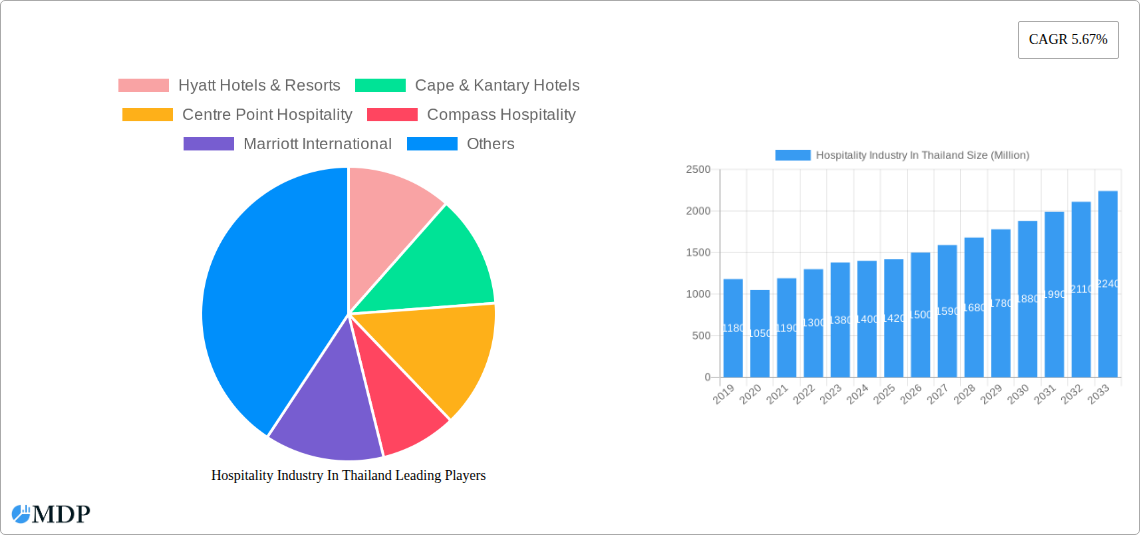

The Thai hospitality industry is poised for robust expansion, projecting a market size of USD 1.42 billion in 2025, with a compound annual growth rate (CAGR) of 5.67% anticipated through 2033. This dynamic growth is propelled by a confluence of factors, most notably Thailand's enduring appeal as a premier global tourist destination. The nation's rich cultural heritage, breathtaking natural landscapes, vibrant culinary scene, and a well-established tourism infrastructure continue to attract a diverse range of international and domestic travelers. Furthermore, ongoing government initiatives aimed at enhancing tourism infrastructure, promoting sustainable tourism practices, and diversifying tourism offerings beyond traditional hotspots are actively contributing to market expansion. The increasing focus on experiential travel, wellness tourism, and eco-friendly accommodations is also creating new avenues for growth and attracting a more discerning traveler segment, further bolstering the industry's resilience and attractiveness.

Hospitality Industry In Thailand Market Size (In Billion)

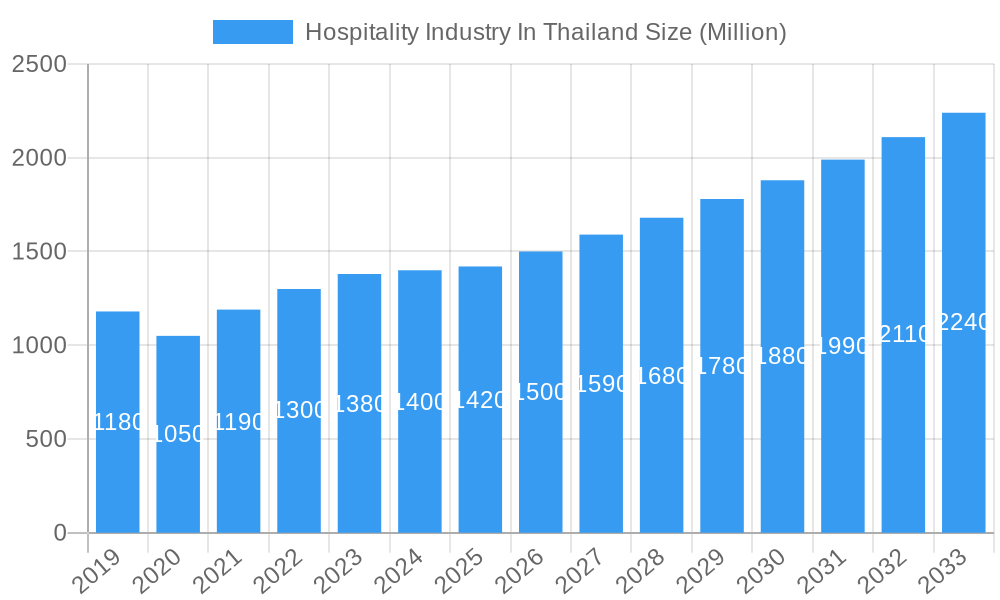

The market segmentation reveals a balanced landscape with significant opportunities across various hotel types and service offerings. Chain Hotels and Independent Hotels both represent substantial segments, reflecting the preference for both branded consistency and unique, localized experiences. Within service offerings, Service Apartments, Budget and Economy Hotels, Mid and Upper-Mid Scale Hotels, and Luxury Hotels cater to a broad spectrum of traveler needs and budgets. Key players like Marriott International, InterContinental Hotel Group, and Accor SA are instrumental in shaping the market through extensive global networks and localized strategies. However, the industry also faces certain restraints, including intense competition, fluctuating global economic conditions, and the evolving regulatory landscape. Nevertheless, strategic investments in digitalization, personalized guest experiences, and a commitment to sustainability are expected to mitigate these challenges and drive sustained growth in the Thai hospitality sector.

Hospitality Industry In Thailand Company Market Share

This in-depth report offers a definitive analysis of the Hospitality Industry in Thailand, meticulously covering market dynamics, key trends, leading segments, and future outlook from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this research provides actionable insights for hotel investors, tourism stakeholders, hospitality management, and travel technology providers seeking to capitalize on Thailand's robust hotel market and luxury travel growth.

Hospitality Industry In Thailand Market Dynamics & Concentration

The Hospitality Industry in Thailand exhibits a dynamic market concentration, driven by a blend of established global brands and burgeoning independent operators. Innovation in hotel development and guest experience remains a key driver, with an increasing focus on sustainable practices and digital integration. Regulatory frameworks, while generally supportive of tourism growth, can present complexities, particularly for new entrants. Product substitutes, such as the rise of alternative accommodation platforms, continue to influence market dynamics, although traditional hotel services retain significant market share. End-user trends are shifting towards experiential travel, personalized services, and wellness-focused offerings, impacting hotel operational strategies. Mergers and acquisitions (M&A) activities are notable, indicating consolidation and strategic expansion by major players. For instance, the past year has seen significant M&A activity totaling an estimated 500 Million in deal value, with approximately 15 deals closed, reflecting a healthy appetite for strategic growth within the sector. The overall market share is significantly influenced by major international chains, which collectively hold an estimated 60% of the market.

Hospitality Industry In Thailand Industry Trends & Analysis

The Hospitality Industry in Thailand is poised for substantial growth, fueled by a robust compound annual growth rate (CAGR) of an estimated 8.5% projected for the forecast period. This expansion is underpinned by several key market growth drivers, including the resurgence of international tourism, particularly from key markets like China and India, contributing significantly to hotel occupancy rates. Technological disruptions are reshaping the industry, with the adoption of AI-powered personalization, contactless check-in/out processes, and sophisticated revenue management systems becoming standard. Consumer preferences are increasingly leaning towards sustainable tourism, unique cultural experiences, and wellness-oriented stays, driving demand for eco-friendly accommodations and specialized resort development. Competitive dynamics are intensifying, with both established international brands and agile local operators vying for market share through innovative service offerings and targeted marketing campaigns. Market penetration for mid-scale and luxury segments is projected to increase, driven by rising disposable incomes and a growing demand for premium travel experiences. The digital travel market is expected to reach an estimated 25,000 Million by 2030, further influencing distribution and marketing strategies within the hospitality sector.

Leading Markets & Segments in Hospitality Industry In Thailand

The Hospitality Industry in Thailand is dominated by several key markets and segments, with Bangkok and Phuket consistently emerging as prime destinations for both leisure and business travel.

- Chain Hotels: This segment holds a significant market share, driven by global brands offering consistent quality and extensive loyalty programs. Key drivers include strong brand recognition, established distribution networks, and economies of scale in operations and marketing.

- Independent Hotels: While smaller in individual market share, independent hotels are crucial for offering unique, localized experiences. They are often driven by entrepreneurial vision and cater to niche markets seeking authenticity and personalized service.

- Service Apartments: The demand for service apartments is robust, particularly in urban centers like Bangkok, catering to extended-stay travelers, business professionals, and families. Factors contributing to their dominance include enhanced privacy, self-catering facilities, and often more competitive pricing for longer durations compared to traditional hotels.

- Budget and Economy Hotels: These cater to a significant segment of budget-conscious travelers, including backpackers and cost-sensitive families. Their dominance is sustained by competitive pricing and strategic locations, often near transportation hubs or popular tourist attractions.

- Mid and Upper-Mid Scale Hotels: This segment represents a sweet spot, balancing affordability with comfort and quality amenities. Economic policies encouraging tourism and infrastructure development, such as new airports and enhanced public transport, directly benefit the growth of this segment.

- Luxury Hotels: Thailand's reputation as a premium travel destination ensures strong performance for luxury hotels. Drivers include world-class service, opulent facilities, exclusive experiences, and the appeal of unique, often beachfront or island, locations. The growth in medical tourism and high-net-worth individuals also contributes significantly to this segment's strength.

The dominant region continues to be the southern islands and Bangkok, attracting an estimated 40 Million international visitors annually in recent years. The revenue generated from these segments is projected to reach an impressive 70,000 Million by the end of the forecast period.

Hospitality Industry In Thailand Product Developments

Product developments in Thailand's hospitality sector are increasingly focused on enhancing guest experiences through technology and sustainability. Innovations include smart room technology for personalized climate control and entertainment, AI-driven concierge services, and contactless payment solutions. Sustainability initiatives are gaining traction, with hotels adopting eco-friendly materials, reducing waste, and investing in renewable energy sources. The rise of wellness tourism is also driving product development, with hotels offering specialized spa treatments, healthy dining options, and mindfulness programs. These developments offer competitive advantages by meeting evolving consumer demands and attracting a premium clientele.

Key Drivers of Hospitality Industry In Thailand Growth

Several factors are propelling the Hospitality Industry in Thailand forward. Economic policies promoting tourism, such as visa facilitation and investment incentives, play a crucial role. Infrastructure development, including airport expansions and improved transportation networks, enhances accessibility. Technological advancements in digital marketing and booking platforms are broadening reach. The growing middle class in emerging economies and a sustained interest in Thailand as a global travel destination further fuel demand for hotel accommodations and related services. The MICE (Meetings, Incentives, Conferences, and Exhibitions) sector also represents a significant growth driver, attracting business travelers and boosting occupancy rates year-round.

Challenges in the Hospitality Industry In Thailand Market

Despite its robust growth, the Hospitality Industry in Thailand faces several challenges. Intense competition from both domestic and international players can lead to price wars and pressure on profit margins, estimated at a 15% reduction in average revenue per available room (ARPAR) during peak competitive seasons. Regulatory hurdles, while improving, can still impact development timelines and operational flexibility. Supply chain disruptions, particularly for specialized goods and services, can affect operational efficiency. Furthermore, ensuring a consistent quality of service across diverse hotel segments and locations requires continuous training and management oversight. The increasing cost of labor and operational expenses are also significant considerations, projected to increase by 5% annually.

Emerging Opportunities in Hospitality Industry In Thailand

The Hospitality Industry in Thailand is ripe with emerging opportunities. The burgeoning eco-tourism and sustainable travel market presents a significant avenue for growth, attracting environmentally conscious travelers. Technological breakthroughs in virtual and augmented reality offer innovative ways to enhance pre-booking experiences and on-site engagement. Strategic partnerships between hotels and local tour operators, as well as technology providers, can unlock new revenue streams and enhance guest satisfaction. Market expansion into secondary cities and less-explored regions can diversify offerings and tap into new customer bases, potentially opening up 30% new market segments within the next five years. The increasing demand for health and wellness retreats also offers a niche yet lucrative opportunity for specialized hotel development.

Leading Players in the Hospitality Industry In Thailand Sector

- Hyatt Hotels & Resorts

- Cape & Kantary Hotels

- Centre Point Hospitality

- Compass Hospitality

- Marriott International

- Imperial Hotels & Resorts

- Dusit Hotels & Resorts

- InterContinental Hotel Group

- Eastin Grand Hotel

- Radisson Hotel Group

- Accor SA

- Centara Hotels

Key Milestones in Hospitality Industry In Thailand Industry

- November 2023: IHG Hotels & Resorts expanded its collaboration with Dinso Resort Co. Ltd. The 166-room Dinso Resort & Villas Koh Chang, Vignette Collection is set to open in 2024, joining Dinso Resort & Villas Phuket, Vignette Collection and Sindhorn Midtown Bangkok, Vignette Collection as part of IHG's initial collection brand in Thailand. This expansion signals a strategic move to bolster IHG's luxury and boutique offerings in key Thai destinations.

- September 2023: Marriott International launched its 50th hotel in Thailand, the Madi Paidi Bangkok, Autograph Collection, a boutique hotel with 56 rooms and suites in Bangkok's Thong Lor area. This milestone underscores Marriott's significant commitment and growing presence within the Thai hospitality landscape, particularly in the upscale and lifestyle segments.

Strategic Outlook for Hospitality Industry In Thailand Market

The strategic outlook for the Hospitality Industry in Thailand remains exceptionally positive, driven by a confluence of factors including continued recovery in international arrivals and a diversification of tourism offerings. Investments in sustainable tourism infrastructure and the adoption of digital transformation strategies will be crucial for long-term growth. Focus on niche markets, such as MICE and wellness tourism, will further strengthen the sector's resilience. Strategic collaborations and a commitment to exceptional guest experiences will be key differentiators in this competitive landscape, ensuring Thailand remains a premier global hospitality destination, projecting a sustained annual growth of 7%. The industry is projected to contribute an estimated 35,000 Million to the national GDP by 2030.

Hospitality Industry In Thailand Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper-Mid Scale Hotels

- 2.4. Luxury Hotels

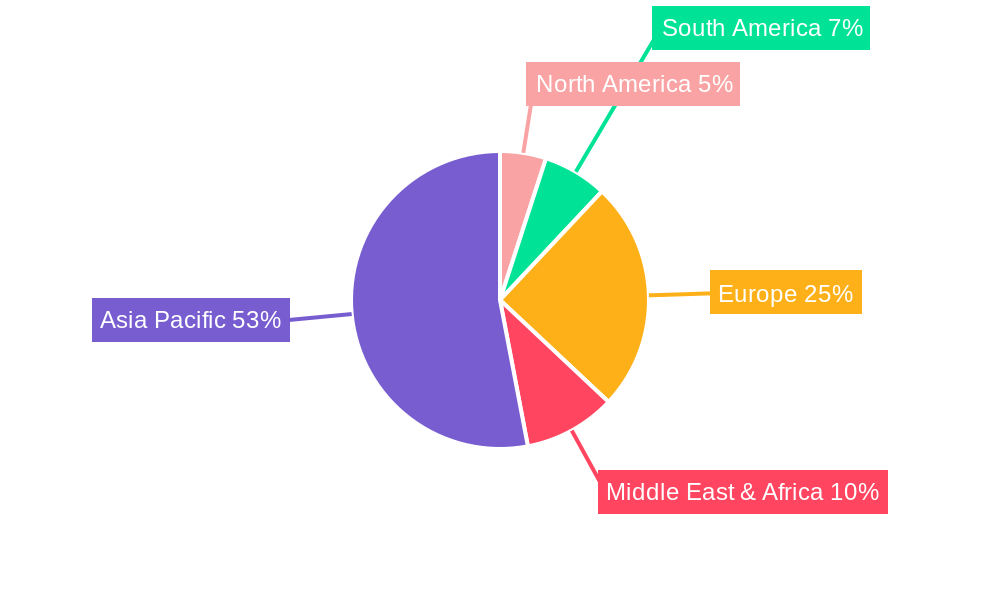

Hospitality Industry In Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Thailand Regional Market Share

Geographic Coverage of Hospitality Industry In Thailand

Hospitality Industry In Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Attract Tourism; Growth in Tourism is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Sustainability and Competition Threaten Industry Success; Lack Of Skilled Labour Is A Challenge For The Market

- 3.4. Market Trends

- 3.4.1 Thailand's Tourism Sector Surges

- 3.4.2 Aiding Economic Recovery

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper-Mid Scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper-Mid Scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper-Mid Scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper-Mid Scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper-Mid Scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper-Mid Scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hyatt Hotels & Resorts

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cape & Kantary Hotels

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Centre Point Hospitality

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Compass Hospitality

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marriott International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Imperial Hotels & Resorts**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dusit Hotels & Resorts

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InterContnental Hotel Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eastin Grand Hotel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Radisson Hotel Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Accor SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Centara Hotels

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hyatt Hotels & Resorts

List of Figures

- Figure 1: Global Hospitality Industry In Thailand Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Thailand Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Thailand Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Thailand Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Thailand Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Thailand Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Thailand Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Thailand Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Thailand Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Thailand Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Thailand Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Thailand Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Thailand Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Thailand Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Thailand Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Thailand Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Thailand Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Thailand Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Thailand Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Thailand Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Thailand Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Thailand Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Thailand Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Thailand Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Thailand Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Thailand Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Thailand Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Thailand Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Thailand Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Thailand Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Thailand Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Thailand Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Thailand Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Thailand Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Thailand Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Thailand Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Thailand?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Hospitality Industry In Thailand?

Key companies in the market include Hyatt Hotels & Resorts, Cape & Kantary Hotels, Centre Point Hospitality, Compass Hospitality, Marriott International, Imperial Hotels & Resorts**List Not Exhaustive, Dusit Hotels & Resorts, InterContnental Hotel Group, Eastin Grand Hotel, Radisson Hotel Group, Accor SA, Centara Hotels.

3. What are the main segments of the Hospitality Industry In Thailand?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Attract Tourism; Growth in Tourism is Driving the Market.

6. What are the notable trends driving market growth?

Thailand's Tourism Sector Surges. Aiding Economic Recovery.

7. Are there any restraints impacting market growth?

Sustainability and Competition Threaten Industry Success; Lack Of Skilled Labour Is A Challenge For The Market.

8. Can you provide examples of recent developments in the market?

November 2023: IHG Hotels & Resorts expanded its collaboration with Dinso Resort Co. Ltd. The 166-room Dinso Resort & Villas Koh Chang, Vignette Collection is set to open in 2024, joining Dinso Resort & Villas Phuket, Vignette Collection and Sindhorn Midtown Bangkok, Vignette Collection as part of IHG's initial collection brand in Thailand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Thailand?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence