Key Insights

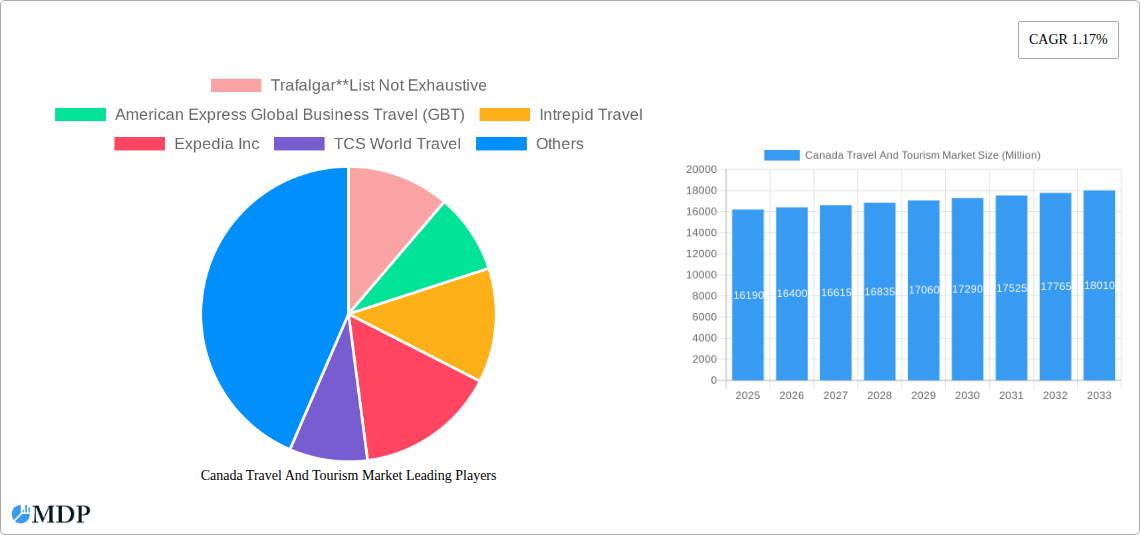

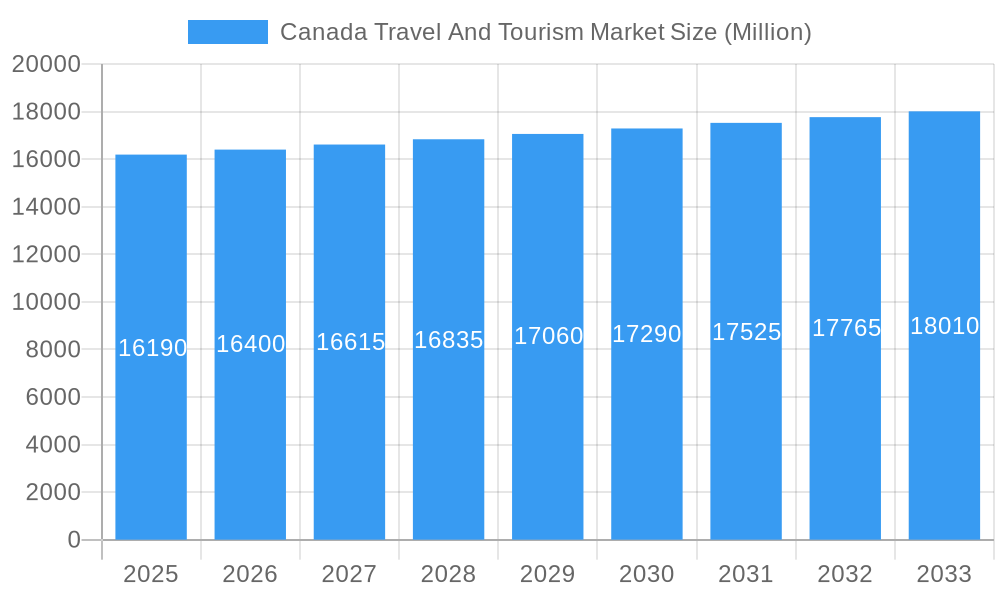

The Canadian travel and tourism market, valued at $16.19 billion in 2025, exhibits a moderate growth trajectory with a compound annual growth rate (CAGR) of 1.17%. This relatively low CAGR reflects a post-pandemic recovery phase, where while the market is rebounding, growth is not yet at pre-pandemic levels. Key drivers include increasing disposable incomes among Canadians, a growing interest in domestic and international travel experiences, and the continued development of robust tourism infrastructure. The rise of online booking platforms simplifies travel planning and booking, further boosting market expansion. However, factors such as fluctuating fuel prices, economic uncertainty, and seasonality impose constraints on market growth. The market is segmented by application (international and domestic), booking method (online and offline), and travel type (leisure, education, business, sports, medical tourism, and others). The domestic travel segment is likely to be significant, driven by Canadians exploring their own country's diverse landscapes and attractions. The online booking segment demonstrates consistent growth, mirroring broader digitalization trends in the travel industry. Within the travel type segment, leisure tourism is expected to be the dominant sector, with business and medical tourism showing potential for considerable growth in the coming years.

Canada Travel And Tourism Market Market Size (In Billion)

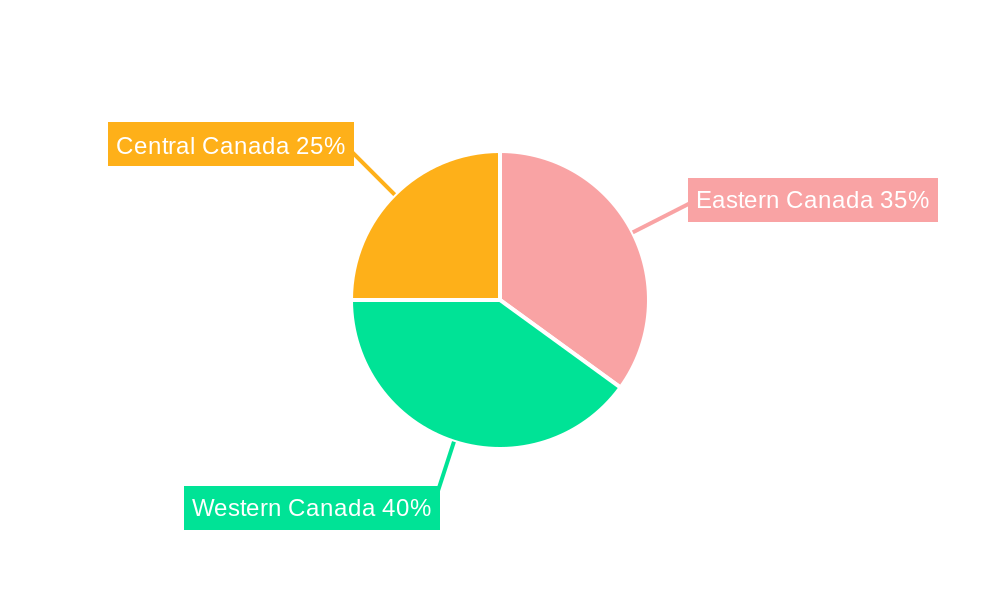

The competitive landscape is fragmented, featuring both international and domestic players. Established companies like Trafalgar, American Express Global Business Travel (GBT), Intrepid Travel, and Expedia Inc. compete with smaller, specialized operators. This competition fosters innovation and diverse offerings, catering to various traveler preferences and budgets. The regional distribution across Eastern, Western, and Central Canada reflects differing tourism attractions and infrastructure in each region. The forecast period of 2025-2033 indicates continued market expansion, albeit cautiously, with a growth trajectory influenced by both economic and geopolitical factors. A sustained focus on sustainable tourism practices and addressing environmental concerns will play a significant role in shaping the market's future trajectory.

Canada Travel And Tourism Market Company Market Share

Canada Travel and Tourism Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Travel and Tourism Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future opportunities within this vibrant sector. The report leverages extensive data analysis and expert insights to offer actionable recommendations for navigating the complexities of this dynamic market. Expect detailed breakdowns by application (international, domestic), booking method (online, offline), and travel type (leisure, education, business, sports, medical tourism, other). Download now to gain a competitive edge.

Canada Travel and Tourism Market Market Dynamics & Concentration

The Canadian travel and tourism market exhibits a moderately concentrated landscape, with a few dominant players alongside numerous smaller operators. Market share is dynamic, influenced by factors such as technological advancements, evolving consumer preferences, and strategic mergers and acquisitions (M&A). Innovation, particularly in online booking platforms and sustainable tourism practices, is a key driver. The regulatory framework, including visa policies and environmental regulations, significantly impacts market growth. Product substitutes, such as staycations or alternative leisure activities, pose competitive pressures. End-user trends, including a growing preference for personalized experiences and sustainable travel, are reshaping the market. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, leading to some consolidation.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Canadian travel and tourism market in 2024 is estimated at xx.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024, with a focus on technology integration and expansion into new segments.

- Innovation Drivers: Technological advancements in booking platforms, personalized travel recommendations, and sustainable tourism solutions are shaping market dynamics.

- Regulatory Framework: Government policies regarding visa requirements, environmental regulations, and tourism promotion influence market access and growth.

- End-User Trends: Increasing demand for personalized, sustainable, and experiential travel is creating new market niches.

Canada Travel and Tourism Market Industry Trends & Analysis

The Canada Travel and Tourism market witnessed significant growth during the historical period (2019-2024), experiencing a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%. Several factors contribute to this positive outlook. The increasing disposable incomes among Canadians, coupled with favorable exchange rates, has fueled domestic tourism. International tourism has also rebounded strongly post-pandemic, driven by pent-up demand and Canada's appealing natural landscapes and diverse cultural attractions. Technological disruptions, such as the rise of online travel agencies (OTAs) and travel apps, have significantly impacted market penetration, improving accessibility and convenience. The market shows a strong preference for personalized experiences, sustainable travel options, and immersive cultural interactions. Intense competition among players requires continuous innovation and adaptation.

- Market Penetration of Online Booking: Online booking penetration reached xx% in 2024 and is projected to reach xx% by 2033.

- CAGR (2019-2024): xx%

- Projected CAGR (2025-2033): xx%

Leading Markets & Segments in Canada Travel And Tourism Market

The Canadian travel and tourism market is geographically diverse, with significant variations in performance across provinces and territories. Ontario and British Columbia consistently dominate, owing to their strong economies, diverse attractions, and well-developed tourism infrastructure. The domestic segment is currently the largest, accounting for approximately xx% of the total market in 2024, driven by increasing disposable incomes and a growing preference for local experiences. However, the international segment is expected to experience strong growth, driven by Canada's increasing global appeal.

- By Application: The domestic segment represents the largest share, followed by the international segment.

- By Booking: Online bookings are rapidly gaining traction, exceeding offline bookings by xx% in 2024.

- By Type: Leisure tourism remains the largest segment, with business travel also contributing significantly.

Key Drivers for Dominant Segments:

- Ontario & British Columbia: Strong economies, extensive tourism infrastructure, diverse attractions, and effective tourism marketing campaigns contribute to these provinces' dominance.

- Domestic Tourism: Growing disposable incomes, increasing preference for staycations, and government initiatives supporting local tourism fuel this segment's growth.

- Online Bookings: Convenience, wider selection, and competitive pricing drive the popularity of online travel booking platforms.

Canada Travel and Tourism Market Product Developments

The Canadian travel and tourism market is witnessing significant product innovation. This includes the development of tailored travel experiences, sustainable tourism packages, and the integration of advanced technologies, such as virtual reality (VR) and augmented reality (AR) for immersive travel planning and engagement. The market emphasizes personalized travel packages catering to niche interests and demands, creating a competitive advantage for operators offering unique and memorable experiences. Technological developments offer improved efficiency and personalized experiences, enhancing customer satisfaction and loyalty.

Key Drivers of Canada Travel and Tourism Market Growth

Several factors are driving the growth of the Canada travel and tourism market. Firstly, the increasing disposable incomes of Canadians and favorable exchange rates are boosting domestic travel. Secondly, Canada's reputation for natural beauty and cultural diversity attracts a significant number of international visitors. Thirdly, government initiatives to promote tourism and improve infrastructure are stimulating the sector's growth. Finally, technological advancements, such as online booking platforms and mobile apps, have enhanced accessibility and convenience for travelers. The development of sustainable tourism practices also attracts environmentally conscious travelers.

Challenges in the Canada Travel And Tourism Market Market

The Canadian travel and tourism sector faces several challenges. Seasonal fluctuations in tourist arrivals present a significant hurdle, as does the high cost of air travel and accommodation. Competitive pressures from international destinations are also notable. Furthermore, the impact of unforeseen events such as pandemics and natural disasters presents unpredictable challenges and requires strong contingency planning. Infrastructure limitations in certain regions also impact the sector's capacity for growth. Supply chain disruptions, especially during peak seasons, can affect service quality and pricing.

Emerging Opportunities in Canada Travel And Tourism Market

The Canadian travel and tourism market offers several promising opportunities. The growth of adventure tourism, wellness tourism, and culinary tourism presents exciting possibilities for market expansion. Strategic partnerships between tourism operators and local communities can create authentic and culturally immersive experiences. Investments in sustainable tourism practices, eco-friendly accommodations, and reduced carbon footprint initiatives can attract environmentally conscious travelers. Furthermore, leveraging technology to enhance the customer journey and offer personalized experiences can provide a significant competitive edge.

Leading Players in the Canada Travel And Tourism Market Sector

- Trafalgar

- American Express Global Business Travel (GBT)

- Intrepid Travel

- Expedia Inc

- TCS World Travel

- BCD Travel

- Topdeck Travel Ltd

- Exodus Travels Ltd

- Abercrombie & Kent USA LLC

- Booking Holdings Inc

Key Milestones in Canada Travel And Tourism Market Industry

- October 2023: The Government of Canada invested USD 500,000 in Indigenous tourism in British Columbia, boosting the "Invest in Iconic" strategy and stimulating the local economy. This initiative signifies a focus on sustainable and culturally sensitive tourism development.

- October 2022: Sabre and BCD Travel's technology partnership is expected to significantly increase booking levels and drive innovation within the corporate travel sector. This collaboration highlights the increasing role of technology in shaping travel trends.

Strategic Outlook for Canada Travel And Tourism Market Market

The Canadian travel and tourism market is poised for continued growth. Focusing on sustainable and responsible tourism practices will be crucial for long-term success. Strategic partnerships, technological innovation, and effective marketing campaigns will be essential for attracting both domestic and international visitors. The development of niche tourism products catering to specific interests will also contribute to market expansion. Investment in infrastructure and effective management of seasonal fluctuations will enhance the overall visitor experience and contribute to the sector's long-term viability.

Canada Travel And Tourism Market Segmentation

-

1. Type

- 1.1. Leisure

- 1.2. Education

- 1.3. Business

- 1.4. Sports

- 1.5. Medical Tourism

- 1.6. Other Types

-

2. Application

- 2.1. International

- 2.2. Domestic

-

3. Booking

- 3.1. Online

- 3.2. Offline

Canada Travel And Tourism Market Segmentation By Geography

- 1. Canada

Canada Travel And Tourism Market Regional Market Share

Geographic Coverage of Canada Travel And Tourism Market

Canada Travel And Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Increasing Interest in Multi-Day Tours is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Travel And Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leisure

- 5.1.2. Education

- 5.1.3. Business

- 5.1.4. Sports

- 5.1.5. Medical Tourism

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. International

- 5.2.2. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trafalgar**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Express Global Business Travel (GBT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intrepid Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expedia Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TCS World Travel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCD Travel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topdeck Travel Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Exodus Travels Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abercrombie & Kent USA LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trafalgar**List Not Exhaustive

List of Figures

- Figure 1: Canada Travel And Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Travel And Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 4: Canada Travel And Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 8: Canada Travel And Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Travel And Tourism Market?

The projected CAGR is approximately 1.17%.

2. Which companies are prominent players in the Canada Travel And Tourism Market?

Key companies in the market include Trafalgar**List Not Exhaustive, American Express Global Business Travel (GBT), Intrepid Travel, Expedia Inc, TCS World Travel, BCD Travel, Topdeck Travel Ltd, Exodus Travels Ltd, Abercrombie & Kent USA LLC, Booking Holdings Inc.

3. What are the main segments of the Canada Travel And Tourism Market?

The market segments include Type, Application, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Increasing Interest in Multi-Day Tours is Driving the Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

October 2023: The Government of Canada invested in tourism across British Columbia to attract new visitors and stimulate local economies. Funding of USD 500,000 has been provided to the Aboriginal Tourism Association of British Columbia to help Indigenous Tourism BC develop its "Invest in Iconic" tourism strategy with Destination BC to grow the Indigenous tourism sector in British Columbia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Travel And Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Travel And Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Travel And Tourism Market?

To stay informed about further developments, trends, and reports in the Canada Travel And Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence