Key Insights

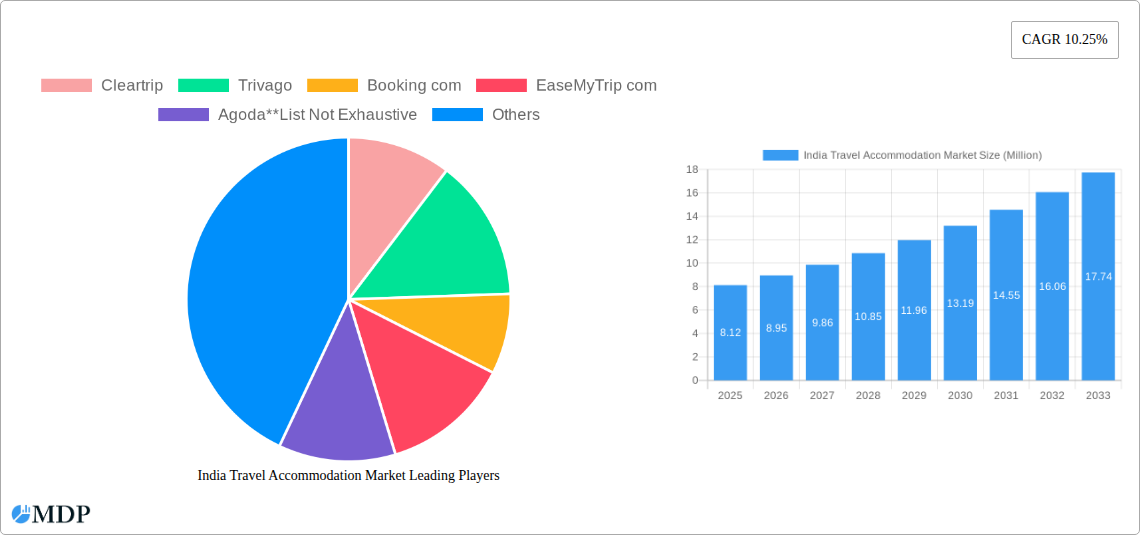

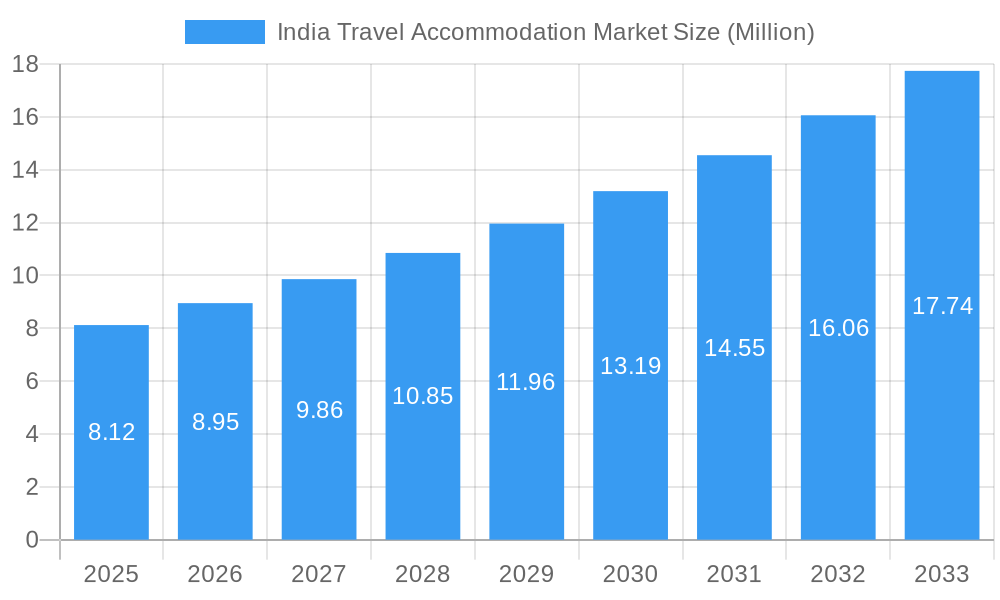

The India Travel Accommodation Market is poised for substantial expansion, projected to reach a market size of 8.12 Million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 10.25% during the forecast period of 2025-2033. This robust growth is primarily driven by a burgeoning middle class, increasing disposable incomes, and a significant rise in both domestic and international tourism. The government's focus on improving tourism infrastructure and promoting various tourist destinations is further fueling demand for diverse accommodation options. The market's evolution is characterized by a dynamic shift towards online booking channels, with mobile applications and websites dominating user preferences. This digital transformation is enabling greater accessibility and convenience for travelers, leading to increased booking volumes.

India Travel Accommodation Market Market Size (In Million)

Key trends shaping the India Travel Accommodation Market include the proliferation of online travel agencies (OTAs) and direct booking portals, offering a wide spectrum of choices from budget-friendly hostels and guesthouses to luxury hotels and boutique stays. The rise of "experiential travel" is also a significant factor, with travelers seeking unique and authentic accommodation experiences beyond traditional hotel stays. Companies like MakeMyTrip, Goibibo, Booking.com, and Agoda are at the forefront, leveraging technology to enhance user experience and expand their offerings. While the market benefits from strong demand drivers, challenges such as intense competition among players, price sensitivity of consumers, and the need for continuous innovation in service offerings and technology adoption are key restraints that companies must navigate to sustain growth. The market's trajectory indicates a future dominated by personalized offerings, seamless digital integration, and a focus on sustainable tourism practices.

India Travel Accommodation Market Company Market Share

India Travel Accommodation Market: Comprehensive Report Description

Dive deep into the India Travel Accommodation Market, a dynamic and rapidly expanding sector poised for significant growth. This report offers an in-depth analysis of market trends, key drivers, challenges, and strategic opportunities shaping the Indian travel accommodation landscape. With a comprehensive study period from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights for industry stakeholders, investors, and businesses seeking to capitalize on the burgeoning Indian tourism industry.

The report focuses on critical segments including Platform: Mobile Application and Website, and Mode of Booking: Third Party Online Portals and Direct/Captive Portals. It examines the impact of leading companies such as Cleartrip, Trivago, Booking.com, EaseMyTrip.com, Agoda (List Not Exhaustive), OYO Rooms, IRCTC, Goibibo, and MakeMyTrip.com. Unlock the potential of this lucrative market with detailed analysis of market dynamics, industry trends, leading segments, product developments, and key players.

India Travel Accommodation Market Market Dynamics & Concentration

The India Travel Accommodation Market exhibits a dynamic concentration, driven by a blend of established online travel agencies (OTAs) and emerging players. Innovation remains a primary driver, with companies continuously investing in technology to enhance user experience, personalize offerings, and streamline booking processes. Regulatory frameworks, while evolving, play a crucial role in shaping market access and operational standards. Product substitutes, such as serviced apartments and homestays, are gaining traction, compelling traditional accommodation providers to adapt. End-user trends are increasingly leaning towards budget-friendly options, unique experiences, and tech-enabled convenience, influencing service offerings. Merger and Acquisition (M&A) activities, while currently moderate, are expected to escalate as larger players seek to consolidate market share and expand their portfolios. The market share distribution is highly competitive, with major OTAs holding significant sway, and smaller, niche providers carving out specific market segments. M&A deal counts are projected to increase as consolidation becomes a strategic imperative for sustainable growth.

India Travel Accommodation Market Industry Trends & Analysis

The India Travel Accommodation Market is experiencing robust growth, fueled by a confluence of factors. The CAGR is projected to be substantial, indicating a healthy expansion trajectory. Increasing disposable incomes, a burgeoning middle class, and a growing desire for leisure travel are significant market growth drivers. Technological disruptions are at the forefront, with the widespread adoption of smartphones and the internet facilitating online bookings and digital payments. The proliferation of mobile applications has democratized access to travel accommodation, making it easier for consumers to search, compare, and book their stays. Consumer preferences are shifting towards personalized experiences, sustainable travel options, and the convenience offered by integrated booking platforms. Competitive dynamics are intense, with both domestic and international players vying for market dominance. Market penetration is steadily increasing, particularly in Tier 2 and Tier 3 cities, as more Indians embrace online travel booking. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing personalized recommendations and customer service. The rise of the "gig economy" is also influencing accommodation trends, with a growing demand for flexible and short-term stays. The government's focus on promoting tourism through initiatives like "Incredible India" further bolsters the sector's growth. The demand for diverse accommodation types, from luxury hotels to budget guesthouses and unique stays, is on the rise.

Leading Markets & Segments in India Travel Accommodation Market

The India Travel Accommodation Market is characterized by the dominance of certain platforms and booking modes. The Website segment continues to hold a significant share, offering comprehensive booking functionalities and detailed information. However, the Mobile Application segment is witnessing rapid growth, driven by the increasing smartphone penetration and the convenience of booking on the go. This segment is crucial for capturing younger demographics and spontaneous travelers.

Platform Dominance:

- Website: Remains a primary channel for in-depth research and complex bookings. Its extensive features and desktop accessibility appeal to a broad user base.

- Mobile Application: Experiencing exponential growth, driven by convenience, accessibility, and a focus on user-friendly interfaces. This segment is critical for impulsive bookings and loyalty program engagement.

Mode of Booking Dominance:

- Third Party Online Portals: These platforms, including major OTAs, dominate the market due to their vast inventory, competitive pricing, and established brand trust. They offer a one-stop solution for a wide range of accommodation needs.

- Direct/Captive Portals: While currently holding a smaller share, direct bookings through hotel websites and airline portals are gaining traction, especially among loyalty program members seeking exclusive deals and a more personalized experience.

The dominance in these segments is influenced by several factors. Economic policies promoting tourism and infrastructure development in key tourist destinations contribute significantly to the overall market expansion. The increasing digital literacy across India further empowers consumers to utilize online platforms for their travel needs. The competitive landscape, with continuous innovation in user experience and pricing strategies by major players like MakeMyTrip, Goibibo, and Booking.com, solidifies the dominance of third-party portals. However, hotels and other accommodation providers are increasingly investing in their direct booking channels to reduce commission costs and build direct customer relationships. The synergy between mobile and website platforms allows for a seamless customer journey, further consolidating market leadership.

India Travel Accommodation Market Product Developments

Product developments in the India Travel Accommodation Market are increasingly focused on enhancing user experience and personalization. Innovations include AI-powered personalized recommendations, voice-assisted booking in multiple Indian languages, and integrated travel and expense management solutions. These advancements aim to streamline the booking process, cater to diverse user preferences, and offer seamless end-to-end travel planning. The competitive advantage lies in delivering intuitive interfaces, curated travel packages, and efficient customer support, thereby fostering customer loyalty and market differentiation in an intensely competitive landscape.

Key Drivers of India Travel Accommodation Market Growth

Several key drivers are propelling the growth of the India Travel Accommodation Market. Economic growth and rising disposable incomes are fostering a culture of travel and leisure. The rapid digitalization and increasing internet penetration across urban and rural India have made online booking platforms highly accessible. Government initiatives aimed at promoting tourism, such as visa reforms and infrastructure development, are further stimulating domestic and international tourist arrivals. The growing middle class with a propensity for experiential travel is creating demand for diverse accommodation options. Technological advancements, including the adoption of mobile applications and AI-driven personalization, are enhancing the booking experience and driving customer engagement.

Challenges in the India Travel Accommodation Market Market

Despite its robust growth, the India Travel Accommodation Market faces several challenges. Intense competition among online travel agencies (OTAs) and accommodation providers can lead to price wars, impacting profit margins. Regulatory hurdles and evolving compliance requirements can pose operational complexities for businesses. Supply chain issues, particularly in ensuring a consistent standard of service across a vast and diverse market, remain a concern. The digital divide, though shrinking, still limits access for some segments of the population. Furthermore, issues related to customer trust and data security need continuous attention to maintain consumer confidence in online booking platforms.

Emerging Opportunities in India Travel Accommodation Market

Emerging opportunities in the India Travel Accommodation Market are abundant, driven by evolving consumer behavior and technological advancements. The burgeoning demand for unique and experiential stays, such as boutique hotels, eco-resorts, and homestays, presents a significant opportunity for niche players. The expansion of tourism into less-explored destinations, facilitated by improved connectivity, opens up new markets. Strategic partnerships between travel tech companies and FinTech players offer integrated travel and expense management solutions, catering to the corporate segment. The increasing adoption of sustainable tourism practices also presents an opportunity for businesses to differentiate themselves and attract environmentally conscious travelers. The growing trend of bleisure travel (business + leisure) is creating demand for flexible accommodation options that cater to both professional and personal needs.

Leading Players in the India Travel Accommodation Market Sector

- Cleartrip

- Trivago

- Booking.com

- EaseMyTrip.com

- Agoda

- OYO Rooms

- IRCTC

- Goibibo

- MakeMyTrip.com

Key Milestones in India Travel Accommodation Market Industry

- February 2024: EaseMyTrip opened its 10th offline retail outlet in Indore, Madhya Pradesh, under its franchise model, demonstrating a commitment to offline customer reach and personalized service.

- February 2024: EaseMyTrip formed a strategic alliance with Zaggle Prepaid Ocean Services Limited to offer integrated travel and expense management solutions.

- May 2023: Microsoft partnered with MakeMyTrip to introduce voice-assisted booking in Indian languages, powered by OpenAI Service & Azure’s Cognitive Services, for personalized travel recommendations and booking.

Strategic Outlook for India Travel Accommodation Market Market

The strategic outlook for the India Travel Accommodation Market is highly optimistic, driven by strong growth accelerators. The increasing penetration of online booking platforms, coupled with a rising propensity for travel among the Indian population, will continue to fuel demand. Key opportunities lie in leveraging technology for hyper-personalization of travel experiences, expanding into Tier 2 and Tier 3 cities, and capitalizing on the growing interest in sustainable and experiential tourism. Strategic partnerships and collaborations, particularly in the FinTech and travel tech space, will be crucial for offering integrated solutions. The focus on improving customer service, ensuring data security, and adapting to evolving consumer preferences will be paramount for sustained success in this dynamic market.

India Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive Portals

India Travel Accommodation Market Segmentation By Geography

- 1. India

India Travel Accommodation Market Regional Market Share

Geographic Coverage of India Travel Accommodation Market

India Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels

- 3.2.2 Resorts

- 3.2.3 and Airbnb Options for Consumers Driving the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Growth of Digital Payments Is Boosting the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive Portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trivago

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EaseMyTrip com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agoda**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OYO Rooms

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IRCTC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goibibo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MakeMyTrip com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Travel Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Travel Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: India Travel Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: India Travel Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Travel Accommodation Market?

The projected CAGR is approximately 10.25%.

2. Which companies are prominent players in the India Travel Accommodation Market?

Key companies in the market include Cleartrip, Trivago, Booking com, EaseMyTrip com, Agoda**List Not Exhaustive, OYO Rooms, IRCTC, Goibibo, MakeMyTrip com.

3. What are the main segments of the India Travel Accommodation Market?

The market segments include Platform, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels. Resorts. and Airbnb Options for Consumers Driving the Market's Growth.

6. What are the notable trends driving market growth?

Rising Growth of Digital Payments Is Boosting the Growth of the Market.

7. Are there any restraints impacting market growth?

Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth.

8. Can you provide examples of recent developments in the market?

February 2024: India’s biggest online travel tech platform, EaseMyTrip, opened its first offline retail outlet in the state of Madhya Pradesh, Indore. This is the 10th offline store launched under the brand's franchise model, which is a testament to its commitment to efficiently serving its customers online and offline. The new offline store is aimed at reaching out to its offline customers who are looking for a personalized meet-and-greet experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the India Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence