Key Insights

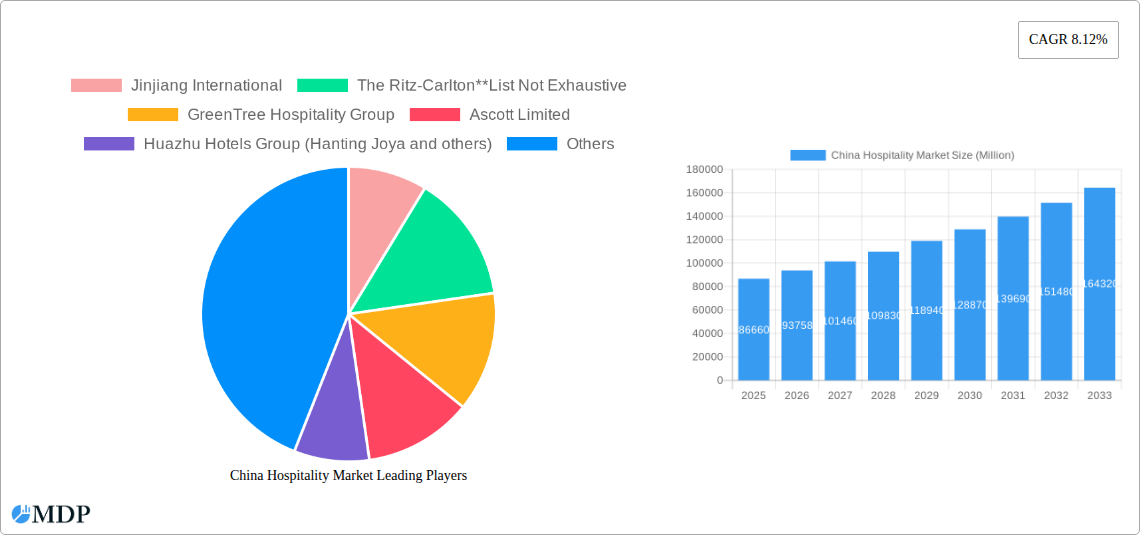

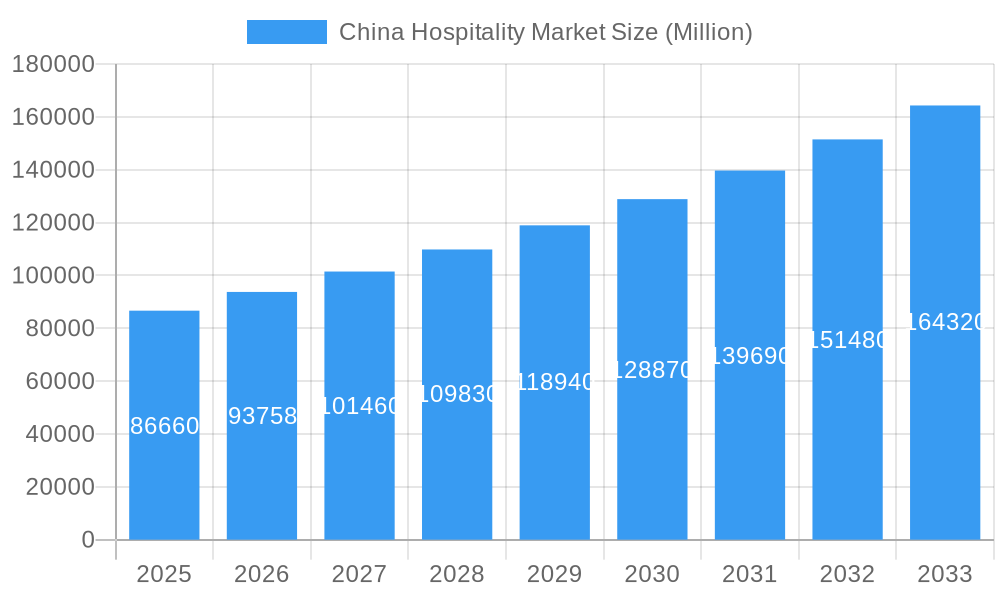

The China hospitality market, valued at $86.66 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.12% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes among China's burgeoning middle class are driving increased leisure and business travel, significantly boosting demand for accommodation across all segments. Government initiatives promoting tourism and infrastructure development, particularly in less-developed regions, further stimulate market growth. The increasing popularity of domestic tourism and the rise of online travel agencies (OTAs) also contribute to market expansion. While the market faces certain restraints, such as fluctuating economic conditions and increased competition, the overall outlook remains positive. The market segmentation reveals a diverse landscape. The budget and economy hotel segment is expected to maintain significant growth due to price sensitivity among a large portion of travelers. However, the mid and upper-mid-scale, and luxury hotel segments are also showing strong potential driven by an expanding affluent population seeking enhanced travel experiences. The dominance of chain hotels is likely to continue, given their established brands and operational efficiencies; however, independent hotels are also finding their niche catering to specific customer preferences and locations.

China Hospitality Market Market Size (In Billion)

The competitive landscape is highly dynamic, with both international and domestic players vying for market share. Major international chains such as Marriott International and The Ritz-Carlton compete alongside prominent Chinese players like Jinjiang International, Huazhu Hotels Group, and Plateno Group. The strategic expansion of hotel brands, particularly into secondary and tertiary cities, signifies a focus on capturing growing demand outside major metropolitan areas. The successful players will be those that can adapt to evolving consumer preferences, leverage technology effectively (e.g., through sophisticated booking systems and personalized service), and navigate the challenges of a competitive market. Future growth will likely be shaped by the ongoing evolution of consumer behavior, technological advancements within the hospitality sector, and the broader macroeconomic conditions within China.

China Hospitality Market Company Market Share

China Hospitality Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China hospitality market, covering the period from 2019 to 2033. We delve into market dynamics, key players, emerging trends, and future growth prospects, offering invaluable insights for industry stakeholders. The report leverages extensive data analysis and incorporates real-world examples to provide actionable intelligence for strategic decision-making. The total market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). This report is essential for investors, hospitality professionals, and anyone seeking to understand the complexities and opportunities within this rapidly evolving market.

China Hospitality Market Market Dynamics & Concentration

The China hospitality market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is relatively high, with a few major players holding significant market share. However, the market also exhibits a significant presence of smaller, independent hotels, particularly in less developed regions. Leading players such as Huazhu Hotels Group, Jinjiang International, and Plateno Group dominate the budget and midscale segments, while international chains like Marriott International and The Ritz-Carlton cater to the luxury market.

Market dynamics are driven by several key factors:

- Innovation: Technological advancements in areas such as online booking platforms, revenue management systems, and smart hotel technologies are reshaping the industry.

- Regulatory Framework: Government policies related to tourism, infrastructure development, and environmental regulations significantly impact market growth and operational efficiency.

- Product Substitutes: The rise of alternative accommodation options, such as Airbnb and vacation rentals, presents a competitive challenge to traditional hotels.

- End-User Trends: Changing consumer preferences, including increasing demand for personalized experiences and sustainable travel options, are influencing hotel offerings and service strategies.

- M&A Activities: The hospitality sector in China has witnessed considerable merger and acquisition (M&A) activity in recent years. The number of M&A deals averaged xx per year during the historical period (2019-2024), indicating a trend of consolidation within the market. The market share of the top 5 players is estimated to be xx% in 2025.

China Hospitality Market Industry Trends & Analysis

The China hospitality market has experienced substantial growth in recent years, driven by several key factors. A rising middle class with increased disposable income fuels demand for leisure and business travel. Government initiatives promoting tourism development and infrastructure improvements, such as the high-speed rail network, have significantly enhanced accessibility and boosted the industry. Technological advancements are transforming the customer experience, with online booking platforms and mobile apps becoming increasingly prevalent. The market penetration of online booking platforms is estimated at xx% in 2025.

The competitive landscape is characterized by intense rivalry among both domestic and international players. International hotel chains are aggressively expanding their presence in China, while domestic players are leveraging their local expertise and cost advantages to maintain market share. Consumer preferences are evolving towards experiences over merely accommodation, driving innovation in hotel design, amenities, and services. The industry is adapting to meet the increasing demand for personalized services and sustainable practices. The market is projected to grow at a CAGR of xx% during the forecast period, driven by the continued expansion of the middle class and increased government support for the tourism industry.

Leading Markets & Segments in China Hospitality Market

The China hospitality market is geographically diverse, with significant variations in growth rates and market characteristics across different regions. Coastal cities and major metropolitan areas such as Beijing, Shanghai, and Guangzhou remain dominant, attracting the highest volume of tourists and business travelers. However, secondary and tertiary cities are experiencing rapid growth, driven by economic development and infrastructure improvements.

By segment, the budget and economy hotel segment holds the largest market share, driven by the large segment of price-sensitive travelers. However, the mid and upper-mid-scale segments are also experiencing strong growth, reflecting an expanding middle class with greater disposable income. The luxury hotel segment, while smaller in terms of overall market share, boasts high revenue generation potential.

- Key Drivers for Dominant Segments:

- Budget and Economy Hotels: Price sensitivity among travelers, significant presence of domestic hotel chains.

- Mid and Upper-Mid-Scale Hotels: Growing middle class with increased disposable income, preference for enhanced amenities and services.

- Luxury Hotels: High-spending tourists and business travelers, appeal of exclusive experiences and services.

- Chain Hotels: Brand recognition, standardization of services, loyalty programs.

- Independent Hotels: Local expertise, unique character and design, personalized service.

China Hospitality Market Product Developments

Recent product innovations in the China hospitality market focus on enhancing guest experiences and operational efficiency. This includes the integration of smart technologies such as mobile check-in/check-out, automated room service, and personalized in-room entertainment systems. Hotels are increasingly incorporating sustainable practices, such as energy-efficient systems and waste reduction programs, to appeal to environmentally conscious travelers. These innovations cater to evolving consumer preferences and enhance the competitive advantages of hotels.

Key Drivers of China Hospitality Market Growth

The China hospitality market's growth is fueled by several factors:

- Economic Growth: A rising middle class with increased disposable income drives travel and leisure spending.

- Government Policies: Government initiatives promoting tourism and infrastructure development enhance accessibility and stimulate market growth.

- Technological Advancements: The integration of technology improves operational efficiency and enhances customer experience.

Challenges in the China Hospitality Market Market

The China hospitality market faces several challenges:

- Intense Competition: The market is characterized by intense rivalry among numerous domestic and international players.

- Regulatory Hurdles: Navigating complex regulatory frameworks and obtaining necessary permits can present significant operational challenges.

- Supply Chain Issues: Disruptions to supply chains can impact the availability of goods and services.

Emerging Opportunities in China Hospitality Market

Emerging opportunities lie in:

- Technological Innovation: Further adoption of smart technologies can enhance efficiency and create unique guest experiences.

- Strategic Partnerships: Collaborations among hospitality providers, technology companies, and tourism agencies can unlock new market segments.

- Market Expansion: Growth in secondary and tertiary cities presents significant opportunities for expansion.

Leading Players in the China Hospitality Market Sector

- Jinjiang International

- The Ritz-Carlton

- GreenTree Hospitality Group

- Ascott Limited

- Huazhu Hotels Group (Hanting Joya and others)

- BTG Homeinns

- Plateno Group (7 Days Inn)

- Holiday Inn

- The Peninsula Beijing

- Marriott International Inc

Key Milestones in China Hospitality Market Industry

- September 2022: InterContinental Hotels Group (IHG) opened its 600th hotel in Greater China.

- November 2022: Marriott International announced plans to add 30 hotels in Greater China by the end of 2023, adding over 460 properties.

Strategic Outlook for China Hospitality Market Market

The China hospitality market presents significant long-term growth potential, driven by sustained economic growth, government support, and technological advancements. Strategic opportunities lie in expanding into underserved markets, leveraging technology to enhance the customer experience, and fostering strategic partnerships to unlock new growth avenues. The market's future will be shaped by its ability to adapt to evolving consumer preferences and navigate the challenges posed by increasing competition and regulatory complexities.

China Hospitality Market Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

China Hospitality Market Segmentation By Geography

- 1. China

China Hospitality Market Regional Market Share

Geographic Coverage of China Hospitality Market

China Hospitality Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. The Rising Demand for Hotels is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Hospitality Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jinjiang International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Ritz-Carlton**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GreenTree Hospitality Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ascott Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huazhu Hotels Group (Hanting Joya and others)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BTG Homeinns

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plateno Group (7 Days Inn)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Holiday Inn

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Peninsula Beijing

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marriott International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jinjiang International

List of Figures

- Figure 1: China Hospitality Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Hospitality Market Share (%) by Company 2025

List of Tables

- Table 1: China Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: China Hospitality Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Hospitality Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Hospitality Market Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: China Hospitality Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Hospitality Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the China Hospitality Market?

Key companies in the market include Jinjiang International, The Ritz-Carlton**List Not Exhaustive, GreenTree Hospitality Group, Ascott Limited, Huazhu Hotels Group (Hanting Joya and others), BTG Homeinns, Plateno Group (7 Days Inn), Holiday Inn, The Peninsula Beijing, Marriott International Inc.

3. What are the main segments of the China Hospitality Market?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 86.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

The Rising Demand for Hotels is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

November 2022: The U.S.-based hotel chain Marriott International announced the plan to add 30 hotels in Greater China by the end of 2023. This is expected to add more than 460 properties in 120 destinations in the Greater China region to Marriott's hotel portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Hospitality Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Hospitality Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Hospitality Market?

To stay informed about further developments, trends, and reports in the China Hospitality Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence