Key Insights

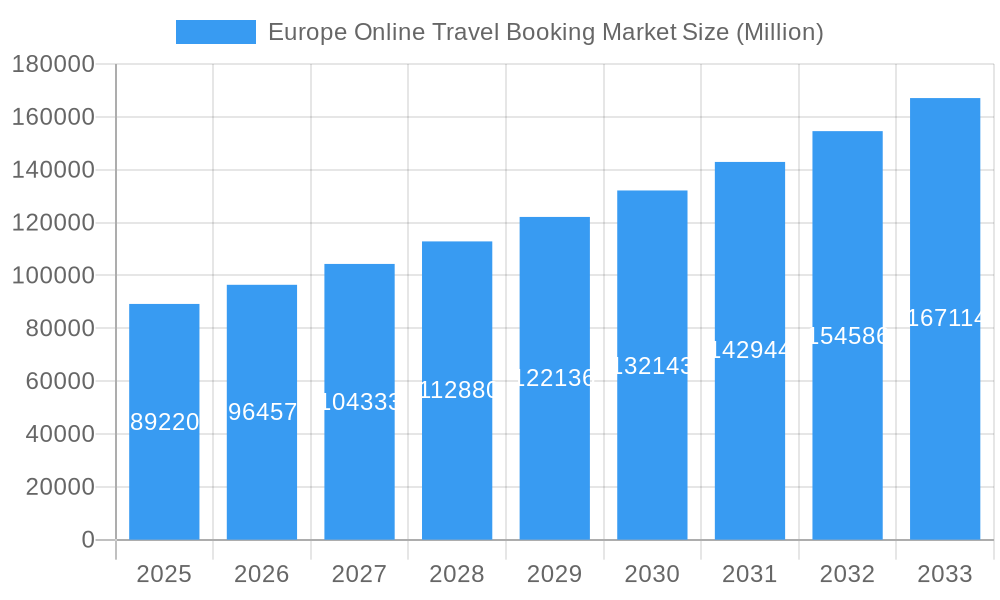

The European online travel booking market, valued at €89.22 billion in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.14% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of smartphones and the proliferation of high-speed internet access across Europe have significantly boosted online booking convenience. Furthermore, the rising popularity of budget travel and the growth of the millennial and Gen Z populations, both significant users of online platforms, fuel market expansion. A diverse range of services, including transportation, accommodation (ranging from budget hostels to luxury villas), and packaged vacations, caters to a broad spectrum of traveler needs and preferences. The competitive landscape includes both established global players like Expedia and Booking.com, and niche players focusing on specific segments, such as hostel bookings or luxury villas. The market is segmented by service type, booking type (online travel agencies versus direct suppliers), platform (desktop versus mobile), and country (with the UK, Germany, France, and Italy representing significant markets). The continuing evolution of technology, such as AI-powered travel recommendations and personalized booking experiences, is anticipated to further stimulate market growth.

Europe Online Travel Booking Market Market Size (In Billion)

However, market growth is not without its challenges. Economic fluctuations and global events can significantly impact travel demand. Concerns around data privacy and security regarding online transactions could deter some users. Furthermore, increasing competition necessitates ongoing innovation and differentiation among market players. The market's success hinges on adapting to evolving consumer preferences, effectively managing operational costs, and maintaining trust in the security of online travel booking platforms. While the market is currently dominated by established players, there remains room for disruptive technologies and business models to emerge and reshape the competitive landscape in the coming years. The continued focus on personalized travel experiences and seamless booking processes will be crucial for sustained growth in the European online travel booking market.

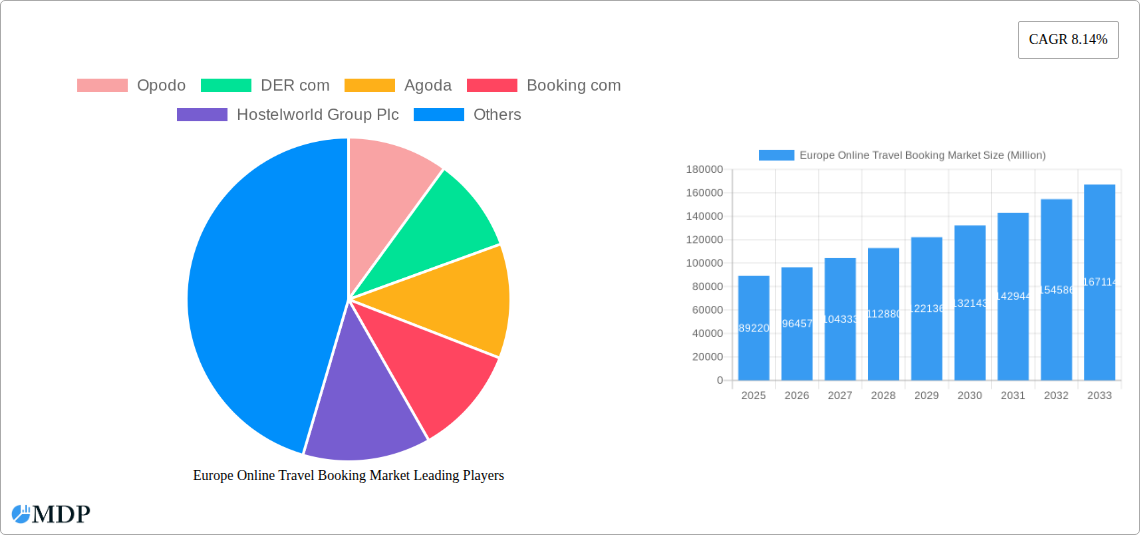

Europe Online Travel Booking Market Company Market Share

Europe Online Travel Booking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe online travel booking market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic sector. The report analyzes market size, growth drivers, competitive landscape, and future trends, offering actionable strategies for success in this multi-billion-euro market. The base year for this report is 2025, with projections extending to 2033.

Europe Online Travel Booking Market Dynamics & Concentration

The European online travel booking market is characterized by a high degree of concentration, with a few major players commanding significant market share. However, the market is also dynamic, experiencing continuous innovation, regulatory shifts, and evolving consumer preferences. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period (2025-2033).

- Market Concentration: The top 5 players account for an estimated xx% of the market share in 2025. This high concentration reflects economies of scale and significant brand recognition within the industry.

- Innovation Drivers: Technological advancements, including AI-powered personalization and improved user interfaces, are key drivers of innovation. The increasing adoption of mobile booking platforms also fuels market growth.

- Regulatory Frameworks: EU regulations concerning data privacy (GDPR) and consumer protection significantly impact market operations. Compliance is crucial for all stakeholders.

- Product Substitutes: The rise of alternative accommodation options, such as home rentals (Airbnb), poses a challenge to traditional hotel bookings, necessitating adaptation by established players.

- End-User Trends: The growing preference for personalized travel experiences and sustainable tourism drives demand for specialized services and innovative offerings.

- M&A Activities: The number of M&A deals in the sector averaged xx per year between 2019 and 2024, indicating a trend toward consolidation and expansion within the market.

Europe Online Travel Booking Market Industry Trends & Analysis

The European online travel booking market demonstrates robust growth, driven by factors such as rising disposable incomes, increased internet penetration, and a growing preference for online travel planning. The market is experiencing significant technological disruption, with the increasing adoption of mobile booking platforms and the integration of AI-powered tools for personalization and customer service. Consumer preferences are shifting towards sustainable and personalized travel experiences, demanding innovative solutions from industry players. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants, leading to ongoing innovation and pricing pressures. The market size is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx%. Market penetration for online travel bookings in Europe has increased from xx% in 2019 to xx% in 2024.

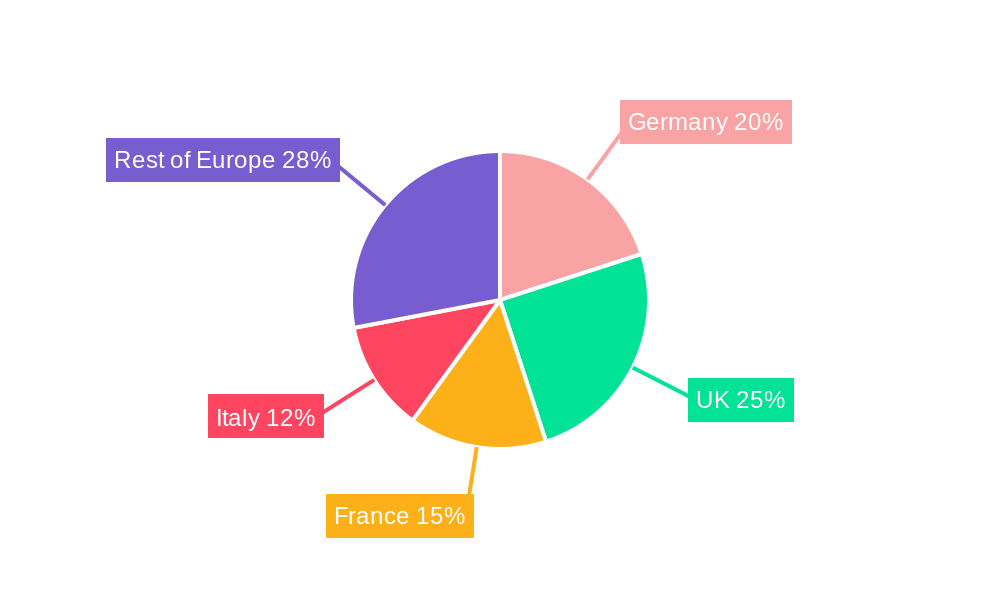

Leading Markets & Segments in Europe Online Travel Booking Market

The United Kingdom, Germany, and France represent the leading markets in Europe for online travel bookings, driven by high levels of internet penetration, robust tourism sectors, and favorable economic conditions. However, Italy and the rest of Europe also show substantial growth potential. The travel accommodation segment dominates the market, followed by transportation and vacation packages. Online Travel Agencies (OTAs) constitute the largest booking type. Mobile platforms are surpassing desktop platforms in terms of market share.

- Key Drivers for UK: High disposable incomes, strong tourism infrastructure, and advanced technology adoption.

- Key Drivers for Germany: High spending power, extensive travel network, and a well-established online retail culture.

- Key Drivers for France: Significant tourism revenue, robust digital infrastructure, and the popularity of both domestic and international travel.

- Key Drivers for Italy: Growing tourist arrivals, historical significance, and increasing digitalization of travel services.

- Key Drivers for Rest of Europe: Diverse tourist attractions, emerging economies, and improving digital connectivity.

The dominance of these regions is a result of factors like high internet and smartphone penetration, robust tourism infrastructure, and strong economic performance. However, smaller markets within the "Rest of Europe" demonstrate significant growth potential, especially those with emerging economies and expanding tourism sectors.

Europe Online Travel Booking Market Product Developments

Recent years have witnessed significant product innovations in the European online travel booking market, driven by technological advancements and evolving consumer preferences. Key developments include AI-powered personalized recommendations, seamless mobile booking experiences, enhanced virtual reality travel planning tools, and the integration of sustainable travel options. These innovations aim to improve customer experience, increase efficiency, and tap into new market segments. This focus on personalized and sustainable travel options caters to evolving consumer demands and creates competitive advantages for companies that embrace these trends.

Key Drivers of Europe Online Travel Booking Market Growth

The growth of the European online travel booking market is propelled by several key factors. Increasing internet and smartphone penetration across Europe expands the potential customer base significantly. Rising disposable incomes and a growing desire for personalized travel experiences boost demand for online booking platforms. Technological advancements, such as AI-powered personalization, improve the customer journey and create more tailored experiences. Favorable government policies supporting tourism further accelerate market growth.

Challenges in the Europe Online Travel Booking Market Market

The European online travel booking market faces several challenges. Intense competition among established players and new entrants creates pricing pressures and necessitates continuous innovation. Regulatory changes concerning data privacy and consumer protection necessitate adjustments and compliance investments. Economic downturns or global events like pandemics can significantly impact travel demand and revenue streams. Supply chain disruptions, particularly in the transportation sector, can lead to operational challenges and affect customer satisfaction.

Emerging Opportunities in Europe Online Travel Booking Market

Emerging opportunities in the European online travel booking market lie in leveraging technological breakthroughs, such as AI and virtual reality, to enhance customer experiences and offer hyper-personalized travel planning. Strategic partnerships with local tourism operators and sustainable travel providers can create new revenue streams and attract environmentally conscious customers. Market expansion into underserved regions and the creation of specialized niche offerings present considerable growth potential.

Leading Players in the Europe Online Travel Booking Market Sector

- Opodo

- DER com

- Agoda

- Booking.com

- Hostelworld Group Plc

- HRS

- Orbitz

- Airbnb

- lastminute.com

- Unique Villas

- Expedia

- eDreams

- ZenHotels.com

- TUI AG

Key Milestones in Europe Online Travel Booking Market Industry

- November 2022: Booking.com launched new features for accommodation, car rentals, and flights, highlighting its commitment to sustainability.

- July 2022: Booking.com launched the Ultimate Pride Amsterdam Experience, demonstrating engagement with social events.

- May 2022: lastminute.com launched its first physical gift card, expanding its reach into offline retail.

- February 2022: eDreams ODIGEO signed an NDC agreement with British Airways and Iberia, improving its flight offerings and distribution.

Strategic Outlook for Europe Online Travel Booking Market Market

The European online travel booking market is poised for sustained growth, driven by technological innovation, evolving consumer preferences, and favorable economic conditions in key markets. Strategic opportunities for players include focusing on personalization, sustainable travel options, and developing robust mobile applications. Expansion into underserved segments and strategic partnerships with tourism stakeholders will be crucial for securing long-term success. The market's future hinges on adapting to changing consumer expectations while leveraging technological advancements to enhance the booking process and deliver exceptional customer experiences.

Europe Online Travel Booking Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

Europe Online Travel Booking Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Travel Booking Market Regional Market Share

Geographic Coverage of Europe Online Travel Booking Market

Europe Online Travel Booking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Airbnb in United States is Dominating the Market; The US Online Accommodation Market is Booming due to an Increase in Domestic Trips

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Shift towards Mobile Phones for Travel Booking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Travel Booking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Opodo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DER com

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Booking com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hostelworld Group Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HRS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orbitz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unique Villas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Expedia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 eDreams

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ZenHotels com

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TUI AG**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Opodo

List of Figures

- Figure 1: Europe Online Travel Booking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Online Travel Booking Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Online Travel Booking Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Europe Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Europe Online Travel Booking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Online Travel Booking Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Online Travel Booking Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Europe Online Travel Booking Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Europe Online Travel Booking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Online Travel Booking Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Travel Booking Market?

The projected CAGR is approximately 8.14%.

2. Which companies are prominent players in the Europe Online Travel Booking Market?

Key companies in the market include Opodo, DER com, Agoda, Booking com, Hostelworld Group Plc, HRS, Orbitz, Airbnb, lastminute com, Unique Villas, Expedia, eDreams, ZenHotels com, TUI AG**List Not Exhaustive.

3. What are the main segments of the Europe Online Travel Booking Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 89.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Airbnb in United States is Dominating the Market; The US Online Accommodation Market is Booming due to an Increase in Domestic Trips.

6. What are the notable trends driving market growth?

Shift towards Mobile Phones for Travel Booking.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

15th November 2022: Booking.com, the leading digital travel platform, announced a series of new features for accommodation, car rental, and flights, to mark the one-year anniversary of its sustainability program launched in 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Travel Booking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Travel Booking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Travel Booking Market?

To stay informed about further developments, trends, and reports in the Europe Online Travel Booking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence