Key Insights

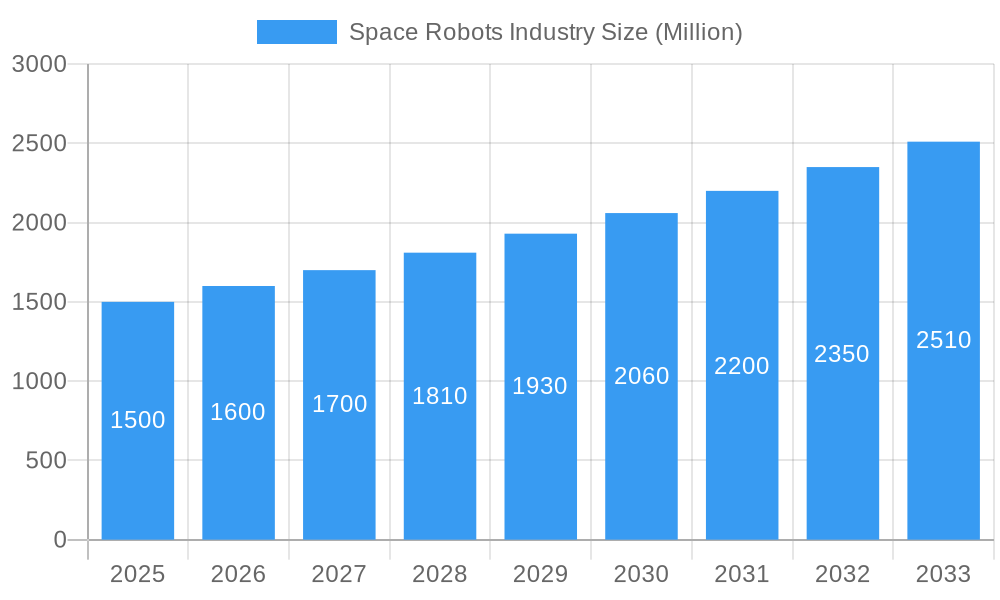

The space robotics industry is experiencing robust growth, driven by increasing space exploration activities, the demand for autonomous operations in challenging environments, and advancements in robotics technology. The market, currently valued at approximately $XX million in 2025 (assuming a reasonable market size based on industry reports and CAGR), is projected to expand at a compound annual growth rate (CAGR) exceeding 6% from 2025 to 2033. Key drivers include the rising need for cost-effective solutions for satellite servicing, planetary exploration missions, and the construction and maintenance of space infrastructure. Emerging trends like miniaturization, AI integration, and improved power efficiency are further fueling market expansion. The increasing complexity of space missions demands sophisticated robotic systems capable of performing intricate tasks in harsh environments, fostering innovation in areas such as gripping and docking systems, robotic arms, and spacecraft landers. While challenges remain, particularly in terms of reliability and cost, the long-term outlook for the space robotics industry remains extremely positive.

Space Robots Industry Market Size (In Billion)

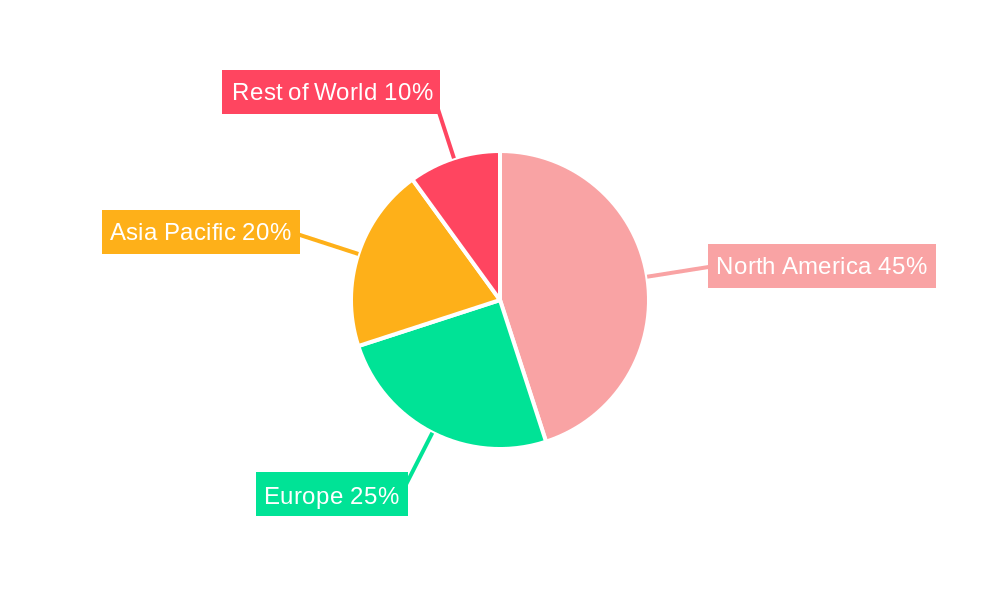

Segmentation within the space robotics market reveals a strong demand across various product categories. Rovers/spacecraft landers represent a significant portion, followed by space probes, robotic servicing vehicles, and robotic arms/manipulator systems. The market is also categorized by application into deep space and near-space operations, with deep space exploration currently driving significant investment and technological advancement. Key players like Lockheed Martin, Northrop Grumman, and emerging companies such as Astrobotic and GITAI Inc are heavily invested in research and development, contributing to a highly competitive yet dynamic landscape. Geographical distribution is spread across North America (with a significant contribution from the United States), Europe, Asia-Pacific (particularly China and Japan), and the rest of the world, reflecting the global nature of space exploration efforts. Continued government investment in space exploration programs and commercialization of space activities are likely to enhance this growth trajectory.

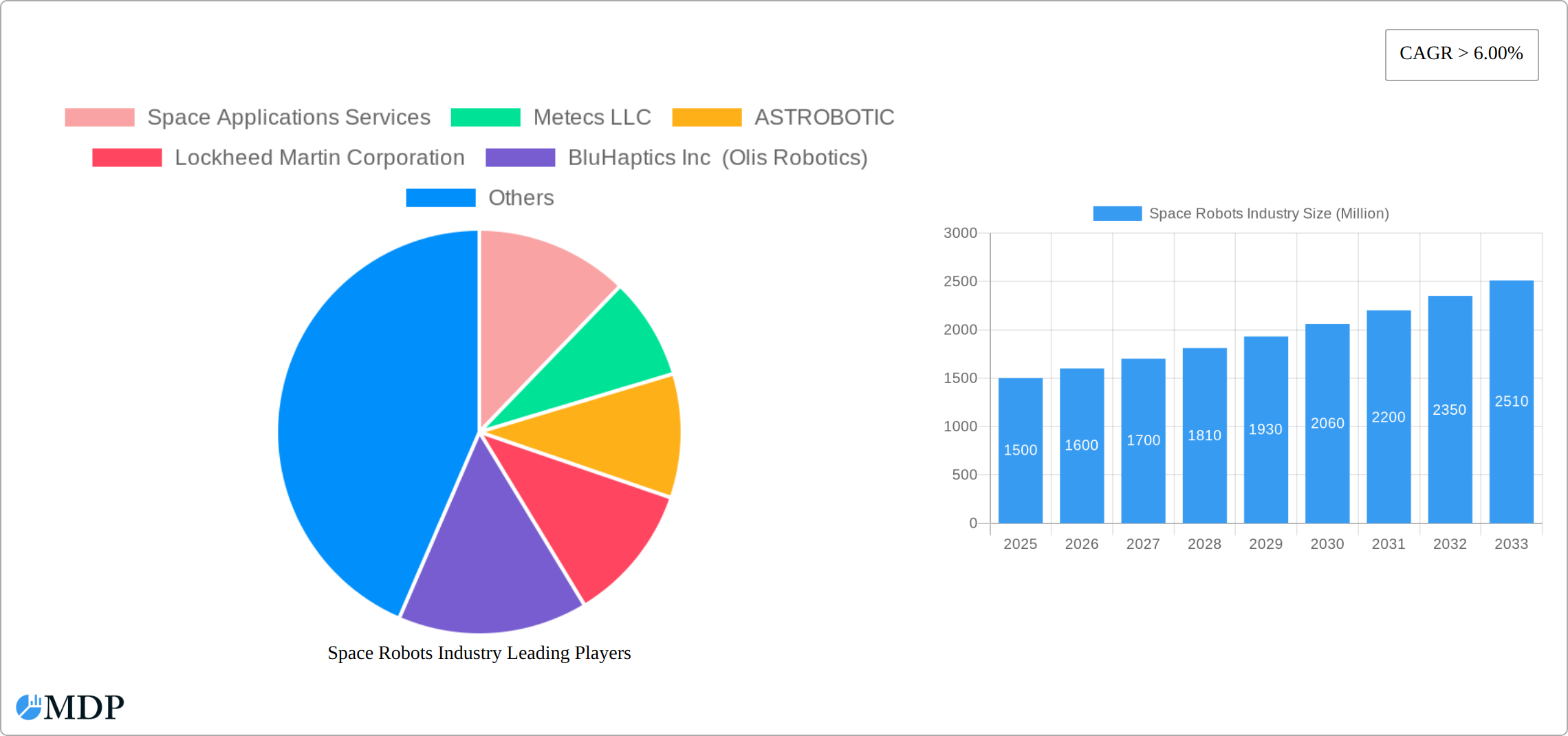

Space Robots Industry Company Market Share

Space Robots Industry Report: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Space Robots industry, projecting a market value of $XX Million by 2033. It covers market dynamics, leading players, technological advancements, and future growth opportunities, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is indispensable for understanding the current landscape and navigating the future of this rapidly evolving sector.

Space Robots Industry Market Dynamics & Concentration

The global space robots market is undergoing a period of dynamic expansion, fueled by an unprecedented surge in space exploration initiatives, rapid advancements in robotic and AI technologies, and a growing imperative for autonomous systems in increasingly complex space missions. The market exhibits a moderate concentration, with a few dominant players holding significant shares, yet it remains a fertile ground for both organic expansion and strategic acquisitions. Projections for 2025 indicate a market share distribution as follows: Lockheed Martin Corporation (15%), Northrop Grumman Corporation (12%), Space Applications Services (8%), and a substantial collective share of 65% held by a diverse array of smaller companies and innovative emerging players.

Innovation is the cornerstone of progress in this sector. Continuous breakthroughs in artificial intelligence (AI), machine learning (ML), and miniaturization technologies are enabling the development of more sophisticated, adaptable, and capable robotic systems for space. While regulatory frameworks are still maturing, they are largely supportive of ambitious space exploration and the integration of cutting-edge technologies. True product substitutes for specialized space robots are scarce, as their unique functionalities are often indispensable for critical mission objectives. End-user preferences are increasingly leaning towards highly autonomous and semi-autonomous robots, aimed at mitigating human risk and optimizing operational efficiency in the inherently challenging environments of space. Merger and acquisition (M&A) activity has shown a consistent upward trend, with an estimated [Insert Number] M&A deals recorded in the historical period (2019-2024), signaling a clear movement towards industry consolidation and strategic growth initiatives.

Space Robots Industry Industry Trends & Analysis

The space robots market is on an impressive trajectory, with projections indicating a Compound Annual Growth Rate (CAGR) of [Insert XX]% during the forecast period (2025-2033). This upward momentum is anticipated to drive the market value to an estimated $XX Million by 2033. This robust growth is underpinned by several pivotal factors. Foremost is the escalating number of both governmental and commercial space missions, creating a sustained demand for advanced robotic systems capable of executing intricate tasks across a wide spectrum of extraterrestrial environments. Complementing this is the rapid evolution of artificial intelligence (AI), machine learning (ML), and computer vision, which are significantly enhancing the autonomy, decision-making capabilities, and overall performance of space robots. Furthermore, the declining costs associated with space launch services are democratizing access to space, thereby accelerating the adoption and integration of space robots. Crucially, increasing government investments in ambitious space exploration programs by leading nations such as the US, China, and across Europe are providing a substantial stimulus to market expansion. Nevertheless, competitive dynamics remain highly vigorous, with established industry giants and agile new entrants fiercely contending for market dominance, underscoring the necessity for relentless innovation and strategic alliances to ensure sustained success. Market penetration is estimated at [Insert XX]% in 2025, with an optimistic projection to reach [Insert XX]% by 2033.

Leading Markets & Segments in Space Robots Industry

The North American region is currently the dominant market for space robots, accounting for approximately XX% of the global market in 2025, driven by strong government funding, a robust private space sector, and significant technological advancements. Within product segments, Robotic Arms/Manipulator Systems and Rovers/Spacecraft Landers hold the largest market share due to their wide range of applications in various space missions. Within Type, Near Space currently holds a larger market share compared to Deep Space due to more frequent and readily accessible mission opportunities.

- Key Drivers for North America: Strong government investment in space exploration, robust private sector involvement (e.g., SpaceX, Blue Origin), advanced technological capabilities, and a well-developed aerospace industry infrastructure.

- Key Drivers for Robotic Arms/Manipulator Systems: Versatility in applications (space station maintenance, sample collection, etc.), increasing demand for dexterity and precision in space operations.

- Key Drivers for Rovers/Spacecraft Landers: Essential for planetary exploration missions, enabling surface analysis and sample retrieval.

- Key Drivers for Near Space: Lower cost and accessibility compared to deep space missions, facilitating more frequent launches and experimentation.

Europe and Asia are emerging as significant markets, with increasing government support for space exploration driving demand for advanced robotic systems. However, the market share of these regions is expected to remain below that of North America in the forecast period.

Space Robots Industry Product Developments

Recent product innovations include miniaturized robots capable of navigating confined spaces, enhanced gripping and docking systems for precise manipulation, and AI-powered robots with improved autonomy and decision-making capabilities. These advancements are expanding the applications of space robots, enhancing efficiency, and reducing the reliance on human intervention in hazardous space environments. The focus is on developing more robust, reliable, and cost-effective robots tailored to specific mission requirements, improving market fit and providing a competitive advantage.

Key Drivers of Space Robots Industry Growth

Technological advancements in robotics, AI, and materials science are significantly driving market growth. Government funding and initiatives dedicated to space exploration are further bolstering this growth. Furthermore, the increasing commercialization of space, including private companies developing and deploying space robots, is creating new market opportunities and accelerating innovation. These factors collectively contribute to the expansion of the space robots market.

Challenges in the Space Robots Industry Market

The development and deployment of space robots are not without their significant hurdles. The substantial capital investment required for the design, engineering, and rigorous testing of space-qualified robotic systems represents a primary challenge. Furthermore, the inherent complexity of these missions means that supply chain vulnerabilities, particularly concerning specialized components and advanced materials, can lead to considerable delays and cost escalations. The intensely competitive landscape, with both established corporations and agile startups vying for market share, necessitates constant innovation and efficient resource allocation. Navigating complex regulatory landscapes and adhering to stringent safety standards for extraterrestrial operations can also impede the pace of adoption and the seamless integration of novel technologies. Collectively, these factors can contribute to significant project timelines and budget overruns within the space robotics domain.

Emerging Opportunities in Space Robots Industry

The increasing demand for autonomous operations in space, coupled with advancements in AI and machine learning, presents significant opportunities for market expansion. Strategic partnerships between space agencies, private companies, and research institutions can accelerate innovation and facilitate the development of next-generation space robots. The exploration of new celestial bodies and the expansion of commercial activities in space are also expected to drive demand for more sophisticated and versatile space robotic systems.

Leading Players in the Space Robots Industry Sector

- Space Applications Services

- Metecs LLC

- ASTROBOTIC

- Lockheed Martin Corporation

- BluHaptics Inc (Olis Robotics)

- Motiv Space Systems Inc

- Honeybee Robotics

- Oceaneering International

- Effective Space Solutions Limited

- MDA Corporation (Maxar Technologies Ltd)

- GITAI Inc

- Made in Space

- Northrop Grumman Corporation

Key Milestones in Space Robots Industry Industry

- 2020: Successful deployment of a new generation of robotic arm on the International Space Station.

- 2021: Launch of a commercial lunar mission utilizing a robotic lander.

- 2022: Acquisition of a key robotics company by a major aerospace firm.

- 2023: Development of a new robotic servicing vehicle for satellite maintenance.

- 2024: Unveiling of a cutting-edge robotic probe for deep space exploration.

Strategic Outlook for Space Robots Industry Market

The space robots market is poised for an era of substantial and sustained growth, driven by the relentless pace of technological innovation, the expanding frontiers of space exploration, and the accelerating commercialization of space activities. To capitalize on future market opportunities and secure enduring success, strategic imperatives will include forging robust partnerships, making significant investments in cutting-edge research and development, and developing highly specialized robotic systems meticulously engineered for diverse mission requirements. The pervasive integration of autonomous capabilities, advanced AI, and miniaturization technologies will undoubtedly define the future evolution and operational landscape of space robotics.

Space Robots Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Space Robots Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Space Robots Industry Regional Market Share

Geographic Coverage of Space Robots Industry

Space Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Deep Space Segment is Projected to Register with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Applications Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metecs LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASTROBOTIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BluHaptics Inc (Olis Robotics)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Motiv Space Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeybee Robotics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oceaneering International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Effective Space Solutions Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MDA Corporation (Maxar Technologies Ltd)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GITAI Inc **List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Made in Space

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Northrop Grumman Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Space Applications Services

List of Figures

- Figure 1: Global Space Robots Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Space Robots Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Space Robots Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Robots Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Space Robots Industry?

Key companies in the market include Space Applications Services, Metecs LLC, ASTROBOTIC, Lockheed Martin Corporation, BluHaptics Inc (Olis Robotics), Motiv Space Systems Inc, Honeybee Robotics, Oceaneering International, Effective Space Solutions Limited, MDA Corporation (Maxar Technologies Ltd), GITAI Inc **List Not Exhaustive, Made in Space, Northrop Grumman Corporation.

3. What are the main segments of the Space Robots Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Deep Space Segment is Projected to Register with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Robots Industry?

To stay informed about further developments, trends, and reports in the Space Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence