Key Insights

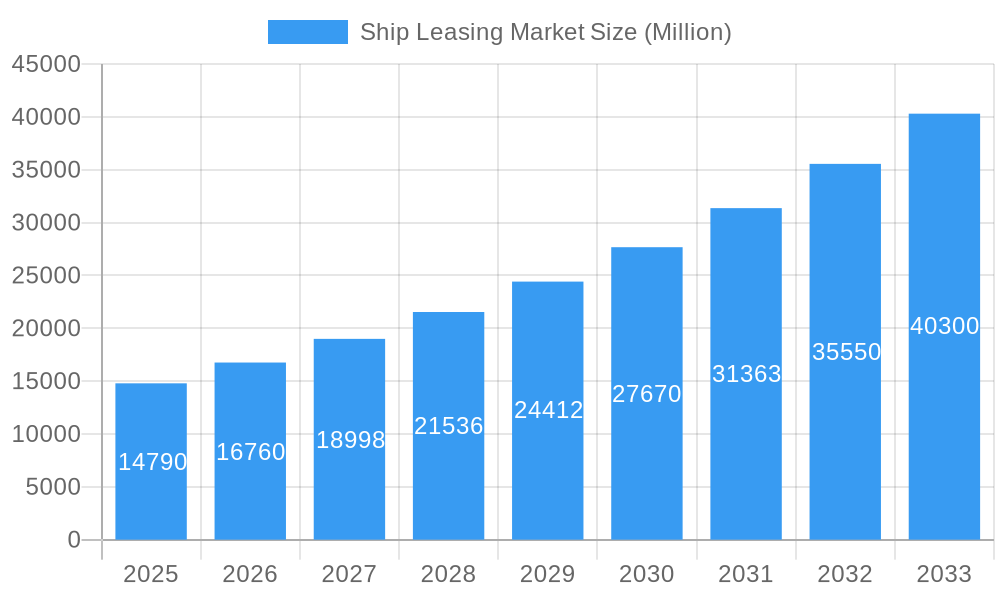

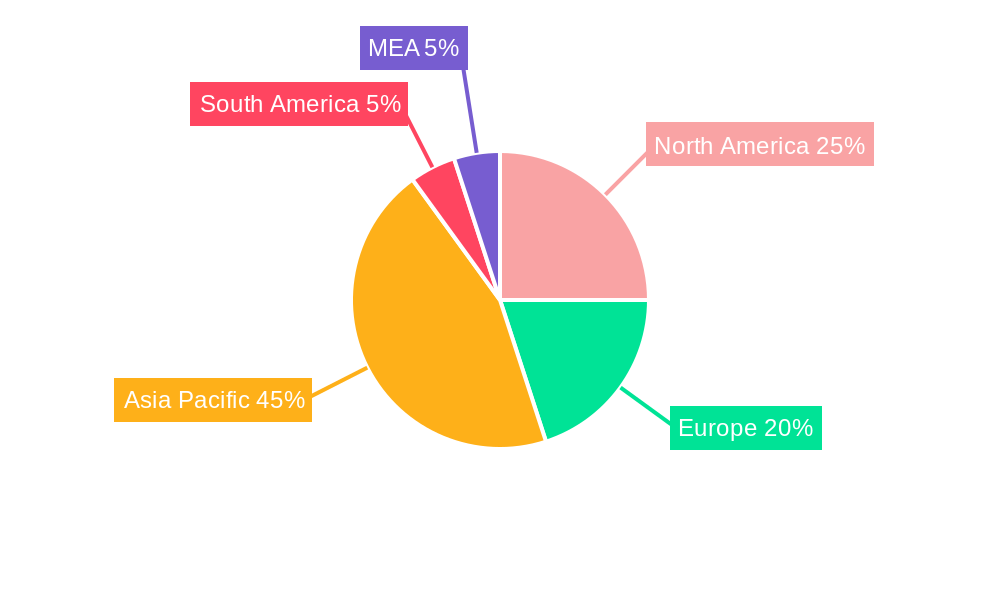

The global ship leasing market, valued at $14.79 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 13.59% from 2025 to 2033. This expansion is driven by several key factors. Increasing global trade volumes necessitate a larger fleet of vessels, fueling demand for leasing arrangements. The preference for operational efficiency and reduced capital expenditure among shipping companies further propels the market. Furthermore, the emergence of innovative leasing models, such as full-service leases that encompass maintenance and crew management, adds to the market's attractiveness. The market segmentation reveals significant opportunities across diverse vessel types, including container ships and bulk carriers, and lease structures like financial leases and bareboat charters. Geographically, regions like Asia-Pacific, fueled by strong economic growth and expanding trade activities in countries such as China and India, are expected to dominate the market. North America and Europe also contribute significantly, albeit with a potentially slower growth rate compared to Asia-Pacific.

Ship Leasing Market Market Size (In Billion)

However, market growth is not without its challenges. Fluctuations in global freight rates and fuel prices pose significant risks to the industry, impacting the profitability of leasing agreements. Stringent environmental regulations and the increasing adoption of eco-friendly vessels may lead to higher operational costs for lessees and lessors alike. Moreover, geopolitical uncertainties and potential disruptions to global supply chains could affect the overall market outlook. Despite these headwinds, the long-term prospects for the ship leasing market remain positive, driven by the enduring need for efficient and cost-effective vessel acquisition and operation within the global shipping industry. The diverse range of vessel types and leasing options, combined with the geographic spread of market activity, presents a nuanced and dynamic landscape ripe for further investment and growth.

Ship Leasing Market Company Market Share

Unlock Growth in the Dynamic Ship Leasing Market: A Comprehensive 2019-2033 Forecast

This in-depth report provides a comprehensive analysis of the global Ship Leasing Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a meticulous study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's trajectory and identifies lucrative opportunities. The report leverages extensive data analysis to provide accurate market sizing, segment-specific growth projections, and competitive landscaping, enabling informed strategic planning. Key segments analyzed include Lease Type (Financial Lease, Full-Service Lease), Application (Container Ships, Bulk Carriers), and Type (Real-Time Lease, Periodic Tenancy, Bareboat Charter, Other Types). Leading players such as ICBC Co Ltd, CMB Financial Leasing CO LTD, and Global Ship Lease Inc. are profiled, highlighting their strategies and market positions.

Ship Leasing Market Market Dynamics & Concentration

The Ship Leasing Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top 5 players in 2024 is estimated to be around xx%. This concentration is driven by the capital-intensive nature of the industry and the strong presence of established financial institutions and shipping companies. However, the market is not static; innovation in leasing models, technological advancements in ship management, and evolving regulatory frameworks are driving dynamic shifts.

Key Market Dynamics:

- Innovation Drivers: The adoption of digital technologies for ship management, including AI-powered predictive maintenance and remote monitoring, is significantly impacting operational efficiency and lease terms. The emergence of innovative financing models is also reshaping the market.

- Regulatory Frameworks: International maritime regulations, particularly those related to environmental compliance (e.g., IMO 2020) and safety standards, are influencing lease agreements and vessel specifications. Compliance costs and associated risks directly impact market dynamics.

- Product Substitutes: While direct substitutes are limited, alternative financing options and the potential for increased ownership models (as opposed to leasing) could marginally impact the market's growth.

- End-User Trends: Growing global trade volumes, particularly in container shipping and bulk commodities, are a key growth driver. Demand from emerging markets and evolving trade routes are significant factors.

- M&A Activities: The number of M&A deals in the ship leasing sector has fluctuated in recent years, with xx deals recorded in 2024. These activities indicate consolidation and competition for market share amongst major players.

Ship Leasing Market Industry Trends & Analysis

The Ship Leasing Market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends: the ongoing expansion of global trade, particularly in Asia and emerging economies; the increasing demand for container ships and bulk carriers; and the adoption of more sophisticated and flexible leasing arrangements. Technological disruptions, such as the deployment of autonomous vessels and the development of environmentally friendly technologies, are expected to further shape the market in the coming years. The market penetration of digital platforms for ship management and lease administration is steadily increasing, driving efficiency and transparency. Competitive dynamics are characterized by a mix of established players and emerging entrants, leading to intensified competition and innovative service offerings.

Leading Markets & Segments in Ship Leasing Market

The Asia-Pacific region is anticipated to dominate the Ship Leasing Market throughout the forecast period. This dominance is fueled by robust economic growth, increasing infrastructure development, and a burgeoning shipping industry in the region. China and other Southeast Asian nations are key contributors to this regional leadership.

Key Drivers by Segment:

- Lease Type: Financial leases are expected to remain the dominant segment, driven by their tax advantages and the ability to transfer ownership. Full-service leases are gaining traction, particularly for smaller operators seeking comprehensive management solutions.

- Application: Container ships currently constitute the largest segment, reflecting the continued growth of containerized trade. Bulk carriers follow, albeit with a slightly slower growth rate.

- Type: Bareboat charters, offering maximum flexibility to lessees, comprise a significant portion of the market. Real-time leases are increasing in popularity due to their adaptability to fluctuating market conditions.

Dominance Analysis: Asia's dominance is primarily attributed to:

- The substantial growth of its maritime industry and the increase in seaborne trade.

- Significant investments in port infrastructure and related logistics.

- The expanding economies of several key Asian nations driving demand.

Ship Leasing Market Product Developments

Recent innovations in the Ship Leasing Market include the development of more flexible and customized lease agreements, tailored to the specific needs of various shipping operators. The integration of digital technologies within lease management platforms is streamlining processes and enhancing transparency. Furthermore, green shipping initiatives and the adoption of fuel-efficient technologies are shaping product offerings and leasing terms, providing competitive advantages to providers who offer environmentally friendly vessels. This allows for increased operational efficiency and reduced environmental impact.

Key Drivers of Ship Leasing Market Growth

Several factors fuel the growth of the Ship Leasing Market:

- Global Trade Expansion: Rising global trade volumes, especially in container shipping and bulk commodities, directly increase demand for vessels, and consequently, for leasing services.

- Technological Advancements: Innovations in vessel design, construction, and operational technology (e.g., AI-powered predictive maintenance) improve efficiency and reduce operational costs.

- Favorable Regulatory Environment: Policies promoting maritime trade and infrastructure development in various regions positively impact market growth.

Challenges in the Ship Leasing Market Market

The Ship Leasing Market faces several significant challenges:

- Geopolitical Uncertainty: Global political instability and trade conflicts can negatively impact shipping activity and demand for vessels.

- Fluctuating Fuel Prices: High and volatile fuel prices significantly affect operational costs for shipping companies, thus influencing lease agreements.

- Environmental Regulations: Stringent environmental regulations, while beneficial in the long term, necessitate costly upgrades and modifications to vessels, impacting lease terms and pricing.

Emerging Opportunities in Ship Leasing Market

Long-term growth opportunities lie in:

- Technological Innovation: The adoption of autonomous vessels and other technological advancements will create new efficiency gains and market possibilities.

- Strategic Partnerships: Collaboration between leasing companies and technology providers can yield innovative solutions to improve operational efficiency and risk management.

- Expansion into Emerging Markets: Unmet demand in developing regions offers significant expansion potential.

Leading Players in the Ship Leasing Market Sector

- ICBC Co Ltd

- CMB Financial Leasing CO LTD

- Hamburg Commercial Bank AG

- Minsheng Financial Leasing Co Ltd

- First Ship Lease Trust

- MUFG Bank Ltd

- Bothra Group

- Bank of Communications Financial Leasing Co Ltd

- Galbraiths Ltd

- A P Møller - Mærsk A/S

- Global Ship Lease Inc

Key Milestones in Ship Leasing Market Industry

- 2020: Implementation of IMO 2020 sulfur cap significantly influenced vessel specifications and lease contracts.

- 2022: Increased focus on ESG (Environmental, Social, and Governance) factors in lease agreements.

- 2024: Several significant mergers and acquisitions reshaped the market landscape. (Specific details would be included in the full report).

Strategic Outlook for Ship Leasing Market Market

The Ship Leasing Market is poised for sustained growth driven by ongoing global trade expansion, technological progress, and strategic partnerships. Future market potential lies in capitalizing on emerging opportunities in green shipping, digitalization, and expansion into new markets. Companies that prioritize innovation, sustainability, and adaptability will be best positioned to capture significant market share and drive long-term success.

Ship Leasing Market Segmentation

-

1. Lease Type

- 1.1. Financial Lease

- 1.2. Full-Service Lease

-

2. Application

- 2.1. Container Ships

- 2.2. Bulk Carriers

-

3. Type

- 3.1. Real-Time Lease

- 3.2. Periodic Tenancy

- 3.3. Bareboat Charter

- 3.4. Other Types

Ship Leasing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Ship Leasing Market Regional Market Share

Geographic Coverage of Ship Leasing Market

Ship Leasing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Bareboat Charter Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ship Leasing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lease Type

- 5.1.1. Financial Lease

- 5.1.2. Full-Service Lease

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Container Ships

- 5.2.2. Bulk Carriers

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Real-Time Lease

- 5.3.2. Periodic Tenancy

- 5.3.3. Bareboat Charter

- 5.3.4. Other Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Lease Type

- 6. North America Ship Leasing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Lease Type

- 6.1.1. Financial Lease

- 6.1.2. Full-Service Lease

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Container Ships

- 6.2.2. Bulk Carriers

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Real-Time Lease

- 6.3.2. Periodic Tenancy

- 6.3.3. Bareboat Charter

- 6.3.4. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Lease Type

- 7. Europe Ship Leasing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Lease Type

- 7.1.1. Financial Lease

- 7.1.2. Full-Service Lease

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Container Ships

- 7.2.2. Bulk Carriers

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Real-Time Lease

- 7.3.2. Periodic Tenancy

- 7.3.3. Bareboat Charter

- 7.3.4. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Lease Type

- 8. Asia Pacific Ship Leasing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Lease Type

- 8.1.1. Financial Lease

- 8.1.2. Full-Service Lease

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Container Ships

- 8.2.2. Bulk Carriers

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Real-Time Lease

- 8.3.2. Periodic Tenancy

- 8.3.3. Bareboat Charter

- 8.3.4. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Lease Type

- 9. Latin America Ship Leasing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Lease Type

- 9.1.1. Financial Lease

- 9.1.2. Full-Service Lease

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Container Ships

- 9.2.2. Bulk Carriers

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Real-Time Lease

- 9.3.2. Periodic Tenancy

- 9.3.3. Bareboat Charter

- 9.3.4. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Lease Type

- 10. Middle East and Africa Ship Leasing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Lease Type

- 10.1.1. Financial Lease

- 10.1.2. Full-Service Lease

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Container Ships

- 10.2.2. Bulk Carriers

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Real-Time Lease

- 10.3.2. Periodic Tenancy

- 10.3.3. Bareboat Charter

- 10.3.4. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Lease Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ICBC Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CMB Financial Leasing CO LTD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hamburg Commercial Bank AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Minsheng Financial Leasing Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 First Ship Lease Trust

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MUFG Bank Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bothra Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bank of Communications Financial Leasing Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Galbraiths Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 A P Møller - Mærsk A/S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Global Ship Lease Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 ICBC Co Ltd

List of Figures

- Figure 1: Global Ship Leasing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Ship Leasing Market Revenue (Million), by Lease Type 2025 & 2033

- Figure 3: North America Ship Leasing Market Revenue Share (%), by Lease Type 2025 & 2033

- Figure 4: North America Ship Leasing Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Ship Leasing Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Ship Leasing Market Revenue (Million), by Type 2025 & 2033

- Figure 7: North America Ship Leasing Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Ship Leasing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Ship Leasing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Ship Leasing Market Revenue (Million), by Lease Type 2025 & 2033

- Figure 11: Europe Ship Leasing Market Revenue Share (%), by Lease Type 2025 & 2033

- Figure 12: Europe Ship Leasing Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Ship Leasing Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Ship Leasing Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Ship Leasing Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Ship Leasing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Ship Leasing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Ship Leasing Market Revenue (Million), by Lease Type 2025 & 2033

- Figure 19: Asia Pacific Ship Leasing Market Revenue Share (%), by Lease Type 2025 & 2033

- Figure 20: Asia Pacific Ship Leasing Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Ship Leasing Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Ship Leasing Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Pacific Ship Leasing Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Ship Leasing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Ship Leasing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Ship Leasing Market Revenue (Million), by Lease Type 2025 & 2033

- Figure 27: Latin America Ship Leasing Market Revenue Share (%), by Lease Type 2025 & 2033

- Figure 28: Latin America Ship Leasing Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Ship Leasing Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Ship Leasing Market Revenue (Million), by Type 2025 & 2033

- Figure 31: Latin America Ship Leasing Market Revenue Share (%), by Type 2025 & 2033

- Figure 32: Latin America Ship Leasing Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Ship Leasing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Ship Leasing Market Revenue (Million), by Lease Type 2025 & 2033

- Figure 35: Middle East and Africa Ship Leasing Market Revenue Share (%), by Lease Type 2025 & 2033

- Figure 36: Middle East and Africa Ship Leasing Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Ship Leasing Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Ship Leasing Market Revenue (Million), by Type 2025 & 2033

- Figure 39: Middle East and Africa Ship Leasing Market Revenue Share (%), by Type 2025 & 2033

- Figure 40: Middle East and Africa Ship Leasing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Ship Leasing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ship Leasing Market Revenue Million Forecast, by Lease Type 2020 & 2033

- Table 2: Global Ship Leasing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Ship Leasing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Ship Leasing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Ship Leasing Market Revenue Million Forecast, by Lease Type 2020 & 2033

- Table 6: Global Ship Leasing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Ship Leasing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Ship Leasing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Ship Leasing Market Revenue Million Forecast, by Lease Type 2020 & 2033

- Table 12: Global Ship Leasing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Ship Leasing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Ship Leasing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Ship Leasing Market Revenue Million Forecast, by Lease Type 2020 & 2033

- Table 20: Global Ship Leasing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Ship Leasing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Ship Leasing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Ship Leasing Market Revenue Million Forecast, by Lease Type 2020 & 2033

- Table 29: Global Ship Leasing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Ship Leasing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Ship Leasing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Latin America Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Ship Leasing Market Revenue Million Forecast, by Lease Type 2020 & 2033

- Table 35: Global Ship Leasing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Ship Leasing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global Ship Leasing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Ship Leasing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ship Leasing Market?

The projected CAGR is approximately 13.59%.

2. Which companies are prominent players in the Ship Leasing Market?

Key companies in the market include ICBC Co Ltd, CMB Financial Leasing CO LTD, Hamburg Commercial Bank AG, Minsheng Financial Leasing Co Ltd, First Ship Lease Trust, MUFG Bank Ltd, Bothra Group, Bank of Communications Financial Leasing Co Ltd, Galbraiths Ltd, A P Møller - Mærsk A/S, Global Ship Lease Inc.

3. What are the main segments of the Ship Leasing Market?

The market segments include Lease Type, Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.79 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Bareboat Charter Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ship Leasing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ship Leasing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ship Leasing Market?

To stay informed about further developments, trends, and reports in the Ship Leasing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence