Key Insights

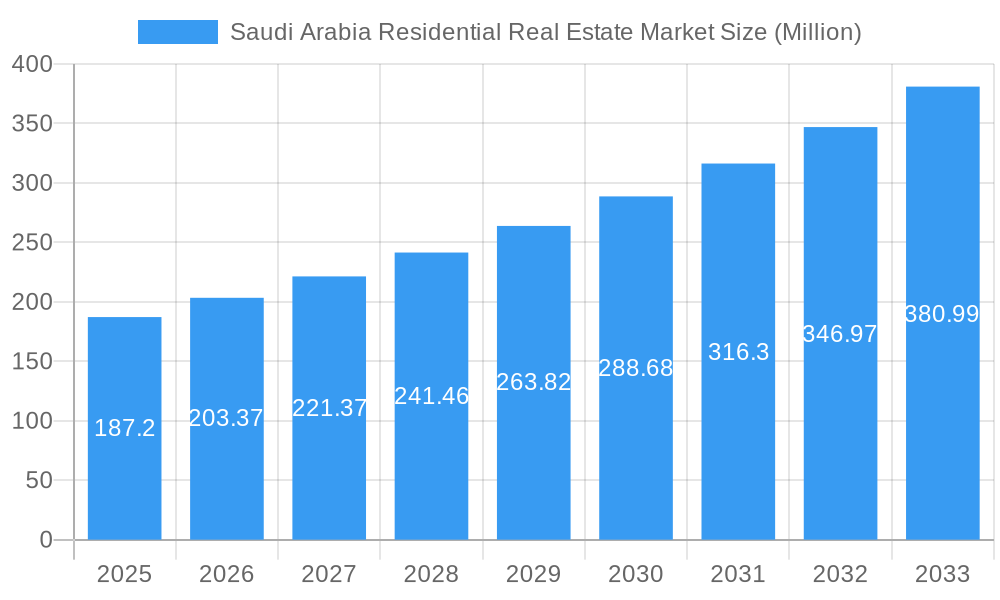

The Saudi Arabian residential real estate market, valued at $187.20 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.77% from 2025 to 2033. This surge is driven by several key factors. Firstly, significant government initiatives aimed at Vision 2030, focusing on infrastructure development and diversification of the economy, are attracting substantial foreign investment and boosting domestic consumer confidence. This translates into increased demand for housing across various segments, including condominiums and apartments, villas, and landed houses. The rising population and a burgeoning middle class further fuel this demand, particularly in major cities like Riyadh, Jeddah, and Dammam. Furthermore, attractive mortgage schemes and favorable government policies are making homeownership more accessible. However, challenges remain. Construction material costs, fluctuating oil prices, and potential regulatory hurdles could influence market growth. Competition among developers is fierce, with established players like Dar Al Arkan and Emaar vying with emerging companies for market share. The market segmentation reveals a strong preference for specific housing types depending on location and affordability, leading to dynamic price fluctuations within and across regions. Growth is expected to be particularly strong in the condominium and apartment sector due to the rising demand for more affordable housing options in urban centers.

Saudi Arabia Residential Real Estate Market Market Size (In Million)

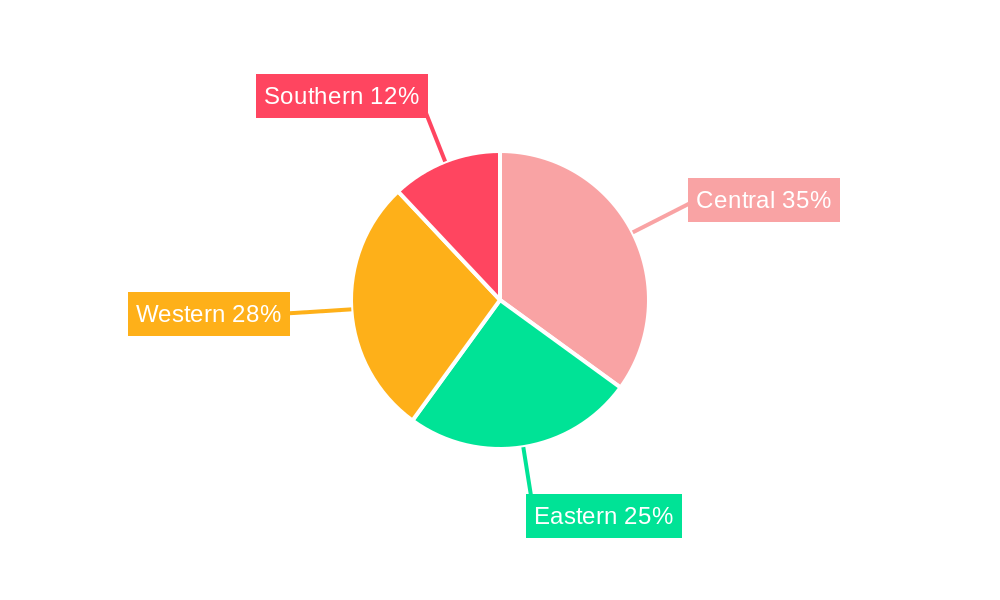

The forecast period (2025-2033) suggests a continuously expanding market, though potential external economic factors necessitate a cautious outlook. Analyzing the regional breakdown (Central, Eastern, Western, and Southern Saudi Arabia), we can expect varied growth rates based on infrastructure development, proximity to major economic hubs, and government investments in each region. The diverse range of developers operating in the market ensures competitive pricing and a variety of housing options, catering to a wider spectrum of buyers. Strategic investments in affordable housing projects and sustainable development initiatives are poised to shape the future trajectory of the Saudi Arabian residential real estate sector in the coming years. Sustained economic growth and a stable political climate will be crucial for realizing the full potential of this dynamic market.

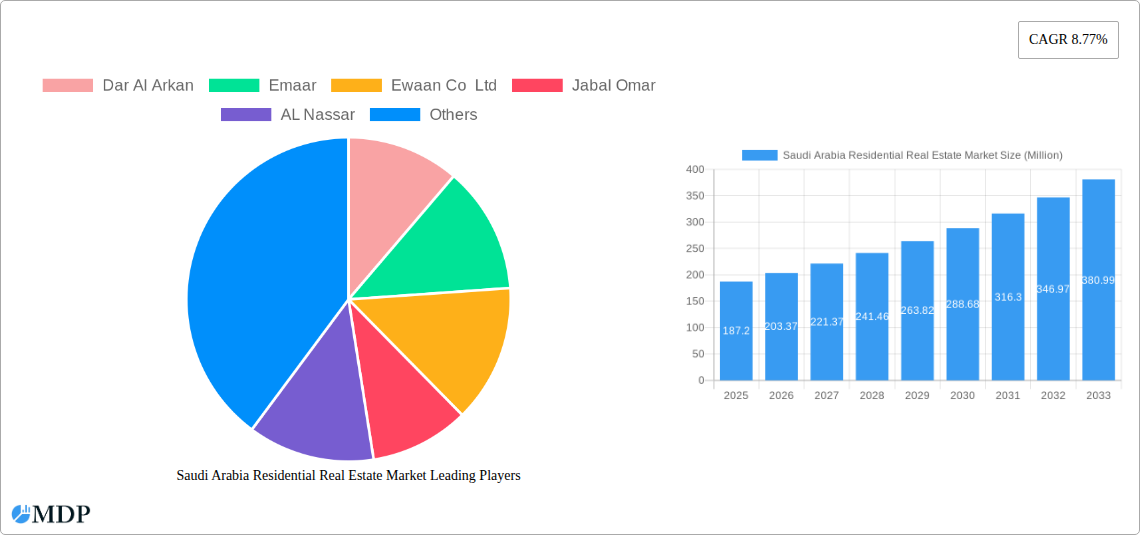

Saudi Arabia Residential Real Estate Market Company Market Share

Saudi Arabia Residential Real Estate Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia residential real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key players, emerging trends, and future growth potential. The report incorporates extensive data and analysis, providing a clear understanding of this rapidly evolving market.

Saudi Arabia Residential Real Estate Market Dynamics & Concentration

The Saudi Arabian residential real estate market is experiencing significant transformation driven by Vision 2030's ambitious goals. Market concentration is moderately high, with major players like Dar Al Arkan, Emaar, and others holding significant shares. However, the market is also witnessing the emergence of smaller, specialized developers catering to niche segments. The regulatory framework, while evolving, plays a key role in shaping market dynamics, influencing land availability, building codes, and financing options. Innovation is driven by the adoption of sustainable building practices, smart home technologies, and innovative financing models. Product substitutes are limited, given the relatively strong demand for housing, particularly in key urban centers. End-user trends reflect a growing preference for modern, energy-efficient, and technologically advanced homes. The M&A landscape shows a moderate level of activity, with approximately xx M&A deals recorded in the historical period (2019-2024), indicating consolidation amongst the players. Market share for the top 5 players in 2024 was estimated to be approximately xx%.

- Market Concentration: Moderately high, with top players holding significant shares.

- Innovation Drivers: Sustainable building, smart home technology, innovative financing.

- Regulatory Framework: Evolving, impacting land availability, building codes, and financing.

- Product Substitutes: Limited, due to strong housing demand.

- End-User Trends: Preference for modern, energy-efficient homes.

- M&A Activity: Moderate, with xx deals recorded between 2019 and 2024.

Saudi Arabia Residential Real Estate Market Industry Trends & Analysis

The Saudi Arabian residential real estate market demonstrates robust growth, fueled by population increase, urbanization, and government initiatives. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, and the forecast period (2025-2033) projects a CAGR of xx%. Market penetration of smart home technologies is increasing, with an estimated xx% penetration in 2024, expected to reach xx% by 2033. Consumer preferences are shifting towards larger, more sustainable homes, influencing design and construction trends. Competitive dynamics are shaping the market, with players focusing on differentiation through innovative designs, premium amenities, and strategic partnerships. Technological disruptions, such as the use of Building Information Modeling (BIM) and 3D printing, are enhancing efficiency and reducing construction time. Government policies aimed at stimulating the housing sector further boost growth.

Leading Markets & Segments in Saudi Arabia Residential Real Estate Market

Riyadh, Jeddah, and Dammam are the leading markets for residential real estate in Saudi Arabia, driven by robust economic activity, substantial infrastructure development, and high population density. However, other regions ("Rest of Saudi Arabia") are also witnessing significant growth, particularly in areas witnessing infrastructural expansion.

Key Cities:

- Riyadh: Strong economic activity, major infrastructure projects.

- Jeddah: Coastal location, tourism, and business hub.

- Dammam: Industrial center, substantial employment opportunities.

Segments:

- Villas and Landed Houses: High demand driven by cultural preferences and larger family sizes.

- Condominiums and Apartments: Growing popularity, particularly amongst younger demographics. Growth is supported by increasing affordability and convenient location.

Key Drivers:

- Economic policies: Government initiatives promoting homeownership and investment.

- Infrastructure development: Improved transportation networks, utilities, and amenities.

- Population growth: Urbanization and increasing demand for housing.

Saudi Arabia Residential Real Estate Market Product Developments

The Saudi Arabian residential real estate market is witnessing the introduction of innovative products and technologies, including smart home features, sustainable building materials, and energy-efficient designs. Companies are increasingly focusing on incorporating eco-friendly practices and technologies to meet growing consumer demand for sustainable housing options. These developments enhance the appeal of residential properties and contribute to a more competitive landscape. Advanced construction techniques such as modular construction are also being adopted to improve efficiency and reduce construction timelines.

Key Drivers of Saudi Arabia Residential Real Estate Market Growth

The Saudi Arabian residential real estate market is propelled by several key drivers: Vision 2030's emphasis on improving living standards and infrastructure development is a key catalyst. Economic diversification and a growing middle class are also driving up demand for quality housing. Furthermore, government initiatives promoting homeownership and investment in the real estate sector create a supportive environment for growth. Technological advancements, such as smart home technology and sustainable building materials, further contribute to market expansion.

Challenges in the Saudi Arabia Residential Real Estate Market Market

Challenges include navigating the regulatory landscape, ensuring sufficient land availability to meet demand, and managing fluctuations in construction material costs. Maintaining a competitive pricing strategy while ensuring high-quality construction presents a significant challenge. The sector also faces the competition from different investment options and the requirement of complying with stringent building codes and environmental regulations. The total impact of these challenges on market growth is approximately xx% as per 2024 estimation.

Emerging Opportunities in Saudi Arabia Residential Real Estate Market

Significant opportunities exist in developing sustainable and smart homes, leveraging technological advancements to enhance the efficiency and sustainability of housing developments. Strategic partnerships between local and international developers can unlock significant growth potential. Expanding into underserved regions and creating affordable housing options will create further market penetration opportunities. The government's continued support through investments and initiatives presents a significant opportunity to capitalise on.

Leading Players in the Saudi Arabia Residential Real Estate Market Sector

- Dar Al Arkan

- Emaar

- Ewaan Co Ltd

- Jabal Omar

- AL Nassar

- Jenan Real Estate Company

- Abdul Latif Jamal

- Sedco Development

- Alfirah United Company for Real Estate

- Al Sedan

- Rafal

Key Milestones in Saudi Arabia Residential Real Estate Market Industry

- September 2023: Emaar Properties announces potential development of a 4,000-unit housing project in Saudi Arabia, signaling significant investment and capacity expansion.

- June 2023: NEOM finalizes contracts for the first phase of its residential communities expansion, a SAR 21 billion (USD 5.6 billion) project, representing a major milestone in large-scale PPP projects and highlighting the significant role of private investments.

Strategic Outlook for Saudi Arabia Residential Real Estate Market Market

The Saudi Arabian residential real estate market is poised for significant growth over the forecast period (2025-2033). Continued government support, robust economic growth, and increasing urbanization will drive demand. Strategic partnerships and innovation in sustainable and smart housing will be key to capturing market share. The focus on affordable housing and addressing the challenges of land availability will be crucial to sustained, inclusive growth within the sector.

Saudi Arabia Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Riyadh

- 2.2. Jeddah

- 2.3. Dammam

- 2.4. Rest of Saudi Arabia

Saudi Arabia Residential Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Residential Real Estate Market Regional Market Share

Geographic Coverage of Saudi Arabia Residential Real Estate Market

Saudi Arabia Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. The Real Estate Market in Saudi Arabia is On The Rise In Line With Vision 2030.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Riyadh

- 5.2.2. Jeddah

- 5.2.3. Dammam

- 5.2.4. Rest of Saudi Arabia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dar Al Arkan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emaar

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ewaan Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jabal Omar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AL Nassar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jenan Real Estate Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abdul Latif Jamal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sedco Development

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alfirah United Company for Real Estate

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Sedan

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rafal

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dar Al Arkan

List of Figures

- Figure 1: Saudi Arabia Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Residential Real Estate Market?

The projected CAGR is approximately 8.77%.

2. Which companies are prominent players in the Saudi Arabia Residential Real Estate Market?

Key companies in the market include Dar Al Arkan, Emaar, Ewaan Co Ltd, Jabal Omar, AL Nassar, Jenan Real Estate Company, Abdul Latif Jamal, Sedco Development, Alfirah United Company for Real Estate, Al Sedan, Rafal.

3. What are the main segments of the Saudi Arabia Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 187.20 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

The Real Estate Market in Saudi Arabia is On The Rise In Line With Vision 2030..

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

September 2023: Emaar Properties has the potential to develop residential communities in the Kingdom of Saudi Arabia. Emaar could begin construction of a 4,000-unit housing project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence