Key Insights

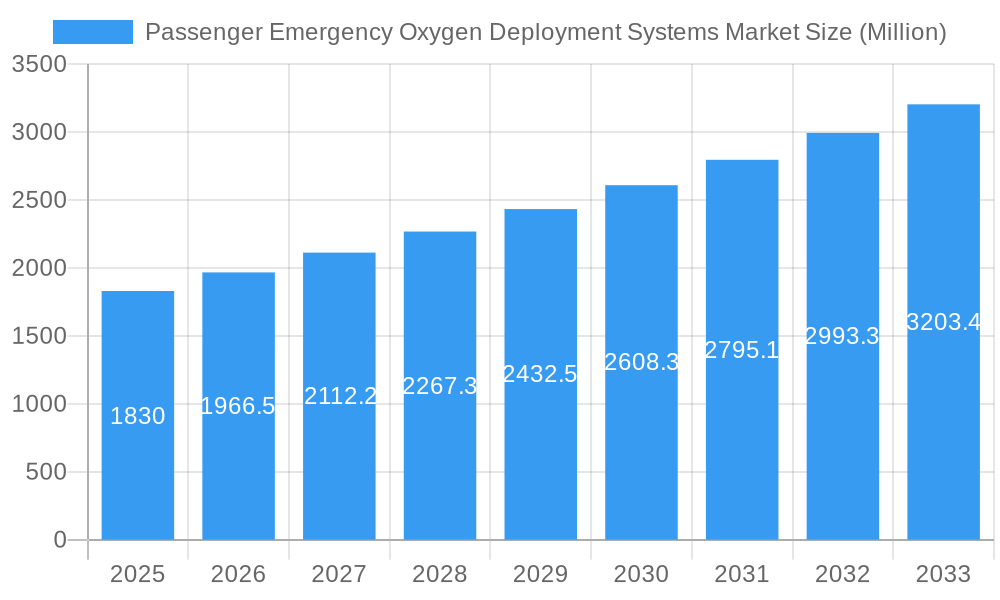

The Passenger Emergency Oxygen Deployment Systems market is poised for significant growth, projected to reach a value of $1.83 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.42% from 2025 to 2033. This expansion is driven by several key factors. The increasing number of air travelers globally fuels demand for enhanced safety features, including reliable oxygen systems. Stringent safety regulations imposed by aviation authorities worldwide mandate the installation and maintenance of efficient oxygen systems in commercial and military aircraft, further driving market growth. Technological advancements leading to lighter, more compact, and reliable oxygen systems are also contributing to this market's expansion. Moreover, the growing focus on passenger comfort and safety, particularly during emergencies at high altitudes, is creating a conducive environment for market growth. The market is segmented by system type (Crew and Passenger) and aircraft type (Commercial, Military, and General Aviation), with commercial aircraft currently dominating the market share due to higher passenger capacity and stringent safety regulations.

Passenger Emergency Oxygen Deployment Systems Market Market Size (In Billion)

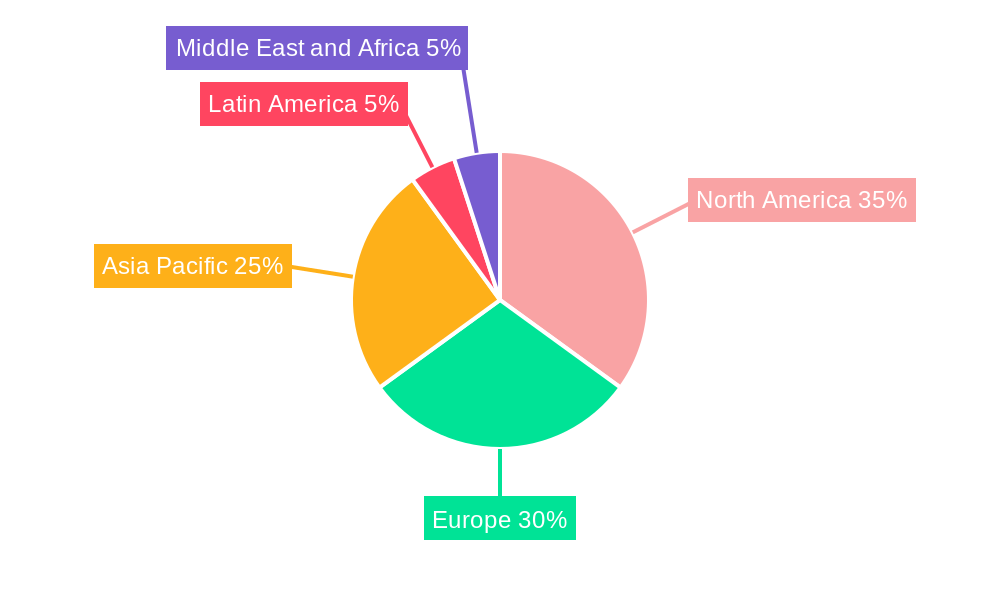

The market’s growth is expected to be geographically diverse. North America and Europe are currently leading regions due to established aviation industries and stringent safety standards. However, the Asia-Pacific region is projected to witness substantial growth over the forecast period due to the rapid expansion of the aviation sector and rising air travel in countries like China and India. While the market faces challenges like high initial investment costs for system installation and maintenance, the increasing awareness of safety and stringent regulatory requirements are likely to outweigh these constraints. Key players in the market, including Safran, Aeromedix Inc, Rostec, and others, are investing in research and development to improve system efficiency and reliability, enhancing their competitive advantage and further stimulating market expansion. This competitive landscape fosters innovation and helps meet the growing demands of the industry.

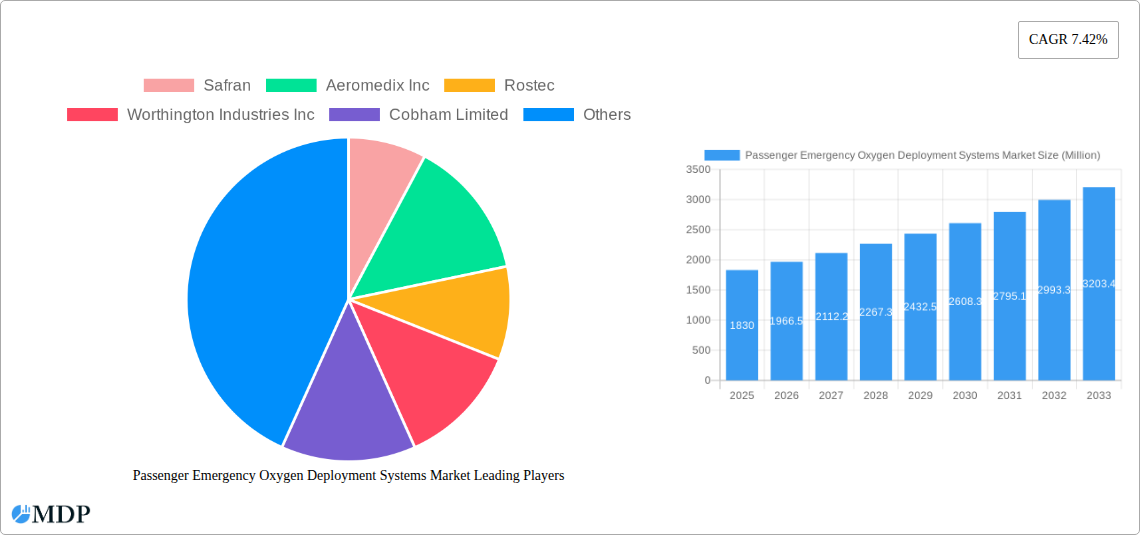

Passenger Emergency Oxygen Deployment Systems Market Company Market Share

Passenger Emergency Oxygen Deployment Systems Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the global Passenger Emergency Oxygen Deployment Systems Market, offering invaluable insights for stakeholders across the aviation and aerospace sectors. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period and a base year of 2025. This report leverages rigorous data analysis and expert insights to illuminate market dynamics, trends, and future growth potential. Key players like Safran, Aeromedix Inc, Rostec, and others are profiled, providing a granular understanding of the competitive landscape. The report segments the market by system (Crew Oxygen System, Passenger Oxygen System) and aircraft type (Commercial Aircraft, Military Aircraft, General Aviation Aircraft), enabling targeted strategic planning. Download now to gain a competitive edge.

Passenger Emergency Oxygen Deployment Systems Market Market Dynamics & Concentration

The Passenger Emergency Oxygen Deployment Systems Market is characterized by moderate concentration, with key players holding significant market share. Safran, Aeromedix Inc, and Rostec are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. Market concentration is influenced by factors such as technological expertise, regulatory compliance, and established supply chains. Innovation is a key driver, with ongoing developments in oxygen delivery systems, improved safety features, and lightweight materials pushing market expansion. Stringent safety regulations imposed by aviation authorities globally influence product design and deployment strategies. Product substitutes, though limited, include alternative breathing apparatus, but these lack the convenience and reliability of dedicated oxygen systems. End-user trends favor increased safety standards and improved passenger experience, further driving market growth. M&A activity has been relatively limited in recent years, with only xx major deals recorded between 2019 and 2024. However, future consolidation among smaller players is anticipated as the market matures.

- Market Share (2025): Safran (xx%), Aeromedix Inc (xx%), Rostec (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Lightweight materials, improved oxygen delivery systems, enhanced safety features.

- Regulatory Impacts: Stringent safety standards from aviation authorities (e.g., FAA, EASA).

Passenger Emergency Oxygen Deployment Systems Market Industry Trends & Analysis

The Passenger Emergency Oxygen Deployment Systems Market is projected to experience robust growth during the forecast period (2025-2033), with a CAGR of xx%. This growth is fueled by several key factors. The increasing air travel demand globally, particularly in developing economies, significantly contributes to market expansion. Technological advancements, such as the development of more efficient and compact oxygen systems, are enhancing product appeal and driving adoption. Consumer preferences are shifting towards enhanced safety and reliability, creating a higher demand for advanced oxygen deployment systems. Competitive dynamics are characterized by ongoing innovation and product differentiation, with companies focusing on improving safety, reducing weight, and enhancing reliability. Market penetration is highest in the commercial aircraft segment, driven by stricter safety regulations and passenger volume. However, the military and general aviation segments also show significant growth potential, driven by increasing military expenditure and rising private aviation.

Leading Markets & Segments in Passenger Emergency Oxygen Deployment Systems Market

The Commercial Aircraft segment dominates the Passenger Emergency Oxygen Deployment Systems Market, accounting for approximately xx% of the total market value in 2025. This dominance stems from the sheer volume of commercial air travel globally, and stringent safety regulations mandating the use of such systems. North America and Europe are the leading regional markets, driven by a large existing fleet of aircraft and robust regulatory frameworks. Asia-Pacific is also emerging as a key market, with significant growth potential due to the rapid expansion of its aviation sector.

- Key Drivers for Commercial Aircraft Segment:

- Stringent safety regulations

- High passenger volume

- Increasing air travel demand

- Key Drivers for North America: Established aviation infrastructure, robust regulatory frameworks.

- Key Drivers for Europe: Similar to North America, with a strong focus on safety standards.

- Key Drivers for Asia-Pacific: Rapid growth in air travel demand and fleet expansion.

The Passenger Oxygen System segment holds a larger market share compared to the Crew Oxygen System segment due to the higher number of passengers requiring oxygen in emergency situations compared to the crew.

Passenger Emergency Oxygen Deployment Systems Market Product Developments

Recent product developments focus on miniaturization, weight reduction, and enhanced safety features. Manufacturers are incorporating advanced materials and technologies to improve oxygen delivery efficiency and reliability. This includes improved chemical oxygen generators that provide more consistent oxygen flow and longer duration of supply. New designs aim for easier integration into aircraft cabins and improved user-friendliness in emergency situations. These developments contribute to enhancing passenger and crew safety, ensuring compliance with stringent regulatory requirements, and creating a competitive advantage in the market.

Key Drivers of Passenger Emergency Oxygen Deployment Systems Market Growth

The Passenger Emergency Oxygen Deployment Systems Market's growth is driven by several factors. The surge in air passenger traffic globally is a primary driver, increasing the demand for these safety-critical systems. Stringent safety regulations and stricter enforcement by aviation authorities worldwide mandate the use and efficient performance of these systems. Technological advancements, like the development of lightweight and more efficient oxygen generators, enhance product appeal and adoption. Furthermore, the increasing focus on passenger safety and comfort is another factor pushing market expansion.

Challenges in the Passenger Emergency Oxygen Deployment Systems Market Market

The market faces challenges like stringent certification and approval processes, potentially delaying product launches. Supply chain disruptions, particularly for specialized materials used in oxygen generation, can impact production and delivery timelines. Intense competition among established players and the emergence of new entrants create pressure on pricing and profitability. Furthermore, fluctuating raw material costs and economic downturns can impact market growth.

Emerging Opportunities in Passenger Emergency Oxygen Deployment Systems Market

Long-term growth will be driven by technological breakthroughs like the development of sustainable and environmentally friendly oxygen generation systems. Strategic partnerships between manufacturers and airlines can foster innovation and streamline integration processes. Expanding into emerging markets with developing aviation sectors will create significant growth opportunities. The focus on improving the efficiency and ease of use of these systems will also create demand.

Leading Players in the Passenger Emergency Oxygen Deployment Systems Market Sector

- Safran

- Aeromedix Inc

- Rostec

- Worthington Industries Inc

- Cobham Limited

- RTX Corporation

- L’AIR LIQUIDE S A

- Parker-Meggitt (Parker Hannifin Corporation)

- Diehl Stiftung & Co K

- Precise Flight Inc

- Caeli Nova

- PFW Aerospace GmbH

Key Milestones in Passenger Emergency Oxygen Deployment Systems Market Industry

- 2020: Introduction of a new lightweight oxygen generator by Safran.

- 2022: Acquisition of a smaller oxygen system manufacturer by RTX Corporation.

- 2023: Implementation of stricter safety regulations by the FAA.

- 2024: Launch of a next-generation chemical oxygen generator with improved performance characteristics.

Strategic Outlook for Passenger Emergency Oxygen Deployment Systems Market Market

The Passenger Emergency Oxygen Deployment Systems Market exhibits substantial future potential, driven by the continued growth in air travel and an unwavering focus on aviation safety. Strategic opportunities lie in developing innovative, lightweight, and cost-effective systems. Companies should focus on strategic partnerships with airlines and regulatory bodies to ensure smooth product integration and compliance. Investment in research and development will be crucial for staying ahead in this technologically evolving market. The focus on sustainability and environmental impact will also become increasingly important for future growth.

Passenger Emergency Oxygen Deployment Systems Market Segmentation

-

1. System

- 1.1. Crew Oxygen System

- 1.2. Passenger Oxygen System

-

2. Aircraft Type

- 2.1. Commercial Aircraft

- 2.2. Military Aircraft

- 2.3. General Aviation Aircraft

Passenger Emergency Oxygen Deployment Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Turkey

- 5.4. Rest of Middle East and Africa

Passenger Emergency Oxygen Deployment Systems Market Regional Market Share

Geographic Coverage of Passenger Emergency Oxygen Deployment Systems Market

Passenger Emergency Oxygen Deployment Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aircraft Segment to Dominate the Market During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passenger Emergency Oxygen Deployment Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System

- 5.1.1. Crew Oxygen System

- 5.1.2. Passenger Oxygen System

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Commercial Aircraft

- 5.2.2. Military Aircraft

- 5.2.3. General Aviation Aircraft

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by System

- 6. North America Passenger Emergency Oxygen Deployment Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System

- 6.1.1. Crew Oxygen System

- 6.1.2. Passenger Oxygen System

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Commercial Aircraft

- 6.2.2. Military Aircraft

- 6.2.3. General Aviation Aircraft

- 6.1. Market Analysis, Insights and Forecast - by System

- 7. Europe Passenger Emergency Oxygen Deployment Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System

- 7.1.1. Crew Oxygen System

- 7.1.2. Passenger Oxygen System

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Commercial Aircraft

- 7.2.2. Military Aircraft

- 7.2.3. General Aviation Aircraft

- 7.1. Market Analysis, Insights and Forecast - by System

- 8. Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System

- 8.1.1. Crew Oxygen System

- 8.1.2. Passenger Oxygen System

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Commercial Aircraft

- 8.2.2. Military Aircraft

- 8.2.3. General Aviation Aircraft

- 8.1. Market Analysis, Insights and Forecast - by System

- 9. Latin America Passenger Emergency Oxygen Deployment Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System

- 9.1.1. Crew Oxygen System

- 9.1.2. Passenger Oxygen System

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Commercial Aircraft

- 9.2.2. Military Aircraft

- 9.2.3. General Aviation Aircraft

- 9.1. Market Analysis, Insights and Forecast - by System

- 10. Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by System

- 10.1.1. Crew Oxygen System

- 10.1.2. Passenger Oxygen System

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Commercial Aircraft

- 10.2.2. Military Aircraft

- 10.2.3. General Aviation Aircraft

- 10.1. Market Analysis, Insights and Forecast - by System

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Safran

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aeromedix Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rostec

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Worthington Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cobham Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RTX Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L’AIR LIQUIDE S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parker-Meggitt (Parker Hannifin Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Diehl Stiftung & Co K

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Precise Flight Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Caeli Nova

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PFW Aerospace GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Safran

List of Figures

- Figure 1: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by System 2025 & 2033

- Figure 3: North America Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by System 2025 & 2033

- Figure 4: North America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 5: North America Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 6: North America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by System 2025 & 2033

- Figure 9: Europe Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by System 2025 & 2033

- Figure 10: Europe Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 11: Europe Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by System 2025 & 2033

- Figure 15: Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by System 2025 & 2033

- Figure 16: Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 17: Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 18: Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by System 2025 & 2033

- Figure 21: Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by System 2025 & 2033

- Figure 22: Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 23: Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 24: Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by System 2025 & 2033

- Figure 27: Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by System 2025 & 2033

- Figure 28: Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 29: Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 30: Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by System 2020 & 2033

- Table 2: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 3: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by System 2020 & 2033

- Table 5: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 6: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by System 2020 & 2033

- Table 10: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 11: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by System 2020 & 2033

- Table 17: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 18: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by System 2020 & 2033

- Table 25: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 26: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by System 2020 & 2033

- Table 30: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 31: Global Passenger Emergency Oxygen Deployment Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Saudi Arabia Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Turkey Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Passenger Emergency Oxygen Deployment Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Emergency Oxygen Deployment Systems Market?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the Passenger Emergency Oxygen Deployment Systems Market?

Key companies in the market include Safran, Aeromedix Inc, Rostec, Worthington Industries Inc, Cobham Limited, RTX Corporation, L’AIR LIQUIDE S A, Parker-Meggitt (Parker Hannifin Corporation), Diehl Stiftung & Co K, Precise Flight Inc, Caeli Nova, PFW Aerospace GmbH.

3. What are the main segments of the Passenger Emergency Oxygen Deployment Systems Market?

The market segments include System, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aircraft Segment to Dominate the Market During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passenger Emergency Oxygen Deployment Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passenger Emergency Oxygen Deployment Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passenger Emergency Oxygen Deployment Systems Market?

To stay informed about further developments, trends, and reports in the Passenger Emergency Oxygen Deployment Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence