Key Insights

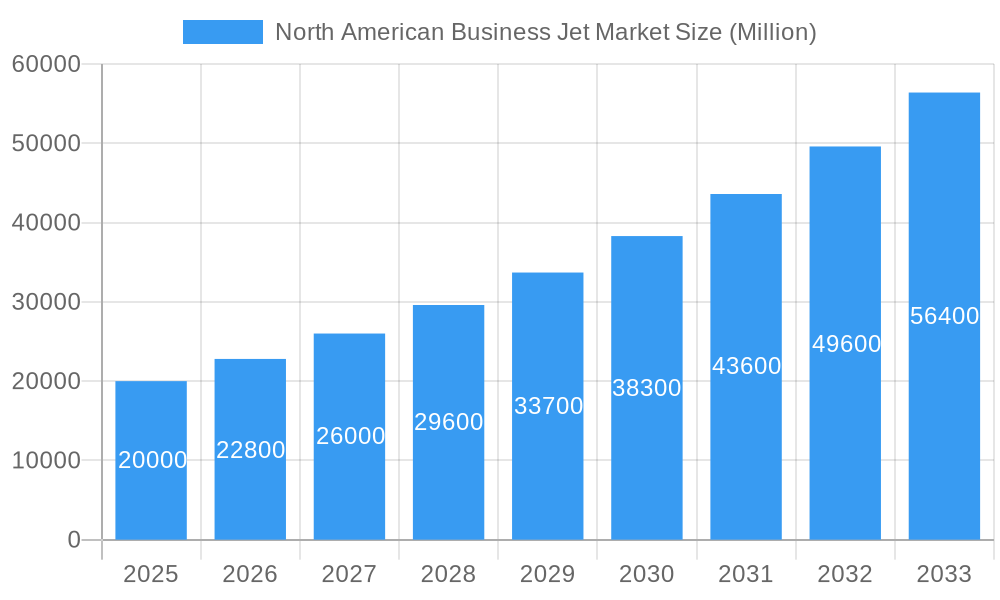

The North American business jet market is projected to reach $48.13 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 4.99% from the base year 2025. This growth is propelled by increasing high-net-worth individual and corporate demand for private aviation, alongside advancements in fuel efficiency, range, and in-flight connectivity. Government support for business travel also bolsters market prospects. Key challenges include potential economic downturns and environmental concerns, necessitating a focus on sustainable aviation solutions. The market segments by jet size, with light jets appealing to individual owners and large jets favored by corporations. The United States dominates the North American market, followed by Canada and Mexico. Intense competition among leading manufacturers drives innovation and price competitiveness.

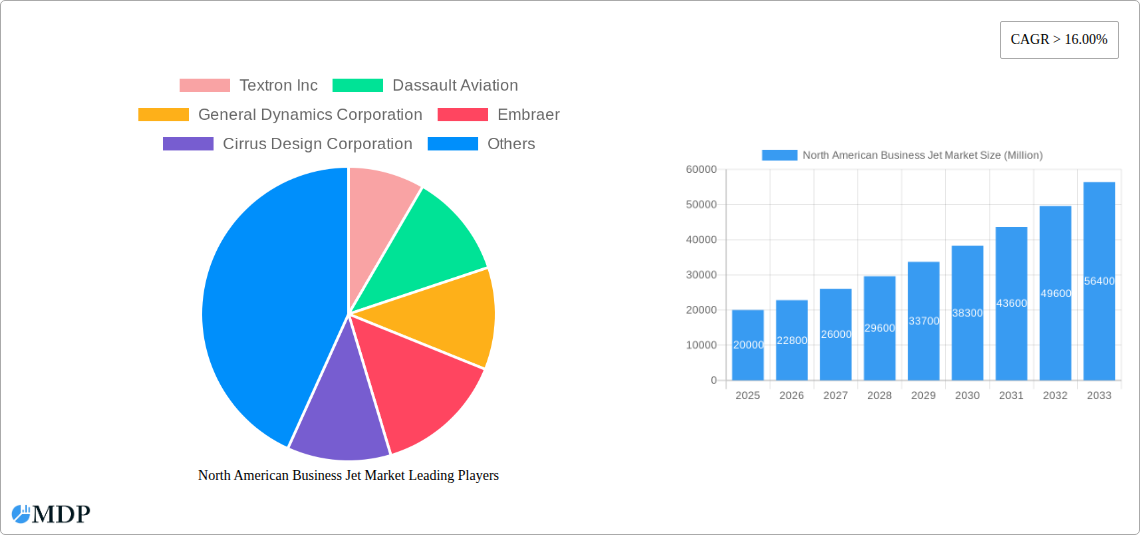

North American Business Jet Market Market Size (In Billion)

The forecast period of 2025-2033 offers substantial growth opportunities, particularly for light and mid-size jets, due to their accessibility and versatility. Technological advancements in sustainable aviation fuels and enhanced efficiency are vital for addressing environmental concerns and ensuring long-term market sustainability. Strategic partnerships and mergers/acquisitions are expected to shape market consolidation and foster access to new technologies and customer segments. Sustained economic growth in North America will be a critical driver for the business aviation industry's performance.

North American Business Jet Market Company Market Share

North American Business Jet Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American business jet market, offering invaluable insights for stakeholders across the aviation industry. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, leading players, emerging trends, and future growth opportunities. Benefit from detailed segmentation by body type (Large Jet, Light Jet, Mid-Size Jet) and country (United States, Canada, Mexico, Rest of North America), enabling informed strategic decision-making. Expect detailed financial projections, including CAGR and market penetration data, supporting investment strategies and future planning.

North American Business Jet Market Dynamics & Concentration

The North American business jet market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors such as economies of scale in manufacturing, extensive service networks, and brand recognition. Innovation is a key driver, with ongoing developments in aircraft technology, such as improved fuel efficiency, enhanced safety features, and advanced cabin technologies, constantly shaping the market. Stringent regulatory frameworks, including safety regulations and environmental standards, significantly impact market operations. While there are limited direct substitutes for business jets, alternative modes of transportation, such as commercial airlines for shorter distances, create competitive pressure. End-user trends, such as growing demand from private charter operators and fractional ownership programs, are also impacting market dynamics. Finally, M&A activity plays a role in shaping market structure. For example, the market saw xx M&A deals in 2024, influencing market share distribution. Several key players maintain substantial market share, with Textron Inc., Dassault Aviation, and Bombardier Inc. among the leading participants, each commanding xx%, xx%, and xx% respectively, of the total market share in 2024.

North American Business Jet Market Industry Trends & Analysis

The North American business jet market demonstrates robust growth, driven by several key factors. The CAGR during the historical period (2019-2024) was xx%, significantly boosted by the recovery from the pandemic. The forecast period (2025-2033) projects a more modest yet sustained CAGR of xx%, reflecting market maturity. Technological advancements, such as the integration of advanced avionics and improved fuel-efficient engines, are driving market expansion. Changing consumer preferences, including a growing preference for larger and more luxurious cabins equipped with advanced connectivity and entertainment systems, are also influencing market demand. Competitive dynamics are shaping the market, with manufacturers constantly striving to differentiate their products through technological innovation, superior service offerings, and strategic partnerships. Market penetration of business jets within the high-net-worth individual segment is expected to reach xx% by 2033, reflecting the ongoing increase in private aviation adoption.

Leading Markets & Segments in North American Business Jet Market

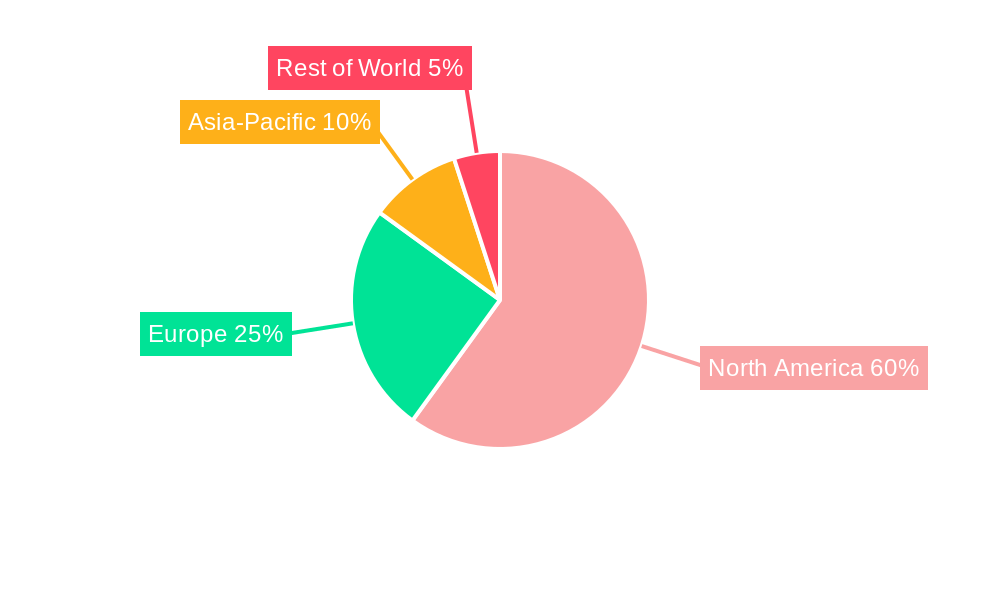

The United States remains the dominant market for business jets in North America, accounting for xx% of the total market value in 2024.

- Key Drivers in the United States: Strong economic growth, a large high-net-worth individual population, well-developed aviation infrastructure, and favorable regulatory environment contribute to its dominance.

- Canada and Mexico: While smaller than the US market, both Canada and Mexico are experiencing growth driven by their respective economic expansions and increasing demand from corporate and private users. Canada’s market share in 2024 stands at xx%, while Mexico accounts for xx%.

By Body Type: The light jet segment presently holds the largest market share, driven by its affordability and suitability for shorter-range flights. However, the mid-size and large jet segments are projected to experience faster growth during the forecast period due to increasing demand from corporations and high-net-worth individuals needing longer-range capabilities and superior cabin comfort. The market share for Light, Mid-size, and Large Jets in 2024 stood at xx%, xx%, and xx% respectively.

North American Business Jet Market Product Developments

Recent product innovations focus on enhanced fuel efficiency, improved safety features, and advanced cabin technologies. Manufacturers are incorporating features like fly-by-wire systems, advanced avionics suites, and luxurious cabin amenities to enhance the passenger experience. These improvements address market demands for environmentally responsible and technologically advanced aircraft that cater to evolving customer preferences. This continuous innovation ensures that business jets maintain their competitive edge and appeal in a dynamic market.

Key Drivers of North American Business Jet Market Growth

Several factors contribute to the growth of the North American business jet market. Technological advancements such as improved engine technology, reduced fuel consumption and increased range, are key drivers. Strong economic growth and increasing high-net-worth individuals fuel demand. Finally, favorable government policies supporting private aviation also support market expansion.

Challenges in the North American Business Jet Market Market

The market faces several challenges. Stringent regulatory compliance and certifications can increase operational costs. Supply chain disruptions, particularly for specialized components, can lead to production delays. Intense competition amongst manufacturers exerts pressure on pricing and profitability. These factors collectively impact the overall market growth trajectory. For example, supply chain issues impacted production by an estimated xx% in 2022.

Emerging Opportunities in North American Business Jet Market

The market presents several opportunities for growth. The increasing adoption of sustainable aviation fuels and the development of electric or hybrid-electric propulsion systems offer potential for environmentally friendly aircraft. The expansion of fractional ownership programs and private jet charter services broadens market access. Continued technological innovations and strategic partnerships will further enhance market growth and shape the future of the industry.

Leading Players in the North American Business Jet Market Sector

Key Milestones in North American Business Jet Market Industry

- October 2023: Textron Aviation secured a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, boosting demand for light jets and highlighting the growing private charter market.

- June 2023: Gulfstream Aerospace Corp.'s investment of USD 28.5 Million in expanding its St. Louis operations signifies confidence in future market growth and commitment to production capacity expansion.

- June 2023: Gulfstream G280's certification for La Môle airport expands operational flexibility, demonstrating the importance of short-field capabilities in the luxury segment.

Strategic Outlook for North American Business Jet Market Market

The North American business jet market is poised for continued growth, driven by technological advancements, increasing affluence, and a favorable regulatory environment. Strategic opportunities lie in focusing on sustainability, enhancing customer experiences through technological innovation and service offerings, and expanding into emerging markets within North America. By capitalizing on these factors, market players can solidify their positions and participate in the long-term growth trajectory of this dynamic sector.

North American Business Jet Market Segmentation

-

1. Body Type

- 1.1. Large Jet

- 1.2. Light Jet

- 1.3. Mid-Size Jet

North American Business Jet Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Business Jet Market Regional Market Share

Geographic Coverage of North American Business Jet Market

North American Business Jet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing preferences for private travel and the rising HNWI population are driving the demand for business jets in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Large Jet

- 5.1.2. Light Jet

- 5.1.3. Mid-Size Jet

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Dynamics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Embraer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cirrus Design Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pilatus Aircraft Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bombardier Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honda Motor Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: North American Business Jet Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North American Business Jet Market Share (%) by Company 2025

List of Tables

- Table 1: North American Business Jet Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: North American Business Jet Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North American Business Jet Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 4: North American Business Jet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North American Business Jet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North American Business Jet Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North American Business Jet Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Business Jet Market?

The projected CAGR is approximately 4.99%.

2. Which companies are prominent players in the North American Business Jet Market?

Key companies in the market include Textron Inc, Dassault Aviation, General Dynamics Corporation, Embraer, Cirrus Design Corporation, Pilatus Aircraft Ltd, Bombardier Inc, Honda Motor Co Ltd.

3. What are the main segments of the North American Business Jet Market?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing preferences for private travel and the rising HNWI population are driving the demand for business jets in the region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Textron Aviation announced that it entered a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, with options for 16 additional aircraft. Fly Alliance is expected to use the aircraft for its luxury private jet charter operations. It expected the delivery of the first aircraft, an XLS Gen2, in 2023.June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at St. Louis Downtown Airport. With this latest expansion, Gulfstream expects to increase operations at the site while modernizing its existing spaces by adding new, state-of-the-art equipment and tooling, representing a total capital investment of USD 28.5 million.June 2023: Gulfstream Aerospace Corp. announced the super-midsize Gulfstream G280 has been cleared for operations at France’s Airport of the Gulf of Saint-Tropez located in La Môle. The aircraft recently flew several takeoff and landing demonstrations at the short-field airport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Business Jet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Business Jet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Business Jet Market?

To stay informed about further developments, trends, and reports in the North American Business Jet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence