Key Insights

The North American small satellite market is experiencing robust growth, driven by increasing demand for cost-effective Earth observation, communication, and navigation solutions. The market's Compound Annual Growth Rate (CAGR) of 5.18% from 2019-2033 indicates a significant expansion, projected to reach substantial value by 2033. Several factors contribute to this growth. Firstly, advancements in miniaturization and propulsion technologies, particularly electric propulsion, are making small satellites more accessible and affordable. Secondly, the burgeoning NewSpace industry, characterized by private companies like SpaceX, Planet Labs, and Spire Global, fosters innovation and competition, leading to reduced launch costs and increased deployment frequency. Thirdly, government initiatives supporting space exploration and national security are further fueling market expansion. The North American market, particularly the United States, dominates due to its strong technological base and substantial investment in space research and development. The commercial sector accounts for a significant portion of the market share, driven by applications in Earth observation for agriculture, environmental monitoring, and urban planning, while the military and government sectors contribute substantially due to national security and defense needs. Future growth will be further fueled by the increasing adoption of constellations of small satellites, providing enhanced coverage and data capabilities across various applications.

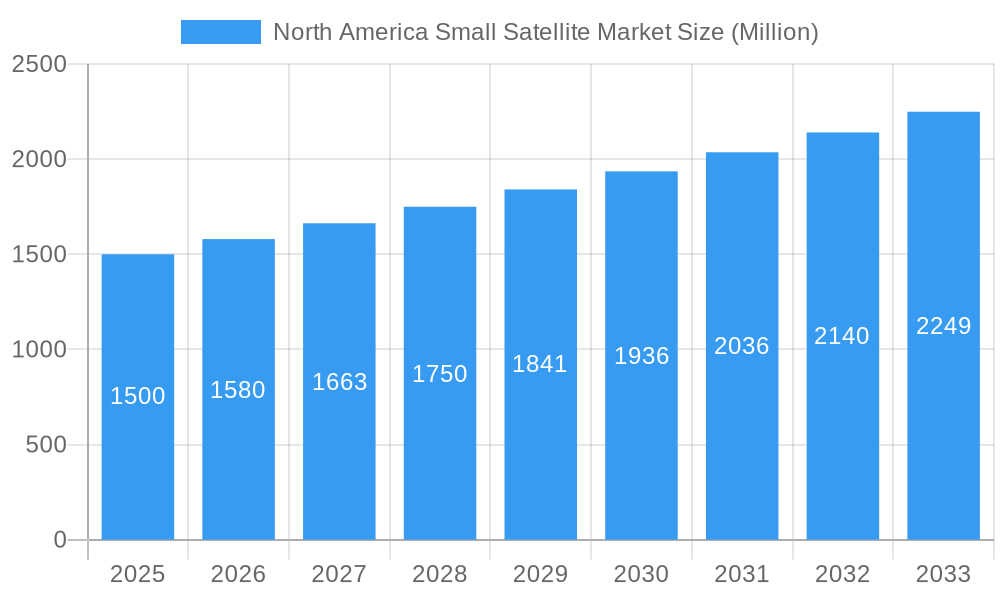

North America Small Satellite Market Market Size (In Billion)

The segmentation of the North American small satellite market reveals a diverse landscape. The communication segment is significant, with the demand for increased broadband access and improved global connectivity. The Earth observation segment continues to be a major driver, fueled by the increasing demand for high-resolution imagery for various applications. Navigation remains crucial, while space observation offers potential for scientific discovery. In terms of orbit class, Low Earth Orbit (LEO) satellites are expected to witness substantial growth due to their advantages in data transmission and imagery resolution. However, Geostationary Earth Orbit (GEO) satellites also retain their importance for continuous coverage of specific regions. The technological advancements in electric propulsion are enhancing the operational lifespan and efficiency of small satellites, positively impacting market growth. While challenges remain in terms of regulatory frameworks and space debris mitigation, the overall trajectory of the North American small satellite market suggests significant expansion throughout the forecast period.

North America Small Satellite Market Company Market Share

North America Small Satellite Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America small satellite market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) and predictive modeling to deliver a clear picture of market dynamics, trends, and future growth potential. The market is segmented by application (Communication, Earth Observation, Navigation, Space Observation, Others), orbit class (GEO, LEO, MEO), end-user (Commercial, Military & Government, Other), and propulsion technology (Electric, Gas-based, Liquid Fuel). Key players such as SpaceX, Swarm Technologies, and Planet Labs are analyzed, providing a comprehensive understanding of the competitive landscape. The estimated market value in 2025 is xx Million.

North America Small Satellite Market Market Dynamics & Concentration

The North American small satellite market exhibits a dynamic landscape shaped by several key factors. Market concentration is moderate, with a few major players holding significant shares, but a growing number of smaller companies and startups contributing to innovation. The market is driven by advancements in miniaturization, reduced launch costs, and increasing demand for Earth observation, communication, and navigation services. Regulatory frameworks, while evolving, generally support the growth of the small satellite industry, although navigating licensing and spectrum allocation can present challenges. Product substitutes, such as ground-based systems, exist but are often limited in their capabilities compared to the flexibility and reach of small satellites.

- Market Share: SpaceX holds a leading market share (estimated at xx%), followed by Planet Labs Inc. (xx%) and Spire Global Inc. (xx%). Smaller companies contribute to the remaining market share.

- M&A Activity: The number of M&A deals in the sector has increased steadily in recent years, reflecting consolidation and strategic acquisitions by larger players. The estimated number of M&A deals in 2024 was xx, an increase of xx% from 2019.

- End-user trends: The commercial sector is a primary driver, with increasing demand for data services across various industries. The military and government sectors also represent significant growth areas.

North America Small Satellite Market Industry Trends & Analysis

The North American small satellite market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the decreasing cost of launch services, technological advancements in miniaturization and payload capabilities, and the rising demand for high-resolution imagery and real-time data across various sectors. The market penetration of small satellites in various applications continues to expand, driven by factors such as increased affordability and accessibility. The emergence of new technologies, such as CubeSats and nanosatellites, further fuels market growth. However, competitive pressures remain, with companies constantly striving to differentiate their offerings through improved technology, faster data processing, and value-added services.

Leading Markets & Segments in North America Small Satellite Market

The LEO (Low Earth Orbit) segment dominates the North American small satellite market, driven by its cost-effectiveness and suitability for various applications, particularly Earth observation. The commercial end-user segment is the largest contributor to market revenue, followed by the military and government sectors. The Earth Observation application segment leads in terms of revenue generation, given the high demand for environmental monitoring, agriculture, and urban planning data.

- Key Drivers for LEO: Lower launch costs, improved data transmission, and suitability for various applications.

- Key Drivers for Commercial Segment: High demand for data across diverse industries like agriculture, logistics, and financial services.

- Key Drivers for Earth Observation: Growing need for environmental monitoring, resource management, and disaster response.

North America Small Satellite Market Product Developments

Recent product developments focus on improving satellite miniaturization, increasing payload capacity, and enhancing data transmission speeds. There's a notable trend towards more robust and reliable satellite designs, as well as the incorporation of advanced sensors and imaging technologies. These developments aim to enhance the cost-effectiveness and performance of small satellites, making them more attractive to a wider range of users. The competitive advantage lies in offering unique data processing capabilities, innovative applications, and customized solutions to meet specific user needs.

Key Drivers of North America Small Satellite Market Growth

The North American small satellite market is driven by several factors:

- Technological Advancements: Miniaturization of components, increased payload capabilities, and improved data processing are key technological drivers.

- Decreased Launch Costs: Reusable rockets and increased launch frequency have significantly reduced launch costs, making small satellites more accessible.

- Government Initiatives: Government support and investment in space technology, such as NASA's initiatives, fuel market growth.

Challenges in the North America Small Satellite Market Market

The market faces challenges such as:

- Regulatory Hurdles: Obtaining licenses and complying with spectrum allocation regulations can be complex and time-consuming.

- Supply Chain Issues: Dependence on global supply chains creates vulnerabilities and potential delays.

- Competitive Pressure: High competition necessitates continuous innovation and cost optimization.

Emerging Opportunities in North America Small Satellite Market

Long-term growth is expected due to:

- Technological Breakthroughs: Advancements in AI, machine learning, and improved sensor technology will drive new applications and higher value services.

- Strategic Partnerships: Collaboration between companies across sectors (e.g., satellite manufacturers and data analytics providers) creates synergistic opportunities.

- New Market Expansion: The application of small satellite technology in emerging markets offers significant untapped potential.

Leading Players in the North America Small Satellite Market Sector

- Space Exploration Technologies Corp

- Swarm Technologies Inc

- SpaceQuest Ltd

- LeoStella

- Ball Corporation

- Planet Labs Inc

- Spire Global Inc

- Capella Space Corp

- National Aeronautics and Space Administration (NASA)

Key Milestones in North America Small Satellite Market Industry

- February 2022: SpaceX launched 49 Starlink internet satellites, demonstrating the increasing scale of mega-constellations.

- April 2022: BlackSky expanded its high-resolution satellite constellation, enhancing its Earth observation capabilities.

- April 2022: Swarm Technologies launched 12 picosatellites for low-data-rate communication, highlighting the growing importance of IoT applications.

Strategic Outlook for North America Small Satellite Market Market

The North American small satellite market is poised for continued expansion, driven by technological innovation, reduced launch costs, and increasing demand for data-driven insights. Strategic partnerships, focus on niche applications, and expansion into new markets present significant opportunities for players to capitalize on the market's growth potential. The long-term outlook remains highly positive, with the potential for small satellites to play an increasingly crucial role in various sectors.

North America Small Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

North America Small Satellite Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Small Satellite Market Regional Market Share

Geographic Coverage of North America Small Satellite Market

North America Small Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. LEO satellites are driving the demand for small satellites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Swarm Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SpaceQuest Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LeoStella

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ball Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Planet Labs Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Spire Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Capella Space Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 National Aeronautics and Space Administration (NASA)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Small Satellite Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Small Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: North America Small Satellite Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Small Satellite Market Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 3: North America Small Satellite Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: North America Small Satellite Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 5: North America Small Satellite Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Small Satellite Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Small Satellite Market Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 8: North America Small Satellite Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: North America Small Satellite Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 10: North America Small Satellite Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States North America Small Satellite Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Small Satellite Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Small Satellite Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small Satellite Market?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the North America Small Satellite Market?

Key companies in the market include Space Exploration Technologies Corp, Swarm Technologies Inc, SpaceQuest Ltd, LeoStella, Ball Corporation, Planet Labs Inc, Spire Global Inc, Capella Space Corp, National Aeronautics and Space Administration (NASA).

3. What are the main segments of the North America Small Satellite Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

LEO satellites are driving the demand for small satellites.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2022: The company expanded its constellation from 12 to 14 high-resolution satellites following the successful RocketLab launch. The rocket launched BlackSky 16, and 17 satellites.April 2022: Swarm Technologies 12 'picosatellites' on the Transporter 4 mission for low-data-rate communications network have been launched.February 2022: In February 2022, 49 more Starlink internet satellites are launched by SpaceX's Falcon 9 rocket.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small Satellite Market?

To stay informed about further developments, trends, and reports in the North America Small Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence