Key Insights

The North American Satellite Attitude and Orbit Control System (AOCS) market is poised for significant expansion, projected to reach a market size of 0.96 billion by 2033. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 10.94% from the base year 2025 to 2033. This upward trajectory is primarily propelled by the escalating adoption of advanced satellite technologies across key sectors, including commercial communications, Earth observation, and defense applications. Analysis of market segmentation indicates that the Geosynchronous Earth Orbit (GEO) segment continues to be a substantial contributor, underscoring the ongoing reliance on established communication satellites. However, Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) segments present considerable growth opportunities, driven by the surge in satellite constellations designed for broadband internet services and enhanced Earth observation capabilities. The burgeoning NewSpace industry and amplified private investment are further catalysts for this market's growth. While larger satellite mass categories (100-500kg and 500-1000kg) currently hold the majority share, the sub-100kg segment is experiencing rapid development, attributed to satellite miniaturization and the increasing popularity of CubeSats.

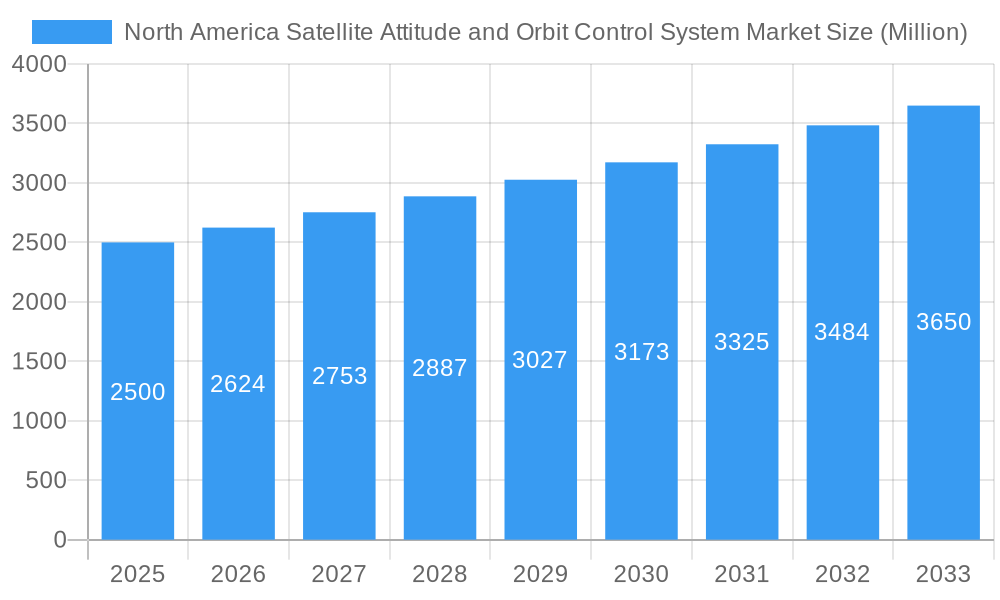

North America Satellite Attitude and Orbit Control System Market Market Size (In Million)

Technological advancements in AOCS systems, encompassing sophisticated sensors, actuators, and control algorithms, are enhancing satellite operational precision and efficiency. These improvements lead to superior data acquisition, reduced operational expenditures, and extended mission lifespans. Nevertheless, certain market restraints exist, including the substantial upfront investment required for AOCS technology, which can pose a hurdle for emerging companies. Furthermore, the rigorous regulatory landscape governing space operations, coupled with the inherent complexities of integrating advanced AOCS into satellite platforms, presents challenges to market expansion. Despite these factors, governmental initiatives aimed at fostering space exploration and commercialization are expected to counterbalance these limitations and stimulate future market growth. The United States, as the dominant force within North America, is anticipated to retain its leadership position, bolstered by its robust aerospace industry, extensive research and development infrastructure, and strong governmental backing for space-centric projects.

North America Satellite Attitude and Orbit Control System Market Company Market Share

North America Satellite Attitude and Orbit Control System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Satellite Attitude and Orbit Control System (AOCS) market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading segments, key players, and future opportunities. The market is segmented by Orbit Class (GEO, LEO, MEO), End User (Commercial, Military & Government, Other), Application (Communication, Earth Observation, Navigation, Space Observation, Others), and Satellite Mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg). The report projects a market value of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Satellite Attitude and Orbit Control System Market Market Dynamics & Concentration

The North American Satellite AOCS market is characterized by a moderate level of concentration, with a handful of established players and a growing number of emerging companies vying for market share. This dynamic landscape is shaped by several influential factors. The increasing demand for smaller, more affordable satellites, coupled with rapid advancements in miniaturization and sensor technologies, is fostering intense competition and driving significant innovation. Furthermore, rising government investments in space exploration, national defense, and scientific research are acting as powerful catalysts for market expansion. While regulatory frameworks are generally supportive of space-related activities, they also introduce inherent complexities that influence market growth trajectories, particularly concerning orbital debris mitigation and cybersecurity. The presence of substitute technologies, though currently limited, presents a potential challenge and encourages continuous improvement in AOCS capabilities. Recent years have witnessed a discernible uptick in M&A activity, with approximately [Insert Number Here] deals recorded in the past five years. This consolidation and expansion within the sector primarily aims to enhance technological capabilities, broaden market reach, and secure competitive advantages.

- Market Concentration: Moderately concentrated, with an estimated [Insert Percentage Here]% market share held by the top 5 players in 2024, indicating a competitive yet consolidated environment.

- Innovation Drivers: Key innovations are being driven by the relentless pursuit of miniaturization, improved sensor accuracy and resolution, and the integration of AI-powered control systems for enhanced autonomy and adaptability.

- Regulatory Frameworks: Primarily supportive of space endeavors, these frameworks are continuously evolving to address critical concerns such as space debris mitigation, cybersecurity of satellite systems, and responsible space operations.

- Product Substitutes: While direct substitutes for core AOCS functionalities are limited, alternative navigation and control systems are emerging, necessitating continuous technological advancement and differentiation.

- End-User Trends: A significant and growing demand is observed from commercial entities, particularly within the burgeoning communication and Earth observation sectors, fueled by the proliferation of satellite constellations.

- M&A Activity: Approximately [Insert Number Here] deals were recorded between 2019-2024, underscoring a trend of industry consolidation and strategic acquisitions to bolster capabilities and market presence.

North America Satellite Attitude and Orbit Control System Market Industry Trends & Analysis

The North American Satellite AOCS market is experiencing robust growth, fueled by a surge in satellite launches across various orbit classes. The increasing adoption of small satellites for diverse applications like Earth observation, communication, and navigation is a significant market driver. Technological advancements, such as the development of more precise and energy-efficient sensors and control algorithms, are further propelling market expansion. The market penetration of advanced AOCS technologies is increasing, particularly in the LEO segment due to the growing number of constellations. The shift towards autonomous and AI-powered systems is another prominent trend. Competitive dynamics are intense, with companies focusing on technological differentiation, cost optimization, and strategic partnerships to gain a market edge. The market is projected to grow at a CAGR of xx% from 2025 to 2033, reaching xx Million by 2033.

Leading Markets & Segments in North America Satellite Attitude and Orbit Control System Market

The Low Earth Orbit (LEO) segment currently commands the largest market share within the North American Satellite AOCS market. This dominance is propelled by the exponential growth in small satellite constellations designed for diverse applications such as Earth observation, global communication, and the provision of widespread internet services. The commercial sector is the primary driver of end-user applications, though significant contributions also stem from the military and government sectors, emphasizing the dual-use nature of space technologies. Within application areas, the communication segment stands out as the leading contributor, driven by the increasing global demand for connectivity. Correspondingly, the 10-100kg satellite mass category represents the most prevalent segment, reflecting the affordability and deployment ease of smaller satellite platforms. Geographically, the United States continues to be the dominant market within North America, leveraging substantial government investments, a highly developed aerospace industry, and a robust ecosystem of research and development institutions.

- Key Drivers for LEO Dominance: The escalating demand for vast constellations of small satellites and the continuous reduction in satellite launch costs are pivotal in driving the LEO segment's growth.

- Key Drivers for Commercial Sector: The rapid expansion of private space companies and the increasing affordability of satellite technology have democratized access to space, fueling commercial innovation and deployment.

- Key Drivers for Communication Applications: The insatiable demand for high-speed internet services and the continuous efforts to improve global telecommunications infrastructure are key drivers for the communication application segment.

- Key Drivers for 10-100kg Satellite Mass: This segment's prevalence is attributed to its cost-effectiveness, ease of launch, and the ability to facilitate the deployment of large, interconnected satellite constellations, offering scalable solutions.

- US Market Dominance: The United States' market leadership is underpinned by strong government funding for space programs, an advanced technological infrastructure, and the strategic presence of major aerospace conglomerates and innovative startups.

North America Satellite Attitude and Orbit Control System Market Product Developments

Recent product developments in the North American AOCS market are characterized by a pronounced focus on miniaturization, enhanced accuracy, and superior energy efficiency. There is a concerted effort to engineer robust and highly reliable AOCS systems specifically tailored for the burgeoning small satellite sector. Simultaneously, the integration of cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning (ML) is significantly improving system autonomy, enabling more sophisticated control capabilities, and facilitating predictive maintenance. These advancements are strategically designed to meet the ever-increasing demands of complex satellite missions while rigorously maintaining cost-effectiveness. Furthermore, manufacturers are emphasizing the development of modular and adaptable AOCS solutions, allowing for greater flexibility and catering to a broader spectrum of satellite platforms and diverse application requirements.

Key Drivers of North America Satellite Attitude and Orbit Control System Market Growth

The growth of the North American Satellite AOCS market is fueled by several key factors. Technological advancements such as miniaturization and enhanced precision of sensors are pivotal. Furthermore, substantial governmental investments in space exploration and defense programs directly stimulate market expansion. Finally, the increasing commercial demand for satellite-based services across various sectors—including communication, Earth observation, and navigation—acts as a powerful catalyst for market growth.

Challenges in the North America Satellite Attitude and Orbit Control System Market Market

The North American Satellite AOCS market faces challenges such as the high cost of development and integration, potential supply chain disruptions impacting component availability, and intense competition amongst established and emerging players. Furthermore, the stringent regulatory environment surrounding space activities can present significant hurdles. These challenges influence the overall market trajectory and profitability. The market also faces challenges from the increasing complexity of satellite missions, requiring more sophisticated and reliable AOCS systems.

Emerging Opportunities in North America Satellite Attitude and Orbit Control System Market

Significant long-term growth opportunities exist within the North American Satellite AOCS market. The ongoing miniaturization trend, alongside the development of more autonomous and AI-powered systems, promises considerable market expansion. Strategic partnerships and collaborations between established players and innovative startups will unlock new avenues for growth. Furthermore, the expansion of satellite-based services into new sectors, coupled with government initiatives to foster space exploration, promises a lucrative future for the market.

Leading Players in the North America Satellite Attitude and Orbit Control System Market Sector

- NewSpace Systems

- SENER Group

- OHB SE

- Innovative Solutions in Space BV

- Sitael S p A

- Thale

- Jena-Optronik

- AAC Clyde Space

Key Milestones in North America Satellite Attitude and Orbit Control System Market Industry

- November 2022: Jena-Optronik GmbH's high-precision star sensors were successfully integrated into NASA's Artemis I mission, a testament to the reliability and accuracy of their advanced AOCS components in critical space endeavors.

- December 2022: Jena-Optronik's ASTRO CL star trackers were selected for deployment on Maxar's innovative new proliferated LEO satellite platform, signaling a growing market acceptance and demand for miniaturized and high-performance AOCS solutions.

- February 2023: Jena-Optronik secured a significant contract with Airbus OneWeb Satellites to supply ASTRO CL sensors for the ARROW family of small satellites. This agreement highlights Jena-Optronik's strong position and strategic importance within the rapidly expanding smallsat market.

Strategic Outlook for North America Satellite Attitude and Orbit Control System Market Market

The North American Satellite AOCS market is poised for robust and sustained growth, fueled by the continuous and rapid expansion of the global space industry. Strategic partnerships, groundbreaking technological advancements, and the ever-increasing demand for sophisticated satellite-based services are identified as key accelerators for this growth trajectory. Companies that prioritize innovation, maintain a keen focus on cost efficiency, and actively pursue strategic alliances will be exceptionally well-positioned to capitalize on the emerging opportunities. The market is expected to witness ongoing expansion, with particularly significant opportunities anticipated within the rapidly evolving LEO segment and an increasing adoption rate of advanced AOCS technologies across a wider array of satellite applications.

North America Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

North America Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of North America Satellite Attitude and Orbit Control System Market

North America Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OHB SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Innovative Solutions in Space BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sitael S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thale

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jena-Optronik

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AAC Clyde Space

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: North America Satellite Attitude and Orbit Control System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the North America Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, OHB SE, Innovative Solutions in Space BV, Sitael S p A, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the North America Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the North America Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence