Key Insights

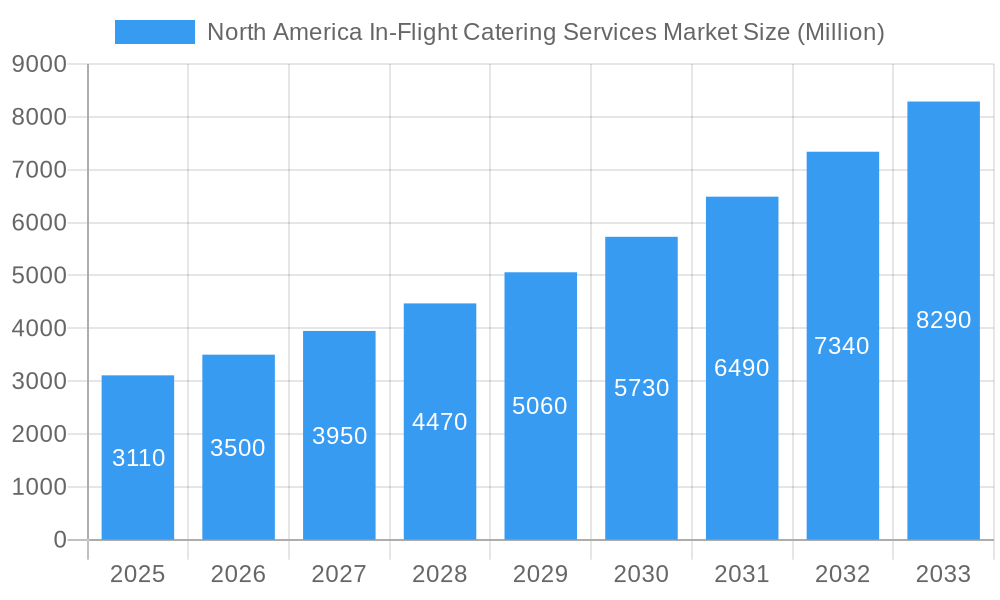

The North America in-flight catering services market, valued at $3.11 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 12.86% from 2025 to 2033. This expansion is fueled by several key factors. The resurgence of air travel post-pandemic, coupled with increasing passenger numbers and a growing preference for premium in-flight dining experiences, are significantly boosting market demand. Airlines are increasingly focusing on enhancing the passenger experience through diverse and high-quality meal options, leading to increased outsourcing of catering services. Furthermore, the rise of sustainable and ethically sourced ingredients is shaping the market, with catering companies investing in eco-friendly practices and catering to health-conscious consumers. Technological advancements, such as improved food preservation and delivery systems, are also contributing to market growth. Competitive pressures are leading to innovation in menu design and service delivery, creating a dynamic market landscape.

North America In-Flight Catering Services Market Market Size (In Billion)

However, challenges remain. Fluctuations in fuel prices and economic downturns can impact air travel demand, indirectly affecting the in-flight catering sector. Maintaining consistent food safety and quality standards across diverse airline routes and logistical complexities in managing supply chains pose operational challenges. Furthermore, evolving consumer preferences and dietary restrictions require constant menu adjustments and adaptation from catering providers. Despite these challenges, the long-term outlook for the North America in-flight catering services market remains positive, driven by the aforementioned growth drivers and a continuously expanding air travel industry. The leading players, including Flying Food Group LLC, GateGroup, and Lufthansa Service Holding AG, are strategically positioning themselves to capitalize on these opportunities through innovation, expansion, and strategic partnerships.

North America In-Flight Catering Services Market Company Market Share

North America In-Flight Catering Services Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the North America In-Flight Catering Services market, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, industry trends, leading players, and future growth opportunities, equipping stakeholders with the knowledge needed to navigate this dynamic sector. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. The market size is presented in Millions of dollars (USD).

North America In-Flight Catering Services Market Dynamics & Concentration

The North American in-flight catering market is characterized by a moderately concentrated landscape, with several major players holding significant market share. The market's competitive intensity is driven by factors including innovation in food and beverage offerings, stringent regulatory compliance, the availability of substitute products (e.g., pre-packaged meals), evolving end-user preferences (e.g., healthier options, dietary restrictions), and ongoing mergers and acquisitions (M&A) activity.

Market Concentration: The top five players hold an estimated xx% market share in 2025, indicating moderate concentration. However, the market also accommodates several smaller, regional players catering to specific airline needs or geographic locations.

Innovation Drivers: The industry is witnessing significant innovation in areas such as sustainable packaging, customized meal options, and advanced food preservation techniques. These innovations directly impact customer satisfaction and operational efficiency.

Regulatory Framework: Stringent food safety regulations, including those enforced by the FDA and TSA, significantly influence operational costs and compliance procedures for catering companies.

Product Substitutes: While the primary offering is in-flight meals, the rise of pre-packaged meals and individual snack options presents a moderate level of substitution, influencing market dynamics.

End-User Trends: Growing demand for healthier, more sustainable, and customizable meal choices is driving innovation and influencing the strategic direction of catering providers.

M&A Activity: The past five years have seen xx M&A deals in the North American in-flight catering market, signifying consolidation and a drive towards economies of scale. These activities often lead to greater market share and operational efficiency.

North America In-Flight Catering Services Market Industry Trends & Analysis

The North American in-flight catering market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by a resurgence in air travel post-pandemic, coupled with increasing passenger demand for high-quality, diverse in-flight meal options. Technological disruptions, including improved logistics and supply chain management, and a rising focus on personalized experiences, also contribute significantly to market expansion.

The market penetration rate for premium in-flight catering services is estimated at xx% in 2025, showcasing the high demand for superior meal offerings. Competitive dynamics involve continuous innovation in menu development, service delivery, and sustainable practices. Airlines are increasingly partnering with catering providers to offer unique dining experiences aligned with their brand image, leading to further market segmentation and competition. Consumer preferences are shifting towards healthier options, locally sourced ingredients, and customized meals catering to dietary needs and preferences, demanding greater flexibility and responsiveness from catering companies.

Leading Markets & Segments in North America In-Flight Catering Services Market

The United States dominates the North American in-flight catering market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily driven by the high volume of domestic and international air travel within the US. Canada, while representing a smaller segment, shows promising growth potential due to increasing tourism and business travel.

Key Drivers for US Market Dominance:

- Large Domestic Air Travel Market: The extensive domestic air network within the US provides a large customer base for in-flight catering services.

- High Spending Power: High disposable income levels in the US allow for greater investment in premium in-flight catering options.

- Robust Airline Industry: A well-developed airline industry supports the growth of the in-flight catering market.

Canada Market:

While smaller than the US market, Canada's in-flight catering sector is steadily growing due to increasing tourism, particularly in major cities such as Toronto and Vancouver. Government initiatives promoting sustainable tourism could significantly impact future market growth.

North America In-Flight Catering Services Market Product Developments

The North American in-flight catering landscape is experiencing a dynamic evolution driven by a strong emphasis on consumer well-being and planetary health. Recent product innovations showcase a significant pivot towards offering healthier and more nutritious meal options. This includes a growing incorporation of locally sourced ingredients, not only to support regional economies but also to ensure fresher, higher-quality produce. Furthermore, catering companies are demonstrating enhanced agility in addressing the diverse needs of travelers by meticulously catering to a wide spectrum of dietary restrictions and preferences, including an increasing demand for plant-based, allergen-free, and specialized dietary meals. Technological advancements are playing a crucial role, particularly in the realm of food preservation and advanced packaging solutions. These innovations are instrumental in ensuring heightened food safety standards and maintaining the optimal quality of meals from preparation to consumption. Concurrently, a prominent trend is the widespread adoption of sustainable packaging options, a direct response to escalating environmental concerns and a growing consumer consciousness. These progressive innovations are pivotal in bolstering the competitive advantage of catering companies. By appealing to a discerning customer base that actively seeks healthy, sustainable, and premium meal experiences, these companies are not only meeting evolving customer preferences but are also aligning with the ambitious sustainability goals set forth by airlines.

Key Drivers of North America In-Flight Catering Services Market Growth

The North American in-flight catering market is primarily driven by:

- Resurgence in Air Travel: Post-pandemic recovery in air travel volume directly boosts demand for in-flight catering services.

- Technological Advancements: Innovations in food preservation and packaging improve food quality and safety.

- Evolving Consumer Preferences: Growing demand for healthier, customized, and sustainable meal options influences catering offerings.

- Strategic Partnerships: Collaborations between airlines and catering companies lead to innovative services.

Challenges in the North America In-Flight Catering Services Market

The North America In-Flight Catering Services Market is navigating a complex terrain marked by several significant challenges:

- Stringent Regulatory Environment: Adherence to rigorous food safety, hygiene, and security regulations imposed by various governmental bodies is a constant requirement. This necessitates substantial investment in compliance protocols, specialized training, and advanced infrastructure, thereby increasing operational costs and complexity.

- Supply Chain Volatility and Disruptions: The market is susceptible to disruptions in global and regional supply chains. Factors such as geopolitical events, climate change impacts on agriculture, and logistical bottlenecks can affect the consistent availability and timely delivery of essential ingredients, specialty products, and packaging materials, leading to potential cost escalations and service interruptions.

- Intense Market Competition: The in-flight catering sector is characterized by a highly competitive landscape. Numerous established players and emerging entities vie for contracts, compelling companies to continually invest in innovation, optimize operational efficiencies, and maintain competitive pricing strategies to secure and retain airline partnerships.

- Fluctuations in Economic Factors: Volatile fuel prices, a significant operating expense for airlines, can directly impact their profitability and operational decisions. Higher fuel costs can lead to route adjustments, capacity reductions, or a drive to cut ancillary costs, which in turn can influence the demand and pricing structures for in-flight catering services.

Emerging Opportunities in North America In-Flight Catering Services Market

The trajectory of long-term growth within the North America In-Flight Catering Services Market is poised to be significantly shaped by several burgeoning opportunities:

- Deepening Commitment to Sustainable Practices: The accelerating demand for eco-conscious solutions presents a major growth avenue. This includes the widespread adoption of biodegradable and recyclable packaging, a greater emphasis on ethically sourced ingredients, and a preference for suppliers who champion sustainable agricultural and production methods.

- Leveraging Technological Breakthroughs: The integration of advanced technologies offers transformative potential. Artificial intelligence (AI) can be employed for demand forecasting, waste reduction, and optimizing logistics. Automation in production and packaging processes can enhance efficiency and consistency. Furthermore, data analytics can enable highly personalized meal offerings based on passenger preferences and historical data, leading to a superior customer experience.

- Strategic Expansion into Niche and Specialized Markets: A significant opportunity lies in catering to specific and often underserved dietary needs. This involves developing and refining offerings for a growing segment of travelers seeking vegan, gluten-free, kosher, halal, and other specialized dietary meals. The ability to provide highly customized and appealing menus for these segments can open up new revenue streams and enhance brand loyalty.

- Forging Robust Strategic Partnerships with Airlines: Collaborative efforts between in-flight catering providers and airlines are becoming increasingly crucial. These partnerships can extend beyond traditional service agreements to co-developing innovative and tailored meal programs, integrating catering services more seamlessly into the overall passenger journey, and jointly exploring new service models that enhance customer satisfaction and operational synergy.

Leading Players in the North America In-Flight Catering Services Market Sector

- Flying Food Group LLC

- gategroup

- Lufthansa Service Holding AG

- Journey Group PLC

- Fleury Michon America

- Cathay Pacific Catering Services (CLS Catering)

- JetFinity

- Newrest International Group SaS

- DNATA

- SATS Lt

Key Milestones in North America In-Flight Catering Services Market Industry

April 2022: Flying Food Group significantly enhanced its market presence and capabilities by securing a contract to provide catering for double daily Lufthansa flights between New York JFK and Frankfurt/Munich. This strategic expansion also saw them extend their services to include Lufthansa routes originating from Chicago, Los Angeles, Washington, and Newark. This development not only solidified their position as a key player in transatlantic catering but also broadened their service portfolio and reinforced their partnership with a major European carrier.

July 2021: Newrest made a substantial entry into the highly competitive American market by commencing in-flight catering operations with two major US carriers: Delta Airlines and United Airlines. This significant expansion into the North American region marks a pivotal moment for Newrest, signaling increased competition within the market and representing a significant gain in market share and operational footprint for the company.

Strategic Outlook for North America In-Flight Catering Services Market

The North American in-flight catering market presents significant growth potential driven by factors such as a rebound in air travel, increasing consumer demand for diverse and high-quality meals, and ongoing technological advancements. Strategic opportunities lie in adopting sustainable practices, leveraging technological innovations such as AI-powered meal customization, and forging strong partnerships with airlines to create unique and competitive offerings. The market will continue to evolve, demanding agility, innovation, and a customer-centric approach from catering providers.

North America In-Flight Catering Services Market Segmentation

-

1. Aircraft Seating Class

- 1.1. Economy Class

- 1.2. Business Class

- 1.3. First Class

-

2. Flight Service Type

- 2.1. Full-service Carrier

- 2.2. Low-cost Carrier

- 2.3. Hybrid and Other Flight Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America In-Flight Catering Services Market Segmentation By Geography

- 1. United States

- 2. Canada

North America In-Flight Catering Services Market Regional Market Share

Geographic Coverage of North America In-Flight Catering Services Market

North America In-Flight Catering Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Hybrid and Other Flight Type Segment Is Expected To Witness Significant Growth During The Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America In-Flight Catering Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.1.1. Economy Class

- 5.1.2. Business Class

- 5.1.3. First Class

- 5.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 5.2.1. Full-service Carrier

- 5.2.2. Low-cost Carrier

- 5.2.3. Hybrid and Other Flight Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6. United States North America In-Flight Catering Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.1.1. Economy Class

- 6.1.2. Business Class

- 6.1.3. First Class

- 6.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 6.2.1. Full-service Carrier

- 6.2.2. Low-cost Carrier

- 6.2.3. Hybrid and Other Flight Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7. Canada North America In-Flight Catering Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.1.1. Economy Class

- 7.1.2. Business Class

- 7.1.3. First Class

- 7.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 7.2.1. Full-service Carrier

- 7.2.2. Low-cost Carrier

- 7.2.3. Hybrid and Other Flight Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Flying Food Group LLC

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 gategroup

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Lufthansa Service Holding AG

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Journey Group PLC

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Fleury Michon America

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Cathay Pacific Catering Services (CLS Catering)

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 JetFinity

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Newrest International Group SaS

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 DNATA

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 SATS Lt

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Flying Food Group LLC

List of Figures

- Figure 1: Global North America In-Flight Catering Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North America In-Flight Catering Services Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States North America In-Flight Catering Services Market Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 4: United States North America In-Flight Catering Services Market Volume (Billion), by Aircraft Seating Class 2025 & 2033

- Figure 5: United States North America In-Flight Catering Services Market Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 6: United States North America In-Flight Catering Services Market Volume Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 7: United States North America In-Flight Catering Services Market Revenue (Million), by Flight Service Type 2025 & 2033

- Figure 8: United States North America In-Flight Catering Services Market Volume (Billion), by Flight Service Type 2025 & 2033

- Figure 9: United States North America In-Flight Catering Services Market Revenue Share (%), by Flight Service Type 2025 & 2033

- Figure 10: United States North America In-Flight Catering Services Market Volume Share (%), by Flight Service Type 2025 & 2033

- Figure 11: United States North America In-Flight Catering Services Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: United States North America In-Flight Catering Services Market Volume (Billion), by Geography 2025 & 2033

- Figure 13: United States North America In-Flight Catering Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: United States North America In-Flight Catering Services Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: United States North America In-Flight Catering Services Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United States North America In-Flight Catering Services Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United States North America In-Flight Catering Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United States North America In-Flight Catering Services Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Canada North America In-Flight Catering Services Market Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 20: Canada North America In-Flight Catering Services Market Volume (Billion), by Aircraft Seating Class 2025 & 2033

- Figure 21: Canada North America In-Flight Catering Services Market Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 22: Canada North America In-Flight Catering Services Market Volume Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 23: Canada North America In-Flight Catering Services Market Revenue (Million), by Flight Service Type 2025 & 2033

- Figure 24: Canada North America In-Flight Catering Services Market Volume (Billion), by Flight Service Type 2025 & 2033

- Figure 25: Canada North America In-Flight Catering Services Market Revenue Share (%), by Flight Service Type 2025 & 2033

- Figure 26: Canada North America In-Flight Catering Services Market Volume Share (%), by Flight Service Type 2025 & 2033

- Figure 27: Canada North America In-Flight Catering Services Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: Canada North America In-Flight Catering Services Market Volume (Billion), by Geography 2025 & 2033

- Figure 29: Canada North America In-Flight Catering Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Canada North America In-Flight Catering Services Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Canada North America In-Flight Catering Services Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Canada North America In-Flight Catering Services Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Canada North America In-Flight Catering Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Canada North America In-Flight Catering Services Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 2: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Aircraft Seating Class 2020 & 2033

- Table 3: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 4: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Flight Service Type 2020 & 2033

- Table 5: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 10: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Aircraft Seating Class 2020 & 2033

- Table 11: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 12: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Flight Service Type 2020 & 2033

- Table 13: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 18: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Aircraft Seating Class 2020 & 2033

- Table 19: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 20: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Flight Service Type 2020 & 2033

- Table 21: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America In-Flight Catering Services Market?

The projected CAGR is approximately 12.86%.

2. Which companies are prominent players in the North America In-Flight Catering Services Market?

Key companies in the market include Flying Food Group LLC, gategroup, Lufthansa Service Holding AG, Journey Group PLC, Fleury Michon America, Cathay Pacific Catering Services (CLS Catering), JetFinity, Newrest International Group SaS, DNATA, SATS Lt.

3. What are the main segments of the North America In-Flight Catering Services Market?

The market segments include Aircraft Seating Class, Flight Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Hybrid and Other Flight Type Segment Is Expected To Witness Significant Growth During The Forecast Period..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, Flying Food Group announced that they are catering double daily Lufthansa flights between New York JFK and Frankfurt and Munich. Moreover, the Flying Food Group also caters to Lufthansa airlines in Chicago, Los Angeles, Washington, and Newark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America In-Flight Catering Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America In-Flight Catering Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America In-Flight Catering Services Market?

To stay informed about further developments, trends, and reports in the North America In-Flight Catering Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence