Key Insights

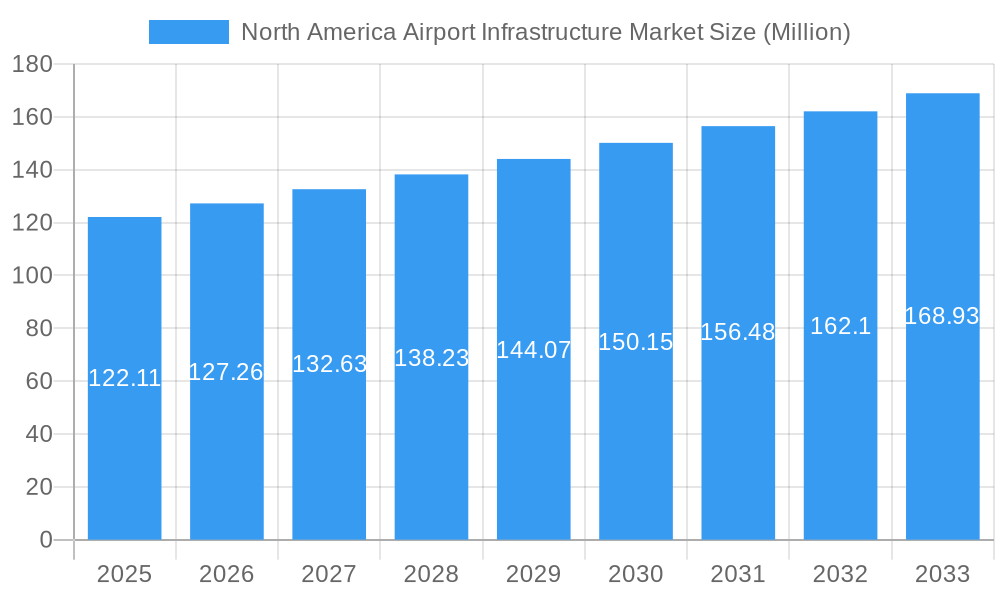

The North American airport infrastructure market, valued at $122.11 million in 2025, is projected to experience robust growth, driven by increasing passenger traffic, the need for modernization at existing airports (brownfield projects), and the development of new airports (greenfield projects) to accommodate expanding air travel demands. The compound annual growth rate (CAGR) of 4.18% from 2025 to 2033 indicates a steady expansion. Key drivers include government initiatives promoting infrastructure development, rising investments in airport modernization and expansion, and the increasing adoption of advanced technologies to enhance airport efficiency and safety. Growth is segmented across various infrastructure types, with terminals, runways, and taxiways representing significant portions of the market. Brownfield airport projects, which focus on upgrading existing facilities, are expected to contribute substantially to market growth, given the higher concentration of existing airports compared to greenfield developments. Leading construction companies, such as PCL Constructors Inc., McCarthy Building Companies Inc., and AECOM, are actively involved in these projects, leveraging their expertise to meet the growing demand for efficient and sustainable airport infrastructure. While specific challenges may arise from economic fluctuations or regulatory hurdles, the overall market outlook remains positive, indicating continued investment and expansion over the forecast period.

North America Airport Infrastructure Market Market Size (In Million)

The market's geographic focus is heavily weighted towards North America, specifically the United States, Canada, and Mexico. The U.S., as the largest economy in the region, dominates market share. Growth in Mexico and Canada is expected, albeit at a potentially slower pace than the U.S., driven by factors such as planned airport expansions and tourism growth. Competition among construction firms is expected to remain high, prompting companies to focus on project management efficiency, cost optimization, and innovative solutions to secure contracts. This competitive landscape fosters innovation and helps maintain cost-effectiveness in project delivery, further supporting the positive market trajectory. The market segmentation by airport type (brownfield vs. greenfield) provides valuable insights into the distribution of projects and investment.

North America Airport Infrastructure Market Company Market Share

North America Airport Infrastructure Market Report: 2019-2033

Dive deep into the dynamic North America airport infrastructure market with this comprehensive report, providing actionable insights for strategic decision-making. This in-depth analysis covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast spanning 2025-2033. The report unveils market size, growth drivers, challenges, and opportunities, featuring key players such as PCL Constructors Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hensel Phelps, Turner Construction Company, J E Dunn Construction Company, and AECOM. This analysis segments the market by infrastructure type (terminals, taxiways and runways, aprons, control towers, hangars, others) and airport type (brownfield and greenfield airports). Expect detailed financial projections reaching into the billions.

North America Airport Infrastructure Market Market Dynamics & Concentration

The North American airport infrastructure market is characterized by moderate concentration, with a few major players holding significant market share. The market size in 2025 is estimated at $XX Billion, projected to reach $YY Billion by 2033, exhibiting a CAGR of XX%. Innovation drivers include advancements in construction materials, sustainable technologies, and digitalization of airport operations. Stringent regulatory frameworks, particularly concerning safety and environmental standards, influence market dynamics. Product substitutes are limited, primarily focusing on alternative construction methodologies. End-user trends show a preference for efficient, sustainable, and passenger-centric infrastructure. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately XX deals recorded between 2019 and 2024. Major players are strategically acquiring smaller companies to expand their service portfolio and geographic reach.

- Market Share: Top 5 players hold approximately XX% of the market share in 2025.

- M&A Activity: An average of XX M&A deals per year were observed during 2019-2024.

- Innovation Drivers: Sustainable building materials, advanced air traffic control systems, and AI-powered passenger management solutions.

- Regulatory Influence: Stringent environmental regulations and safety protocols significantly impact project timelines and costs.

North America Airport Infrastructure Market Industry Trends & Analysis

The North American airport infrastructure market is experiencing a dynamic surge, propelled by the sustained rebound and anticipated growth in air passenger traffic. This expansion is further amplified by substantial investments in both the enlargement of existing airports and the ambitious development of new greenfield facilities. The landscape is being rapidly reshaped by technological disruptions, notably the pervasive integration of 5G networks and the strategic deployment of advanced analytics, all aimed at revolutionizing airport operations. Consumer expectations are evolving, with a clear shift towards an elevated passenger experience, demanding enhanced comfort, seamless convenience, and robust connectivity. The competitive arena is becoming increasingly vigorous, compelling companies to prioritize groundbreaking innovation, rigorous cost optimization, and the formation of strategic alliances. A discernible trend is the growing market penetration of sustainable building materials, reflecting a profound and increasing commitment to environmental stewardship. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at a robust **XX%**, underscoring significant growth potential. This market expansion is further bolstered by substantial government investments in airport infrastructure upgrades and a notable increase in private sector participation and innovation.

Leading Markets & Segments in North America Airport Infrastructure Market

The dominant segments within the North American airport infrastructure market are undeniably terminals and taxiways/runways, critical arteries for air travel. The prevailing development strategy leans towards brownfield airport enhancements, leveraging existing infrastructure and readily available land for expansion and modernization. The United States continues to lead this expansive market, driven by a potent combination of strong economic activity, exceptionally high passenger volumes, and substantial government funding dedicated to infrastructure development. Canada and Mexico are also key contributors, albeit with scales of development that follow those of the US.

- Key Drivers for Terminal Development: Escalating passenger traffic, an imperative to elevate the passenger experience, and the critical need for modernizing aging facilities.

- Key Drivers for Taxiway/Runway Development: The necessity to expand airport capacity, the implementation of advanced air traffic management systems for improved flow, and crucial safety upgrades to meet international standards.

- Key Drivers for Brownfield Development: The inherent cost-effectiveness of utilizing existing sites, the pragmatic availability of land parcels, and the strategic advantage of leveraging established infrastructure networks.

- Dominance Analysis: The US market commands its leading position due to its unparalleled passenger volumes, considerable and sustained government investment, and the sheer number of active airports requiring continuous development and upgrades.

North America Airport Infrastructure Market Product Developments

Recent product innovations are significantly enhancing the durability and efficiency of airport infrastructure. The adoption of advanced materials such as high-strength concrete and cutting-edge sustainable composites is improving structural integrity and extending the lifespan of critical assets. Applications are rapidly expanding into the realm of smart airport technologies, encompassing automated baggage handling systems that streamline operations, intelligent security checkpoints that enhance both efficiency and security, and AI-driven predictive maintenance solutions for infrastructure assets, ensuring proactive problem-solving. Competitive advantages are being forged through a commitment to technological leadership, highly efficient project management methodologies, and specialized expertise in sustainable construction practices. The overarching market trend clearly favors solutions that demonstrably boost operational efficiency, significantly improve the passenger journey, and minimize environmental impact.

Key Drivers of North America Airport Infrastructure Market Growth

The North American airport infrastructure market's robust expansion is underpinned by a confluence of potent drivers. Foremost is the relentless and escalating growth in air passenger traffic, which directly necessitates the continuous expansion, modernization, and, in some cases, the creation of entirely new airport facilities to accommodate demand. Secondly, substantial and ongoing government investments in airport infrastructure development, encompassing both major upgrades and strategic modernization projects, play a pivotal role in shaping the market. Finally, rapid technological advancements in airport infrastructure design, construction, and operational systems are not only enhancing efficiency and safety but also profoundly improving the passenger experience, thereby acting as significant catalysts for further market growth and innovation.

Challenges in the North America Airport Infrastructure Market Market

The market faces challenges, including obtaining necessary regulatory approvals and permits which can cause significant delays. Supply chain disruptions can impact project timelines and budgets. Intense competition among major contractors leads to pressure on pricing and profit margins. These factors significantly influence the overall market dynamics, and their impact needs to be carefully considered in strategic planning.

Emerging Opportunities in North America Airport Infrastructure Market

The integration of advanced technologies, such as AI and IoT, presents substantial opportunities for enhanced operational efficiency and improved passenger experience. Strategic partnerships between airport operators and technology providers can accelerate the adoption of innovative solutions. Expanding into emerging markets within North America, such as smaller regional airports, offers further growth potential. A focus on sustainable and resilient infrastructure designs will also attract more investment.

Leading Players in the North America Airport Infrastructure Market Sector

Key Milestones in North America Airport Infrastructure Market Industry

- 2020: A pronounced and intensified focus on the development of sustainable and environmentally conscious airport infrastructure across the region.

- 2021: The commencement of several ambitious and large-scale airport expansion and renovation projects, signaling a strong recovery and investment outlook.

- 2022: Significant capital investment was channeled into the implementation and upgrade of advanced air traffic management systems to enhance efficiency and safety.

- 2023: Widespread adoption and implementation of 5G technology at numerous key airports, enabling enhanced connectivity and new operational capabilities.

- 2024: Witnessed a series of strategic mergers and acquisitions among key market players, indicating a consolidation and strengthening of competitive positions.

Strategic Outlook for North America Airport Infrastructure Market Market

The North America airport infrastructure market is poised for continued growth, driven by sustained air passenger traffic growth and increasing investments in modernizing existing infrastructure. Strategic opportunities exist for companies to focus on innovative solutions, sustainable practices, and efficient project management. Further growth will be driven by the increasing adoption of smart technologies and integration of sustainable solutions within the airport ecosystem, thereby leading to further expansion of this critical market segment.

North America Airport Infrastructure Market Segmentation

-

1. Infrastructure Type

- 1.1. Terminals

- 1.2. Taxiway and Runways

- 1.3. Aprons

- 1.4. Control Towers

- 1.5. Hangars

- 1.6. Others

-

2. Airport Type

- 2.1. Brownfield Airports

- 2.2. Greenfield Airports

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Airport Infrastructure Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Airport Infrastructure Market Regional Market Share

Geographic Coverage of North America Airport Infrastructure Market

North America Airport Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.1.1. Terminals

- 5.1.2. Taxiway and Runways

- 5.1.3. Aprons

- 5.1.4. Control Towers

- 5.1.5. Hangars

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Brownfield Airports

- 5.2.2. Greenfield Airports

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6. United States North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.1.1. Terminals

- 6.1.2. Taxiway and Runways

- 6.1.3. Aprons

- 6.1.4. Control Towers

- 6.1.5. Hangars

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Airport Type

- 6.2.1. Brownfield Airports

- 6.2.2. Greenfield Airports

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7. Canada North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.1.1. Terminals

- 7.1.2. Taxiway and Runways

- 7.1.3. Aprons

- 7.1.4. Control Towers

- 7.1.5. Hangars

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Airport Type

- 7.2.1. Brownfield Airports

- 7.2.2. Greenfield Airports

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8. Mexico North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.1.1. Terminals

- 8.1.2. Taxiway and Runways

- 8.1.3. Aprons

- 8.1.4. Control Towers

- 8.1.5. Hangars

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Airport Type

- 8.2.1. Brownfield Airports

- 8.2.2. Greenfield Airports

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PCL Constructors Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 McCarthy Building Companies Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 The Walsh Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Austin Industries

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hensel Phelps

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Turner Construction Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 J E Dunn Construction Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AECOM

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 PCL Constructors Inc

List of Figures

- Figure 1: North America Airport Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Airport Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 2: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Airport Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 10: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 11: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 14: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Airport Infrastructure Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the North America Airport Infrastructure Market?

Key companies in the market include PCL Constructors Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hensel Phelps, Turner Construction Company, J E Dunn Construction Company, AECOM.

3. What are the main segments of the North America Airport Infrastructure Market?

The market segments include Infrastructure Type, Airport Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Airport Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Airport Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Airport Infrastructure Market?

To stay informed about further developments, trends, and reports in the North America Airport Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence