Key Insights

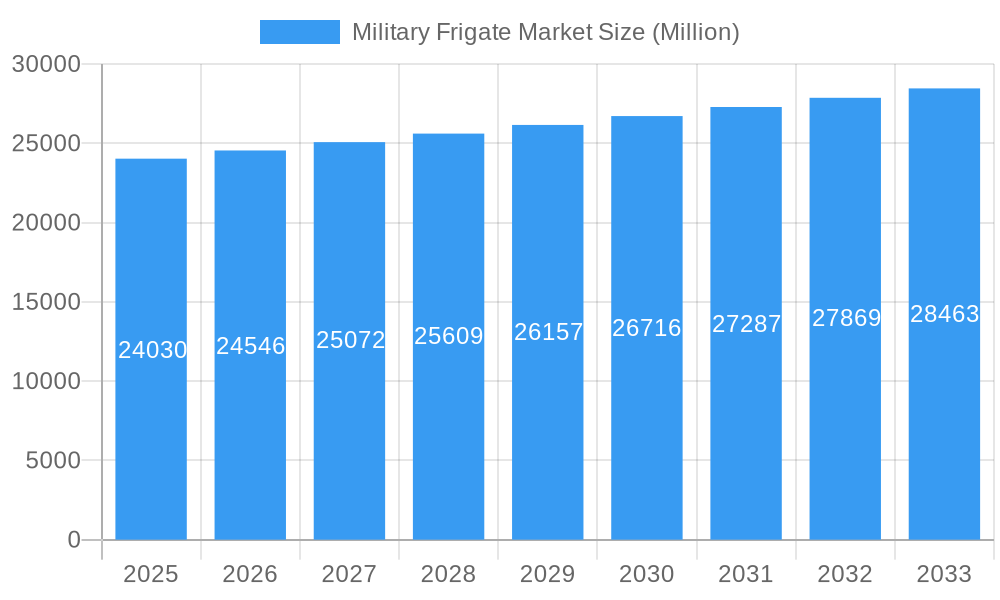

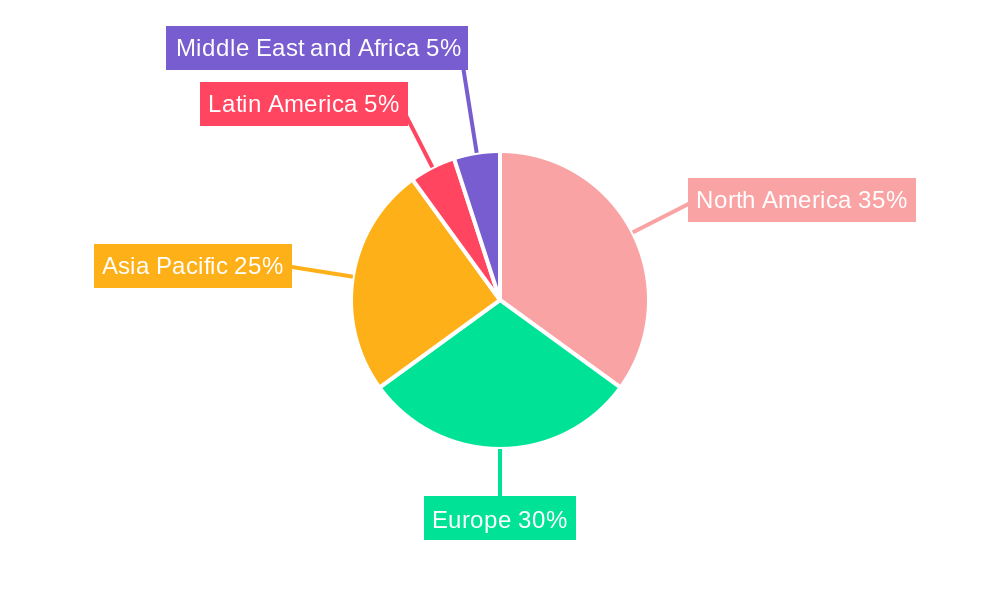

The global military frigate market, valued at $24.03 billion in 2025, is projected to experience steady growth, driven by increasing geopolitical instability and the need for advanced naval capabilities among nations worldwide. A Compound Annual Growth Rate (CAGR) of 2.17% from 2025 to 2033 suggests a continued, albeit moderate, expansion. Key drivers include the modernization of existing fleets, the development of next-generation frigates incorporating cutting-edge technologies like advanced sensors, improved weaponry, and enhanced cybersecurity measures. Furthermore, the rising demand for multi-role frigates capable of performing diverse missions such as anti-submarine warfare, anti-air warfare, and littoral combat operations contributes significantly to market growth. Technological advancements in areas such as unmanned systems integration and artificial intelligence are further shaping the market landscape, prompting naval forces to invest in sophisticated platforms. Regional variations exist, with North America and Europe expected to maintain substantial market share due to strong defense budgets and established naval programs. However, the Asia-Pacific region is anticipated to witness significant growth, driven by increasing defense spending and rising naval modernization efforts in countries like China, India, and South Korea. Competitive pressures from established players like General Dynamics, Lockheed Martin, and BAE Systems, alongside emerging regional shipbuilders, create a dynamic and evolving market environment. The segment breakdown shows patrol and escort missions as dominant applications, reflecting the core functionality of frigates in naval operations.

Military Frigate Market Market Size (In Billion)

While the market exhibits consistent growth, certain restraints exist. Budgetary constraints in some nations, particularly amidst competing defense priorities, may temper growth. Furthermore, the lengthy procurement cycles associated with military vessel construction can influence market dynamics. The evolving technological landscape also presents challenges, as nations strive to balance technological advancements with affordability and maintainability. Despite these constraints, the ongoing need for effective naval power projection and maritime security is expected to sustain market demand for military frigates over the forecast period, creating opportunities for innovative technology integration and strategic partnerships within the industry.

Military Frigate Market Company Market Share

Military Frigate Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Military Frigate Market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. The report covers market dynamics, trends, leading players, and future projections, providing a clear understanding of this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for navigating the complexities of the military frigate landscape. The total market value is projected to reach xx Million by 2033.

Military Frigate Market Dynamics & Concentration

The Military Frigate Market is characterized by a moderately concentrated landscape with a few major players holding significant market share. General Dynamics Corporation, Lockheed Martin Corporation, and BAE Systems plc are among the key players, but regional players like Damen Shipyards Group and United Shipbuilding Corporation also hold considerable regional influence. Innovation, particularly in areas such as hybrid propulsion systems and advanced sensor technologies, are key drivers of market growth. Stringent regulatory frameworks, including export controls and environmental regulations, significantly impact market dynamics. While there are few direct product substitutes for frigates, cost pressures and budget constraints remain substantial challenges. End-user trends point towards a demand for multi-role frigates capable of performing various tasks including anti-submarine warfare, anti-air warfare, and humanitarian aid. M&A activity in the sector has been moderate in recent years, with xx major deals recorded between 2019 and 2024. This suggests consolidation may increase as smaller companies seek to leverage technological advantages through strategic partnerships or acquisitions.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2024.

- Innovation Drivers: Advanced sensor technology, AI-powered systems, hybrid propulsion systems.

- Regulatory Frameworks: Stringent export controls, environmental regulations regarding emissions and waste disposal.

- Product Substitutes: Limited direct substitutes; however, budgetary constraints lead to exploration of alternative solutions.

- M&A Activity: xx major mergers and acquisitions between 2019 and 2024.

Military Frigate Market Industry Trends & Analysis

The Military Frigate Market exhibits a robust growth trajectory, driven by increasing geopolitical tensions, modernization of naval fleets, and the need for advanced anti-submarine warfare capabilities. Technological advancements, including the incorporation of hybrid propulsion systems and improved sensor technologies, are fundamentally reshaping the market. Consumer preferences, reflected in the demand for versatile, multi-role frigates, are significantly influencing design and technological development. Competitive dynamics are shaped by the ongoing efforts of major players to enhance their technological capabilities and secure lucrative government contracts. The market is experiencing a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration steadily increasing in key regions. Technological advancements, specifically in autonomous systems and AI integration, are driving a significant portion of this growth. Further, the market is witnessing increased collaboration between governments and private entities leading to a rise in public-private partnerships in the development and manufacturing of frigates.

Leading Markets & Segments in Military Frigate Market

The Asia-Pacific region has emerged as a leading market for military frigates, owing to significant investments in naval modernization by countries in the region. Increased defense spending by countries in the Asia-Pacific such as China and India are driving market growth in the region. Within applications, the escort segment dominates the market, accounting for the largest share, driven by the necessity to protect high-value assets, including aircraft carriers and amphibious assault ships.

- Key Drivers in Asia-Pacific:

- Increased defense budgets.

- Growing geopolitical tensions.

- Modernization of naval fleets.

- Escort Segment Dominance:

- High demand for protecting high-value naval assets.

- Increased focus on anti-submarine warfare capabilities.

- Requirement for maintaining maritime security and safeguarding trade routes.

Military Frigate Market Product Developments

Recent product innovations focus heavily on enhancing stealth capabilities, improving anti-submarine warfare (ASW) capabilities, and integrating advanced sensor technologies. The development of hybrid diesel-electric propulsion systems is a notable trend, combining environmental considerations with improved operational efficiency. These innovations directly contribute to enhancing the competitiveness of military frigates in the global market, providing greater operational versatility and combat effectiveness. Manufacturers are prioritizing features that enhance survivability, operational range, and versatility, adapting to emerging threats and diverse operational needs.

Key Drivers of Military Frigate Market Growth

Technological advancements, particularly in areas such as hybrid propulsion, advanced sensor technologies, and autonomous systems are significant growth drivers. The rise of asymmetric warfare and the increased need for robust maritime security further fuel market growth. Government initiatives aimed at modernizing naval capabilities and expanding their fleets, coupled with favorable economic policies, bolster the market’s expansion. For instance, the significant contracts awarded by the UK and Dutch Ministries of Defence underscore the robust governmental investment in this sector.

Challenges in the Military Frigate Market Market

Supply chain disruptions, coupled with the complexity of integrating advanced technologies, represent significant hurdles. Stringent regulatory frameworks and export controls impact production timelines and costs. Intense competition amongst major players, coupled with pressure on defense budgets in some regions, results in challenges securing contracts and maintaining profit margins. The high cost of procurement and maintenance coupled with fluctuating geopolitical situations further increases these challenges. The average cost of a frigate is estimated at xx Million, creating a significant financial barrier for many nations.

Emerging Opportunities in Military Frigate Market

Technological breakthroughs in AI and autonomous systems offer substantial opportunities to enhance the efficiency and capabilities of frigates. Strategic partnerships between defense contractors and technology companies create opportunities to incorporate cutting-edge technologies rapidly. Expansion into new markets, particularly in regions experiencing increased geopolitical instability and naval modernization drives, presents further growth potential. The emergence of new hybrid technologies and energy solutions will also drive opportunities in this market.

Leading Players in the Military Frigate Market Sector

- General Dynamics Corporation

- Lockheed Martin Corporation

- Rosoboronexport

- China Shipbuilding Industry Trading Co Ltd

- Fr Lürssen Werft GmbH & Co KG

- Naval Group

- Fincantieri S p A

- thyssenkrupp AG

- Austal Limited

- BAE Systems plc

- United Shipbuilding Corporation

- Damen Shipyards Group

Key Milestones in Military Frigate Market Industry

- November 2022: BAE Systems plc secures a USD 4.59 Billion contract from the UK MoD for five Type 26 frigates, showcasing the ongoing commitment to naval modernization.

- June 2023: The Dutch Ministry of Defence, Damen, and Thales sign a contract for four cutting-edge Anti-Submarine Warfare (ASW) frigates, highlighting the focus on advanced capabilities and environmental considerations (hybrid propulsion).

Strategic Outlook for Military Frigate Market Market

The Military Frigate Market is poised for sustained growth driven by technological innovation, geopolitical factors, and increasing investments in naval modernization. Strategic partnerships and collaborations between nations and defense contractors will play a pivotal role in shaping the market's future. Opportunities exist in developing and deploying advanced capabilities, such as autonomous systems and AI-powered technologies, to enhance operational efficiency and combat effectiveness. Further, a focus on sustainability and the integration of environmentally friendly technologies will be crucial for long-term success in this sector.

Military Frigate Market Segmentation

-

1. Application

- 1.1. Patrol

- 1.2. Escort

- 1.3. Other Applications

Military Frigate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Italy

- 2.2. United Kingdom

- 2.3. Spain

- 2.4. France

- 2.5. Germany

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Taiwan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Turkey

- 5.2. Egypt

- 5.3. Saudi Arabia

- 5.4. Rest of Middle East and Africa

Military Frigate Market Regional Market Share

Geographic Coverage of Military Frigate Market

Military Frigate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Patrol Frigates are Expected to Have the Largest Market Share of the Military Frigates Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Frigate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Patrol

- 5.1.2. Escort

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Military Frigate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Patrol

- 6.1.2. Escort

- 6.1.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Military Frigate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Patrol

- 7.1.2. Escort

- 7.1.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Military Frigate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Patrol

- 8.1.2. Escort

- 8.1.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Military Frigate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Patrol

- 9.1.2. Escort

- 9.1.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Military Frigate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Patrol

- 10.1.2. Escort

- 10.1.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rosoboronexport

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Shipbuilding Industry Trading Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fr Lürssen Werft GmbH & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Naval Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fincantieri S p A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 thyssenkrupp AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Austal Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAE Systems plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 United Shipbuilding Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Damen Shipyards Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Military Frigate Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Military Frigate Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Military Frigate Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Military Frigate Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Military Frigate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Military Frigate Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Military Frigate Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Military Frigate Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Military Frigate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Military Frigate Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Military Frigate Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Military Frigate Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Military Frigate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Military Frigate Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Military Frigate Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Military Frigate Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Military Frigate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Military Frigate Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Military Frigate Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Military Frigate Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Military Frigate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Frigate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Military Frigate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Military Frigate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Military Frigate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Military Frigate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Military Frigate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Italy Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Russia Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Military Frigate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Military Frigate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Taiwan Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Military Frigate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Military Frigate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Mexico Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Brazil Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Military Frigate Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Military Frigate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Egypt Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Military Frigate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Frigate Market?

The projected CAGR is approximately 2.17%.

2. Which companies are prominent players in the Military Frigate Market?

Key companies in the market include General Dynamics Corporation, Lockheed Martin Corporation, Rosoboronexport, China Shipbuilding Industry Trading Co Ltd, Fr Lürssen Werft GmbH & Co KG, Naval Group, Fincantieri S p A, thyssenkrupp AG, Austal Limited, BAE Systems plc, United Shipbuilding Corporation, Damen Shipyards Group.

3. What are the main segments of the Military Frigate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Patrol Frigates are Expected to Have the Largest Market Share of the Military Frigates Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: The Dutch Ministry of Defence (MoD), Damen, and THALES jointly signed a contract for the construction of four cutting-edge Anti-Submarine Warfare (ASW) Frigates. This pivotal agreement marked the beginning of a new era, heralding the retirement of the current Karel Doorman Class multipurpose frigates. The primary focus of these ASW frigates will revolve around bolstering anti-submarine warfare capabilities, showcasing a strategic shift in naval operations. These state-of-the-art frigates will feature hybrid diesel-electric propulsion, embodying a commitment to technological advancement and environmental considerations. A paramount objective is to enhance stealth capabilities, enabling the vessels to navigate with utmost silence, thereby minimizing the risk of detection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Frigate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Frigate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Frigate Market?

To stay informed about further developments, trends, and reports in the Military Frigate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence