Key Insights

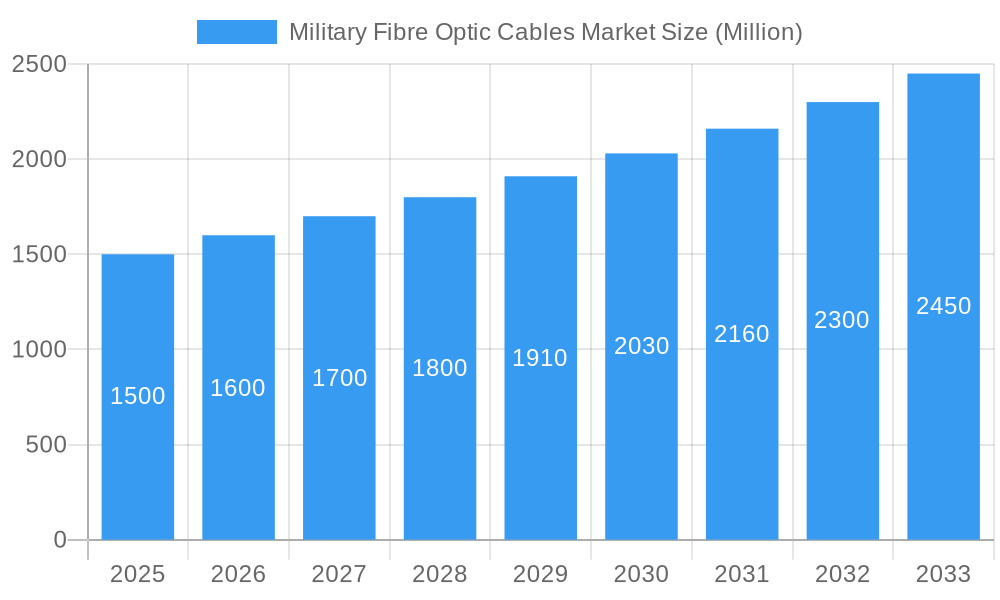

The Military Fibre Optic Cable market is poised for significant expansion, driven by the escalating demand for secure, high-bandwidth communication solutions in defense. The market is projected to reach $27.89 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.31% from 2019 to 2024. This robust growth is underpinned by several critical factors. First, the widespread adoption of advanced military technologies, including unmanned aerial vehicles (UAVs) and sophisticated surveillance systems, necessitates high-speed, reliable data transmission capabilities that fiber optic cables inherently provide. Second, global governments are making substantial investments in modernizing their military communication infrastructure to improve operational efficiency and enhance situational awareness, particularly in regions facing geopolitical challenges. Furthermore, the inherent security advantages of fiber optic cables, such as resistance to signal interception and electromagnetic interference, make them the optimal choice for sensitive military communications. Market segmentation reflects the diverse requirements of military applications. Single-mode fibers are in high demand for long-range communication due to their extended transmission distances, while multi-mode fibers are suitable for shorter-range applications. Material types, including glass and plastic optical fibers, also influence market dynamics, with glass fibers generally offering superior performance at a higher cost. Leading market participants, such as Prysmian Group, Sterlite Technologies, and Corning Incorporated, are spearheading innovation and shaping the market through technological advancements and strategic alliances.

Military Fibre Optic Cables Market Market Size (In Billion)

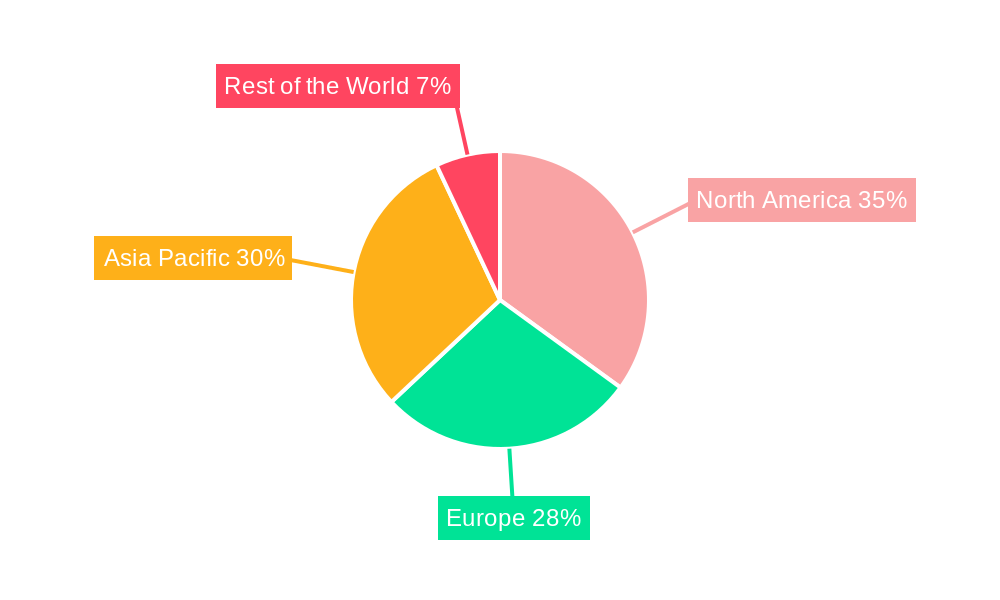

Key market restraints include the substantial initial investment costs associated with deploying fiber optic infrastructure, especially in challenging terrains. Nevertheless, the long-term cost-effectiveness and superior security offered by fiber optic cables effectively mitigate these upfront expenditures. Future growth is anticipated to be concentrated in the Asia-Pacific region, fueled by escalating military expenditures and modernization initiatives across several nations. While North America and Europe maintain substantial market shares, the Asia-Pacific region is projected to exhibit the highest growth rate throughout the forecast period (2025-2033). The market is expected to sustain its upward trajectory, propelled by continuous technological advancements, increased defense budgets, and the persistent need for secure, high-bandwidth military communication networks. Our projections indicate sustained strong performance for the military fiber optic cable market, with significant contributions from the ongoing integration of advanced technologies and increased investments in military infrastructure.

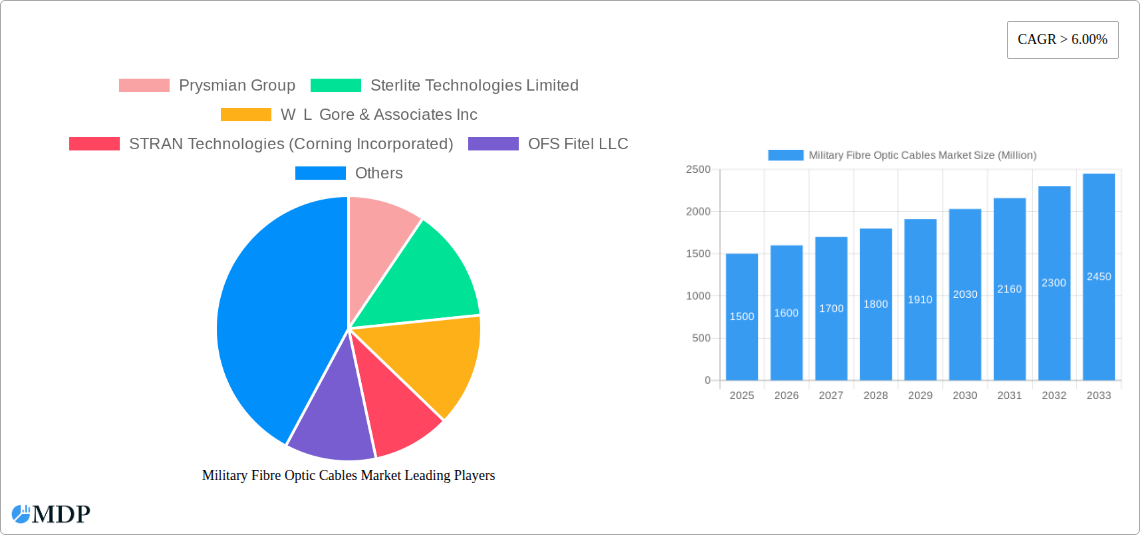

Military Fibre Optic Cables Market Company Market Share

Military Fibre Optic Cables Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Military Fibre Optic Cables Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report delivers actionable intelligence on market dynamics, trends, leading players, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Military Fibre Optic Cables Market Market Dynamics & Concentration

The Military Fibre Optic Cables Market is characterized by a moderately concentrated landscape, with key players such as Prysmian Group, Sterlite Technologies Limited, and Nexans holding significant market share. However, the market is also witnessing the emergence of smaller, specialized players focusing on niche applications. Innovation is a key driver, fueled by the increasing demand for high-bandwidth, secure communication systems in military operations. Stringent regulatory frameworks governing the use of military-grade technology influence market dynamics, while the absence of readily available substitutes ensures strong demand. End-user trends towards enhanced data security and network resilience further propel market growth. M&A activities, although not excessively frequent, play a role in shaping the competitive landscape. For instance, the recent acquisitions within the broader fiber optics sector signal a potential increase in consolidation within the military segment in the coming years. The overall market share distribution shows a slight shift towards larger players due to their scale and technological capabilities. The number of M&A deals in the sector between 2019-2024 stood at approximately xx, indicating a steady level of consolidation.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: High-bandwidth demands, enhanced security needs

- Regulatory Frameworks: Stringent standards and regulations

- Product Substitutes: Limited availability of effective alternatives

- End-User Trends: Growing demand for secure and resilient networks

- M&A Activity: Steady, with potential for increased consolidation

Military Fibre Optic Cables Market Industry Trends & Analysis

The Military Fibre Optic Cables Market is experiencing robust growth, driven primarily by escalating investments in military modernization programs globally. Technological advancements, such as the development of multicore fibers offering significantly increased bandwidth, are reshaping the market landscape. Consumer preferences lean toward superior performance and reliability, pushing the adoption of advanced fiber optic technologies. Competitive dynamics are intense, with players focusing on product differentiation through innovation and cost optimization. The market is witnessing a shift towards specialized, high-performance cables tailored to specific military applications, leading to increased product differentiation. The market penetration of advanced fiber optic technologies in military applications is steadily increasing, reaching an estimated xx% in 2025. The market is projected to reach xx Million by 2033 with a CAGR of xx% (2025-2033).

Leading Markets & Segments in Military Fibre Optic Cables Market

The North American region currently holds a dominant position in the Military Fibre Optic Cables Market, driven by substantial military spending and robust technological advancements. Within the market segments, Glass Optical Fibre dominates the Material Type segment owing to its superior performance characteristics. Similarly, Single-mode cables hold a larger market share in the Cable Type segment due to their ability to transmit data over long distances with minimal signal degradation.

Key Drivers for North American Dominance:

- High Military Expenditure

- Advanced Technological Infrastructure

- Strong Domestic Manufacturing Capabilities

Key Drivers for Glass Optical Fibre Dominance:

- Superior Performance and Reliability

- High Bandwidth Capacity

- Suitability for Long-Distance Transmission

Key Drivers for Single-mode Cable Dominance:

- Long-Distance Transmission Capabilities

- Higher Bandwidth Capacity

- Reduced Signal Attenuation

Military Fibre Optic Cables Market Product Developments

Recent product innovations focus on enhancing bandwidth, improving durability, and enhancing resistance to harsh environmental conditions. The development of multicore fibers, as exemplified by OFS's TeraWave SCUBA 4X Multicore Ocean Fiber, represents a significant leap forward in terms of bandwidth capacity. These advancements cater to the growing demand for high-speed data transmission in demanding military applications, offering a competitive advantage to manufacturers who can deliver these advanced solutions.

Key Drivers of Military Fibre Optic Cables Market Growth

Technological advancements, such as the development of higher bandwidth and more resilient fiber optic cables, are a major growth driver. Increased military spending globally, particularly in regions experiencing geopolitical instability, fuels market growth. Stringent regulatory requirements for secure communication in military applications further bolster demand for specialized fiber optic cables. For example, the growing need for secure communication in autonomous weapons systems significantly boosts the market's growth trajectory.

Challenges in the Military Fibre Optic Cables Market Market

Stringent quality control and certification requirements pose a significant hurdle for manufacturers. Supply chain disruptions and the dependence on specialized materials can lead to cost increases and production delays. Intense competition among established players and the entry of new market participants exert downward pressure on prices. These challenges could potentially restrain market growth to a limited extent. Specifically, it is predicted that approximately xx% of potential growth might be curbed by these factors.

Emerging Opportunities in Military Fibre Optic Cables Market

Technological breakthroughs, such as the development of more robust and lightweight fiber optic cables, present exciting opportunities. Strategic partnerships between manufacturers and military organizations can lead to the development of customized solutions. Expansion into new markets, particularly in developing economies with growing military modernization programs, offers significant growth potential. These factors collectively contribute to a positive outlook for the long-term growth of the Military Fibre Optic Cables Market.

Leading Players in the Military Fibre Optic Cables Market Sector

- Prysmian Group

- Sterlite Technologies Limited

- W L Gore & Associates Inc

- STRAN Technologies (Corning Incorporated)

- OFS Fitel LLC

- Timbercon Inc

- Nexans

- G&H

- Sumitomo Electric Lightwave Corp

- Infinite Electronics International Inc

- OCC

Key Milestones in Military Fibre Optic Cables Market Industry

- November 2021: Nexans and Terna secured a contract exceeding EUR 650 Million to provide 500km of 500kV HVDC subsea cable for the Tyrrhenian Link project. This highlights the growing demand for high-capacity submarine cables in large-scale infrastructure projects, indirectly indicating similar trends in military applications.

- March 2023: OFS announced the TeraWave SCUBA 4X Multicore Ocean Fiber, significantly increasing bandwidth capacity in ocean applications. This demonstrates technological progress in high-bandwidth fiber optic solutions, indicating similar potential for military applications.

Strategic Outlook for Military Fibre Optic Cables Market Market

The Military Fibre Optic Cables Market presents a robust growth trajectory driven by sustained technological innovation, escalating military spending, and the critical need for secure communication systems. The focus on enhancing bandwidth, improving durability, and developing specialized solutions for diverse military applications will shape future market dynamics. Strategic partnerships and market expansion into new geographies will further contribute to the market's future growth and success.

Military Fibre Optic Cables Market Segmentation

-

1. Cable Type

- 1.1. Single-mode

- 1.2. Multi-mode

-

2. Material Type

- 2.1. Plastic Optical Fibre

- 2.2. Glass Optical Fibre

Military Fibre Optic Cables Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Military Fibre Optic Cables Market Regional Market Share

Geographic Coverage of Military Fibre Optic Cables Market

Military Fibre Optic Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Plastic Optical Fiber to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Single-mode

- 5.1.2. Multi-mode

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic Optical Fibre

- 5.2.2. Glass Optical Fibre

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. North America Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 6.1.1. Single-mode

- 6.1.2. Multi-mode

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Plastic Optical Fibre

- 6.2.2. Glass Optical Fibre

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 7. Europe Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 7.1.1. Single-mode

- 7.1.2. Multi-mode

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Plastic Optical Fibre

- 7.2.2. Glass Optical Fibre

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 8. Asia Pacific Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 8.1.1. Single-mode

- 8.1.2. Multi-mode

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Plastic Optical Fibre

- 8.2.2. Glass Optical Fibre

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 9. Rest of the World Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 9.1.1. Single-mode

- 9.1.2. Multi-mode

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Plastic Optical Fibre

- 9.2.2. Glass Optical Fibre

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Prysmian Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sterlite Technologies Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 W L Gore & Associates Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 STRAN Technologies (Corning Incorporated)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 OFS Fitel LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Timbercon Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nexans

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 G&H

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sumitomo Electric Lightwave Corp

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Infinite Electronics International Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 OCC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Prysmian Group

List of Figures

- Figure 1: Global Military Fibre Optic Cables Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Military Fibre Optic Cables Market Revenue (billion), by Cable Type 2025 & 2033

- Figure 3: North America Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 4: North America Military Fibre Optic Cables Market Revenue (billion), by Material Type 2025 & 2033

- Figure 5: North America Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Military Fibre Optic Cables Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Military Fibre Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Military Fibre Optic Cables Market Revenue (billion), by Cable Type 2025 & 2033

- Figure 9: Europe Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 10: Europe Military Fibre Optic Cables Market Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Military Fibre Optic Cables Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Military Fibre Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Military Fibre Optic Cables Market Revenue (billion), by Cable Type 2025 & 2033

- Figure 15: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 16: Asia Pacific Military Fibre Optic Cables Market Revenue (billion), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Military Fibre Optic Cables Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Military Fibre Optic Cables Market Revenue (billion), by Cable Type 2025 & 2033

- Figure 21: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2025 & 2033

- Figure 22: Rest of the World Military Fibre Optic Cables Market Revenue (billion), by Material Type 2025 & 2033

- Figure 23: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Rest of the World Military Fibre Optic Cables Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Cable Type 2020 & 2033

- Table 2: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Cable Type 2020 & 2033

- Table 5: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Cable Type 2020 & 2033

- Table 8: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Cable Type 2020 & 2033

- Table 11: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Cable Type 2020 & 2033

- Table 14: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 15: Global Military Fibre Optic Cables Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Fibre Optic Cables Market?

The projected CAGR is approximately 6.31%.

2. Which companies are prominent players in the Military Fibre Optic Cables Market?

Key companies in the market include Prysmian Group, Sterlite Technologies Limited, W L Gore & Associates Inc, STRAN Technologies (Corning Incorporated), OFS Fitel LLC, Timbercon Inc, Nexans, G&H, Sumitomo Electric Lightwave Corp, Infinite Electronics International Inc, OCC.

3. What are the main segments of the Military Fibre Optic Cables Market?

The market segments include Cable Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.89 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Plastic Optical Fiber to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, Nexans and Terna announced a contract of more than EUR 650 million. As per the terms of the contract, Nexans will provide 500km of 500kV HVDC mass-impregnated subsea cable link for the Tyrrhenian Link project to build a new electricity corridor connecting Sicily and Sardinia to Italy's mainland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Fibre Optic Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Fibre Optic Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Fibre Optic Cables Market?

To stay informed about further developments, trends, and reports in the Military Fibre Optic Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence