Key Insights

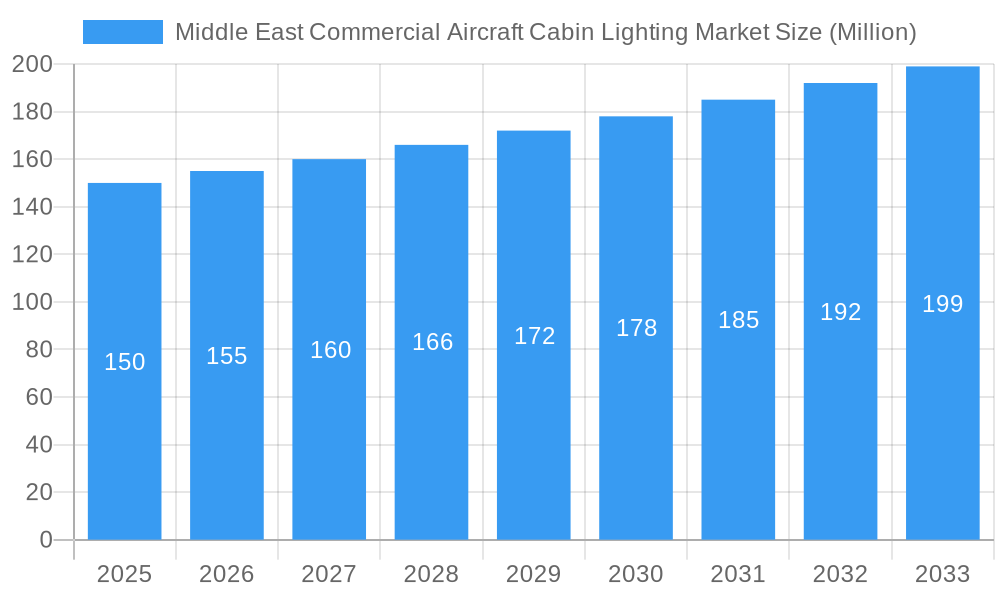

The Middle East commercial aircraft cabin lighting market is experiencing steady growth, driven by a burgeoning aviation sector and increasing passenger demand for enhanced in-flight comfort and experience. The region's major airline hubs, particularly in the UAE and Saudi Arabia, are undergoing significant expansion, necessitating substantial investments in modern aircraft interiors. This includes advanced cabin lighting systems that offer greater control, energy efficiency, and customizable ambiance, contributing to improved passenger wellbeing and airline branding. The market's compound annual growth rate (CAGR) of 3.26% from 2019 to 2024 indicates a stable trajectory, projected to continue through 2033. This growth is fueled by several key trends, including the adoption of LED lighting technology, which provides significant energy savings and design flexibility, and the rising integration of smart lighting systems capable of responding to various flight phases and passenger preferences. Narrow-body aircraft currently dominate the market share due to the high volume of short-to-medium haul flights within the region, however, the increasing demand for long-haul flights is expected to boost the wide-body segment in the coming years. While regulatory compliance and technological advancements pose some challenges, the overall market outlook remains optimistic, propelled by continuous fleet modernization and increasing passenger traffic within the Middle East.

Middle East Commercial Aircraft Cabin Lighting Market Market Size (In Million)

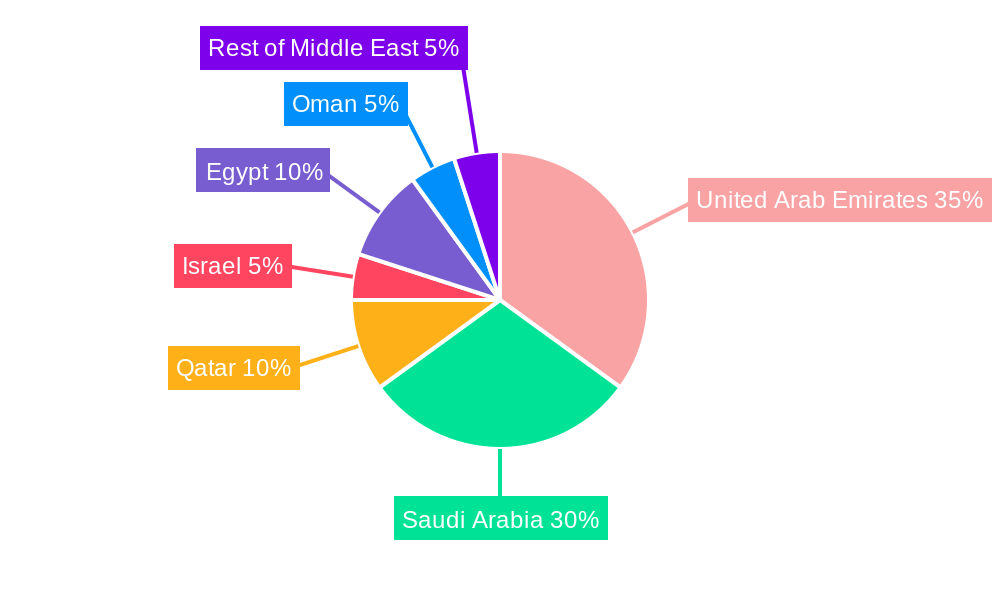

The competitive landscape includes both established global players like Collins Aerospace and Astronics Corporation, and regional specialists, creating a dynamic market with diverse product offerings and pricing strategies. Growth in the broader Middle East aviation sector, driven by tourism and business travel, will be a significant catalyst for future market expansion. Furthermore, airlines are increasingly prioritizing cabin aesthetics and passenger experience as a key differentiator, influencing the demand for sophisticated, aesthetically pleasing, and technologically advanced cabin lighting systems. The ongoing focus on fuel efficiency and sustainable aviation practices will likely increase the preference for energy-efficient LED lighting solutions, further stimulating market growth. The regional segmentation, with the UAE and Saudi Arabia leading the market, underscores the concentration of aviation activity in these key economic powerhouses. The "Rest of Middle East" segment holds significant potential for growth as aviation infrastructure develops and expands throughout the region.

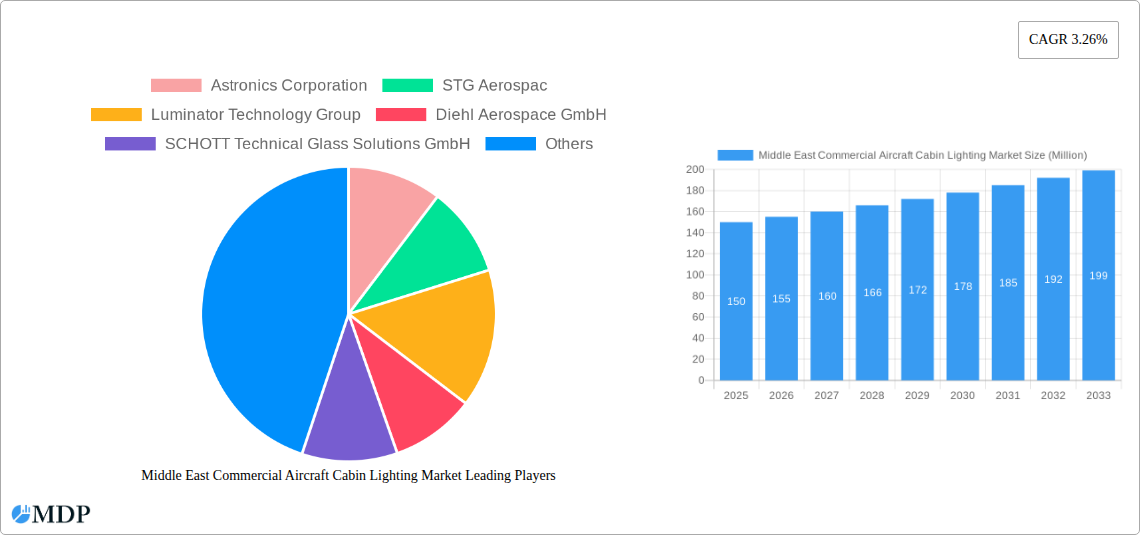

Middle East Commercial Aircraft Cabin Lighting Market Company Market Share

Middle East Commercial Aircraft Cabin Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East commercial aircraft cabin lighting market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report leverages rigorous data analysis and expert insights to forecast a xx Million market value by 2033.

Middle East Commercial Aircraft Cabin Lighting Market Market Dynamics & Concentration

The Middle East commercial aircraft cabin lighting market is characterized by a moderately concentrated landscape, with key players like Astronics Corporation, STG Aerospac, Luminator Technology Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, and Collins Aerospace holding significant market share. Market concentration is influenced by factors such as technological advancements, stringent regulatory frameworks (e.g., safety and efficiency standards), and the increasing preference for advanced lighting solutions that enhance passenger experience.

Innovation Drivers: The market is driven by continuous innovation in LED lighting, smart lighting systems, and customizable cabin ambiance solutions. These advancements cater to airline demands for energy efficiency, cost reduction, and enhanced passenger comfort.

Regulatory Frameworks: Compliance with stringent safety regulations and environmental standards significantly impacts market growth. Stringent regulations related to aircraft lighting systems and their compliance drive innovation and investment in advanced, compliant technologies.

Product Substitutes: Although limited, alternative lighting technologies are being explored. However, LED-based solutions currently dominate due to their superior energy efficiency and longevity.

End-User Trends: Airlines are increasingly focused on enhancing the passenger experience through advanced cabin lighting systems that offer improved ambience, mood lighting capabilities, and customizable settings.

M&A Activities: The number of M&A activities in the last five years has been moderate (xx deals), primarily driven by the need for companies to expand their product portfolios and geographic reach. Market share consolidation through acquisitions is also a contributing factor.

Middle East Commercial Aircraft Cabin Lighting Market Industry Trends & Analysis

The Middle East commercial aircraft cabin lighting market is experiencing robust growth, driven by a surge in air travel, expanding airline fleets, and increased adoption of advanced lighting technologies. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), propelled by several factors.

Market growth is significantly influenced by the burgeoning aviation sector in the Middle East, fueled by increased tourism, business travel, and expanding regional connectivity. Technological disruptions, such as the integration of LED and smart lighting systems, are significantly influencing market dynamics. Airlines are increasingly prioritizing passenger experience, leading to higher demand for sophisticated lighting solutions. The competitive landscape is intensifying with major players focusing on product innovation and strategic partnerships to gain market share. Market penetration of advanced lighting technologies is growing steadily, with LED-based solutions rapidly replacing traditional lighting systems.

Leading Markets & Segments in Middle East Commercial Aircraft Cabin Lighting Market

The Middle East commercial aircraft cabin lighting market shows significant regional variation in its growth.

Saudi Arabia: This market is experiencing rapid growth, driven by substantial investments in aviation infrastructure and the expansion of national carriers. Key drivers include government initiatives to boost tourism and economic diversification.

United Arab Emirates: The UAE’s established aviation industry and the presence of major airlines are driving considerable market demand. The country's focus on luxury and high-end travel services contributes to the adoption of premium cabin lighting systems.

Rest of Middle East: This segment displays a moderate growth rate, influenced by varying levels of aviation infrastructure development and economic conditions across different countries.

Aircraft Type Segmentation:

Narrowbody Aircraft: This segment dominates the market due to the larger number of narrowbody aircraft in operation across the region.

Widebody Aircraft: This segment is expected to showcase significant growth due to increasing demand for long-haul flights and the preference for enhanced passenger comfort in widebody aircraft.

Middle East Commercial Aircraft Cabin Lighting Market Product Developments

Recent product developments in the Middle East commercial aircraft cabin lighting market highlight a strong focus on energy efficiency, advanced features, and improved passenger experience. Key innovations include LED-based lighting systems offering customizable color temperatures and intensity levels, smart lighting solutions that can be controlled remotely, and systems integrated with cabin management systems. These developments reflect technological advancements and a strong market fit for airlines seeking to enhance passenger comfort and operational efficiency.

Key Drivers of Middle East Commercial Aircraft Cabin Lighting Market Growth

Several factors are driving growth in this market:

Technological advancements: The shift towards energy-efficient LED and smart lighting systems is a major catalyst.

Economic growth: The burgeoning aviation sector in the Middle East, fueled by economic growth and tourism, is creating a strong demand for new aircraft and cabin upgrades.

Regulatory support: Government initiatives promoting sustainable aviation practices incentivize the adoption of environmentally friendly lighting solutions.

Challenges in the Middle East Commercial Aircraft Cabin Lighting Market Market

Despite the positive outlook, the market faces some challenges:

High initial investment costs: Implementing advanced lighting systems can require significant upfront investments.

Supply chain disruptions: Global supply chain issues can impact the timely delivery of components.

Intense competition: The presence of several established players creates a highly competitive market environment.

Emerging Opportunities in Middle East Commercial Aircraft Cabin Lighting Market

Several emerging opportunities hold promise for long-term growth:

Technological breakthroughs: Continued innovation in areas like bioluminescent lighting and holographic displays offers new avenues for market expansion.

Strategic partnerships: Collaborative efforts between lighting manufacturers and airlines can lead to customized lighting solutions tailored to specific needs.

Market expansion: Untapped market potential exists in several countries within the Middle East region.

Leading Players in the Middle East Commercial Aircraft Cabin Lighting Market Sector

- Astronics Corporation

- STG Aerospac

- Luminator Technology Group

- Diehl Aerospace GmbH

- SCHOTT Technical Glass Solutions GmbH

- Collins Aerospace

Key Milestones in Middle East Commercial Aircraft Cabin Lighting Market Industry

June 2022: Collins Aerospace launched its Hypergamut™ Lighting System, scheduled for entry into service in early 2024. This launch signifies a significant advancement in cabin lighting technology, offering enhanced color accuracy and energy efficiency.

February 2021: Diehl Aviation secured a contract extension from Boeing for the delivery of the interior lighting system for the Boeing 787 Dreamliner. This highlights the continued demand for high-quality cabin lighting systems in the widebody aircraft segment.

Strategic Outlook for Middle East Commercial Aircraft Cabin Lighting Market Market

The Middle East commercial aircraft cabin lighting market presents significant long-term growth potential, driven by technological advancements, increased passenger demand, and the expansion of the aviation sector. Strategic partnerships, product innovation, and a focus on sustainable solutions will be crucial for companies seeking to capitalize on this burgeoning market. The focus on enhanced passenger experience, coupled with growing airline fleets, will continue to be key growth accelerators in the coming years.

Middle East Commercial Aircraft Cabin Lighting Market Segmentation

-

1. Aircraft Type

- 1.1. Narrowbody

- 1.2. Widebody

Middle East Commercial Aircraft Cabin Lighting Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Commercial Aircraft Cabin Lighting Market Regional Market Share

Geographic Coverage of Middle East Commercial Aircraft Cabin Lighting Market

Middle East Commercial Aircraft Cabin Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Commercial Aircraft Cabin Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Narrowbody

- 5.1.2. Widebody

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Astronics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 STG Aerospac

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luminator Technology Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Diehl Aerospace GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SCHOTT Technical Glass Solutions GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Collins Aerospace

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Astronics Corporation

List of Figures

- Figure 1: Middle East Commercial Aircraft Cabin Lighting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Commercial Aircraft Cabin Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 2: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 4: Middle East Commercial Aircraft Cabin Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East Commercial Aircraft Cabin Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Commercial Aircraft Cabin Lighting Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Middle East Commercial Aircraft Cabin Lighting Market?

Key companies in the market include Astronics Corporation, STG Aerospac, Luminator Technology Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, Collins Aerospace.

3. What are the main segments of the Middle East Commercial Aircraft Cabin Lighting Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Collins Aerospace launched its Hypergamut™ Lighting System which is scheduled for entry into service in early 2024.February 2021: Diehl Aviation has secured a contract extension from Boeing for the delivery of the interior lighting system for the Boeing 787 Dreamliner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Commercial Aircraft Cabin Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Commercial Aircraft Cabin Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Commercial Aircraft Cabin Lighting Market?

To stay informed about further developments, trends, and reports in the Middle East Commercial Aircraft Cabin Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence