Key Insights

The Medium Earth Orbit (MEO) satellite market is experiencing robust growth, driven by increasing demand for reliable and high-throughput communication services, advanced navigation systems, and enhanced earth observation capabilities. The market's Compound Annual Growth Rate (CAGR) of 4.96% from 2019 to 2024 suggests a consistently expanding market. This growth is fueled by several key factors. Firstly, the proliferation of connected devices and the burgeoning need for high-speed internet access, particularly in underserved regions, are significantly boosting the demand for MEO satellite constellations. Secondly, advancements in propulsion technology, particularly electric propulsion, are enabling more efficient and cost-effective satellite deployment and operation. This is leading to a wider adoption of MEO satellites across various sectors, including commercial, military & government applications. The segment breakdown reveals that commercial applications currently dominate, followed by military and government sectors, which are expected to see considerable growth due to increasing reliance on satellite-based communication and surveillance. Finally, the increasing availability of larger satellite platforms (above 1000kg) further enhances capabilities and expands market potential.

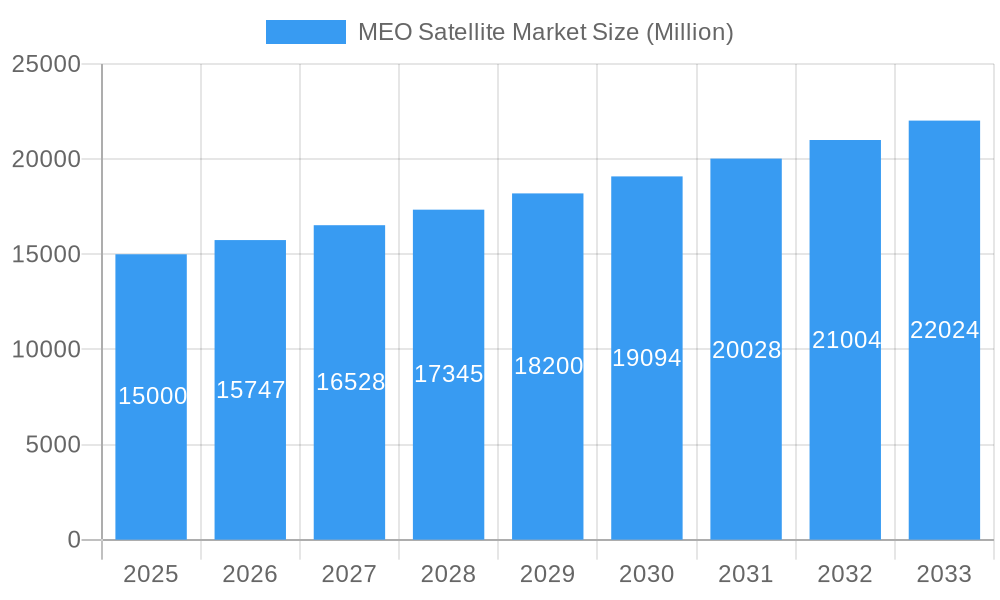

MEO Satellite Market Market Size (In Billion)

While the market exhibits significant potential, certain challenges remain. These include the high initial investment costs associated with satellite development and launch, the complexity of obtaining regulatory approvals for satellite operations, and potential risks related to space debris. However, ongoing technological advancements, coupled with strategic partnerships between private companies and government agencies, are expected to mitigate these challenges. The various segments within the MEO satellite market present diverse growth opportunities. The electric propulsion technology segment is anticipated to experience faster growth compared to traditional gas-based and liquid fuel systems due to its inherent advantages in fuel efficiency and operational longevity. The increasing adoption of MEO satellites for communication and earth observation applications presents further lucrative avenues for growth. The market size is estimated to be significantly larger than the provided data indicates, owing to increasing demand and technological advancements. Looking ahead to 2033, the MEO satellite market is projected to maintain a strong growth trajectory, driven by continuous innovation and expansion into new applications and geographical regions.

MEO Satellite Market Company Market Share

Unlock Growth Opportunities in the Booming MEO Satellite Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Medium Earth Orbit (MEO) Satellite market, offering invaluable insights for industry stakeholders, investors, and strategists. Spanning the period from 2019 to 2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025), this report meticulously examines market dynamics, technological advancements, key players, and emerging opportunities within this rapidly evolving sector. Expect detailed segmentation analysis across end-users (Commercial, Military & Government, Other), propulsion technologies (Electric, Gas-based, Liquid Fuel), applications (Communication, Earth Observation, Navigation, Others), and satellite mass categories (100-500kg, 500-1000kg, above 1000kg). The report projects a market valued at xx Million by 2033, exhibiting a CAGR of xx%.

MEO Satellite Market Market Dynamics & Concentration

The MEO satellite market is characterized by a dynamic and moderately concentrated landscape, where a select group of industry leaders significantly influences market trends and innovation. Prominent players like Information Satellite Systems Reshetnev, Lockheed Martin Corporation, China Aerospace Science and Technology Corporation (CASC), OHB SE, and Thales are at the forefront, driving advancements and shaping the future of MEO satellite technology. The market's concentration is further shaped by a confluence of factors, including stringent international and national regulatory frameworks, substantial capital investments required for cutting-edge satellite development and deployment, and the necessity for highly specialized technological expertise. Recent years have seen a moderate level of Mergers and Acquisitions (M&A) activity, with approximately [Insert specific number of M&A deals] transactions recorded between 2019 and 2024. This trend is anticipated to persist, fueled by strategic objectives to consolidate market share, acquire innovative technologies, and expand operational capabilities. Innovation remains a pivotal growth engine, with companies relentlessly pursuing improvements in satellite performance, cost optimization, and the diversification of service offerings. The advent of disruptive technologies, such as next-generation propulsion systems and highly miniaturized satellite components, is actively reshaping the competitive arena.

- Market Share: Lockheed Martin commands an estimated [Insert Lockheed Martin's estimated market share]% of the market share, closely followed by CASC with approximately [Insert CASC's estimated market share]% and Information Satellite Systems Reshetnev with around [Insert Information Satellite Systems Reshetnev's estimated market share]%.

- M&A Deal Count (2019-2024): Approximately [Insert specific number of M&A deals] deals.

- Key Innovation Drivers: Miniaturization of components, development of advanced and efficient propulsion systems, and the integration of cutting-edge communication technologies are key areas of innovation.

- Regulatory Landscape: The market operates under a complex web of international space laws, national licensing requirements, and crucial spectrum allocation policies, all of which influence operational strategies and market entry.

- Product Substitutes: While MEO satellites offer unique advantages, they face competition from terrestrial communication networks and alternative positioning, navigation, and timing (PNT) systems.

- End-User Trends: A significant surge in demand for high-throughput communication services and escalating government investments in space-based assets are defining end-user behavior.

MEO Satellite Market Industry Trends & Analysis

The MEO satellite market is experiencing significant growth, driven by increasing demand for high-bandwidth communication services, particularly for applications like broadband internet access and mobile connectivity. Technological advancements, including the development of more efficient and cost-effective satellites, are also fueling market expansion. Consumer preferences are shifting towards reliable, high-speed, and readily available connectivity, which MEO satellites are uniquely positioned to provide. The market is characterized by strong competitive dynamics, with established players continuously innovating and new entrants seeking to disrupt the status quo. This intense competition is driving down prices and improving the quality and availability of MEO satellite services. Market penetration continues to rise as affordability and availability increase. This has led to significant growth in the commercial segment, particularly in the areas of broadband internet and IoT. The expected CAGR for the period 2025-2033 is xx%.

Leading Markets & Segments in MEO Satellite Market

Currently, the North American region stands as the dominant force in the MEO satellite market, propelled by substantial government investment in space infrastructure and the presence of leading satellite manufacturers. Concurrently, the Asia-Pacific region is experiencing a remarkable growth trajectory, largely attributed to the escalating demand for advanced communication services and proactive government initiatives aimed at fostering domestic space capabilities.

- Dominant Region: North America continues to lead the market.

- Dominant End-User Segment: The Commercial sector is the primary driver, fueled by the expanding broadband market and the widespread adoption of the Internet of Things (IoT).

- Dominant Propulsion Technology: Liquid fuel propulsion systems currently offer superior performance and are dominant for larger, high-capacity MEO satellites.

- Dominant Application: Communication services, particularly the increasing need for high-bandwidth internet access, represent the most significant application.

- Dominant Satellite Mass Category: Satellites weighing between 500-1000kg are most prevalent, offering an optimal balance between payload capacity and launch cost.

Key Drivers for Regional Dominance:

- North America: Characterized by high levels of government funding, a strong ecosystem of established satellite manufacturers, and a robust technological infrastructure.

- Asia-Pacific: Driven by rapid economic expansion, an ever-increasing demand for seamless connectivity, and proactive government support for national space programs.

MEO Satellite Market Product Developments

Recent product developments in the MEO satellite market are focused on increasing efficiency, miniaturization, and enhancing performance. Manufacturers are investing in advanced propulsion systems, improved communication payloads, and more robust satellite designs. These innovations are aimed at reducing launch costs, improving operational lifespan, and offering greater flexibility in satellite configurations to meet diverse customer needs. The development of smaller, more modular satellites is also a significant trend, making launches more cost-effective and allowing for more frequent deployments. These developments are key to furthering market penetration and ensuring the continued growth of the MEO satellite industry.

Key Drivers of MEO Satellite Market Growth

Several factors are driving the growth of the MEO satellite market. These include the increasing demand for high-bandwidth communication services, particularly broadband internet access; the rising adoption of Internet of Things (IoT) devices, which require reliable satellite connectivity; government investment in space exploration and defense applications; and advancements in satellite technology leading to smaller, more affordable, and efficient satellites. Regulatory developments supporting the use of MEO satellites for various applications also contribute to market growth.

Challenges in the MEO Satellite Market

The MEO satellite market navigates a landscape marked by considerable challenges. The substantial initial investment costs associated with satellite development and deployment present a significant barrier to entry. The intricate and evolving regulatory environment surrounding space activities adds another layer of complexity. Furthermore, the market's dependence on launch services, which are susceptible to delays and unpredictable cost escalations, poses a continuous risk. Competition from established terrestrial communication technologies, such as advanced fiber optic networks, also exerts pressure. Disruptions within the global supply chain and the availability of a highly skilled workforce can impact production timelines and overall market expansion.

Emerging Opportunities in MEO Satellite Market

The MEO satellite market is strategically positioned for robust long-term growth, propelled by a series of transformative opportunities. The ongoing development of advanced and more powerful propulsion systems will pave the way for deploying larger, more capable satellites, thereby enhancing service offerings. Strategic collaborations between satellite operators and telecommunication providers are expected to significantly broaden market reach and diversify service portfolios. Moreover, the expansion of satellite-based services into previously underserved markets, such as providing reliable internet access to remote and underserved regions, represents a vast and largely untapped opportunity. Breakthroughs in technologies like artificial intelligence (AI) and machine learning (ML) are set to further revolutionize satellite efficiency, autonomous operations, and overall performance capabilities.

Leading Players in the MEO Satellite Market Sector

- Information Satellite Systems Reshetnev

- Lockheed Martin Corporation

- China Aerospace Science and Technology Corporation (CASC)

- OHB SE

- Thales

Key Milestones in MEO Satellite Market Industry

- January 2023: Thales Alenia Space introduced MEOLUT Next, a groundbreaking satellite search and rescue technology for the COSPAS-SARSAT system. This innovation marks a pivotal advancement in global safety and emergency response capabilities.

- September 2022: China successfully launched two BeiDou satellites, significantly enhancing its global navigation system and underscoring its rapidly growing prowess in the MEO satellite sector.

- March 2022: Lockheed Martin successfully completed final testing for its LM 400 mid-sized satellite bus. This milestone highlights a significant leap forward in their multi-mission satellite platform technology and production capabilities.

Strategic Outlook for MEO Satellite Market

The future of the MEO satellite market appears bright, with significant growth potential driven by technological innovations, increasing demand for connectivity, and government support. Strategic partnerships and investments in advanced technologies will be crucial for success. The market is expected to continue its expansion, driven by the need for high-bandwidth communication services globally. The focus will increasingly be on efficiency, cost reduction, and the development of innovative applications to serve diverse market segments.

MEO Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Others

-

2. Satellite Mass

- 2.1. 100-500kg

- 2.2. 500-1000kg

- 2.3. above 1000kg

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

MEO Satellite Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEO Satellite Market Regional Market Share

Geographic Coverage of MEO Satellite Market

MEO Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Europe is expected to open new scope of opportunities with significant new product developments in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 100-500kg

- 5.2.2. 500-1000kg

- 5.2.3. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America MEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication

- 6.1.2. Earth Observation

- 6.1.3. Navigation

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.2.1. 100-500kg

- 6.2.2. 500-1000kg

- 6.2.3. above 1000kg

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial

- 6.3.2. Military & Government

- 6.3.3. Other

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6.4.1. Electric

- 6.4.2. Gas based

- 6.4.3. Liquid Fuel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America MEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication

- 7.1.2. Earth Observation

- 7.1.3. Navigation

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.2.1. 100-500kg

- 7.2.2. 500-1000kg

- 7.2.3. above 1000kg

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial

- 7.3.2. Military & Government

- 7.3.3. Other

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 7.4.1. Electric

- 7.4.2. Gas based

- 7.4.3. Liquid Fuel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe MEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication

- 8.1.2. Earth Observation

- 8.1.3. Navigation

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.2.1. 100-500kg

- 8.2.2. 500-1000kg

- 8.2.3. above 1000kg

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial

- 8.3.2. Military & Government

- 8.3.3. Other

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 8.4.1. Electric

- 8.4.2. Gas based

- 8.4.3. Liquid Fuel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa MEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication

- 9.1.2. Earth Observation

- 9.1.3. Navigation

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.2.1. 100-500kg

- 9.2.2. 500-1000kg

- 9.2.3. above 1000kg

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial

- 9.3.2. Military & Government

- 9.3.3. Other

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 9.4.1. Electric

- 9.4.2. Gas based

- 9.4.3. Liquid Fuel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific MEO Satellite Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication

- 10.1.2. Earth Observation

- 10.1.3. Navigation

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.2.1. 100-500kg

- 10.2.2. 500-1000kg

- 10.2.3. above 1000kg

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Commercial

- 10.3.2. Military & Government

- 10.3.3. Other

- 10.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 10.4.1. Electric

- 10.4.2. Gas based

- 10.4.3. Liquid Fuel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Information Satellite Systems Reshetnev

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Aerospace Science and Technology Corporation (CASC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OHB SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thale

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Global MEO Satellite Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America MEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America MEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 5: North America MEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 6: North America MEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America MEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America MEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 9: North America MEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 10: North America MEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America MEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America MEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: South America MEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America MEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 15: South America MEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 16: South America MEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: South America MEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: South America MEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 19: South America MEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 20: South America MEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America MEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe MEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe MEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe MEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 25: Europe MEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 26: Europe MEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 27: Europe MEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 28: Europe MEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 29: Europe MEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 30: Europe MEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe MEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa MEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 33: Middle East & Africa MEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Middle East & Africa MEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 35: Middle East & Africa MEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 36: Middle East & Africa MEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 37: Middle East & Africa MEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East & Africa MEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 39: Middle East & Africa MEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 40: Middle East & Africa MEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East & Africa MEO Satellite Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific MEO Satellite Market Revenue (undefined), by Application 2025 & 2033

- Figure 43: Asia Pacific MEO Satellite Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Asia Pacific MEO Satellite Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 45: Asia Pacific MEO Satellite Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 46: Asia Pacific MEO Satellite Market Revenue (undefined), by End User 2025 & 2033

- Figure 47: Asia Pacific MEO Satellite Market Revenue Share (%), by End User 2025 & 2033

- Figure 48: Asia Pacific MEO Satellite Market Revenue (undefined), by Propulsion Tech 2025 & 2033

- Figure 49: Asia Pacific MEO Satellite Market Revenue Share (%), by Propulsion Tech 2025 & 2033

- Figure 50: Asia Pacific MEO Satellite Market Revenue (undefined), by Country 2025 & 2033

- Figure 51: Asia Pacific MEO Satellite Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global MEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 3: Global MEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global MEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Global MEO Satellite Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global MEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global MEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 8: Global MEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global MEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Global MEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global MEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global MEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 16: Global MEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 17: Global MEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 18: Global MEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Brazil MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Argentina MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global MEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global MEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 24: Global MEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global MEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 26: Global MEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: United Kingdom MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Germany MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Italy MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Russia MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Benelux MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Nordics MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global MEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global MEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 38: Global MEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 39: Global MEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 40: Global MEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Turkey MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: GCC MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: North Africa MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Global MEO Satellite Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 48: Global MEO Satellite Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 49: Global MEO Satellite Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 50: Global MEO Satellite Market Revenue undefined Forecast, by Propulsion Tech 2020 & 2033

- Table 51: Global MEO Satellite Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: China MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 53: India MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: South Korea MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: ASEAN MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: Oceania MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific MEO Satellite Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEO Satellite Market?

The projected CAGR is approximately 10.07%.

2. Which companies are prominent players in the MEO Satellite Market?

Key companies in the market include Information Satellite Systems Reshetnev, Lockheed Martin Corporation, China Aerospace Science and Technology Corporation (CASC), OHB SE, Thale.

3. What are the main segments of the MEO Satellite Market?

The market segments include Application, Satellite Mass, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Europe is expected to open new scope of opportunities with significant new product developments in the region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Thales Alenia Space offers a revolutionary technology for satellite search and rescue called MEOLUT Next. The solution will be deployed as part of the global COSPAS-SARSAT system.September 2022: China successfully sent two BeiDou satellites (BDS) into space from the Xichang Satellite Launch Center. The new satellites and boosters were developed by the China Academy of Space Technology (CAST) and the China Academy of Launch Vehicle Technology under the China Aerospace Science and Technology Corporation.March 2022: Lockheed Martin announced that its first mid-sized satellite, LM 400, had entered the final stage of testing; it is expected to be launched later this year. The multi-mission space bus rolled off the production line at the company's Digital Factory. The LM 400 is the first satellite developed by Lockheed Martin as part of a series of missions to demonstrate the LM 400 technology in its regularly scheduled orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEO Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEO Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEO Satellite Market?

To stay informed about further developments, trends, and reports in the MEO Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence