Key Insights

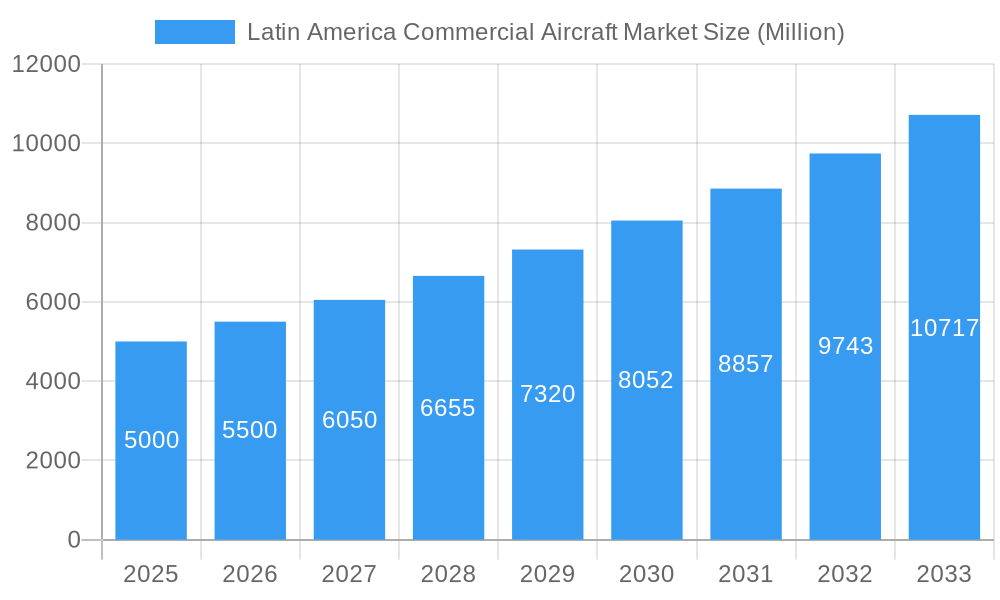

The Latin American Commercial Aircraft Market is poised for significant expansion, driven by sustained passenger traffic growth, fleet modernization needs, and supportive government infrastructure initiatives. Projections indicate a Compound Annual Growth Rate (CAGR) of 4.4% from 2025 to 2033. Key market segments include passenger aircraft and regional jets, with major global manufacturers such as Airbus SE, Boeing, and Embraer actively competing. The region's dynamic aviation landscape is further characterized by the presence of strong local players like Embraer, adapting offerings to prioritize fuel efficiency and operational versatility for Latin American carriers.

Latin America Commercial Aircraft Market Market Size (In Billion)

Brazil, Argentina, and Mexico are the primary market drivers, supported by well-developed aviation sectors and strong economies. Emerging economies like Peru and Chile present substantial growth opportunities. Despite potential challenges from economic volatility, fluctuating fuel prices, and regulatory complexities, the market outlook remains positive due to substantial pent-up demand and ongoing regional economic development. The estimated market size for 2025 is 38.55 billion.

Latin America Commercial Aircraft Market Company Market Share

Latin America Commercial Aircraft Market: A Comprehensive Report (2019-2033)

Unlock the potential of the booming Latin American commercial aircraft market with this in-depth report. This comprehensive analysis provides a detailed overview of market dynamics, industry trends, leading players, and future growth opportunities, covering the period 2019-2033. This report is essential for airlines, manufacturers, investors, and anyone seeking to understand this dynamic sector. Keywords: Latin America, Commercial Aircraft, Passenger Aircraft, Regional Jets, Freighters, Airbus, Boeing, Embraer, ATR, Roste, Market Size, Market Share, CAGR, Forecast, Industry Analysis.

Latin America Commercial Aircraft Market Dynamics & Concentration

The Latin America commercial aircraft market, valued at xx Million in 2025, exhibits a moderately concentrated landscape. Airbus SE, The Boeing Company, and Embraer SA hold significant market share, collectively accounting for approximately xx% of the market in 2025. However, regional players like ATR and Roste are increasingly active, driving competition and innovation. Market concentration is influenced by factors such as:

- Regulatory Frameworks: Varying aviation regulations across Latin American countries impact market entry and operations. Harmonization efforts are gradually increasing market openness.

- Innovation Drivers: Demand for fuel-efficient aircraft, advanced technologies (e.g., fly-by-wire systems), and enhanced passenger comfort drive continuous innovation.

- Product Substitutes: The limited availability of high-speed rail networks makes air travel the primary mode of long-distance transportation, reducing the threat of substitutes.

- End-User Trends: Growth in tourism and air travel demand, coupled with the rise of low-cost carriers, significantly influence market growth.

- M&A Activities: The number of M&A deals in the Latin American aviation sector has remained relatively stable in recent years, at approximately xx deals annually during the historical period (2019-2024). This activity primarily focuses on consolidation within the regional airline market. Further consolidation is anticipated in the forecast period.

Latin America Commercial Aircraft Market Industry Trends & Analysis

The Latin American commercial aircraft market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several key factors. Market penetration of commercial aircraft is increasing steadily, particularly in rapidly developing economies. Rising disposable incomes, robust tourism growth, and improving infrastructure are contributing significantly to this expansion. Technological advancements are also pivotal, with airlines increasingly adopting fuel-efficient aircraft to reduce operational costs. The emergence of low-cost carriers (LCCs) has also fueled demand for smaller, regional aircraft. Competitive dynamics are characterized by intense rivalry among major players, each striving to gain market share through strategic pricing, technological innovation, and efficient service offerings.

Leading Markets & Segments in Latin America Commercial Aircraft Market

Brazil and Mexico are the dominant markets within Latin America, accounting for approximately xx% of the total market in 2025. This dominance is due to:

- Brazil: Strong domestic air travel demand, a robust economy (prior to recent economic uncertainty), and a large geographical area requiring extensive air connectivity.

- Mexico: Significant tourist inflow, growing middle class, and increasing international connectivity.

Segment Dominance:

- Passenger Aircraft: This segment constitutes the largest share (xx%) of the Latin America commercial aircraft market in 2025, reflecting the region's focus on passenger transport.

- Regional Jets: This segment is experiencing robust growth, driven by the increasing popularity of short-haul flights and LCC expansion. Freighters comprise a relatively smaller portion of the market.

Latin America Commercial Aircraft Market Product Developments

Recent years have witnessed the introduction of more fuel-efficient aircraft models equipped with advanced technologies. Manufacturers are focusing on incorporating features that enhance passenger experience and optimize operational efficiency. This includes lighter materials, improved aerodynamics, and advanced avionics systems. This adaptation to market needs (fuel efficiency and passenger comfort) is a key competitive advantage.

Key Drivers of Latin America Commercial Aircraft Market Growth

Several factors fuel market growth:

- Economic Growth: Expanding economies in several Latin American countries are driving an increase in air travel demand.

- Tourism Boom: The rising popularity of Latin American tourist destinations fuels demand for air transportation.

- Infrastructure Development: Investments in airport infrastructure across the region improve air connectivity.

Challenges in the Latin America Commercial Aircraft Market

Challenges include:

- Economic Volatility: Fluctuations in currency values and economic uncertainty in some countries pose risks to market growth.

- Infrastructure Gaps: Uneven distribution of airport infrastructure across the region presents logistical barriers.

- Regulatory Hurdles: Inconsistent regulatory frameworks across different nations can complicate market entry and operations.

Emerging Opportunities in Latin America Commercial Aircraft Market

The increasing adoption of advanced technologies such as sustainable aviation fuels and the growth of e-commerce presents significant long-term growth opportunities. Strategic partnerships between airlines and manufacturers, focused on fleet modernization and capacity expansion, are expected to further drive market growth.

Leading Players in the Latin America Commercial Aircraft Market Sector

Key Milestones in Latin America Commercial Aircraft Market Industry

- 2021: Embraer secures significant orders from Latin American airlines.

- 2022: Airbus announces plans to expand its presence in the region.

- 2023: New regulations aimed at improving safety standards are implemented in several countries.

Strategic Outlook for Latin America Commercial Aircraft Market Market

The Latin America commercial aircraft market offers significant long-term growth potential driven by economic expansion, rising tourism, and ongoing infrastructure developments. Strategic focus on fuel efficiency, technological innovation, and efficient service offerings will be key to achieving success in this competitive yet dynamic market. The market’s future is bright, contingent on consistent economic growth and supportive governmental policies.

Latin America Commercial Aircraft Market Segmentation

-

1. Geography

- 1.1. Brazil

- 1.2. Mexico

- 1.3. Colombia

- 1.4. Rest of Latin America

Latin America Commercial Aircraft Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Colombia

- 4. Rest of Latin America

Latin America Commercial Aircraft Market Regional Market Share

Geographic Coverage of Latin America Commercial Aircraft Market

Latin America Commercial Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Passenger Aircraft Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Brazil

- 5.1.2. Mexico

- 5.1.3. Colombia

- 5.1.4. Rest of Latin America

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Colombia

- 5.2.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Brazil Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Brazil

- 6.1.2. Mexico

- 6.1.3. Colombia

- 6.1.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Mexico Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Brazil

- 7.1.2. Mexico

- 7.1.3. Colombia

- 7.1.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Colombia Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Brazil

- 8.1.2. Mexico

- 8.1.3. Colombia

- 8.1.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Rest of Latin America Latin America Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Brazil

- 9.1.2. Mexico

- 9.1.3. Colombia

- 9.1.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Airbus SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Roste

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Embraer SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ATR

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Boeing Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Airbus SE

List of Figures

- Figure 1: Latin America Commercial Aircraft Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Commercial Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 2: Latin America Commercial Aircraft Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin America Commercial Aircraft Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Commercial Aircraft Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Commercial Aircraft Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Latin America Commercial Aircraft Market?

Key companies in the market include Airbus SE, Roste, Embraer SA, ATR, The Boeing Company.

3. What are the main segments of the Latin America Commercial Aircraft Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.55 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Passenger Aircraft Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Commercial Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Commercial Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Commercial Aircraft Market?

To stay informed about further developments, trends, and reports in the Latin America Commercial Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence