Key Insights

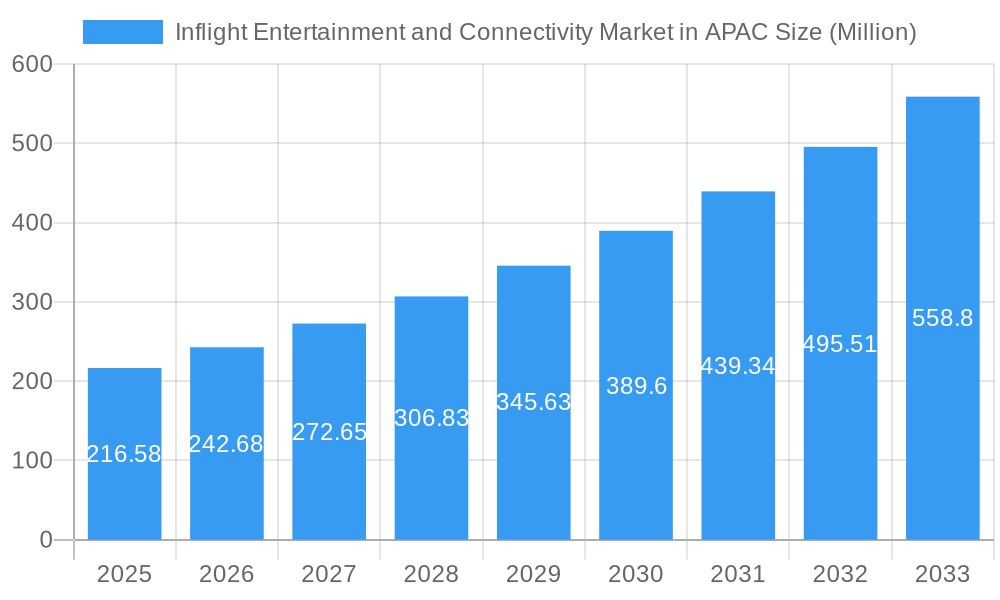

The Asia-Pacific (APAC) inflight entertainment and connectivity (IFE&C) market is experiencing robust growth, projected to reach \$216.58 million in 2025 and expand significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 12.02% reflects the increasing demand for enhanced passenger experiences and the proliferation of connected devices. Key drivers include rising disposable incomes, increased air travel, particularly in rapidly developing economies like China and India, and a growing preference for premium services, including high-speed internet access and diverse entertainment options. The market segmentation reveals strong growth across all segments. Line-fit installations are a significant portion of the market, reflecting the focus on new aircraft orders, while retrofit installations cater to the upgrading of existing fleets. Within classes, business and first-class cabins are driving demand for advanced IFE&C solutions, while the economy class segment is also witnessing increased adoption of basic connectivity packages. The hardware segment dominates in terms of revenue share, driven by ongoing investments in advanced satellite technology and cabin systems. However, content and connectivity services are witnessing rapid growth as airlines increasingly recognize the value proposition of comprehensive, engaging, and reliable digital services. Competition among established players like Honeywell, Thales, and Gogo, alongside emerging innovative companies, is fierce, resulting in continuous improvements in technology and service offerings.

Inflight Entertainment and Connectivity Market in APAC Market Size (In Million)

The APAC region’s unique characteristics fuel this market expansion. Countries like China and India, with their vast populations and burgeoning middle class, are significant contributors to market growth. Technological advancements such as higher bandwidth satellite systems (e.g., Ka-band) and the development of lighter, more efficient hardware are continuously improving the passenger experience, driving adoption and justifying premium pricing. Challenges remain, however; regulatory hurdles in some markets, infrastructure limitations in certain regions, and the need for robust cybersecurity measures all impact market expansion. Nevertheless, the long-term outlook for the APAC IFE&C market remains positive, with substantial opportunities for growth driven by evolving passenger expectations and technological innovations.

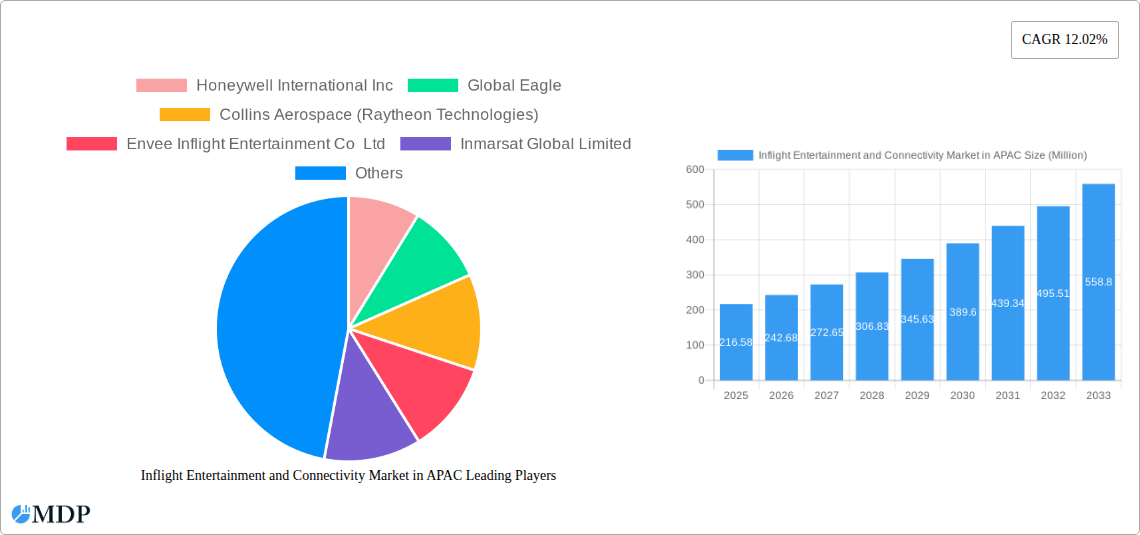

Inflight Entertainment and Connectivity Market in APAC Company Market Share

Inflight Entertainment and Connectivity Market in APAC: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Inflight Entertainment and Connectivity market in the Asia-Pacific region, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on the significant growth opportunities within this dynamic sector. The report meticulously analyzes market dynamics, industry trends, leading players, and future prospects, providing a data-driven roadmap for informed decision-making. The market size is projected to reach xx Million by 2033, showcasing substantial growth potential. Key segments analyzed include Line-fit and Retrofit installations across First Class, Business Class, and Economy Class cabins, encompassing Hardware, Content, and Connectivity product types.

Inflight Entertainment and Connectivity Market in APAC Market Dynamics & Concentration

The APAC inflight entertainment and connectivity market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, Global Eagle, and Collins Aerospace holding significant market share. However, the market is witnessing increasing competition from regional players and new entrants. Innovation is a key driver, fueled by advancements in high-speed broadband technologies, improved content delivery systems, and the integration of personalized entertainment options. Regulatory frameworks, particularly concerning data privacy and security, play a crucial role in shaping market dynamics. Product substitutes, such as personal devices and ground-based streaming services, pose a competitive challenge. End-user preferences are shifting towards personalized, on-demand content and seamless connectivity. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding service capabilities and geographic reach. Market share data for major players is shown below (2024 estimates):

- Honeywell International Inc: xx%

- Global Eagle: xx%

- Collins Aerospace: xx%

- Others: xx%

Inflight Entertainment and Connectivity Market in APAC Industry Trends & Analysis

The APAC inflight entertainment and connectivity market is experiencing robust growth, driven by factors such as rising disposable incomes, increased air travel, and the increasing demand for seamless connectivity during flights. Technological advancements, such as the adoption of 5G and satellite-based connectivity solutions, are significantly impacting market dynamics. Consumer preferences are evolving toward personalized, high-quality entertainment options and reliable internet access at altitude. The market is characterized by intense competition, with companies continuously innovating to offer superior services and enhance customer experiences. The CAGR for the forecast period (2025-2033) is projected at xx%, with market penetration expected to reach xx% by 2033. Specific trends include the rise of streaming services, the integration of AR/VR technologies, and the growing demand for in-flight e-commerce options. Competitive dynamics are shaped by factors like pricing strategies, technological capabilities, and partnership agreements.

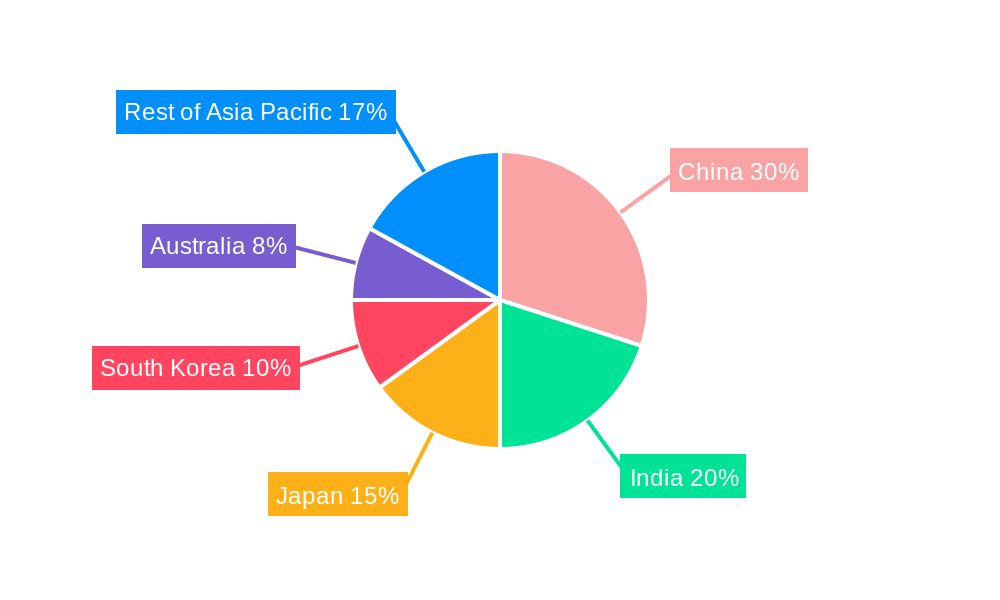

Leading Markets & Segments in Inflight Entertainment and Connectivity Market in APAC

China and India are the leading markets within APAC, driven by rapid economic growth, increasing air passenger numbers, and government initiatives to improve aviation infrastructure. Line-fit installations dominate the market, reflecting the integration of systems during aircraft manufacturing, but Retrofit solutions are growing significantly as airlines upgrade their fleets.

Dominant Segments:

- Region: China and India

- Fit: Line-fit (xx%) Retrofit (xx%)

- Class: Business Class (highest average spend per passenger)

- Product Type: Connectivity (Fastest growing segment)

Key Drivers:

- Economic Growth: High GDP growth in key markets drives increased air travel.

- Infrastructure Development: Investments in airport infrastructure facilitate seamless connectivity.

- Government Policies: Supportive regulatory environment promotes industry growth.

Inflight Entertainment and Connectivity Market in APAC Product Developments

Recent product innovations focus on enhancing connectivity speeds, improving content diversity and personalization, and integrating new technologies like augmented reality (AR) and virtual reality (VR) experiences. Competitive advantages are derived from superior technology, strategic partnerships with content providers, and efficient service delivery models. The market is witnessing a shift toward cloud-based platforms for content delivery, improving scalability and flexibility for airlines.

Key Drivers of Inflight Entertainment and Connectivity Market in APAC Growth

The market's growth is fueled by several key factors: advancements in satellite technology providing faster and more reliable internet connectivity in-flight; rising disposable incomes in the region leading to increased air travel and a higher demand for premium inflight services; supportive government regulations encouraging the adoption of advanced inflight entertainment and connectivity solutions; and the increasing demand for personalized entertainment options and seamless digital experiences among passengers.

Challenges in the Inflight Entertainment and Connectivity Market in APAC Market

Significant challenges include high initial investment costs for implementing advanced systems, the complexity of integrating different technologies within existing aircraft infrastructure, ensuring robust cybersecurity to protect sensitive passenger data, and navigating varying regulatory frameworks across different countries within APAC. Supply chain disruptions and the impact of economic fluctuations also pose ongoing concerns.

Emerging Opportunities in Inflight Entertainment and Connectivity Market in APAC

The integration of 5G technology promises significantly improved in-flight connectivity speeds, paving the way for advanced services like high-definition video streaming and real-time data applications. Strategic partnerships between airlines, technology providers, and content creators will be crucial in developing innovative solutions. Expansion into underserved markets and the development of cost-effective solutions will unlock significant opportunities in the APAC region.

Leading Players in the Inflight Entertainment and Connectivity Market in APAC Sector

- Honeywell International Inc

- Global Eagle

- Collins Aerospace (Raytheon Technologies)

- Envee Inflight Entertainment Co Ltd

- Inmarsat Global Limited

- Stellar Entertainment Grou

- Viasat Inc

- Safran SA

- Thales Group

- Kontron S&T AG

- Gogo LLC

- Panasonic Corporation

Key Milestones in Inflight Entertainment and Connectivity Market in APAC Industry

- 2020: Increased adoption of high-speed satellite internet services by major airlines.

- 2021: Launch of several new in-flight entertainment platforms with personalized content.

- 2022: Significant investments in 5G-ready infrastructure by major telecom providers.

- 2023: Growing partnerships between airlines and content providers for exclusive in-flight content.

- 2024: Several successful mergers and acquisitions in the inflight connectivity sector.

Strategic Outlook for Inflight Entertainment and Connectivity Market in APAC Market

The future of the APAC inflight entertainment and connectivity market looks bright, with continued growth driven by technological advancements, rising air travel, and increasing demand for advanced services. Strategic partnerships, investments in research and development, and a focus on customer experience will be crucial for success. Airlines and technology providers that successfully integrate innovative solutions and offer personalized experiences will capture a significant share of this rapidly expanding market.

Inflight Entertainment and Connectivity Market in APAC Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Content

- 1.3. Connectivity

-

2. Fit

- 2.1. Line-fit

- 2.2. Retrofit

-

3. Class

- 3.1. First Class

- 3.2. Business Class

- 3.3. Economy Class

Inflight Entertainment and Connectivity Market in APAC Segmentation By Geography

-

1. Country

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

Inflight Entertainment and Connectivity Market in APAC Regional Market Share

Geographic Coverage of Inflight Entertainment and Connectivity Market in APAC

Inflight Entertainment and Connectivity Market in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The First Class Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inflight Entertainment and Connectivity Market in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Content

- 5.1.3. Connectivity

- 5.2. Market Analysis, Insights and Forecast - by Fit

- 5.2.1. Line-fit

- 5.2.2. Retrofit

- 5.3. Market Analysis, Insights and Forecast - by Class

- 5.3.1. First Class

- 5.3.2. Business Class

- 5.3.3. Economy Class

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Country

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Eagle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Collins Aerospace (Raytheon Technologies)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Envee Inflight Entertainment Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inmarsat Global Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stellar Entertainment Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viasat Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thales Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kontron S&T AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gogo LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Panasonic Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Inflight Entertainment and Connectivity Market in APAC Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Fit 2025 & 2033

- Figure 5: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Fit 2025 & 2033

- Figure 6: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Class 2025 & 2033

- Figure 7: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Class 2025 & 2033

- Figure 8: Country Inflight Entertainment and Connectivity Market in APAC Revenue (Million), by Country 2025 & 2033

- Figure 9: Country Inflight Entertainment and Connectivity Market in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Fit 2020 & 2033

- Table 3: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Class 2020 & 2033

- Table 4: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Fit 2020 & 2033

- Table 7: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Class 2020 & 2033

- Table 8: Global Inflight Entertainment and Connectivity Market in APAC Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Inflight Entertainment and Connectivity Market in APAC Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inflight Entertainment and Connectivity Market in APAC?

The projected CAGR is approximately 12.02%.

2. Which companies are prominent players in the Inflight Entertainment and Connectivity Market in APAC?

Key companies in the market include Honeywell International Inc, Global Eagle, Collins Aerospace (Raytheon Technologies), Envee Inflight Entertainment Co Ltd, Inmarsat Global Limited, Stellar Entertainment Grou, Viasat Inc, Safran SA, Thales Group, Kontron S&T AG, Gogo LLC, Panasonic Corporation.

3. What are the main segments of the Inflight Entertainment and Connectivity Market in APAC?

The market segments include Product Type, Fit, Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 216.58 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The First Class Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inflight Entertainment and Connectivity Market in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inflight Entertainment and Connectivity Market in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inflight Entertainment and Connectivity Market in APAC?

To stay informed about further developments, trends, and reports in the Inflight Entertainment and Connectivity Market in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence