Key Insights

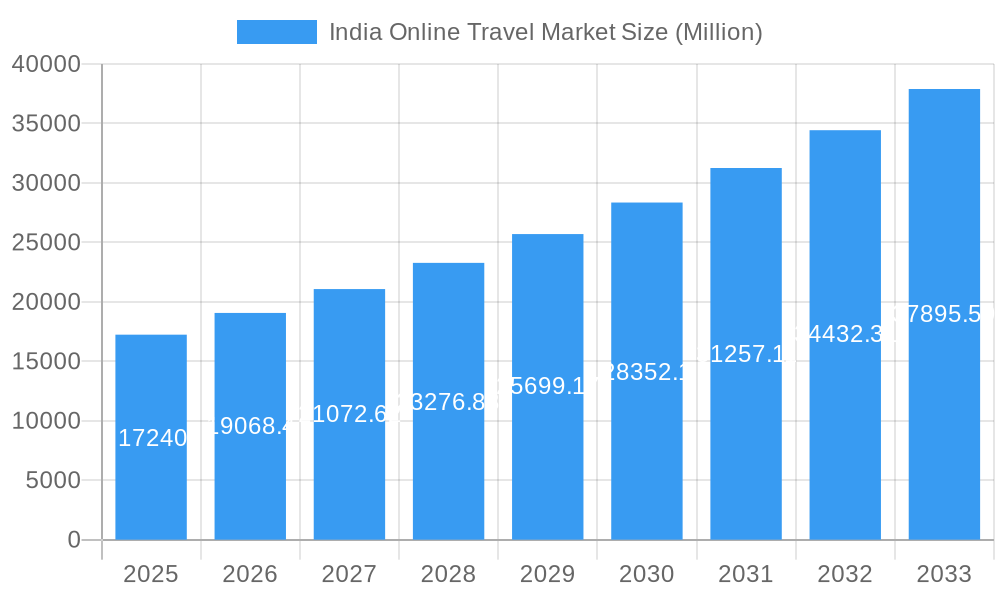

The India online travel market, valued at $17.24 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This surge is driven by increasing internet and smartphone penetration, a burgeoning middle class with greater disposable income, and a preference for convenient online booking platforms. Factors like improved digital infrastructure and the rising popularity of online travel agencies (OTAs) are further fueling market expansion. The market is segmented by service type (transportation, accommodation, packages, others), booking type (OTAs, direct suppliers), platform (desktop, mobile), and tour type (independent, group, package). The dominance of OTAs like MakeMyTrip, Cleartrip, and Booking.com is evident, alongside the significant contribution of direct bookings from travel suppliers. Mobile booking is gaining traction, reflecting the increasing mobile usage in India. Regional variations exist, with potentially higher growth in regions like North and West India due to a larger population and higher disposable incomes, though all regions will witness substantial growth. The market is also seeing a rise in customized travel packages targeting specific demographics, contributing to the overall market expansion.

India Online Travel Market Market Size (In Billion)

Growth in the coming years will be influenced by several factors. Increased competition among players necessitates innovative strategies for customer acquisition and retention. Government regulations concerning online travel platforms and data privacy could also influence market dynamics. Furthermore, fluctuating fuel prices and global economic uncertainties could present challenges to sustained growth. However, the long-term outlook remains positive, driven by the continuous growth of India's economy and its expanding tourism sector. The market’s strong growth trajectory indicates significant opportunities for established players and new entrants alike. Focusing on technological advancements, personalized customer experiences, and strategic partnerships will be key to success in this dynamic and competitive market.

India Online Travel Market Company Market Share

India Online Travel Market Report: 2019-2033 Forecast

Unlocking the Potential of India's Thriving Online Travel Sector: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the India online travel market, covering the period 2019-2033. We delve into market dynamics, industry trends, leading players, and future growth opportunities, offering actionable insights for businesses and stakeholders. With a focus on key segments like transportation, accommodation, and vacation packages, the report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the market's trajectory until 2033. The report incorporates data on key players including Cleartrip, Yatra, Booking.com, MakeMyTrip, ixigo, EaseMyTrip, Thomas Cook Ltd, Oyo Rooms, Expedia, Cox & Kings Ltd, and Via.com. This report is essential for anyone seeking a detailed understanding of this rapidly expanding market.

India Online Travel Market Market Dynamics & Concentration

The Indian online travel market is a dynamic arena characterized by fierce competition, rapid technological advancements, and a constantly evolving regulatory landscape. Market concentration is moderate, with several major players commanding significant market share, while a multitude of smaller companies compete within niche segments. MakeMyTrip and Booking.com, for example, hold substantial market positions, while others such as Cleartrip and Yatra have established themselves as key players. A projected market share breakdown for 2025 illustrates this: MakeMyTrip (25%), Booking.com (20%), Cleartrip (15%), Yatra (10%), and Others (30%). However, these figures are estimates and subject to market fluctuations.

Innovation is paramount, with companies continuously developing new technologies and services to enhance the user experience and broaden their offerings. Regulatory shifts, particularly concerning data privacy and consumer protection, significantly impact market dynamics. The emergence of alternative travel planning methods, including independent planning via social media and peer-to-peer platforms, presents a challenge to traditional online travel agencies (OTAs). Consumer trends highlight a growing preference for mobile booking and personalized travel experiences. Furthermore, the market has experienced a moderate level of mergers and acquisitions (M&A) activity in recent years (approximately xx deals between 2019 and 2024), leading to market consolidation and fostering further innovation.

India Online Travel Market Industry Trends & Analysis

The Indian online travel market exhibits robust growth, fueled by rising disposable incomes, expanding internet and smartphone penetration, and a burgeoning middle class with a strong desire to travel. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Technological disruptions, including the rise of AI-powered travel planning tools and personalized recommendations, are reshaping the customer journey. Consumer preferences are shifting toward convenient, mobile-first booking platforms, customized travel packages, and value-added services. The competitive landscape remains highly dynamic, with established players consistently innovating and new entrants continuously emerging. Market penetration of online travel bookings is anticipated to increase substantially, reaching approximately xx% by 2033 from the current xx%.

Leading Markets & Segments in India Online Travel Market

The online travel market in India is experiencing robust growth across all segments. However, certain segments are emerging as leaders, driven by distinct factors:

- Dominant Service Type: Transportation (airlines and railways) holds the largest market share due to high demand and ease of online booking.

- Dominant Booking Type: Online Travel Agencies (OTAs) dominate the market due to their comprehensive offerings and user-friendly platforms.

- Dominant Platform: Mobile platforms are rapidly surpassing desktop usage as the preferred method for booking due to increased mobile penetration and convenience.

- Dominant Tour Type: Independent travelers account for a significant share of the market as they value flexibility and customization.

Key Drivers:

- Economic Growth: Rising disposable incomes and increased spending power are fueling travel demand.

- Infrastructure Development: Investments in transportation infrastructure are enhancing connectivity and accessibility.

- Government Initiatives: Supportive government policies and initiatives promote tourism and digital adoption.

India Online Travel Market Product Developments

Recent innovations demonstrate a clear focus on enhancing the customer experience. This includes AI-powered chatbots for efficient customer support, personalized travel recommendations tailored to individual preferences, and the integration of virtual reality (VR) technology to offer immersive travel previews. These features not only enhance user experience and boost customer engagement but also provide a crucial competitive advantage. The market's commitment to technological advancements ensures services remain relevant and appealing to evolving customer expectations. The overarching goal is to deliver seamless and integrated travel planning solutions.

Key Drivers of India Online Travel Market Growth

The growth trajectory of the Indian online travel market is propelled by several interconnected factors: First, rising disposable incomes and the expansion of the middle class are directly translating into increased travel demand. Second, rapid technological advancements, particularly in mobile technology, have significantly simplified and broadened access to online travel booking. Finally, supportive government policies and tourism-promoting initiatives are providing further impetus to market expansion.

Challenges in the India Online Travel Market Market

Challenges include inconsistent internet connectivity in certain regions, concerns about data security and privacy, and the need to adapt to evolving customer expectations. The competitive landscape also poses a significant challenge, with companies vying for market share through aggressive pricing and promotional strategies. Regulatory hurdles and changing government policies pose further risks to the consistent market growth.

Emerging Opportunities in India Online Travel Market

Significant opportunities exist in expanding to underserved regions, catering to niche travel segments (e.g., adventure tourism, wellness tourism), and leveraging emerging technologies such as blockchain and AI for enhanced security and personalization. Strategic partnerships and collaborations with local businesses can further unlock untapped potential.

Leading Players in the India Online Travel Market Sector

- Cleartrip

- Yatra

- Booking.com

- MakeMyTrip

- ixigo

- EaseMyTrip

- Thomas Cook Ltd

- Oyo Rooms

- Expedia

- Cox & Kings Ltd

- Via.com

Key Milestones in India Online Travel Market Industry

- August 2023: Skyscanner launched its Hindi language experience, significantly expanding its reach within the Indian market.

- August 2023: MakeMyTrip, in collaboration with the Ministry of Tourism, launched a "Travellers' Map of India," showcasing diverse destinations and boosting domestic tourism.

Strategic Outlook for India Online Travel Market Market

The future of the Indian online travel market presents significant opportunities for growth, driven by continuous technological innovation, expanding internet accessibility, and the sustained rise of the middle class. Strategic opportunities abound in areas such as personalized travel experiences, strategic alliances and partnerships, and targeted marketing campaigns designed to reach diverse customer segments. The key to success lies in delivering seamless, secure, and personalized travel solutions that cater to the ever-evolving needs and preferences of the Indian traveler.

India Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Other Service Types

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

-

4. Tour Type

- 4.1. Tour Group

- 4.2. Package Traveller

India Online Travel Market Segmentation By Geography

- 1. India

India Online Travel Market Regional Market Share

Geographic Coverage of India Online Travel Market

India Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Winter Sports and Outdoor Recreation

- 3.3. Market Restrains

- 3.3.1. Unpredictable Weather Conditions

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Tour Type

- 5.4.1. Tour Group

- 5.4.2. Package Traveller

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yatra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MakeMyTrip

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ixigo*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EaseMyTrip

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oyo Rooms

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expedia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cox & Kings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Via com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 5: India Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: India Online Travel Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: India Online Travel Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: India Online Travel Market Revenue Million Forecast, by Tour Type 2020 & 2033

- Table 10: India Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Online Travel Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the India Online Travel Market?

Key companies in the market include Cleartrip, Yatra, Booking com, MakeMyTrip, ixigo*List Not Exhaustive, EaseMyTrip, Thomas Cook Ltd, Oyo Rooms, Expedia, Cox & Kings Ltd, Via com.

3. What are the main segments of the India Online Travel Market?

The market segments include Service Type, Booking Type, Platform, Tour Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Winter Sports and Outdoor Recreation.

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in India is Driving the Market.

7. Are there any restraints impacting market growth?

Unpredictable Weather Conditions.

8. Can you provide examples of recent developments in the market?

August 2023: Skyscanner launched its Hindi language experience across all its products and services to penetrate deeper into the Indian market. Skyscanner acts as a one-stop solution for travelers looking to compare ticket fares, hotel tariffs, and intra-city commutes by curating data from its partner Online Travel Agent (OTA) sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Online Travel Market?

To stay informed about further developments, trends, and reports in the India Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence