Key Insights

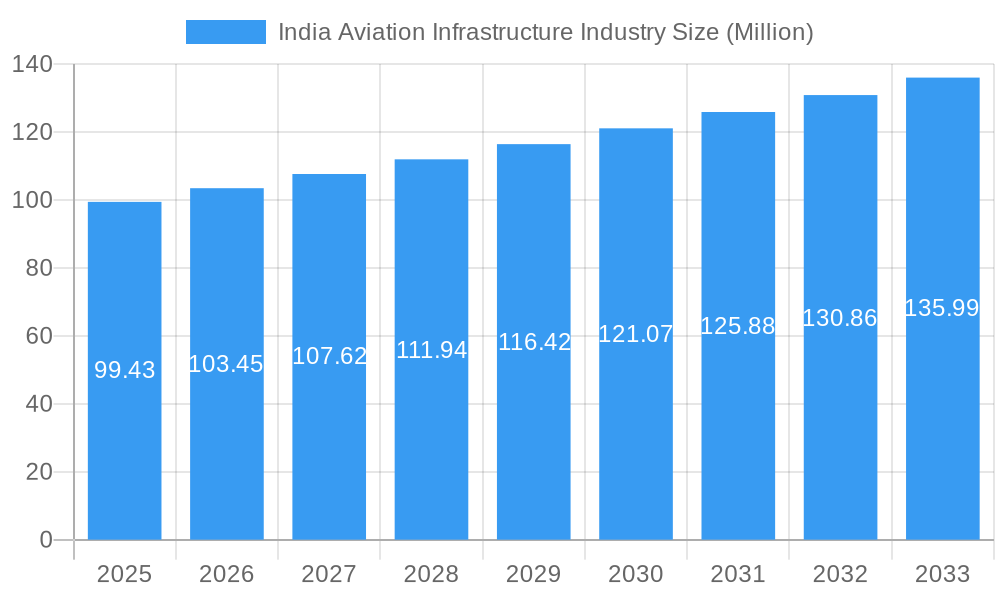

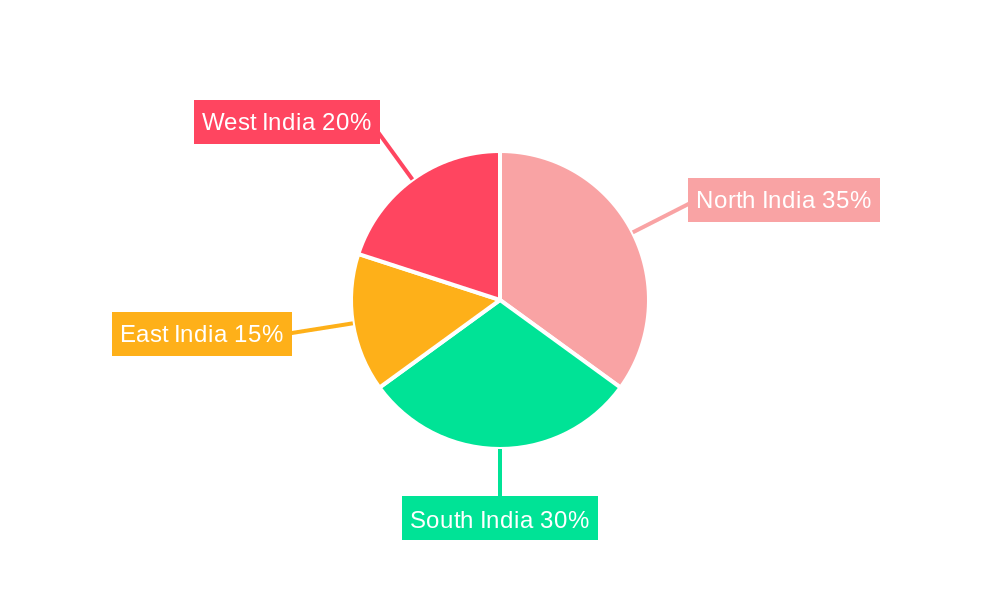

The India aviation infrastructure market, valued at $99.43 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, India's burgeoning air passenger traffic, fueled by a growing middle class and increasing disposable incomes, necessitates significant airport infrastructure development. Secondly, the government's proactive initiatives to modernize and expand airport capacity, including investments in new greenfield airports and upgrades to existing brownfield facilities, significantly contribute to market growth. The rising demand for air travel, coupled with the government's focus on improving air connectivity across the country, particularly in underserved regions, creates a fertile ground for expansion. Key segments driving growth include commercial airport infrastructure, which accounts for the largest share, followed by the construction of new greenfield airports. Leading players like Adani Group, L&T Construction, and GMR Infrastructure are actively involved in shaping this market. Regional variations exist, with North and South India expected to dominate due to higher passenger volumes and existing infrastructure.

India Aviation Infrastructure Industry Market Size (In Million)

However, the market also faces certain challenges. Land acquisition complexities and environmental concerns often delay project implementation. Funding constraints for some projects and potential fluctuations in global economic conditions could also influence market growth. Nevertheless, the overall outlook remains positive given the strong underlying growth drivers and the government’s commitment to improving India’s aviation infrastructure. The market is expected to reach approximately $137 million by 2033, signifying significant investment opportunities for industry participants. This sustained growth trajectory necessitates a strategic approach by companies to navigate regulatory hurdles and effectively address the aforementioned constraints to fully capitalize on the immense potential of the Indian aviation infrastructure market.

India Aviation Infrastructure Industry Company Market Share

India Aviation Infrastructure Industry Report: 2019-2033 Forecast

Unlocking the Potential of India's Soaring Aviation Sector: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Indian aviation infrastructure industry, encompassing market dynamics, leading players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for stakeholders across the value chain. The report uses 2025 as its estimated year and leverages extensive data analysis to predict market trends and provide actionable recommendations. The Indian aviation sector is poised for explosive growth, presenting significant opportunities for investors, developers, and operators. This report will equip you with the knowledge needed to navigate this dynamic market and capitalize on its potential. Market size values are expressed in Millions.

India Aviation Infrastructure Industry Market Dynamics & Concentration

The Indian aviation infrastructure market exhibits a moderately concentrated landscape, dominated by large players like Adani Group, GMR Infrastructure Limited, and the Airports Authority of India (AAI). However, the market is witnessing increased participation from private players and increased M&A activity driving consolidation. Innovation is primarily focused on enhancing operational efficiency, improving passenger experience, and adopting sustainable practices. Regulatory frameworks, while evolving, play a significant role in shaping market dynamics, particularly concerning airport development and operations. Product substitutes are limited, given the specialized nature of aviation infrastructure. End-user trends indicate a growing demand for improved connectivity, especially in Tier-2 and Tier-3 cities. M&A activity has increased significantly in recent years, with xx deals recorded between 2019 and 2024, resulting in a shift in market share amongst major players. The market share of the top 3 players in 2024 is estimated at xx%.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Efficiency, Passenger Experience, Sustainability

- Regulatory Impact: Significant influence on development and operations

- M&A Activity: xx deals between 2019-2024

India Aviation Infrastructure Industry Industry Trends & Analysis

The Indian aviation infrastructure market is experiencing robust growth, driven by increasing passenger traffic, government initiatives promoting regional connectivity, and substantial investments in airport modernization and expansion. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, indicating significant market expansion. Technological disruptions, such as the adoption of AI and IoT in airport operations, are streamlining processes and enhancing efficiency. Consumer preferences are shifting towards seamless travel experiences, driving investments in advanced passenger services. The market penetration of advanced technologies like biometric security systems is steadily increasing, contributing to enhanced security and convenience. Competitive dynamics are characterized by both cooperation and competition, with players collaborating on infrastructure projects while simultaneously vying for market share.

Leading Markets & Segments in India Aviation Infrastructure Industry

The commercial airport segment dominates the Indian aviation infrastructure market, accounting for xx% of the total market value in 2024. This dominance is fueled by the rapid expansion of air travel within the country. Greenfield airport construction presents substantial growth potential, particularly in regions with limited existing infrastructure.

- Dominant Airport Type: Commercial Airport (xx% market share in 2024)

- Dominant Infrastructure Type: Terminals

- Dominant Construction Type: Brownfield Airport (due to existing infrastructure)

- Key Drivers:

- Government initiatives (e.g., UDAN scheme) to improve regional connectivity

- Rapid growth of air passenger traffic

- Investments in airport modernization and expansion

- Economic growth and increasing disposable incomes

India Aviation Infrastructure Industry Product Developments

Recent product innovations focus on enhancing operational efficiency, sustainability, and passenger experience. This includes the adoption of advanced technologies like AI-powered baggage handling systems, improved passenger information systems, and sustainable building materials for airport construction. These innovations offer competitive advantages by improving operational efficiency, lowering costs, and enhancing the passenger experience. The market is witnessing a growing adoption of smart technologies aimed at optimizing airport operations and enhancing security.

Key Drivers of India Aviation Infrastructure Industry Growth

Several factors fuel the growth of India's aviation infrastructure sector. Firstly, rapid economic growth and rising disposable incomes lead to increased air travel demand. Secondly, government policies like the UDAN scheme aim to enhance regional connectivity, stimulating infrastructure development in underserved areas. Finally, technological advancements are improving efficiency and creating a more streamlined passenger experience.

Challenges in the India Aviation Infrastructure Industry Market

The industry faces several challenges. Land acquisition for new projects remains a significant hurdle, leading to project delays and cost overruns. Supply chain disruptions can impact construction timelines and budgets, impacting overall project delivery. Intense competition for contracts and limited resources further present challenges. The estimated impact of these challenges on project costs is around xx% in 2024.

Emerging Opportunities in India Aviation Infrastructure Industry

The sector presents significant opportunities. The increasing adoption of sustainable technologies, such as solar power for airport operations, provides a competitive edge and aligns with global sustainability goals. Strategic partnerships between public and private entities can help leverage resources and expertise for large-scale infrastructure projects. Expansion into underserved markets and development of new airports in Tier 2 and 3 cities present substantial growth potential.

Leading Players in the India Aviation Infrastructure Industry Sector

- Adani Group

- L&T Construction

- GVK Industries Limited

- AIC Infrastructures Pvt Ltd

- Tarmat Ltd

- GMR Infrastructure Limited

- Taneja Aerospace & Aviation Ltd

- AIRPORTS AUTHORITY OF INDIA

- Gujarat State Aviation Infrastructure Company Limited

- Tata Sons Private Limited

Key Milestones in India Aviation Infrastructure Industry Industry

- 2020: Government announces expanded UDAN scheme, leading to increased regional airport development.

- 2021: Adani Group wins bids for multiple airport privatization projects.

- 2022: Significant investments made in upgrading existing airport infrastructure across India.

- 2023: Launch of several greenfield airport projects.

- 2024: Increased adoption of sustainable technologies in airport construction and operations.

Strategic Outlook for India Aviation Infrastructure Industry Market

The Indian aviation infrastructure market is poised for continued robust growth, driven by increasing air passenger traffic, government support, and technological advancements. Strategic partnerships, investments in sustainable infrastructure, and expansion into underserved markets will be crucial for success. The focus on enhancing passenger experience and improving operational efficiency will define the future of the sector. The market is expected to reach xx Million by 2033.

India Aviation Infrastructure Industry Segmentation

-

1. Airport Construction Type

- 1.1. Greenfield Airport

- 1.2. Brownfield Airport

-

2. Airport Type

- 2.1. Commercial Airport

- 2.2. Military Airport

- 2.3. General Aviation Airport

-

3. Infrastructure Type

- 3.1. Terminal

- 3.2. Control Tower

- 3.3. Taxiway and Runway

- 3.4. Apron

- 3.5. Hangar

- 3.6. Other Infrastructure Type

India Aviation Infrastructure Industry Segmentation By Geography

- 1. India

India Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of India Aviation Infrastructure Industry

India Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Construction Type

- 5.1.1. Greenfield Airport

- 5.1.2. Brownfield Airport

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Commercial Airport

- 5.2.2. Military Airport

- 5.2.3. General Aviation Airport

- 5.3. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.3.1. Terminal

- 5.3.2. Control Tower

- 5.3.3. Taxiway and Runway

- 5.3.4. Apron

- 5.3.5. Hangar

- 5.3.6. Other Infrastructure Type

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Airport Construction Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADANI GROUP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L&T Construction

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GVK Industries Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AIC Infrastructures Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tarmat Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GMR Infrastructure Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taneja Aerospace & Aviation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AIRPORTS AUTHORITY OF INDIA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gujarat State Aviation Infrastructure Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tata Sons Private Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADANI GROUP

List of Figures

- Figure 1: India Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Aviation Infrastructure Industry Share (%) by Company 2025

List of Tables

- Table 1: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Construction Type 2020 & 2033

- Table 2: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: India Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 4: India Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Construction Type 2020 & 2033

- Table 6: India Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: India Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 8: India Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Aviation Infrastructure Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the India Aviation Infrastructure Industry?

Key companies in the market include ADANI GROUP, L&T Construction, GVK Industries Limited, AIC Infrastructures Pvt Ltd, Tarmat Ltd, GMR Infrastructure Limited, Taneja Aerospace & Aviation Ltd, AIRPORTS AUTHORITY OF INDIA, Gujarat State Aviation Infrastructure Company Limited, Tata Sons Private Limite.

3. What are the main segments of the India Aviation Infrastructure Industry?

The market segments include Airport Construction Type, Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.43 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the India Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence