Key Insights

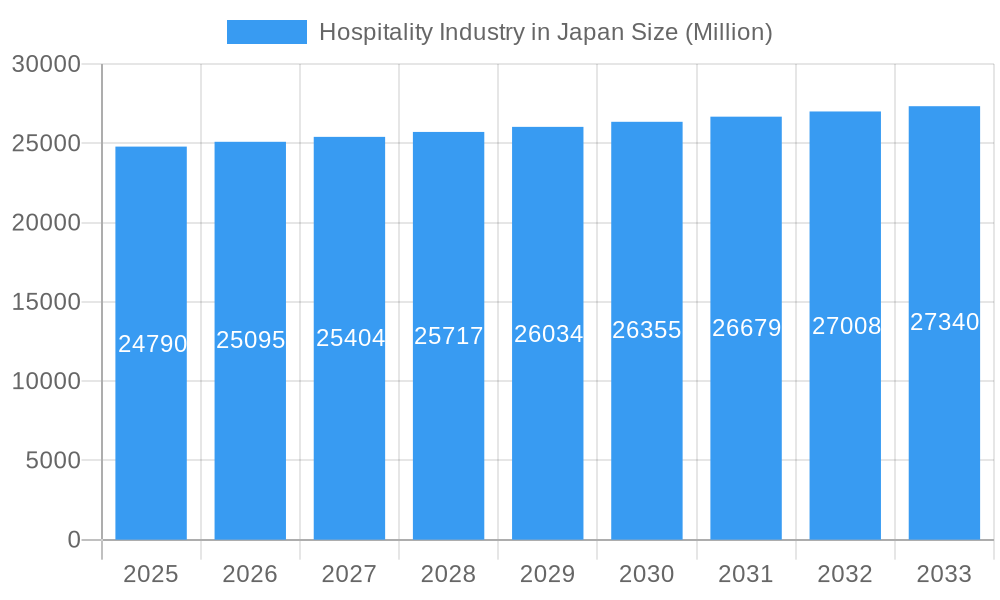

The Japanese hospitality industry, valued at $24.79 billion in 2025, exhibits a modest yet steady growth trajectory, projected to maintain a 1.18% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This growth is driven by several factors. Firstly, the ongoing increase in inbound tourism, despite fluctuations, contributes significantly to demand, particularly within the budget and mid-scale hotel segments. Secondly, Japan's robust domestic travel market provides a stable base for occupancy rates. Expansion of business travel and increasing disposable incomes among Japanese consumers further bolster the industry. However, the market faces challenges. Competition from alternative accommodation options like Airbnb and vacation rentals exerts pressure on traditional hotels. Furthermore, the relatively high operating costs in major urban centers, combined with potential labor shortages, constrain profit margins for many hospitality businesses. Segmentation reveals a diverse landscape; while luxury hotels cater to high-spending tourists and business travelers, budget and economy hotels are vital for price-sensitive travelers and contribute a significant portion of the overall market share. The prevalence of both chain and independent hotels indicates a dynamic interplay between established brands and local businesses.

Hospitality Industry in Japan Market Size (In Billion)

Geographic distribution showcases regional disparities. Kanto and Kansai, Japan's most populous regions, naturally command the largest market share, reflecting higher tourist traffic and business activity. However, growing domestic tourism and targeted investments in infrastructure are likely to stimulate growth in other regions like Chubu and Kyushu over the forecast period. The presence of major hotel chains like Tokyu Hotels, Prince Hotels & Resorts, and international players such as Marriott International, alongside numerous independent hotels, highlights a competitive yet evolving landscape requiring continuous adaptation to changing consumer preferences and market dynamics. The industry's future hinges on the successful balance between cost efficiency, service excellence, and strategic investments in technology and sustainability.

Hospitality Industry in Japan Company Market Share

Japan's Hospitality Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of Japan's dynamic hospitality market, projecting robust growth from 2025 to 2033. Targeting industry stakeholders, investors, and strategic planners, it offers actionable insights into market trends, leading players, and emerging opportunities within the ¥XX Million market. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), providing a complete picture of this lucrative sector.

Hospitality Industry in Japan Market Dynamics & Concentration

Japan's hospitality industry presents a dynamic landscape shaped by a complex interplay of market forces. While market concentration remains relatively high, with a few major players dominating key segments, the emergence of independent hotels and boutique accommodations is significantly challenging this established order. This competitive tension is further fueled by the rapid growth of alternative accommodations such as Airbnb and other short-term rentals, particularly impacting the budget and mid-range sectors. Technological innovation plays a crucial role, driving advancements in booking platforms, smart room technology, personalized guest experiences, and operational efficiency. The regulatory environment, while generally supportive of the industry, is subject to ongoing review and adjustments concerning fair competition, labor practices, and sustainability standards. Consumer trends indicate a growing preference for unique, authentic experiences, sustainable travel options, and seamless digital interactions. Mergers and acquisitions (M&A) activity has shown a moderate level of consolidation in recent years, predominantly focused on the budget and mid-scale segments.

- Market Share (2024 Estimate): Top 5 players hold approximately 60% market share, indicating significant concentration at the top.

- M&A Deal Count (2019-2024): [Insert precise number of deals here] deals, reflecting a consistent, albeit not dramatically escalating, level of consolidation within the sector.

- Innovation Drivers: Technological advancements, evolving consumer preferences (including a rising demand for sustainable and personalized travel), and government initiatives promoting sustainable tourism.

- Regulatory Framework: The regulatory framework encompasses tourism promotion strategies, labor laws, environmental regulations, and increasingly stringent guidelines concerning fair competition and data privacy.

Hospitality Industry in Japan Industry Trends & Analysis

The Japanese hospitality market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of [Insert precise CAGR percentage here]% during the forecast period (2025-2033). This growth trajectory is driven by several key factors: a substantial increase in inbound tourism fueled by improved infrastructure and more lenient visa policies, a burgeoning domestic leisure travel sector driven by rising disposable incomes, and the transformative impact of technological disruptions. These technological advancements are not only streamlining operations but also fundamentally reshaping customer interactions through online booking platforms, mobile check-in, and personalized digital services. The increasing demand for personalized service, unique experiences, and sustainable travel options presents significant opportunities for niche players and innovative business models. However, competitive intensity remains high, particularly in the budget and mid-scale segments, where price competition is a dominant factor. The market penetration of online booking platforms is approaching [Insert precise percentage here]%, highlighting the significant adoption of digital channels across all market segments.

Leading Markets & Segments in Hospitality Industry in Japan

The Tokyo metropolitan area remains the dominant market, accounting for approximately xx% of total revenue, driven by a high concentration of business and leisure travelers. However, regional markets are experiencing growth, fueled by infrastructure improvements and government initiatives to promote domestic tourism.

By Segment:

- Budget and Economy Hotels: This segment dominates due to price sensitivity and strong demand from budget travelers. Key drivers include cost-effective operations and strategic locations.

- Mid and Upper Mid-scale Hotels: This segment is experiencing steady growth, driven by the expanding middle class and growing demand for comfortable accommodations with added amenities.

- Luxury Hotels: This segment benefits from increasing high-net-worth individuals and growing demand for luxury experiences. Key drivers include unique offerings, personalized service, and strategic locations.

- Service Apartments: This niche segment is experiencing modest growth, catering to long-stay business travelers and families.

By Type:

- Chain Hotels: These dominate due to brand recognition, economies of scale, and consistent service standards.

- Independent Hotels: These are gaining traction by focusing on unique experiences and catering to specific clientele.

Hospitality Industry in Japan Product Developments

Recent innovations include the integration of smart technologies (e.g., mobile check-in, personalized room settings), emphasis on sustainable practices, and the development of unique experiences tailored to specific customer segments. These developments highlight a market focus on efficiency, personalized service, and environmental responsibility. The emphasis is on enhancing the guest journey while optimizing operations for hotels of all sizes.

Key Drivers of Hospitality Industry in Japan Growth

The growth of Japan's hospitality sector is propelled by a confluence of factors. Firstly, a significant surge in both inbound and outbound tourism, facilitated by improvements in infrastructure and streamlined visa processes. Secondly, a robust expansion of the domestic travel market, driven by increasing disposable incomes and a growing preference for leisure activities. Finally, technological advancements are playing a critical role in optimizing operational efficiency and enhancing the overall customer experience, as evidenced by the widespread adoption of online booking platforms and the integration of mobile technologies throughout the guest journey.

Challenges in the Hospitality Industry in Japan Market

The industry faces challenges including a tight labor market, resulting in higher labor costs and staff shortages, which impacts service quality. Supply chain disruptions, particularly in the post-pandemic era, affect procurement of goods and services. Intense competition across all segments necessitates continuous innovation and efficient operations to maintain profitability.

Emerging Opportunities in Hospitality Industry in Japan

The integration of technology to personalize guest experiences represents a major opportunity. Strategic partnerships with local businesses and tour operators enhance offerings and boost revenue streams. Targeting niche markets, such as sustainable tourism and experiential travel, presents significant growth potential. Expansion into underserved regional markets is also an attractive avenue for growth.

Leading Players in the Hospitality Industry in Japan Sector

- Tokyu Hotels

- Prince Hotels & Resorts

- APA Hotels & Resorts

- Toyoko Inn Co Ltd

- Okura Nikko Hotels

- Marriott International

- Super Hotel Co Ltd

- JR Hotel Group

- Route-Inn Hotels

- Hotel Mystays

Key Milestones in Hospitality Industry in Japan Industry

- October 20, 2022: Hyatt's opening of the Fuji Speedway Hotel, its first Unbound Collection property in Japan, marked a significant step in offering luxury accommodations with unique experiences.

- July 25, 2022: YOTEL's announcement of its first Japanese hotel in Ginza, Tokyo, highlighted the growing integration of innovative technology and potentially robotic staff within the hospitality sector.

- [Add more recent milestones here - Include dates and brief descriptions of significant events, such as new hotel openings, technological advancements, or policy changes impacting the industry.]

Strategic Outlook for Hospitality Industry in Japan Market

The Japanese hospitality industry is poised for significant growth, driven by increasing tourism, technological advancements, and evolving consumer preferences. Strategic opportunities lie in embracing technology, focusing on sustainable practices, and creating unique, personalized experiences. Expansion into regional markets and strategic partnerships with local businesses will further unlock the immense potential of this dynamic sector.

Hospitality Industry in Japan Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in Japan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Japan Regional Market Share

Geographic Coverage of Hospitality Industry in Japan

Hospitality Industry in Japan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Number of Tourists is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tokyu Hotels

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Prince Hotels & Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 APA Hotels & Resorts

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toyoko Inn Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Okura Nikko Hotels

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marriott International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Super Hotel Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JR Hotel Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Route-Inn Hotels

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hotel Mystays**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tokyu Hotels

List of Figures

- Figure 1: Global Hospitality Industry in Japan Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Japan Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Japan Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Japan Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Japan Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Japan Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Japan Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Japan Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Japan Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Japan Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Japan Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Japan Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Japan Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Japan Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Japan Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Japan Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Japan Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Japan Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Japan Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Japan Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Japan Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Japan Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Japan Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Japan Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Japan Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Japan Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Japan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Japan Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Japan Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Japan Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Japan Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Japan Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Japan Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Japan Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Japan Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Japan Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Japan Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Japan Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Japan Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Japan Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Japan Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Japan Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Japan Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Japan Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Japan Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Japan Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Japan?

The projected CAGR is approximately 1.18%.

2. Which companies are prominent players in the Hospitality Industry in Japan?

Key companies in the market include Tokyu Hotels, Prince Hotels & Resorts, APA Hotels & Resorts, Toyoko Inn Co Ltd, Okura Nikko Hotels, Marriott International, Super Hotel Co Ltd, JR Hotel Group, Route-Inn Hotels, Hotel Mystays**List Not Exhaustive.

3. What are the main segments of the Hospitality Industry in Japan?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism Sector is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Number of Tourists is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Operational Costs are Restraining the Market.

8. Can you provide examples of recent developments in the market?

On October 20, 2022, Hyatt expanded its portfolio of hotels in Japan with the opening of the Fuji Speedway Hotel in Shizuoka, the first Unbound Collection by Hyatt property in the country. The hotel features 120 rooms, including 21 suites, with private balconies offering views of the Fuji Speedway race circuit or Mount Fuji.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Japan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Japan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Japan?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Japan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence