Key Insights

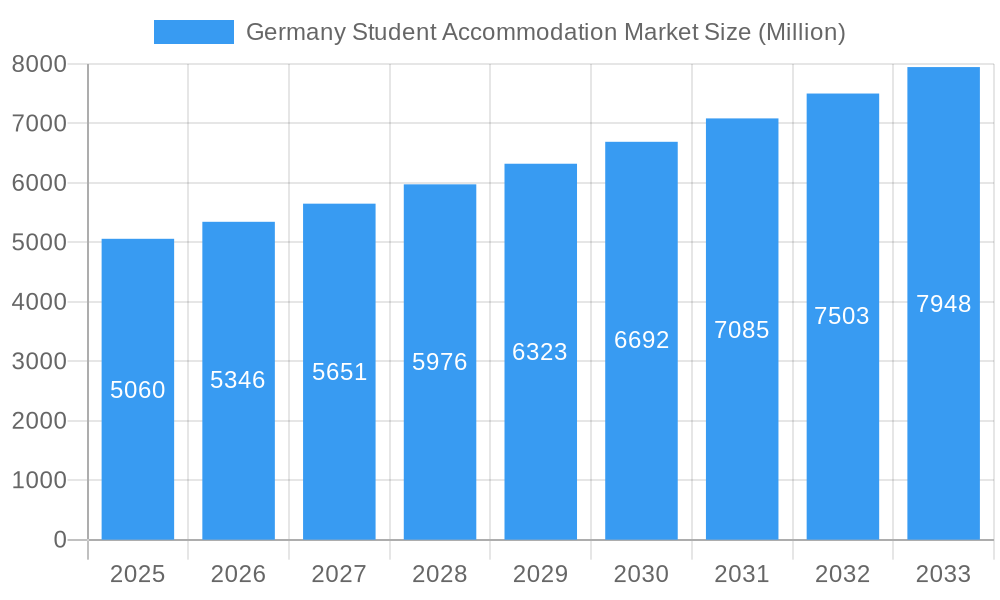

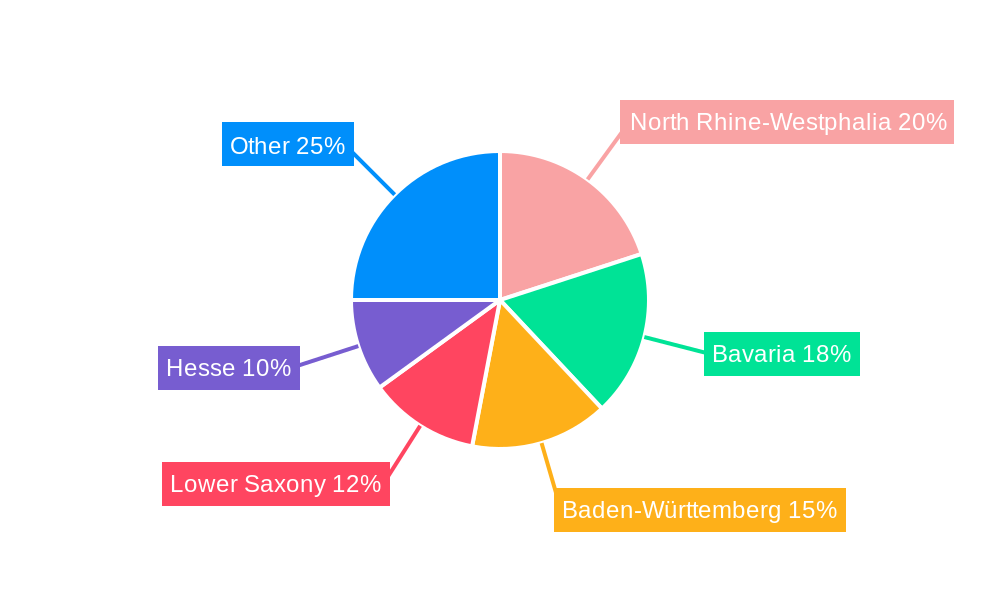

The German student accommodation market, valued at €5.06 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.45% from 2025 to 2033. This expansion is fueled by several key drivers. Rising student enrollment numbers across German universities, particularly in populous states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, create consistent demand. Furthermore, a growing preference for convenient, modern, and well-equipped accommodation options, including private student accommodation and halls of residence, is driving market segmentation and investment. The increasing popularity of online platforms for finding and booking student housing also contributes to market growth. While constraints such as limited housing supply in city centers and rising construction costs present challenges, the overall market outlook remains positive. The market is segmented by price (economy, mid-range, luxury), rental type (basic rent, total rent), booking mode (online, offline), accommodation type (halls of residence, rented houses/rooms, private student accommodation), and location (city center, periphery). Key players like Iam Expat, Amber Student, and Unite Group are capitalizing on these trends, offering diverse accommodation options to cater to the evolving needs of students. The mid-range segment is expected to dominate due to its affordability and availability, while online booking is gaining traction due to convenience and accessibility. The long-term outlook suggests sustained growth, driven by ongoing urbanization, increasing student populations, and the continued development of purpose-built student accommodation.

Germany Student Accommodation Market Market Size (In Billion)

The competitive landscape is dynamic, with both established players and new entrants vying for market share. Companies are focusing on improving their services, expanding their portfolios, and leveraging technology to enhance the student experience. The trend toward purpose-built student accommodation (PBSA) is particularly noteworthy, as developers are investing in modern, well-equipped facilities that meet the demands of today's students. The market’s geographic distribution reflects the concentration of universities across Germany, with major cities and university hubs experiencing higher demand and consequently higher rental prices. Future growth will hinge on addressing supply constraints, improving affordability, and further developing digital platforms to optimize the student housing search and booking process. This will require collaboration between universities, private developers, and government agencies to ensure adequate and accessible student accommodation for the growing student population.

Germany Student Accommodation Market Company Market Share

Germany Student Accommodation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany student accommodation market, covering historical data (2019-2024), the current market (2025), and future projections (2025-2033). It delves into market dynamics, leading players, key trends, and emerging opportunities, offering invaluable insights for investors, developers, and industry stakeholders. The report analyzes a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Germany Student Accommodation Market Dynamics & Concentration

The German student accommodation market is characterized by a moderately concentrated landscape, with a few large players alongside numerous smaller operators. Market share is largely dictated by location, with city centers commanding higher prices and occupancy rates. Innovation drivers include technological advancements in property management, online booking platforms, and the rise of co-living spaces. Regulatory frameworks, including building codes and zoning regulations, significantly impact development and supply. Product substitutes include private rentals and shared apartments, while end-user trends show a preference for modern, amenity-rich accommodation. Mergers and acquisitions (M&A) activity is notably increasing, with larger companies consolidating their market position.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

- Innovation Drivers: Smart home technology, sustainable building practices, and flexible lease terms are key innovations.

- Regulatory Landscape: Building permits, environmental regulations, and tenant protection laws significantly influence the market.

Germany Student Accommodation Market Industry Trends & Analysis

The German student accommodation market is experiencing robust growth fueled by several factors. Increased student enrollment, rising urbanization, and a growing preference for purpose-built student accommodation (PBSA) are driving demand. Technological disruptions, including online booking platforms and smart building management systems, are enhancing efficiency and convenience. Consumer preferences are shifting towards modern amenities, flexible lease options, and sustainable accommodations. Intense competition is pushing companies to innovate and offer competitive pricing and value-added services. Market penetration of online booking platforms is expected to reach xx% by 2033.

Leading Markets & Segments in Germany Student Accommodation Market

The city centers of major university hubs like Munich, Berlin, and Cologne dominate the market. Within segments:

- By Price: Mid-range accommodation holds the largest market share, followed by economy and luxury segments.

- By Rent Type: Total rent (inclusive of utilities and services) is the preferred option among students.

- By Mode: Online bookings are increasing in popularity, yet offline channels remain significant.

- By Accommodation Type: Rented houses or rooms and private student accommodation are leading segments, with Halls of Residence holding a substantial portion of the market.

- By Location: City Centre accommodation commands premium pricing due to proximity to universities and city amenities.

Key Drivers:

- Strong economic growth in major cities.

- Well-developed public transportation infrastructure.

- Government support for student housing initiatives.

Germany Student Accommodation Market Product Developments

Recent product developments focus on enhancing student experience and sustainability. Smart building technology, co-living spaces with shared amenities, and eco-friendly designs are gaining traction. These innovations cater to the evolving demands of students and improve operational efficiency for providers. The market is seeing a rise in flexible lease options and value-added services, enhancing the overall student experience.

Key Drivers of Germany Student Accommodation Market Growth

Several factors contribute to market growth:

- Increased Student Enrollment: A rising number of students fuels demand.

- Urbanization: Students prefer living in urban centers close to universities.

- Government Initiatives: Support for student housing projects further boosts the market.

- Technological Advancements: Online platforms and smart building technology improve efficiency.

Challenges in the Germany Student Accommodation Market

Challenges include:

- High Construction Costs: Rising construction costs in major cities can limit supply.

- Regulatory Hurdles: Complex permitting processes can delay development projects.

- Competition: Intense competition among providers necessitates continuous innovation.

- Shortage of Skilled Labor: Finding skilled construction workers poses a challenge.

Emerging Opportunities in Germany Student Accommodation Market

Long-term growth is fueled by:

- Expansion into Secondary Cities: Untapped potential exists in smaller university towns.

- Focus on Sustainability: Eco-friendly buildings and operational practices are gaining popularity.

- Technological Innovation: Further integration of smart technology offers efficiencies and enhanced living experiences.

Leading Players in the Germany Student Accommodation Market Sector

- Iam Expat

- Amber Student

- Studentendorf Schlachtensee

- Expatrio

- GSA Group

- Unite Group

- University living

- Uni Acco

Key Milestones in Germany Student Accommodation Market Industry

- January 2023: International Campus acquired five student apartment blocks in Berlin, Frankfurt am Main, Hanover, and Vienna, representing a significant transaction in the German-speaking region.

- November 2022: Catella Residential Investment Management GmbH (CRIM) sold two student housing assets in Poland for more than USD 65.38 Million.

Strategic Outlook for Germany Student Accommodation Market Market

The German student accommodation market presents significant long-term growth potential. Strategic opportunities exist in developing sustainable, technologically advanced accommodations, expanding into secondary markets, and capitalizing on the increasing demand for flexible living options. Companies focusing on innovation and efficiency will be well-positioned to thrive in this dynamic market.

Germany Student Accommodation Market Segmentation

-

1. Accomodation Type

- 1.1. Halls of Residence

- 1.2. Rented Houses or Rooms

- 1.3. Private Student Accommodation

-

2. location

- 2.1. City Center

- 2.2. Periphery

-

3. Price

- 3.1. Economy

- 3.2. Mid-range

- 3.3. Luxury

-

4. Rent Type

- 4.1. Basic Rent

- 4.2. Total Rent

-

5. Mode

- 5.1. Online

- 5.2. Offline

Germany Student Accommodation Market Segmentation By Geography

- 1. Germany

Germany Student Accommodation Market Regional Market Share

Geographic Coverage of Germany Student Accommodation Market

Germany Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Cost of Living In Germany Affecting Student Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 5.1.1. Halls of Residence

- 5.1.2. Rented Houses or Rooms

- 5.1.3. Private Student Accommodation

- 5.2. Market Analysis, Insights and Forecast - by location

- 5.2.1. City Center

- 5.2.2. Periphery

- 5.3. Market Analysis, Insights and Forecast - by Price

- 5.3.1. Economy

- 5.3.2. Mid-range

- 5.3.3. Luxury

- 5.4. Market Analysis, Insights and Forecast - by Rent Type

- 5.4.1. Basic Rent

- 5.4.2. Total Rent

- 5.5. Market Analysis, Insights and Forecast - by Mode

- 5.5.1. Online

- 5.5.2. Offline

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iam Expat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amber Student

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Studentendorf Schlachtensee*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expatrio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GSA Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unite Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 University living

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uni Acco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Iam Expat

List of Figures

- Figure 1: Germany Student Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 2: Germany Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 3: Germany Student Accommodation Market Revenue Million Forecast, by Price 2020 & 2033

- Table 4: Germany Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 5: Germany Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 6: Germany Student Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Germany Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 8: Germany Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 9: Germany Student Accommodation Market Revenue Million Forecast, by Price 2020 & 2033

- Table 10: Germany Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 11: Germany Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 12: Germany Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Student Accommodation Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Germany Student Accommodation Market?

Key companies in the market include Iam Expat, Amber Student, Studentendorf Schlachtensee*List Not Exhaustive, Expatrio, GSA Group, Unite Group, University living, Uni Acco.

3. What are the main segments of the Germany Student Accommodation Market?

The market segments include Accomodation Type, location, Price, Rent Type, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Cost of Living In Germany Affecting Student Accommodation Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

January 2023: International Campus acquired five student apartment blocks from Allianz Real Estate and CBRE Investment Management. This acquisition was one of the largest transactions of an International Campus in German Speaking region. The properties are in Berlin, Frankfurt, am Main, Hanover, and Vienna.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Student Accommodation Market?

To stay informed about further developments, trends, and reports in the Germany Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence