Key Insights

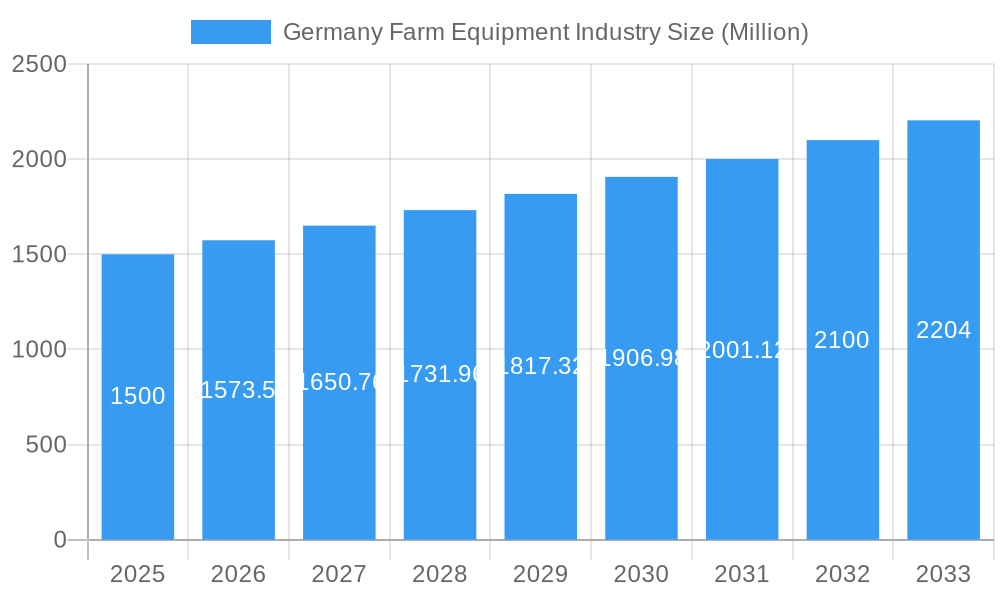

The German farm equipment market, currently valued at approximately €[Estimate based on Market Size XX and Value Unit Million; let's assume XX is 1500 for this example, making it €1500 million in 2025], is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 4.90% from 2025 to 2033. This growth is driven by several key factors. Increasing demand for high-efficiency farming technologies to optimize yields and reduce operational costs is a major contributor. Furthermore, government initiatives promoting sustainable agricultural practices and technological advancements in precision farming are significantly impacting market expansion. The rising adoption of automation and GPS-guided machinery is streamlining operations and improving productivity, thereby increasing market demand. Finally, the diverse agricultural landscape in Germany, encompassing various crops and livestock, necessitates a wide range of equipment, sustaining market growth across different horsepower segments.

Germany Farm Equipment Industry Market Size (In Billion)

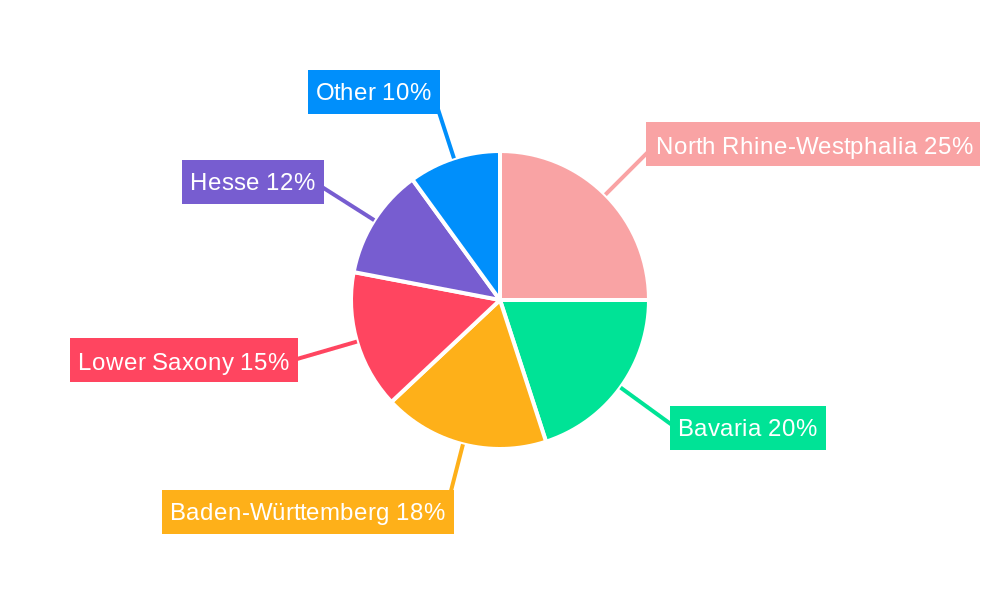

However, challenges remain. Fluctuations in agricultural commodity prices can impact investment decisions among farmers, potentially slowing down market growth. The increasing cost of raw materials and components used in farm equipment manufacturing can lead to price increases, potentially affecting market demand. Furthermore, stringent environmental regulations and emission standards are influencing the design and manufacturing processes of new farm equipment, presenting both opportunities and constraints for industry players. The market is segmented by horsepower (less than 50 HP, 51-100 HP, 101-150 HP, and above 150 HP), reflecting the diverse needs of German farms, ranging from small family-run operations to large-scale agricultural businesses. Key players like FMC Corporation, Deere & Company, Kubota Corporation, and Mahindra & Mahindra Ltd are actively competing in this dynamic market, adapting their offerings to meet evolving demands and regulatory requirements. The regions of North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse represent significant market hubs within Germany.

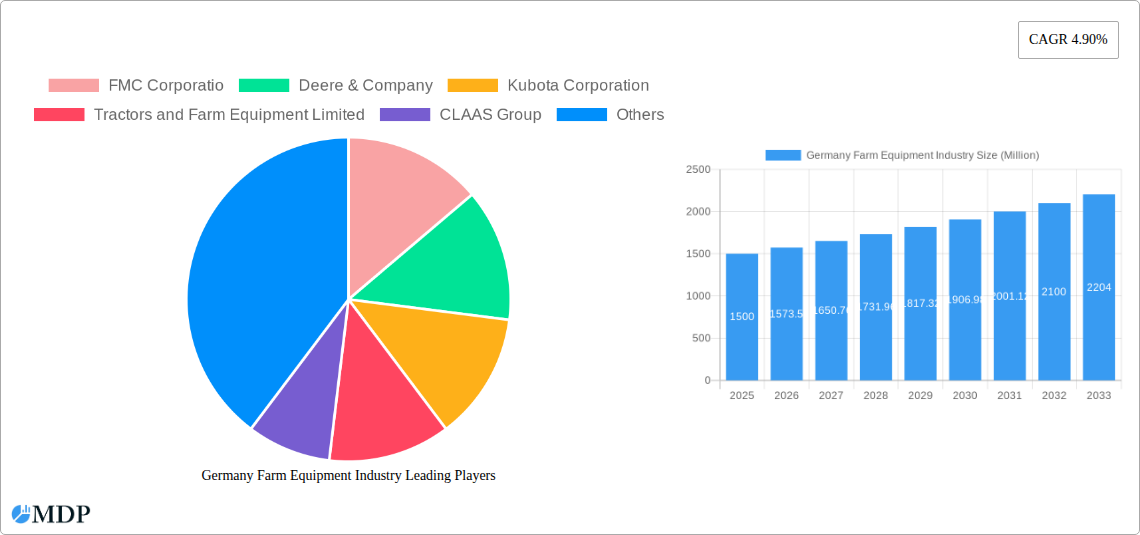

Germany Farm Equipment Industry Company Market Share

Germany Farm Equipment Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Germany farm equipment industry, encompassing market dynamics, trends, leading players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data and in-depth analysis to offer actionable insights into this dynamic market.

Germany Farm Equipment Industry Market Dynamics & Concentration

The German farm equipment market, valued at XX Million in 2024, exhibits a moderately concentrated landscape with several key players dominating market share. FMC Corporation, Deere & Company, and Kubota Corporation, among others, hold significant positions, influenced by factors like brand reputation, technological advancements, and distribution networks. Market concentration is further shaped by mergers and acquisitions (M&A) activity, with approximately xx M&A deals recorded between 2019 and 2024. Innovation is a crucial driver, fueled by the demand for automation, precision farming technologies, and sustainable solutions. Stringent environmental regulations within Germany play a significant role, pushing manufacturers to develop environmentally friendly equipment. Product substitution is minimal, with traditional farm equipment remaining dominant, though the integration of precision technologies and data analytics is steadily transforming the industry. End-user trends favor increased efficiency, reduced operating costs, and enhanced yields.

- Market Share: Deere & Company (xx%), Kubota Corporation (xx%), CNH Industrial NV (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Precision farming, automation, sustainability

Germany Farm Equipment Industry Industry Trends & Analysis

The German farm equipment market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing agricultural output, government support for modernization of farming practices, and rising adoption of technologically advanced equipment. Technological disruptions are significantly influencing the market, with the integration of IoT (Internet of Things), AI (Artificial Intelligence), and GPS technology enhancing efficiency and productivity. Consumer preferences are shifting towards higher-performance, fuel-efficient, and technologically advanced machinery. Competitive dynamics are characterized by intense rivalry among established players, ongoing innovation, and increasing focus on providing comprehensive solutions beyond individual equipment. Market penetration of precision farming technologies is increasing steadily, with an estimated xx% penetration rate in 2024.

Leading Markets & Segments in Germany Farm Equipment Industry

While data on specific regional dominance isn't available, the overall German market demonstrates strong performance across different segments. The analysis of horsepower segments reveals a diverse demand:

- Less than 50 HP: This segment caters to smaller farms and specialized applications. Key drivers include affordability, suitability for smaller land holdings, and ease of operation. Its market share is estimated to be xx%.

- 51-100 HP: This is a widely used segment, ideal for medium-sized farms. Key drivers include versatility, balance between performance and cost, and suitability for a range of tasks. Its market share is estimated to be xx%.

- 101-150 HP: This segment targets larger farms requiring higher power and productivity. Key drivers include higher efficiency, capacity for larger-scale operations, and ability to handle heavier tasks. Its market share is estimated to be xx%.

- Above 150 HP: This high-power segment focuses on large-scale commercial farming operations. Key drivers include high productivity, ability to handle extensive land, and suitability for intensive farming practices. Its market share is estimated to be xx%.

The dominant segment is likely the 51-100 HP category due to the prevalence of medium-sized farms in Germany.

Germany Farm Equipment Industry Product Developments

Recent innovations include the increasing integration of GPS-guided systems, automated steering, and data analytics capabilities within farm equipment. These advancements enhance precision, optimize resource utilization, and improve overall farm productivity. The focus is on developing machines that cater to the specific needs of different farming practices, encompassing specialized equipment for vineyards, orchards, and other unique agricultural environments. This aligns with market demands for efficiency, sustainability, and cost-effectiveness. The award-winning New Holland Straddle tractor concept highlights the innovation in addressing the unique challenges of narrow vineyards.

Key Drivers of Germany Farm Equipment Industry Growth

Several factors contribute to the growth of the German farm equipment market:

- Technological advancements: Precision farming, automation, and data analytics significantly enhance efficiency and productivity.

- Government policies: Subsidies and incentives supporting farm modernization drive demand for new equipment.

- Economic growth: A stable economy fosters investment in agricultural infrastructure and technology.

Challenges in the Germany Farm Equipment Industry Market

The industry faces challenges including:

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of components. This has been estimated to reduce market growth by xx% in the past year.

- Regulatory hurdles: Stringent environmental and safety regulations increase compliance costs for manufacturers.

- Competitive pressures: Intense competition among established and emerging players puts pressure on pricing and margins.

Emerging Opportunities in Germany Farm Equipment Industry

The market presents significant opportunities fueled by:

- Technological breakthroughs: Continued innovations in automation, AI, and data analytics will create new market segments.

- Strategic partnerships: Collaborations between equipment manufacturers and agricultural technology companies will generate innovative solutions.

- Market expansion: Focus on exports and expanding into new geographic areas will increase market reach.

Leading Players in the Germany Farm Equipment Industry Sector

- FMC Corporation

- Deere & Company

- Kubota Corporation

- Tractors and Farm Equipment Limited

- CLAAS Group

- AGCO Corporation

- CNH Industrial NV

- Mahindra & Mahindra Ltd

- Valent Biosciences Corporation

Key Milestones in Germany Farm Equipment Industry Industry

- December 2022: New Holland Agriculture's Straddle tractor wins the gold medal at the German Design Awards 2023. This signifies a major advancement in vineyard equipment technology.

- March 2022: Approximately 24,800 tractors were sold in Germany, indicating robust market demand.

Strategic Outlook for Germany Farm Equipment Industry Market

The German farm equipment market holds significant long-term growth potential driven by continuous technological advancements, increasing demand for efficient and sustainable farming solutions, and supportive government policies. Strategic partnerships and focused investments in research and development will be key to success in this evolving landscape. Expanding into niche markets and offering integrated solutions will provide significant competitive advantages.

Germany Farm Equipment Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Germany Farm Equipment Industry Segmentation By Geography

- 1. Germany

Germany Farm Equipment Industry Regional Market Share

Geographic Coverage of Germany Farm Equipment Industry

Germany Farm Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Agricultural Labour Cost

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporatio

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere & Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kubota Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tractors and Farm Equipment Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CLAAS Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CNH Industrial NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valent Biosciences Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 FMC Corporatio

List of Figures

- Figure 1: Germany Farm Equipment Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Farm Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Farm Equipment Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Farm Equipment Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Germany Farm Equipment Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Germany Farm Equipment Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Germany Farm Equipment Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Germany Farm Equipment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Germany Farm Equipment Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Germany Farm Equipment Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Germany Farm Equipment Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Germany Farm Equipment Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Germany Farm Equipment Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Germany Farm Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Farm Equipment Industry?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Germany Farm Equipment Industry?

Key companies in the market include FMC Corporatio, Deere & Company, Kubota Corporation, Tractors and Farm Equipment Limited, CLAAS Group, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Valent Biosciences Corporation.

3. What are the main segments of the Germany Farm Equipment Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Increasing Agricultural Labour Cost.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

December 2022: The Straddle tractor concept from New Holland Agriculture, a global brand of CNH Industrial, won the gold medal for "Excellent Product Design" at the German Design Awards 2023. The German Design Council (GDC) gives this prestigious award to products that display outstanding innovation and a seamless marriage of form and function. New Holland collaborated with the internationally renowned design firm Pininfarina to create the Straddle tractor concept. The tractor is intended to address the challenging constraints posed by narrow vineyards, known for producing high-quality, high-value wines from grapes grown in rows less than 1.5 meters wide, often on steep slopes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Farm Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Farm Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Farm Equipment Industry?

To stay informed about further developments, trends, and reports in the Germany Farm Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence