Key Insights

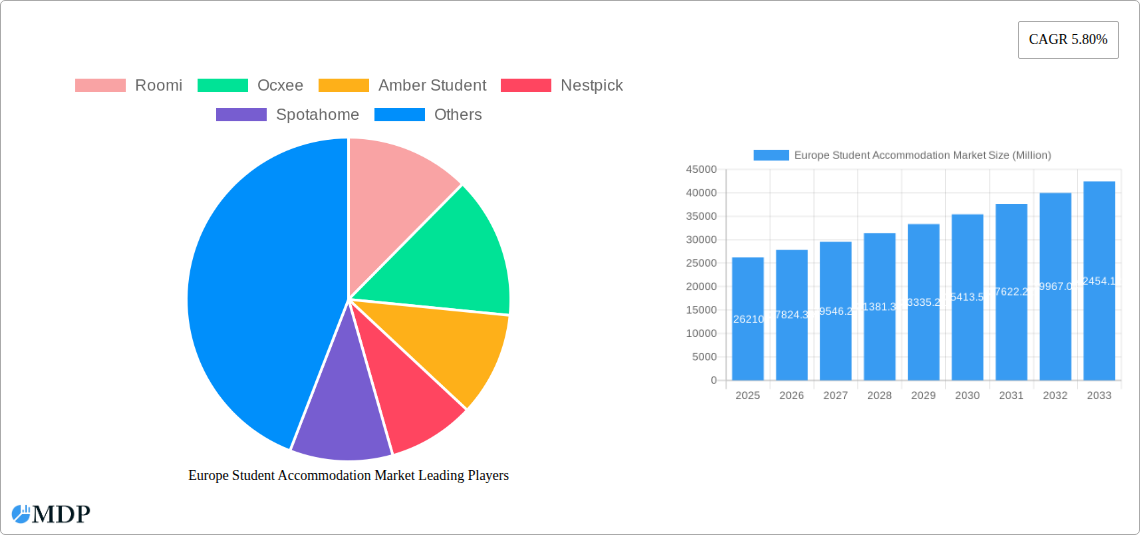

The European student accommodation market, valued at €26.21 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Increasing student enrollment across major European nations like Germany, France, and the UK fuels demand for diverse accommodation options, ranging from traditional halls of residence to privately rented apartments and rooms. The rising popularity of online platforms facilitating accommodation searches and bookings contributes significantly to market growth, enhancing transparency and streamlining the process for students. Furthermore, a growing preference for convenient city-center locations and a shift towards flexible rental agreements (both basic and total rent options) further shape market dynamics. Competition is intense, with established players like Uniplaces and Housing Anywhere vying for market share alongside newer entrants offering innovative solutions. However, challenges such as fluctuating rental prices, particularly in prime city locations, and the availability of affordable housing in areas with high student populations, represent significant restraints to market expansion.

Europe Student Accommodation Market Market Size (In Billion)

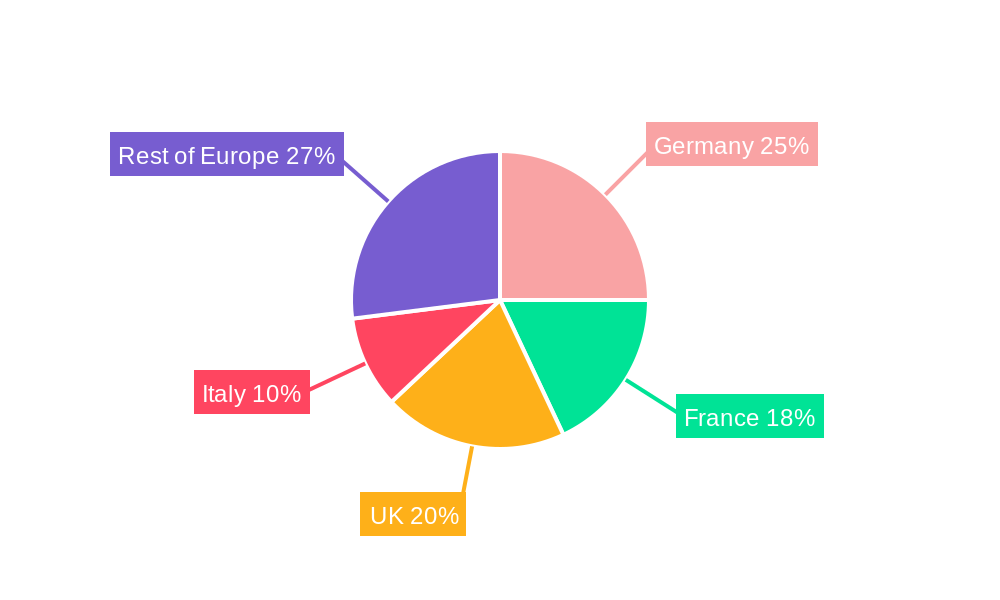

Market segmentation reveals key trends. The private student accommodation segment exhibits strong growth potential due to its flexibility and often superior amenities compared to traditional halls. City-center locations remain highly sought after, despite higher rental costs, reflecting students’ desire for proximity to universities and urban amenities. The increasing adoption of online booking platforms underscores the digital transformation of the sector, which contributes to greater accessibility and ease of finding suitable accommodation. Germany, France, and the UK are leading markets in Europe, exhibiting significant growth potential due to their large student populations and well-established educational institutions. The "Rest of Europe" segment also presents considerable opportunities, particularly in countries experiencing growth in higher education enrollment. Future growth will depend on addressing the challenges of affordability and sustainability in the student accommodation sector, particularly in light of growing concerns about the environmental impact of housing. Strategic partnerships between accommodation providers and universities may play a crucial role in enhancing affordability and accessibility.

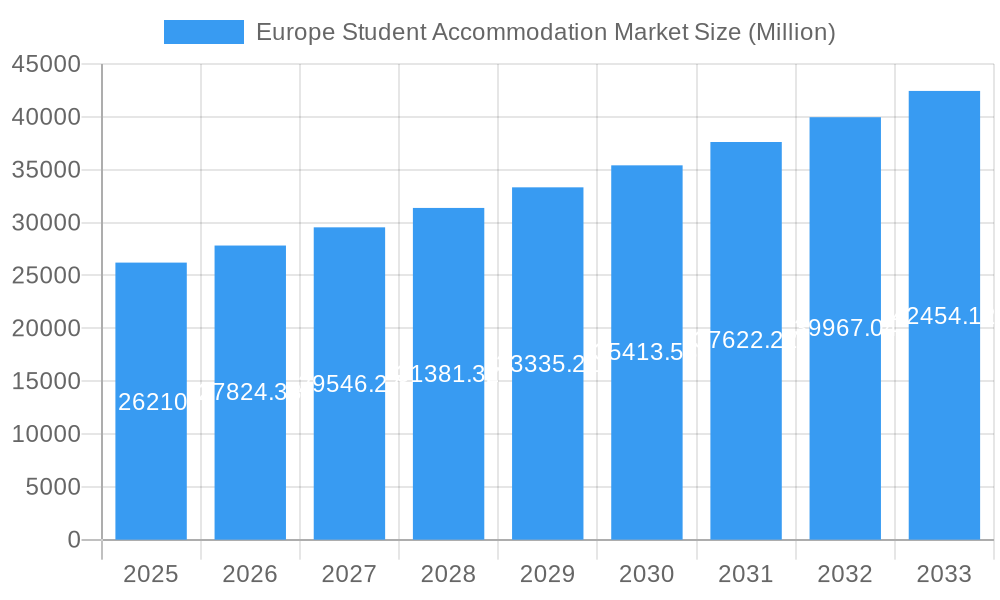

Europe Student Accommodation Market Company Market Share

Europe Student Accommodation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe student accommodation market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market. The report incorporates data from the historical period (2019-2024) and estimated data for 2025.

Europe Student Accommodation Market Market Dynamics & Concentration

The European student accommodation market is characterized by increasing demand driven by rising student enrollment and urbanization. Market concentration is moderate, with several large players alongside numerous smaller operators. Innovation is fueled by technological advancements, particularly in online booking platforms and property management systems. Regulatory frameworks vary across countries, impacting market access and operational costs. Product substitutes, such as shared apartments or homestays, exist but often lack the dedicated services and amenities offered by purpose-built student accommodation (PBSA). End-user trends show a preference for modern, well-equipped accommodations with convenient locations and communal facilities. M&A activity is significant, reflecting consolidation within the sector. For example, in October 2022, Unite Group’s acquisition of 180 Stratford signifies the ongoing investment in PBSA.

- Market Share: The top 5 players hold approximately xx% of the market share in 2025 (estimated).

- M&A Deal Counts: An estimated xx M&A deals were recorded in the European student accommodation market between 2019 and 2024.

- Innovation Drivers: Technological advancements in online booking, smart home technology, and sustainable building practices.

- Regulatory Frameworks: Varying regulations across European countries regarding building codes, rental agreements, and tenant rights.

Europe Student Accommodation Market Industry Trends & Analysis

The European student accommodation market is experiencing robust growth, driven by several key factors. Rising student populations across major European cities are increasing demand for quality student housing. The expanding higher education sector fuels the need for more accommodation options, particularly purpose-built student accommodation (PBSA) which offers amenities and services tailored to students’ needs. Technological disruptions are transforming the sector, with online platforms streamlining the booking process and improving accessibility. Consumer preferences are shifting towards modern, sustainable, and tech-enabled accommodations with social spaces and study areas. Competitive dynamics are intense, with established players facing increasing competition from new entrants and alternative accommodation providers. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% by 2033. This growth reflects the increasing preference for purpose-built student accommodation over traditional rental options.

Leading Markets & Segments in Europe Student Accommodation Market

Germany, the UK, and France are the leading markets for student accommodation in Europe, driven by large student populations and well-established higher education institutions. The UK market enjoys high demand given its renowned universities. France also benefits from numerous educational institutions. Germany’s substantial student numbers and robust economy contribute to market leadership. Within these countries, city centre locations command higher rents than peripheral areas, reflecting convenience and access to educational resources. Private student accommodation is the fastest-growing segment, driven by the rising demand for high-quality, purpose-built accommodations with tailored amenities and services.

- By Accommodation Type: Private Student Accommodation is the dominant segment.

- By Location: City Centre locations command the highest rents.

- By Rent Type: Total rent (including utilities and services) is the most common payment structure.

- By Mode: Online booking is increasingly prevalent.

- By Country: Germany, UK, and France are leading markets.

Key Drivers:

- Germany: Strong economy, high student enrollment, robust infrastructure.

- UK: Prestigious universities, high international student population, well-developed market.

- France: Large student population, many universities, government support for higher education.

Europe Student Accommodation Market Product Developments

Recent product innovations focus on enhancing the student experience through technology integration, sustainable designs, and flexible lease options. Smart home technology, co-working spaces, and communal areas are becoming standard features in modern student accommodation. The emphasis on creating communities within student housing complexes is a key trend. This focus on the student experience offers a competitive advantage.

Key Drivers of Europe Student Accommodation Market Growth

Several factors are driving the growth of the European student accommodation market. The increasing number of students pursuing higher education is a primary driver. Economic growth in several European countries boosts disposable incomes, enabling students to afford better housing. Government initiatives promoting access to higher education also contribute to market expansion. Technological advancements are facilitating market growth through innovative online platforms and management systems.

Challenges in the Europe Student Accommodation Market Market

The European student accommodation market faces several challenges. Fluctuations in student enrollment can impact occupancy rates. Strict building regulations and planning permissions can hinder development. Competition from alternative accommodation providers and rising construction costs pose ongoing challenges. These factors can lead to increased rental costs and potentially reduced profitability for operators.

Emerging Opportunities in Europe Student Accommodation Market

The long-term outlook for the European student accommodation market is positive. Technological innovations such as AI-powered property management systems and smart building technologies create opportunities for increased efficiency and improved tenant experiences. Strategic partnerships between developers and educational institutions facilitate the expansion of PBSA. The increasing focus on sustainability presents opportunities for developers to incorporate eco-friendly designs and technologies into new student accommodation projects.

Leading Players in the Europe Student Accommodation Market Sector

- Roomi

- Ocxee

- Amber Student

- Nestpick

- Spotahome

- Casita

- Housing Anywhere

- Homelike

- UniAcco

- UniPlaces

- Yugo

Key Milestones in Europe Student Accommodation Market Industry

- October 2022: Unite Group acquires 180 Stratford, a 178-unit property in Stratford, East London, for GBP 71 Million, expanding its reach into the young professionals market. At the time of acquisition, Unite Group operated 1,700 student beds and had two student developments in its pipeline.

- January 2022: Patrizia SE invests EUR 314 Million in a Danish student accommodation portfolio, comprising PBSA assets in Copenhagen and Aarhus.

Strategic Outlook for Europe Student Accommodation Market Market

The European student accommodation market presents significant opportunities for growth and innovation. Continued investment in PBSA, driven by increasing student populations and the preference for high-quality accommodations, will shape market dynamics. Technological advancements will continue to transform the sector, streamlining operations and enhancing the student experience. Strategic partnerships and mergers & acquisitions will likely consolidate the market and drive further growth. The focus on sustainability and community building will be paramount in attracting students and investors.

Europe Student Accommodation Market Segmentation

-

1. Accomodation Type

- 1.1. Halls of Residence

- 1.2. Rented Houses or Rooms

- 1.3. Private Student Accomodation

-

2. location

- 2.1. City Centre

- 2.2. Periphery

-

3. Rent Type

- 3.1. Basic Rent

- 3.2. Total Rent

-

4. Mode

- 4.1. Online

- 4.2. Offline

Europe Student Accommodation Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Student Accommodation Market Regional Market Share

Geographic Coverage of Europe Student Accommodation Market

Europe Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Restaurants and Bars in the Industry; Increase in the Number of Tourist Attractions and Activities

- 3.3. Market Restrains

- 3.3.1 Inadequate Research and Development

- 3.3.2 Unpredictability of the Market

- 3.4. Market Trends

- 3.4.1. Percentage of Young Adults in Education Affecting Europe Student Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 5.1.1. Halls of Residence

- 5.1.2. Rented Houses or Rooms

- 5.1.3. Private Student Accomodation

- 5.2. Market Analysis, Insights and Forecast - by location

- 5.2.1. City Centre

- 5.2.2. Periphery

- 5.3. Market Analysis, Insights and Forecast - by Rent Type

- 5.3.1. Basic Rent

- 5.3.2. Total Rent

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roomi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ocxee

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amber Student

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestpick

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Spotahome

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Casita

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Housing Anywhere

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Homelike*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UniAcco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 UniPlaces

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yugo

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Roomi

List of Figures

- Figure 1: Europe Student Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 2: Europe Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 3: Europe Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 4: Europe Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 5: Europe Student Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 7: Europe Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 8: Europe Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 9: Europe Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 10: Europe Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Student Accommodation Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Student Accommodation Market?

Key companies in the market include Roomi, Ocxee, Amber Student, Nestpick, Spotahome, Casita, Housing Anywhere, Homelike*List Not Exhaustive, UniAcco, UniPlaces, Yugo.

3. What are the main segments of the Europe Student Accommodation Market?

The market segments include Accomodation Type, location, Rent Type, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Restaurants and Bars in the Industry; Increase in the Number of Tourist Attractions and Activities.

6. What are the notable trends driving market growth?

Percentage of Young Adults in Education Affecting Europe Student Accommodation Market.

7. Are there any restraints impacting market growth?

Inadequate Research and Development. Unpredictability of the Market.

8. Can you provide examples of recent developments in the market?

October 2022: Unite Group leading developer of student accommodation, acquired 180 Stratford, a 178-unit purpose-to-build-to-rent property in Stratford, East London for GBP 71 Mn. This acquisition will enable the group to test its operational capability to extend its accommodation offer to young professionals In the Stratford market united group during October 2022 was operating 1,700 student beds with two student development in its pipeline.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Student Accommodation Market?

To stay informed about further developments, trends, and reports in the Europe Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence