Key Insights

The European Satellite Attitude and Orbit Control System (AOCS) market is poised for significant expansion, propelled by the escalating demand for sophisticated satellite technologies across diverse industries. The market, estimated at 291.2 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.96% from 2025 to 2033. This robust growth trajectory is underpinned by several key drivers. The increasing proliferation of compact, agile satellites, particularly within the dynamic NewSpace sector, is a primary catalyst. Segments focusing on satellites weighing 10-100kg and 100-500kg are anticipated to experience the most rapid growth, driven by the widespread adoption of CubeSats and microsatellites for Earth observation, communication, and navigation applications. Furthermore, the expanding commercial space industry in Europe is a major contributor to market expansion, with commercial applications such as environmental monitoring and precision agriculture stimulating investment in advanced AOCS solutions. Increased government and military expenditure on satellite-based surveillance and communication systems also significantly bolsters market growth. Finally, ongoing technological advancements in areas like enhanced sensors, more efficient actuators, and sophisticated control algorithms are elevating the capabilities and reliability of AOCS, thereby fostering wider market penetration.

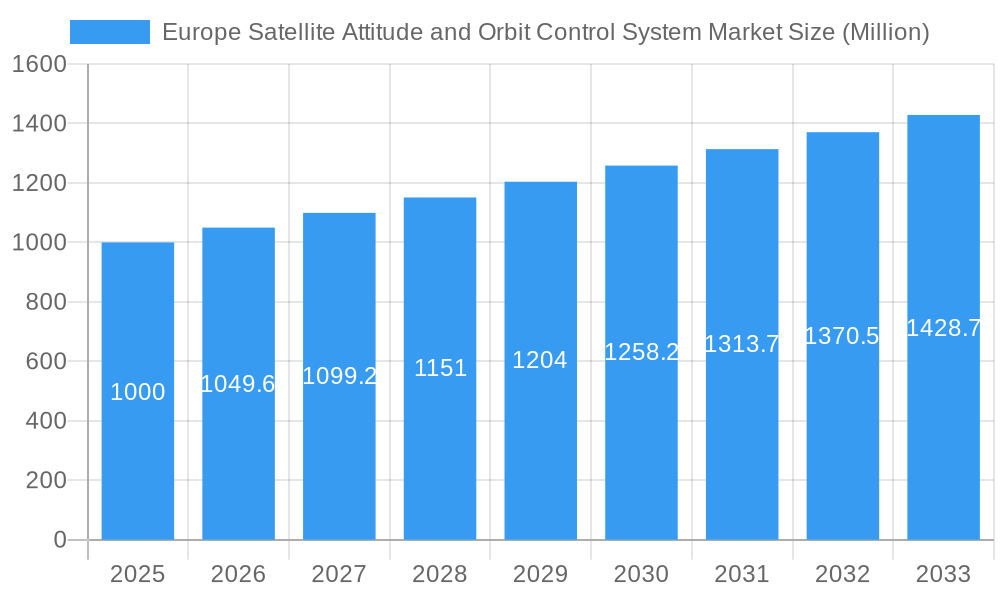

Europe Satellite Attitude and Orbit Control System Market Market Size (In Million)

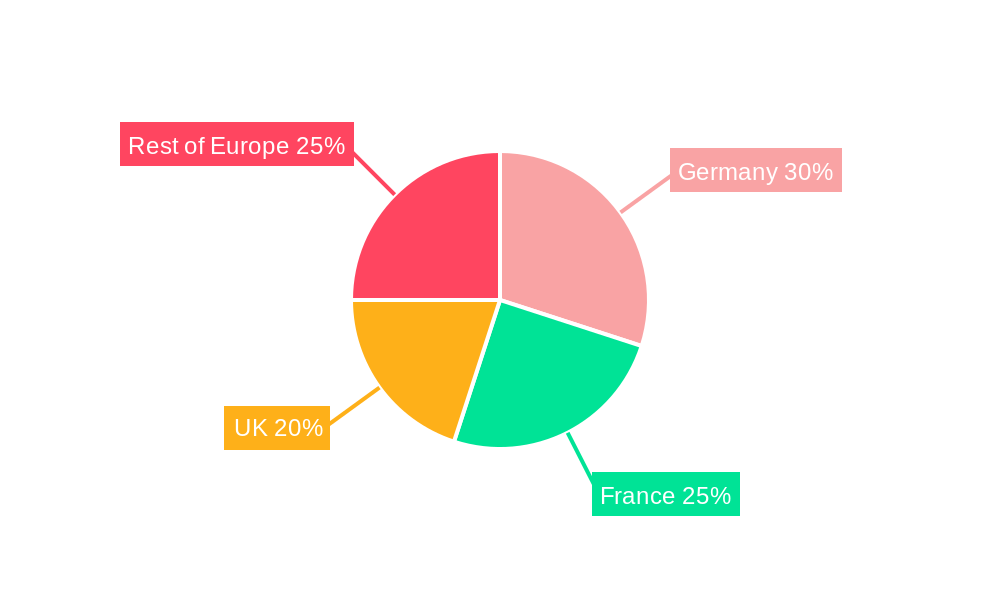

Despite the optimistic outlook, certain challenges may temper market expansion. The substantial development and production costs associated with cutting-edge AOCS technology, especially for larger satellite platforms (exceeding 1000kg), could present a restraining factor. Additionally, the escalating complexity of AOCS systems necessitates rigorous testing and validation protocols, contributing to increased overall costs and extended development timelines. Nevertheless, the long-term prospects for the European AOCS market remain exceptionally positive, fueled by continuous technological innovation, a rising cadence of satellite launches, and the growing demand for advanced satellite-derived services across a spectrum of sectors. Germany, France, and the United Kingdom currently lead the European market, benefiting from their established aerospace industries and substantial governmental backing for space research and development. This regional leadership is expected to persist, although other European nations may witness considerable growth due to their technological advancements and the cultivation of supportive space ecosystems.

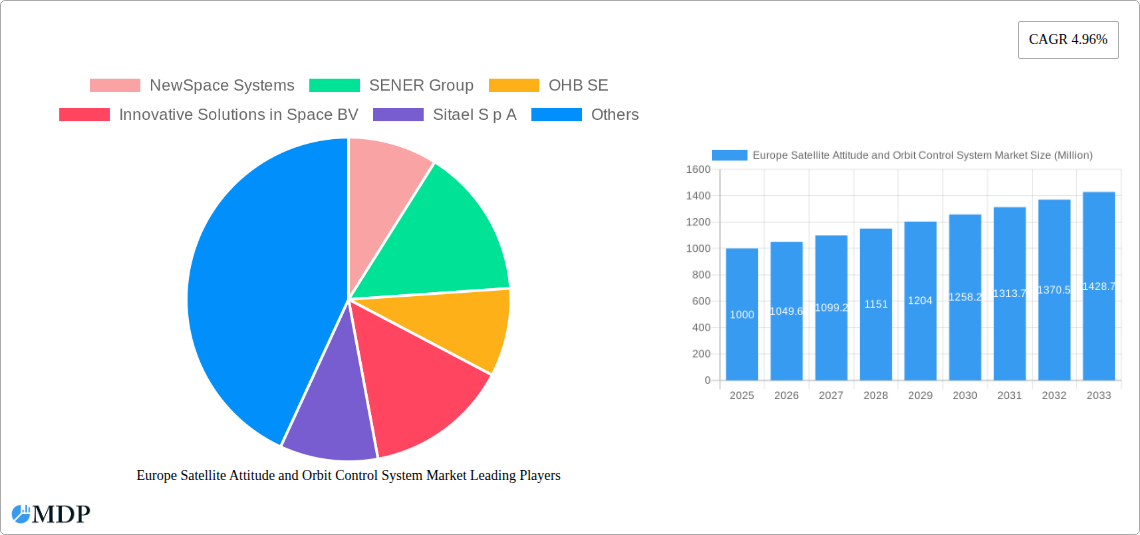

Europe Satellite Attitude and Orbit Control System Market Company Market Share

Europe Satellite Attitude and Orbit Control System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European Satellite Attitude and Orbit Control System (AOCS) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future growth opportunities. The market is segmented by satellite mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg), orbit class (LEO, MEO, GEO), end-user (Commercial, Military & Government, Other), and application (Communication, Earth Observation, Navigation, Space Observation, Others). The report projects significant growth, driven by technological advancements and increasing demand for satellite-based services.

Europe Satellite Attitude and Orbit Control System Market Market Dynamics & Concentration

The European Satellite AOCS market is characterized by a moderately concentrated landscape with several key players vying for market share. Market concentration is influenced by factors such as technological expertise, established customer relationships, and R&D investments. Innovation is a crucial driver, with companies constantly developing advanced AOCS solutions to meet the demands of evolving satellite missions. Stringent regulatory frameworks within the European Space Agency (ESA) and individual member states play a significant role in shaping market dynamics, particularly concerning safety and operational standards. While few direct product substitutes exist for specialized AOCS systems, cost-effectiveness and performance improvements continually challenge established technologies. End-user trends, such as the increasing adoption of smaller satellites and constellations, are pushing demand for miniaturized and highly reliable AOCS. The market has seen a moderate level of M&A activity (xx deals in the last 5 years) aiming to enhance technological capabilities and broaden market reach. Key metrics include:

- Market Share: Dominated by a few major players (xx% combined market share in 2025).

- M&A Activity: xx deals over the last five years, primarily focused on technology integration and expansion.

- Innovation Rate: High, driven by the need for improved accuracy, miniaturization, and cost reduction.

Europe Satellite Attitude and Orbit Control System Market Industry Trends & Analysis

The European Satellite AOCS market is poised for substantial growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the increasing demand for satellite-based services in various sectors (communication, Earth observation, navigation), advancements in miniaturization and cost reduction technologies, and supportive government policies promoting space exploration and technological development. Technological disruptions, particularly in areas like AI and machine learning for improved autonomous control, are reshaping the industry. Consumer preference for high-precision, reliable, and cost-effective AOCS drives innovation. Competitive dynamics are intensified by the entry of new players and increased investments in R&D. Market penetration is increasing, particularly in the LEO and small satellite segments. The overall market size was estimated at xx Million in 2025 and is expected to reach xx Million by 2033.

Leading Markets & Segments in Europe Satellite Attitude and Orbit Control System Market

The dominance within the European AOCS market is spread across various segments. While specific market share figures for each segment require in-depth analysis for accuracy, certain trends are observable:

- Satellite Mass: The 10-100kg segment is experiencing the most rapid growth due to the proliferation of smallsat constellations. The above 1000kg segment remains a significant sector, driven by larger governmental and commercial missions.

- Orbit Class: The LEO segment holds a significant share, propelled by the increasing demand for broadband internet and Earth observation applications. GEO remains important for communication and navigation applications, but growth is slower compared to LEO.

- End-User: The commercial sector is the largest end-user segment, followed by military & government applications, with a steady rise in demand from both sectors.

- Application: Communication applications constitute a major segment, but Earth Observation and Navigation are showing strong growth potential.

Key Drivers:

- Government Funding & Policies: Strong governmental support for space initiatives within the EU.

- Technological Advancements: Miniaturization, improved reliability, and reduced cost of AOCS.

- Increased Demand for Satellite Services: Driven by various sectors including telecommunications and Earth observation.

Europe Satellite Attitude and Orbit Control System Market Product Developments

Recent product developments focus on miniaturization, enhanced accuracy, increased reliability, and reduced power consumption. Companies are incorporating advanced technologies like AI and machine learning to improve autonomy and decision-making capabilities within AOCS systems. The market is seeing a trend towards modular and adaptable designs, allowing for easier integration into various satellite platforms and mission profiles. This aligns with the increasing demand for versatile and cost-effective solutions in the burgeoning smallsat market.

Key Drivers of Europe Satellite Attitude and Orbit Control System Market Growth

Several factors drive the growth of the European Satellite AOCS market:

- Technological advancements: Miniaturization, improved accuracy, reduced power consumption, and increased reliability of AOCS systems are key drivers.

- Economic growth: Increased investments in the space sector from both public and private entities fuel market expansion.

- Regulatory support: Favorable governmental policies and supportive regulatory frameworks incentivize growth. Examples include ESA programs and national space agencies’ initiatives.

Challenges in the Europe Satellite Attitude and Orbit Control System Market Market

The market faces challenges, including:

- High development costs: Developing advanced AOCS systems requires substantial R&D investment.

- Supply chain complexities: Securing reliable and timely supply of components can pose difficulties.

- Intense competition: The presence of several established and emerging players creates a competitive landscape.

Emerging Opportunities in Europe Satellite Attitude and Orbit Control System Market

Long-term growth is fueled by technological breakthroughs like advanced sensors and AI-powered control algorithms. Strategic partnerships and collaborations among companies can lead to shared resources and expertise. Expansion into new markets, particularly in developing nations, and the growth of the NewSpace sector present significant opportunities. The development of more robust and reliable systems for extreme environments (e.g., deep space missions) is another major opportunity area.

Leading Players in the Europe Satellite Attitude and Orbit Control System Market Sector

- NewSpace Systems

- SENER Group

- OHB SE

- Innovative Solutions in Space BV

- Sitael S p A

- Bradford Engineering BV

- Thale

- Jena-Optronik

- AAC Clyde Space

Key Milestones in Europe Satellite Attitude and Orbit Control System Market Industry

- November 2022: Jena-Optronik GmbH's star sensors used in NASA's Artemis I mission, highlighting the reliability and accuracy of their technology.

- December 2022: Jena-Optronik's ASTRO CL star tracker selected by Maxar for its new LEO satellite platform, demonstrating market acceptance.

- February 2023: Jena-Optronik selected by Airbus OneWeb Satellites to provide AOCS sensors for the ARROW family of small satellites, expanding its presence in the smallsat market.

Strategic Outlook for Europe Satellite Attitude and Orbit Control System Market Market

The European Satellite AOCS market is poised for continued growth, driven by factors like increasing demand for satellite-based services, technological advancements, and supportive government policies. Companies should focus on strategic partnerships, R&D investments, and the development of innovative, cost-effective, and reliable solutions to maintain a competitive edge. Focus on miniaturization and the development of next-generation AOCS technologies are crucial for long-term success in this dynamic and rapidly expanding market.

Europe Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Europe Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of Europe Satellite Attitude and Orbit Control System Market

Europe Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OHB SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Innovative Solutions in Space BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sitael S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bradford Engineering BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thale

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jena-Optronik

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AAC Clyde Space

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: Europe Satellite Attitude and Orbit Control System Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Satellite Mass 2020 & 2033

- Table 3: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Orbit Class 2020 & 2033

- Table 4: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by End User 2020 & 2033

- Table 5: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Satellite Mass 2020 & 2033

- Table 8: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Orbit Class 2020 & 2033

- Table 9: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by End User 2020 & 2033

- Table 10: Europe Satellite Attitude and Orbit Control System Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Satellite Attitude and Orbit Control System Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 11.96%.

2. Which companies are prominent players in the Europe Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, OHB SE, Innovative Solutions in Space BV, Sitael S p A, Bradford Engineering BV, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the Europe Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 291.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform by Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the Europe Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence