Key Insights

The European remote sensing satellite market, valued at approximately 19.8 billion in 2024, is projected for substantial growth with a compound annual growth rate (CAGR) of 11.5% from 2024 to 2033. This expansion is propelled by escalating government investments in national security and defense across Europe, driving demand for advanced surveillance and intelligence capabilities. Concurrently, the increasing adoption of remote sensing technologies in commercial sectors like agriculture, environmental monitoring, and urban planning significantly contributes to market expansion. The market is segmented by satellite subsystem (propulsion, bus & subsystems, solar arrays, structures, harnesses), end-user (commercial, military & government), and satellite mass (below 10kg to above 1000kg). Larger satellite mass segments are anticipated to experience accelerated growth due to their superior capabilities. Growth across orbit classes (GEO, LEO, MEO) will align with application demands, with LEO poised for strong expansion owing to its suitability for high-resolution imaging and frequent data acquisition. Key market players, including Airbus SE, Lockheed Martin, and Maxar Technologies, are instrumental in this growth through their technological expertise and established market presence. High initial investment costs for satellite development and launch remain a key market restraint.

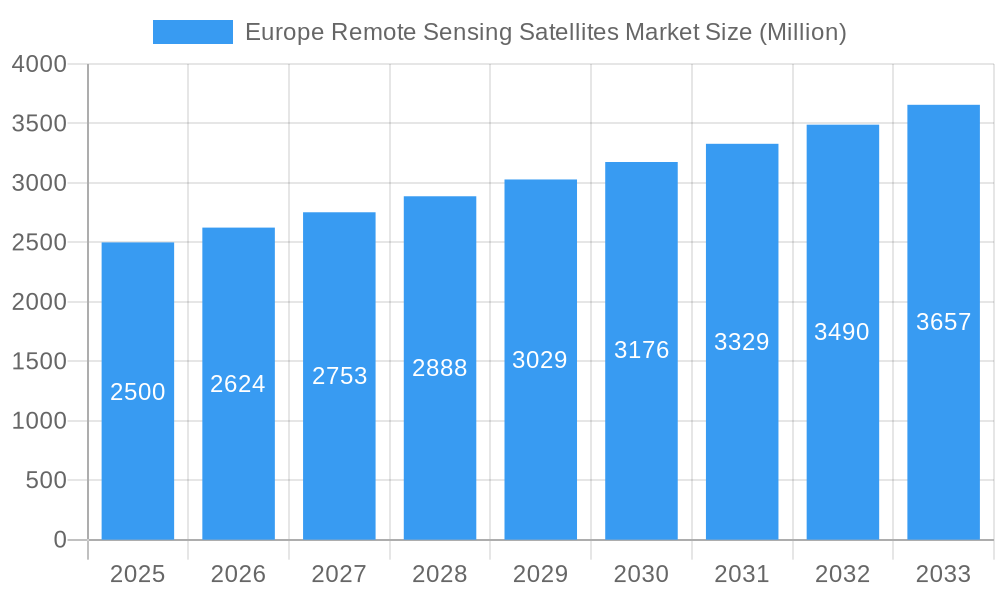

Europe Remote Sensing Satellites Market Market Size (In Billion)

The competitive landscape features a mix of large multinational corporations and specialized firms. European nations, particularly Germany, France, and the United Kingdom, are leading contributors, supported by robust governmental backing and a strong aerospace industry. Continued advancements in miniaturized satellites and sensor technology are expected to foster further market expansion. Market trajectory will be influenced by technological innovation, space utilization regulations, and geopolitical factors impacting defense expenditure. Success will depend on companies offering cost-effective solutions, superior data analytics, and efficient deployment strategies. The market is likely to witness significant consolidation, with larger entities acquiring smaller companies to enhance technology portfolios and expand market reach.

Europe Remote Sensing Satellites Market Company Market Share

Europe Remote Sensing Satellites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Remote Sensing Satellites Market, offering actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, leading players, technological advancements, and future growth prospects. The report utilizes rigorous data analysis and expert insights to provide a clear and concise picture of this dynamic market, encompassing key segments and geographical regions.

Europe Remote Sensing Satellites Market Dynamics & Concentration

The Europe Remote Sensing Satellites Market exhibits a moderately concentrated landscape, with key players like Airbus SE, Maxar Technologies Inc, and Lockheed Martin Corporation holding significant market share. The market's value in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033. Several factors drive market dynamics:

- Innovation Drivers: Continuous advancements in sensor technology, miniaturization, and data analytics capabilities are pushing the market forward. The development of higher-resolution imagery and improved data processing techniques fuels demand across various sectors.

- Regulatory Frameworks: Stringent regulations related to data privacy, space debris mitigation, and satellite licensing influence market growth and investment strategies. Harmonization of regulations across European nations is a key area for future development.

- Product Substitutes: While remote sensing satellites remain the primary source for high-resolution Earth observation data, alternative technologies like drones and airborne sensors offer niche applications, creating competitive pressures.

- End-User Trends: The increasing adoption of remote sensing data by commercial entities (agriculture, urban planning, environmental monitoring) alongside continued strong demand from the military and government sectors drives market expansion.

- M&A Activities: The past five years (2019-2024) have witnessed xx M&A deals in the European remote sensing satellite market, reflecting consolidation and strategic partnerships within the industry. Major players are consolidating to broaden their product portfolios and geographic reach. The market share of the top 5 players is approximately xx%.

Europe Remote Sensing Satellites Market Industry Trends & Analysis

The European remote sensing satellites market is experiencing robust and dynamic growth, propelled by an ever-increasing demand for high-resolution imagery and comprehensive geospatial data across a multitude of critical sectors. Industries such as precision agriculture, sophisticated urban planning, vital environmental monitoring, and advanced defense applications are major beneficiaries. Technological breakthroughs are a significant catalyst, with continuous innovation in the development of smaller, more agile, and energy-efficient satellites, coupled with sophisticated data processing techniques, accelerating market expansion. The penetration of remote sensing data within the commercial sector is projected to grow at a compounded annual growth rate (CAGR) of approximately XX%, while government adoption is expected to remain a substantial force, accounting for an estimated XX% of the total market share in 2025. The burgeoning availability of cloud-based data processing and advanced analytics platforms is effectively democratizing access, lowering the barrier to entry for smaller enterprises and significantly expediting overall market growth. Despite this positive trajectory, competitive dynamics remain intensely vigorous, with established market leaders continuously challenged by nimble, emerging companies that are at the forefront of innovative satellite technologies and niche application development.

Leading Markets & Segments in Europe Remote Sensing Satellites Market

The LEO (Low Earth Orbit) segment dominates the Europe Remote Sensing Satellites market, driven by increased accessibility and lower launch costs. The 100-500kg satellite mass segment holds the largest market share, offering a balance between payload capacity and launch cost-effectiveness.

Dominant Segments:

- Orbit Class: LEO (Low Earth Orbit) accounts for the largest market share, exceeding xx% in 2025 due to improved data acquisition capabilities and lower launch costs.

- Satellite Mass: The 100-500 kg segment dominates due to its balance of payload capacity and cost-effectiveness, comprising xx% of the market in 2025.

- Satellite Subsystem: Satellite Bus & Subsystems represent a significant portion of the market, driven by the need for reliable and advanced satellite platforms, exceeding xx% in 2025.

- End User: The commercial sector demonstrates substantial growth, with a projected market share of xx% in 2025, fueled by increasing adoption across various industries. The Military & Government sector continues to be a substantial contributor.

Key Drivers by Segment:

- LEO Orbit: Driven by reduced launch costs and improved data acquisition capabilities.

- 100-500kg Satellite Mass: Optimal balance between payload capacity and launch cost-effectiveness.

- Satellite Bus & Subsystems: Need for reliable and technologically advanced satellite platforms.

- Commercial End-User: Growing adoption of remote sensing data in agriculture, urban planning, and environmental monitoring.

Europe Remote Sensing Satellites Market Product Developments

Recent product innovations within the European remote sensing satellites market are sharply focused on achieving unprecedented levels of image resolution, dramatically improving data processing speeds, and engineering more compact, cost-effective, and deployable satellite solutions. Miniaturization stands out as a pivotal trend, enabling the strategic deployment of satellite constellations comprised of numerous smaller units, thereby facilitating enhanced spatial coverage and more frequent data acquisition cycles. Emerging applications are continuously being discovered and refined, particularly in the realms of precision agriculture for optimized crop management, advanced environmental monitoring for climate change impact assessment, and critical disaster response operations, underscoring the inherent adaptability and remarkable versatility of remote sensing technologies. A key emphasis in market development is also placed on engineering satellites with extended operational lifespans and significantly increased data throughput capacities to meet the growing demands for real-time and large-scale data analysis.

Key Drivers of Europe Remote Sensing Satellites Market Growth

The substantial growth trajectory of the European remote sensing satellites market is being propelled by a confluence of influential factors. These key drivers include:

- Technological Advancements: Continuous innovation in satellite miniaturization, the development of highly sensitive and sophisticated sensor technology, and advancements in artificial intelligence-driven data processing capabilities are fundamental to market expansion.

- Government Funding and Policy Support: Proactive and substantial investments from European governments in space exploration initiatives, coupled with supportive policies that encourage the development and application of remote sensing technologies, are critical enablers.

- Increased Demand Across Diverse Sectors: The rapid and accelerating adoption of remote sensing data by the commercial sector, with a particular surge in applications within agriculture and infrastructure development, is significantly boosting market demand.

- Growing Need for Environmental and Climate Monitoring: The increasing global focus on climate change, natural resource management, and environmental protection necessitates continuous and detailed Earth observation, driving demand for remote sensing solutions.

- Advancements in Data Analytics and Cloud Computing: The development of powerful data analytics tools and accessible cloud platforms is making remote sensing data more interpretable and actionable for a wider range of users.

Challenges in the Europe Remote Sensing Satellites Market

The European remote sensing satellites market faces several challenges:

- High initial investment costs: Developing and launching satellites requires substantial capital investment.

- Regulatory complexities: Obtaining necessary licenses and approvals can be time-consuming and costly.

- Intense competition: The market is highly competitive, with established and emerging players vying for market share.

- Data security and privacy concerns: Concerns regarding the security and privacy of remotely sensed data are growing. This requires robust data encryption and management strategies.

Emerging Opportunities in Europe Remote Sensing Satellites Market

The long-term growth of the European remote sensing satellites market is driven by several emerging opportunities:

- Technological breakthroughs: Advancements in AI and machine learning are improving data analysis and interpretation capabilities.

- Strategic partnerships: Collaborations between satellite operators, data providers, and technology companies are fostering innovation and market expansion.

- New applications: The application of remote sensing data is expanding into new areas such as autonomous driving and smart cities. This opens new avenues for market expansion.

Leading Players in the Europe Remote Sensing Satellites Market Sector

- ImageSat International

- GomSpace ApS

- RSC Energia

- Esri

- Lockheed Martin Corporation

- Airbus SE

- Maxar Technologies Inc

- NPO Lavochkin

- ROSCOSMOS

- IHI Corp

- Thales Alenia Space (Thale)

- Planet Labs Inc

- Northrop Grumman Corporation

- Spire Global Inc

- Surrey Satellite Technology Ltd (SSTL)

- OHB SE

Key Milestones in Europe Remote Sensing Satellites Market Industry

- February 2023: NASA and Esri's Space Act Agreement expands access to geospatial content, boosting research and development.

- January 2023: Airbus Defence and Space secures a contract with Poland for two high-performance Earth observation satellites, driving market expansion in Eastern Europe.

- November 2022: Launch of Kosmos 2563 (Tundra 16L, Kupol 16L, EKS #6) by Russia replaces Oko-1 system satellites, highlighting ongoing investment in early warning systems.

Strategic Outlook for Europe Remote Sensing Satellites Market Market

The strategic outlook for the European remote sensing satellites market is exceptionally promising, anticipating sustained and significant growth in the foreseeable future. This optimistic trajectory is underpinned by the relentless pace of technological innovation, a continually expanding demand base from a diverse array of sectors, and the unwavering support of forward-thinking government policies. To effectively capitalize on the emerging opportunities, companies will need to prioritize strategic partnerships, foster innovative business models, and invest in developing niche expertise. A paramount focus will be placed on enhancing data accessibility, refining data processing capabilities through advanced analytics and AI, and pioneering novel applications that address evolving societal and industrial needs. The market's evolution will be shaped by these critical developments, leading to a landscape that is both competitive and rich with potential for groundbreaking advancements.

Europe Remote Sensing Satellites Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Europe Remote Sensing Satellites Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Remote Sensing Satellites Market Regional Market Share

Geographic Coverage of Europe Remote Sensing Satellites Market

Europe Remote Sensing Satellites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Remote Sensing Satellites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ImageSat International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GomSpaceApS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RSC Energia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esri

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maxar Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NPO Lavochkin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSCOSMOS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IHI Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Thale

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Planet Labs Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Northrop Grumman Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Spire Global Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 ImageSat International

List of Figures

- Figure 1: Europe Remote Sensing Satellites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Remote Sensing Satellites Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 2: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: Europe Remote Sensing Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 7: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: Europe Remote Sensing Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Remote Sensing Satellites Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Europe Remote Sensing Satellites Market?

Key companies in the market include ImageSat International, GomSpaceApS, RSC Energia, Esri, Lockheed Martin Corporation, Airbus SE, Maxar Technologies Inc, NPO Lavochkin, ROSCOSMOS, IHI Corp, Thale, Planet Labs Inc, Northrop Grumman Corporation, Spire Global Inc.

3. What are the main segments of the Europe Remote Sensing Satellites Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: NASA and geographic information service provider Esri will grant wider access to the space agency's geospatial content for research and exploration purposes through the Space Act Agreement.January 2023: Airbus Defence and Space has signed a contract with Poland to provide a geospatial intelligence system including the development, manufacture, launch and delivery in orbit of two high-performance optical Earth observation satellites.November 2022: Russian Soyuz launched Kosmos 2563 (Tundra 16L, Kupol 16L, EKS #6) into orbit to replace the US-K and US-KMO early warning satellites of the Oko-1 system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Remote Sensing Satellites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Remote Sensing Satellites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Remote Sensing Satellites Market?

To stay informed about further developments, trends, and reports in the Europe Remote Sensing Satellites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence