Key Insights

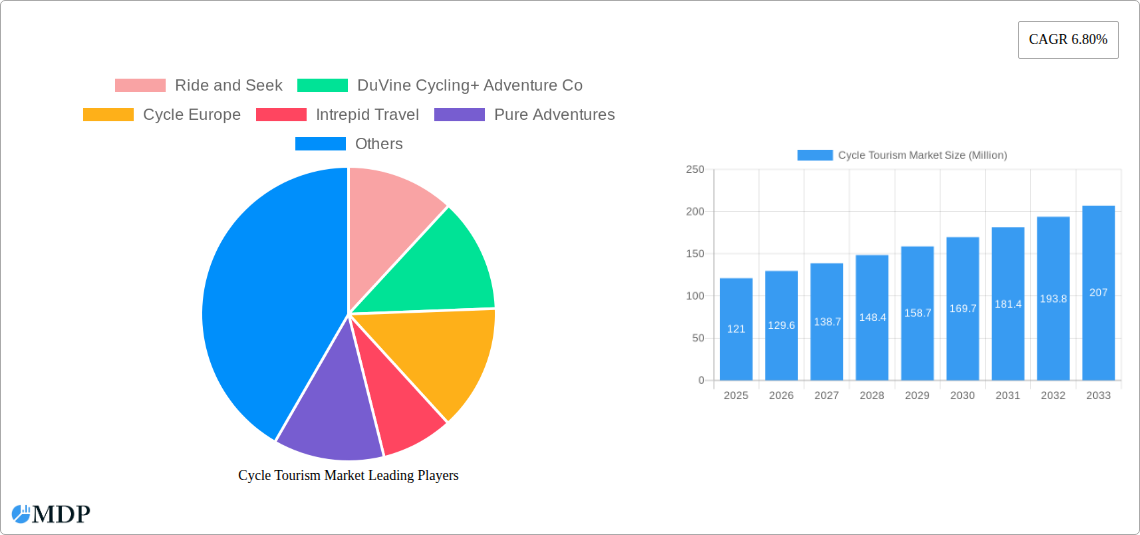

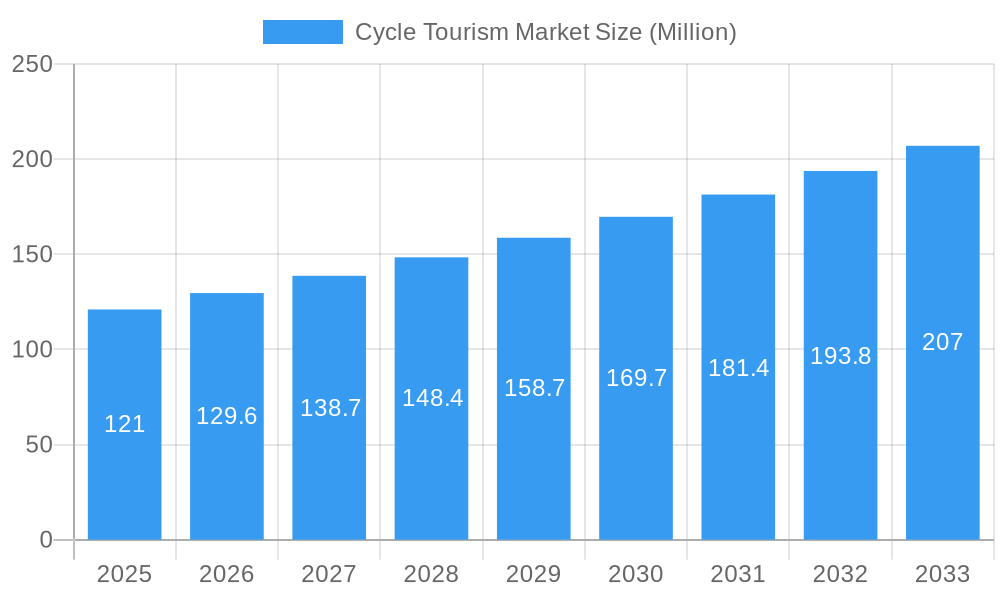

The global cycle tourism market, valued at $121 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of adventure tourism and eco-friendly travel options is significantly driving demand. Consumers, particularly younger demographics (18-50 years), are increasingly seeking active and immersive travel experiences, leading to a surge in bookings across various segments – group tours, couple's getaways, family cycling vacations, and solo adventures. The convenience of online booking platforms and the rise of specialized tour operators catering to different cycling skill levels further contribute to market growth. Geographic expansion, with North America and Europe currently leading the market share, but significant potential in the Asia-Pacific region and other emerging economies, also plays a crucial role. While the market faces challenges like fluctuating fuel prices impacting transportation costs and potential safety concerns, the ongoing investment in cycling infrastructure and the development of new cycling routes are expected to mitigate these restraints. Furthermore, the increasing awareness of health and wellness benefits associated with cycling contributes to the market's positive outlook.

Cycle Tourism Market Market Size (In Million)

The market segmentation reveals interesting trends. The 18-to-50-year-old demographic constitutes the largest segment, reflecting the preference for active travel amongst younger and middle-aged individuals. Group and couple bookings dominate the booking type segment, highlighting the social aspect of cycle tourism. While direct bookings remain prevalent, the use of online marketplaces and travel agents shows notable growth, suggesting a shift towards enhanced convenience and access to information. Leading companies in the cycle tourism market are diversifying their offerings to cater to various interests and skill levels, incorporating features like guided tours, luxury accommodations, and bespoke itineraries. The continued growth is anticipated to be driven by targeted marketing campaigns focusing on the unique experiences and health benefits of cycling vacations and increasing the accessibility of cycle tours to a wider audience.

Cycle Tourism Market Company Market Share

Cycle Tourism Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global cycle tourism market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future trajectory. The report leverages robust data analysis, incorporating key performance indicators (KPIs) to provide a 360-degree view of the market, covering segments like age groups (18-30, 31-50, above 50), group types (group/friends, couples, family, solo), and booking modes (direct, travel agent, marketplace). The report also profiles leading players such as Ride and Seek, DuVine Cycling+ Adventure Co, Cycle Europe, Intrepid Travel, Pure Adventures, Butterfield and Robinson, Pedaltours, Explore Worldwide, Trek Travel, Bike Tours, Exodus Travels, and Backroads, offering a detailed competitive landscape analysis. The total market size is estimated at xx Million in 2025.

Cycle Tourism Market Market Dynamics & Concentration

The cycle tourism market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The market share of the top 5 players is estimated at xx%. However, the market is witnessing increased competition from smaller, specialized operators focusing on niche segments. Several factors are driving market innovation, including the rise of e-bikes, improved cycling infrastructure in various regions, and a growing emphasis on sustainable tourism. Regulatory frameworks, although varying across regions, generally favor the growth of cycle tourism, with many governments promoting cycling infrastructure and eco-tourism initiatives. While traditional forms of tourism remain prominent, cycle tourism is experiencing a shift from car-based travel, presenting a strong substitute. End-user trends show a clear preference for immersive and experiential travel, with cycle tourism offering unique opportunities for exploration and personal fulfillment. The M&A activity in the sector is robust, with notable deals like Ride & Seek's acquisition of Cycle Japan boosting market consolidation.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: E-bike technology, improved infrastructure, sustainable tourism focus.

- Regulatory Frameworks: Mostly supportive, with variations across regions.

- Product Substitutes: Traditional forms of tourism (car-based travel).

- End-User Trends: Preference for experiential and immersive travel.

- M&A Activity: Significant activity, with xx deals recorded in the past five years.

Cycle Tourism Market Industry Trends & Analysis

The global cycle tourism market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including rising disposable incomes in emerging economies, increasing awareness of health and wellness, and a growing preference for sustainable and eco-friendly travel options. Technological disruptions, such as the development of advanced GPS tracking systems and e-bike technologies, are enhancing the overall cycling experience and attracting a wider range of participants. Consumer preferences are shifting towards personalized and customized tour packages, leading to increased demand for bespoke cycling adventures. The competitive landscape is characterized by both established tour operators and new entrants focusing on niche segments, driving innovation and offering diverse tour options. Market penetration is highest in developed economies but expanding rapidly in emerging markets with improving infrastructure.

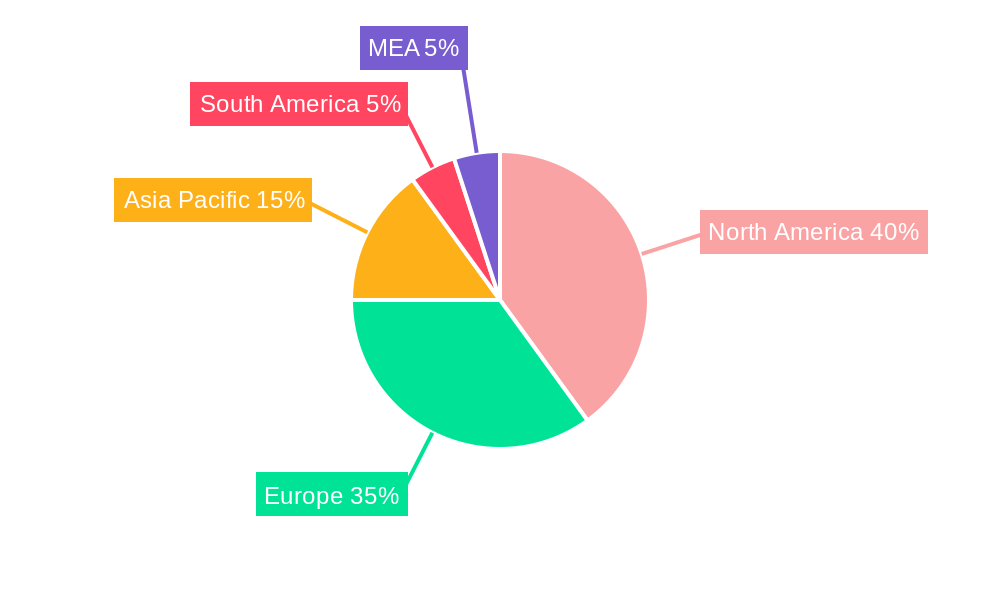

Leading Markets & Segments in Cycle Tourism Market

Europe and North America currently dominate the cycle tourism market, driven by well-established cycling infrastructure, strong tourism industries, and high disposable incomes. However, Asia-Pacific is emerging as a significant growth market.

Dominant Segments:

- By Age Group: The 31-50 years age group currently holds the largest market share, followed by the above 50 years group. The 18-30 years segment is experiencing strong growth.

- By Group: Group/friends and couples represent the largest segments, although solo travel and family cycling tours are also gaining popularity.

- By Booking Mode: Direct bookings dominate, with online travel agencies and marketplaces showing consistent growth.

Key Drivers:

- Europe & North America: Developed cycling infrastructure, strong tourism sector, high disposable incomes.

- Asia-Pacific: Rapid economic growth, increasing middle class, government support for tourism development.

Cycle Tourism Market Product Developments

Recent product innovations in the cycle tourism market include the integration of smart technology into cycling tours, such as GPS tracking and fitness monitoring. The increasing availability of e-bikes is expanding the accessibility of cycle tourism to a broader demographic. Tour operators are focusing on developing unique and immersive experiences that cater to diverse interests, creating a competitive advantage. The trend is towards specialized tours focusing on specific themes, such as cultural immersion, wildlife viewing, and culinary experiences.

Key Drivers of Cycle Tourism Market Growth

Several factors are driving the growth of the cycle tourism market. The rising popularity of sustainable tourism, driven by environmental concerns, fuels demand for eco-friendly travel options. Technological advancements such as GPS tracking and e-bike technology enhance the overall experience, attracting more participants. Government initiatives promoting cycling infrastructure, and the increasing affordability of cycling tours contribute to market expansion. Finally, the growing awareness of health and wellness is also a significant factor, as cycling is increasingly recognized as a beneficial recreational activity.

Challenges in the Cycle Tourism Market Market

The cycle tourism market faces challenges including weather dependency, fluctuating fuel prices impacting transportation costs, and the need for specialized skill sets within the industry. Furthermore, infrastructure limitations in some regions, and safety concerns might restrict market expansion. Competition from other forms of tourism and the seasonal nature of cycle tourism also pose significant challenges. These factors can impact overall market growth and profitability.

Emerging Opportunities in Cycle Tourism Market

The integration of technology continues to present significant opportunities, including the development of virtual reality experiences and advanced tour planning platforms. Strategic partnerships with local communities and businesses can lead to authentic and sustainable tourism development. Expanding into new and emerging markets with growing middle-class populations presents significant market expansion opportunities. Focus on niche segments and tailored experiences will be key to attracting a broader demographic.

Leading Players in the Cycle Tourism Market Sector

- Ride and Seek

- DuVine Cycling+ Adventure Co

- Cycle Europe

- Intrepid Travel

- Pure Adventures

- Butterfield and Robinson

- Pedaltours

- Explore Worldwide

- Trek Travel

- Bike Tours

- Exodus Travels

- Backroads

Key Milestones in Cycle Tourism Market Industry

- July 2023: Ride & Seek acquires Cycle Japan, expanding its offerings to include a new Samurai Tour.

- January 2023: Active Travel Group acquires the cycling assets of Inspired Italy, expanding its operations in Italy.

Strategic Outlook for Cycle Tourism Market Market

The cycle tourism market is poised for continued growth, driven by technological advancements, the increasing popularity of sustainable travel, and the expanding middle class in emerging markets. Strategic partnerships, expansion into niche segments, and innovative marketing strategies will be key to maximizing market potential. The focus on unique and personalized experiences will further drive market expansion.

Cycle Tourism Market Segmentation

-

1. Group

- 1.1. Group/Friends

- 1.2. Couples

- 1.3. Family

- 1.4. Solo

-

2. Booking Mode

- 2.1. Direct

- 2.2. Travel Agent

- 2.3. Marketplace Booking

-

3. Age Group

- 3.1. 18 to 30 Years

- 3.2. 31 to 50 Years

- 3.3. Above 50 Years

Cycle Tourism Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Asia Pacific

- 2.1. India

- 2.2. China

- 2.3. Australia

- 2.4. Rest of the Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of the Middle East and Africa

Cycle Tourism Market Regional Market Share

Geographic Coverage of Cycle Tourism Market

Cycle Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Demand For E-Bikes Drives The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cycle Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Group

- 5.1.1. Group/Friends

- 5.1.2. Couples

- 5.1.3. Family

- 5.1.4. Solo

- 5.2. Market Analysis, Insights and Forecast - by Booking Mode

- 5.2.1. Direct

- 5.2.2. Travel Agent

- 5.2.3. Marketplace Booking

- 5.3. Market Analysis, Insights and Forecast - by Age Group

- 5.3.1. 18 to 30 Years

- 5.3.2. 31 to 50 Years

- 5.3.3. Above 50 Years

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Group

- 6. North America Cycle Tourism Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Group

- 6.1.1. Group/Friends

- 6.1.2. Couples

- 6.1.3. Family

- 6.1.4. Solo

- 6.2. Market Analysis, Insights and Forecast - by Booking Mode

- 6.2.1. Direct

- 6.2.2. Travel Agent

- 6.2.3. Marketplace Booking

- 6.3. Market Analysis, Insights and Forecast - by Age Group

- 6.3.1. 18 to 30 Years

- 6.3.2. 31 to 50 Years

- 6.3.3. Above 50 Years

- 6.1. Market Analysis, Insights and Forecast - by Group

- 7. Asia Pacific Cycle Tourism Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Group

- 7.1.1. Group/Friends

- 7.1.2. Couples

- 7.1.3. Family

- 7.1.4. Solo

- 7.2. Market Analysis, Insights and Forecast - by Booking Mode

- 7.2.1. Direct

- 7.2.2. Travel Agent

- 7.2.3. Marketplace Booking

- 7.3. Market Analysis, Insights and Forecast - by Age Group

- 7.3.1. 18 to 30 Years

- 7.3.2. 31 to 50 Years

- 7.3.3. Above 50 Years

- 7.1. Market Analysis, Insights and Forecast - by Group

- 8. Europe Cycle Tourism Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Group

- 8.1.1. Group/Friends

- 8.1.2. Couples

- 8.1.3. Family

- 8.1.4. Solo

- 8.2. Market Analysis, Insights and Forecast - by Booking Mode

- 8.2.1. Direct

- 8.2.2. Travel Agent

- 8.2.3. Marketplace Booking

- 8.3. Market Analysis, Insights and Forecast - by Age Group

- 8.3.1. 18 to 30 Years

- 8.3.2. 31 to 50 Years

- 8.3.3. Above 50 Years

- 8.1. Market Analysis, Insights and Forecast - by Group

- 9. South America Cycle Tourism Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Group

- 9.1.1. Group/Friends

- 9.1.2. Couples

- 9.1.3. Family

- 9.1.4. Solo

- 9.2. Market Analysis, Insights and Forecast - by Booking Mode

- 9.2.1. Direct

- 9.2.2. Travel Agent

- 9.2.3. Marketplace Booking

- 9.3. Market Analysis, Insights and Forecast - by Age Group

- 9.3.1. 18 to 30 Years

- 9.3.2. 31 to 50 Years

- 9.3.3. Above 50 Years

- 9.1. Market Analysis, Insights and Forecast - by Group

- 10. Middle East and Africa Cycle Tourism Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Group

- 10.1.1. Group/Friends

- 10.1.2. Couples

- 10.1.3. Family

- 10.1.4. Solo

- 10.2. Market Analysis, Insights and Forecast - by Booking Mode

- 10.2.1. Direct

- 10.2.2. Travel Agent

- 10.2.3. Marketplace Booking

- 10.3. Market Analysis, Insights and Forecast - by Age Group

- 10.3.1. 18 to 30 Years

- 10.3.2. 31 to 50 Years

- 10.3.3. Above 50 Years

- 10.1. Market Analysis, Insights and Forecast - by Group

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ride and Seek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DuVine Cycling+ Adventure Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cycle Europe

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intrepid Travel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pure Adventures

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Butterfield and Robinson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pedaltours**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Explore Worldwide

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trek Travel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bike Tours

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Exodus Travels

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Backroads

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ride and Seek

List of Figures

- Figure 1: Global Cycle Tourism Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cycle Tourism Market Revenue (Million), by Group 2025 & 2033

- Figure 3: North America Cycle Tourism Market Revenue Share (%), by Group 2025 & 2033

- Figure 4: North America Cycle Tourism Market Revenue (Million), by Booking Mode 2025 & 2033

- Figure 5: North America Cycle Tourism Market Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 6: North America Cycle Tourism Market Revenue (Million), by Age Group 2025 & 2033

- Figure 7: North America Cycle Tourism Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 8: North America Cycle Tourism Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cycle Tourism Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Cycle Tourism Market Revenue (Million), by Group 2025 & 2033

- Figure 11: Asia Pacific Cycle Tourism Market Revenue Share (%), by Group 2025 & 2033

- Figure 12: Asia Pacific Cycle Tourism Market Revenue (Million), by Booking Mode 2025 & 2033

- Figure 13: Asia Pacific Cycle Tourism Market Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 14: Asia Pacific Cycle Tourism Market Revenue (Million), by Age Group 2025 & 2033

- Figure 15: Asia Pacific Cycle Tourism Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 16: Asia Pacific Cycle Tourism Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Cycle Tourism Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cycle Tourism Market Revenue (Million), by Group 2025 & 2033

- Figure 19: Europe Cycle Tourism Market Revenue Share (%), by Group 2025 & 2033

- Figure 20: Europe Cycle Tourism Market Revenue (Million), by Booking Mode 2025 & 2033

- Figure 21: Europe Cycle Tourism Market Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 22: Europe Cycle Tourism Market Revenue (Million), by Age Group 2025 & 2033

- Figure 23: Europe Cycle Tourism Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 24: Europe Cycle Tourism Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cycle Tourism Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cycle Tourism Market Revenue (Million), by Group 2025 & 2033

- Figure 27: South America Cycle Tourism Market Revenue Share (%), by Group 2025 & 2033

- Figure 28: South America Cycle Tourism Market Revenue (Million), by Booking Mode 2025 & 2033

- Figure 29: South America Cycle Tourism Market Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 30: South America Cycle Tourism Market Revenue (Million), by Age Group 2025 & 2033

- Figure 31: South America Cycle Tourism Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 32: South America Cycle Tourism Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Cycle Tourism Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Cycle Tourism Market Revenue (Million), by Group 2025 & 2033

- Figure 35: Middle East and Africa Cycle Tourism Market Revenue Share (%), by Group 2025 & 2033

- Figure 36: Middle East and Africa Cycle Tourism Market Revenue (Million), by Booking Mode 2025 & 2033

- Figure 37: Middle East and Africa Cycle Tourism Market Revenue Share (%), by Booking Mode 2025 & 2033

- Figure 38: Middle East and Africa Cycle Tourism Market Revenue (Million), by Age Group 2025 & 2033

- Figure 39: Middle East and Africa Cycle Tourism Market Revenue Share (%), by Age Group 2025 & 2033

- Figure 40: Middle East and Africa Cycle Tourism Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cycle Tourism Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cycle Tourism Market Revenue Million Forecast, by Group 2020 & 2033

- Table 2: Global Cycle Tourism Market Revenue Million Forecast, by Booking Mode 2020 & 2033

- Table 3: Global Cycle Tourism Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 4: Global Cycle Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cycle Tourism Market Revenue Million Forecast, by Group 2020 & 2033

- Table 6: Global Cycle Tourism Market Revenue Million Forecast, by Booking Mode 2020 & 2033

- Table 7: Global Cycle Tourism Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 8: Global Cycle Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of the North America Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cycle Tourism Market Revenue Million Forecast, by Group 2020 & 2033

- Table 13: Global Cycle Tourism Market Revenue Million Forecast, by Booking Mode 2020 & 2033

- Table 14: Global Cycle Tourism Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 15: Global Cycle Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Australia Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of the Asia Pacific Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Cycle Tourism Market Revenue Million Forecast, by Group 2020 & 2033

- Table 21: Global Cycle Tourism Market Revenue Million Forecast, by Booking Mode 2020 & 2033

- Table 22: Global Cycle Tourism Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 23: Global Cycle Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Germany Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: United Kingdom Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of the Europe Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Cycle Tourism Market Revenue Million Forecast, by Group 2020 & 2033

- Table 28: Global Cycle Tourism Market Revenue Million Forecast, by Booking Mode 2020 & 2033

- Table 29: Global Cycle Tourism Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 30: Global Cycle Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of the South America Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Cycle Tourism Market Revenue Million Forecast, by Group 2020 & 2033

- Table 35: Global Cycle Tourism Market Revenue Million Forecast, by Booking Mode 2020 & 2033

- Table 36: Global Cycle Tourism Market Revenue Million Forecast, by Age Group 2020 & 2033

- Table 37: Global Cycle Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of the Middle East and Africa Cycle Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cycle Tourism Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Cycle Tourism Market?

Key companies in the market include Ride and Seek, DuVine Cycling+ Adventure Co, Cycle Europe, Intrepid Travel, Pure Adventures, Butterfield and Robinson, Pedaltours**List Not Exhaustive, Explore Worldwide, Trek Travel, Bike Tours, Exodus Travels, Backroads.

3. What are the main segments of the Cycle Tourism Market?

The market segments include Group, Booking Mode, Age Group.

4. Can you provide details about the market size?

The market size is estimated to be USD 121 Million as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Demand For E-Bikes Drives The Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

July 2023: Ride & Seek has acquired Cycle Japan, a Japanese bike tour operator. The acquisition gives expansion of their bike tour offerings to include a new extended Samurai Tour, featuring traditional Japanese inns and historic sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cycle Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cycle Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cycle Tourism Market?

To stay informed about further developments, trends, and reports in the Cycle Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence