Key Insights

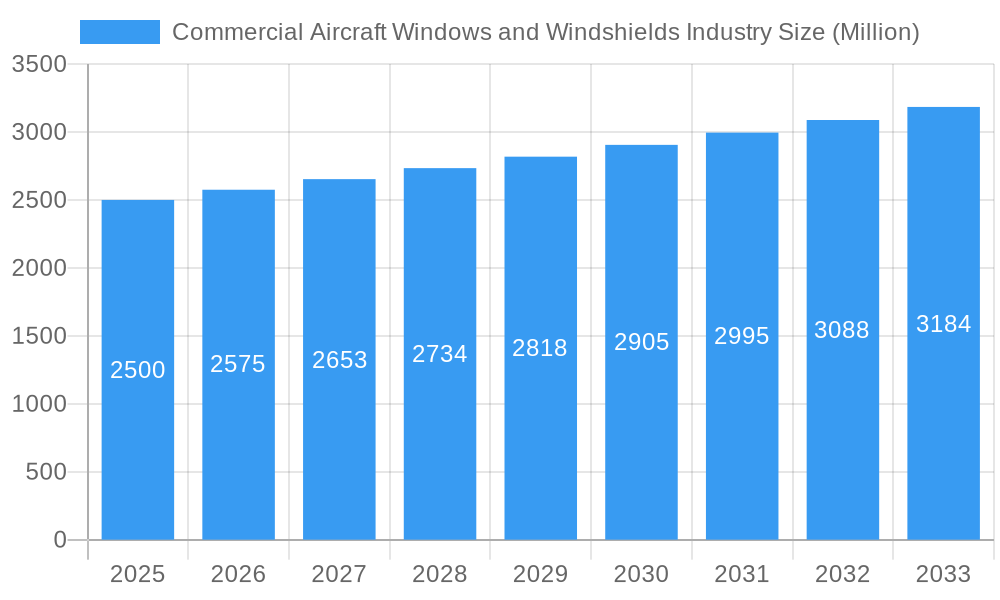

The global commercial aircraft windows and windshields market is forecast for substantial growth, propelled by escalating air travel demand and the imperative replacement cycle for aging aircraft fleets. The market, valued at $11.45 billion in 2025, is projected to achieve a compound annual growth rate (CAGR) of 11.29% between 2025 and 2033. This expansion is underpinned by several critical drivers. The rising production of new commercial aircraft, particularly narrow-body and wide-body models, is generating significant demand for advanced windows and windshields. Concurrently, technological innovations in materials science are yielding lighter, stronger, and more fuel-efficient components, enhancing aircraft performance and reducing operational expenditures. These advancements feature the integration of advanced polymers and composite materials, offering superior impact resistance, improved thermal insulation, and enhanced optical clarity. Moreover, stringent safety regulations governing aircraft window and windshield performance are accelerating the adoption of cutting-edge technologies and driving market proliferation. Segment analysis indicates robust demand across all aircraft categories, with narrow-body aircraft commanding the largest market share, followed by wide-body and regional aircraft. Within segments, cabin windows represent a larger market than cockpit windshields, reflecting the higher quantity of windows per aircraft. The market landscape is characterized by intense competition, with leading players such as Tech-Tool Plastics Inc, Saint-Gobain SA, and LP Aero Plastics Inc actively pursuing product innovation. Geographically, North America and Europe hold substantial market shares, supported by strong domestic air travel and a dense concentration of aircraft manufacturing facilities. The Asia Pacific region is anticipated to experience significant growth, driven by rapidly expanding economies and increasing air travel penetration.

Commercial Aircraft Windows and Windshields Industry Market Size (In Billion)

However, market expansion is subject to certain constraints. Economic downturns and volatile fuel prices can impact airline capital expenditures on new aircraft and maintenance, potentially moderating market growth. Supply chain disruptions and raw material availability also present challenges. Furthermore, the increasing complexity and specialization inherent in aircraft window and windshield manufacturing necessitate substantial research and development investments, creating a barrier to entry for new participants. Despite these impediments, the long-term outlook remains optimistic, fueled by continuous technological advancements and the sustained robust global demand for air travel. The market is well-positioned for ongoing expansion, offering opportunities for manufacturers to leverage innovations in materials science, refined manufacturing processes, and the growing demand for more fuel-efficient and safer aircraft.

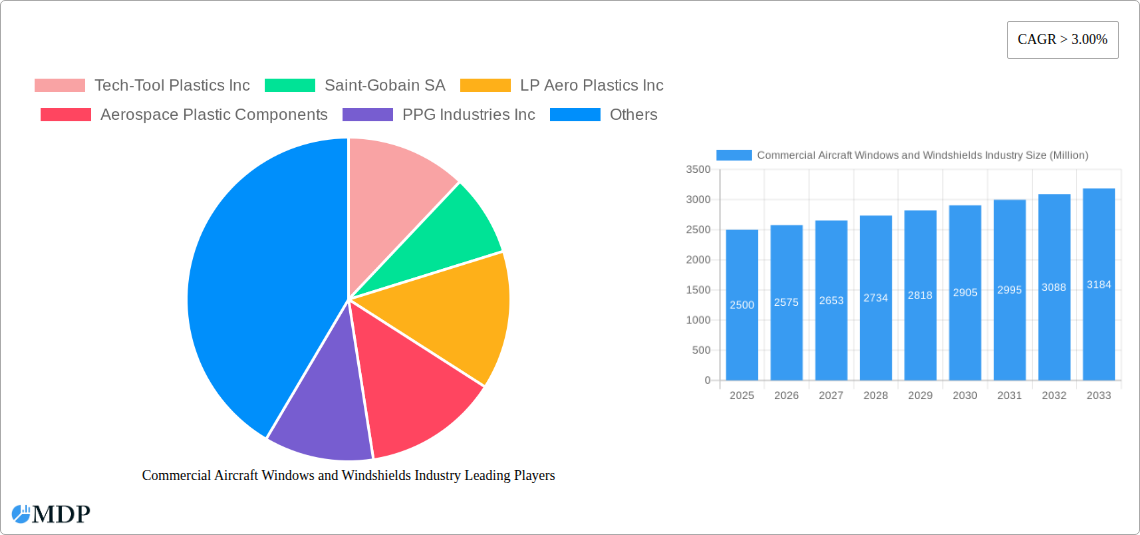

Commercial Aircraft Windows and Windshields Industry Company Market Share

Commercial Aircraft Windows and Windshields Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Commercial Aircraft Windows and Windshields industry, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The report leverages extensive data analysis to provide actionable intelligence for strategic decision-making. The global market is projected to reach xx Million by 2033.

Commercial Aircraft Windows and Windshields Industry Market Dynamics & Concentration

This section analyzes the market's competitive landscape, growth drivers, and regulatory influences. The industry exhibits a moderately concentrated structure with key players holding significant market share. However, the presence of smaller, specialized companies ensures a degree of dynamism. Market share data for 2024 indicates that PPG Industries Inc and Saint-Gobain SA hold approximately 30% and 25% respectively, while other major players like Gentex Corporation and GKN Aerospace each hold around 10-15%. Smaller players collectively account for the remaining market share.

Innovation Drivers:

- Advancements in materials science (e.g., lighter, stronger polymers).

- Development of electrochromic and other smart window technologies.

- Focus on enhanced safety and improved passenger comfort.

Regulatory Frameworks:

- Stringent safety regulations and certification processes.

- Environmental regulations impacting material selection and manufacturing.

Product Substitutes:

- Limited direct substitutes, primarily alternative materials with trade-offs in performance.

End-User Trends:

- Growing demand for enhanced passenger comfort and aesthetic appeal.

- Increasing focus on fuel efficiency driving demand for lighter weight components.

M&A Activities: The historical period (2019-2024) witnessed approximately 15-20 M&A deals, mainly involving smaller companies being acquired by larger players to expand product portfolios or enhance technological capabilities.

Commercial Aircraft Windows and Windshields Industry Industry Trends & Analysis

The commercial aircraft windows and windshields market is experiencing robust growth, driven by a surge in air travel, particularly in emerging economies. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately 5%, and is projected to reach xx% from 2025-2033. This growth is fueled by increasing demand for new aircraft across various segments (narrowbody, widebody, and regional) and the rising popularity of air travel. Technological advancements, particularly in smart windows offering improved light control and thermal insulation, are further driving market expansion. Increased focus on passenger comfort is also a significant factor, leading to higher demand for larger and more advanced window systems. Competition is intense, with established players focusing on product innovation, strategic partnerships, and geographic expansion to maintain their market position. Market penetration of advanced window technologies is increasing steadily.

Leading Markets & Segments in Commercial Aircraft Windows and Windshields Industry

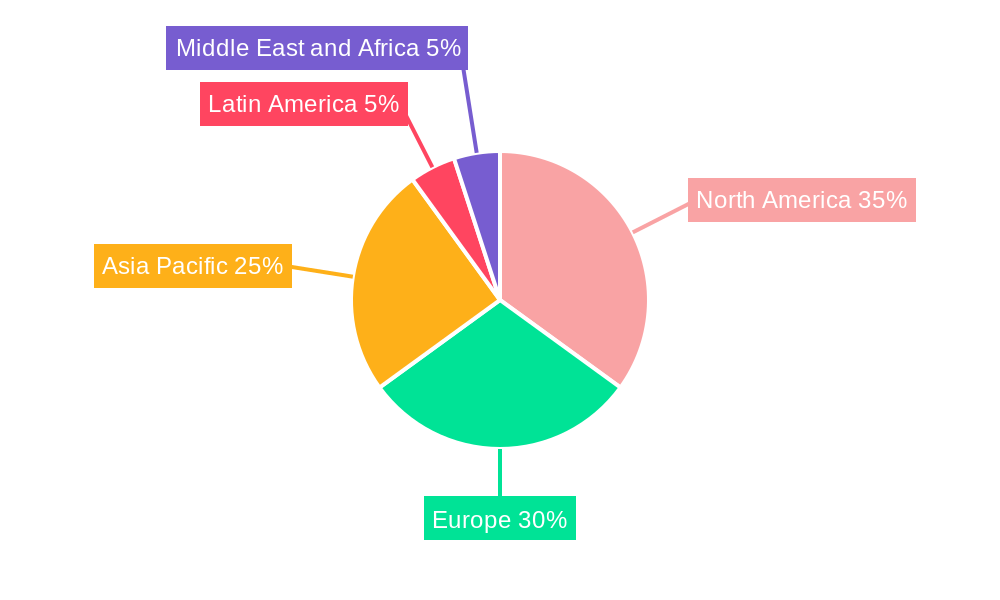

The North American and European regions are currently dominant, accounting for a combined 60-65% market share. However, the Asia-Pacific region is expected to witness significant growth in the coming years, propelled by increasing air travel and aircraft manufacturing activities.

Aircraft Type:

- Narrowbody Aircraft: This segment holds the largest market share due to the high volume of narrowbody aircraft production. Key drivers include the ongoing fleet renewal programs by major airlines and the increasing demand for fuel-efficient aircraft.

- Widebody Aircraft: This segment demonstrates strong growth potential driven by long-haul travel and the increasing demand for premium cabin experiences.

- Regional Aircraft: This segment offers steady growth driven by the expansion of regional air connectivity.

Application:

- Cabin Windows: This is the larger segment, reflecting the high number of windows in typical aircraft configurations. Innovation is focused on enhanced passenger comfort and aesthetics.

- Cockpit Windshields: While smaller in volume than cabin windows, this segment commands premium pricing due to stringent safety and performance requirements.

Key Drivers for Dominant Regions:

- North America: Strong domestic airline industry, robust aerospace manufacturing base, and technological advancements.

- Europe: Significant aircraft manufacturing presence, well-established airline networks, and focus on safety regulations.

- Asia-Pacific: Rapid economic growth, increasing air travel demand, and government support for infrastructure development.

Commercial Aircraft Windows and Windshields Industry Product Developments

Recent product developments focus on enhanced functionality, improved safety, and weight reduction. The introduction of electrochromic windows, offering adjustable light transmission and thermal insulation, represents a significant advancement. Lightweight materials, such as advanced polymers, are gaining traction to enhance aircraft fuel efficiency. Companies are also focusing on integrating technologies for improved de-icing and anti-fog capabilities. The market is seeing a trend towards modular designs for easier maintenance and replacement.

Key Drivers of Commercial Aircraft Windows and Windshields Industry Growth

The industry's growth is propelled by several factors:

- Technological advancements: Electrochromic windows, improved materials, and enhanced manufacturing processes.

- Economic growth: Rising disposable incomes and increased air travel demand, especially in developing economies.

- Stringent safety regulations: Driving demand for advanced safety features and higher quality products.

- Airline fleet renewals: Ongoing programs by major airlines to modernize their fleets.

Challenges in the Commercial Aircraft Windows and Windshields Industry Market

Challenges include:

- Supply chain disruptions: Impacting material availability and production timelines. Recent disruptions have led to estimated xx Million in lost revenue for the industry.

- Stringent certification processes: Increasing development costs and time-to-market.

- Intense competition: Pressure on pricing and margins from established and emerging players.

Emerging Opportunities in Commercial Aircraft Windows and Windshields Industry

Long-term growth is driven by:

- Development of next-generation smart windows with integrated technologies (e.g., sensors, displays).

- Expansion into emerging markets with growing air travel demand.

- Strategic partnerships and collaborations to leverage technological expertise and market reach.

Leading Players in the Commercial Aircraft Windows and Windshields Industry Sector

- Tech-Tool Plastics Inc

- Saint-Gobain SA

- LP Aero Plastics Inc

- Aerospace Plastic Components

- PPG Industries Inc

- Gentex Corporation

- Llamas Plastics Inc

- Lee Aerospace

- VT San Antonio AerospaceNagia

- Plexiweiss GmbH

- Control Logistics Inc

- NORDAM Group Inc

- GKN Aerospace

- Air-Craftglass Inc

Key Milestones in Commercial Aircraft Windows and Windshields Industry Industry

- September 2021: Airbus and Gentex partnered to offer Gentex Dimmable Aircraft Windows for the A350-1000 and A350-900, featuring faster darkening capabilities and superior heat blocking technology.

- June 2021: Jet Shade launched new cockpit windshield panels for Boeing 737 aircraft, made from optical-quality polycarbonate and offering enhanced UV protection, infrared light blocking, and glare reduction.

Strategic Outlook for Commercial Aircraft Windows and Windshields Industry Market

The future of the commercial aircraft windows and windshields market is promising, driven by technological innovation, expanding air travel, and ongoing fleet modernization. Strategic partnerships, focused R&D efforts, and expansion into new markets will be crucial for success. The increasing demand for sustainable and lightweight materials presents significant opportunities for manufacturers. Companies that successfully navigate the challenges of supply chain management and regulatory compliance will be best positioned to capture market share and drive growth in the coming years.

Commercial Aircraft Windows and Windshields Industry Segmentation

-

1. Application

- 1.1. Cabin Windows

- 1.2. Cockpit Windshields

Commercial Aircraft Windows and Windshields Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Latin America

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Europe

- 4.1. United Kingdom

- 4.2. Germany

- 4.3. France

- 4.4. Rest of Europe

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. Rest of Middle East and Africa

Commercial Aircraft Windows and Windshields Industry Regional Market Share

Geographic Coverage of Commercial Aircraft Windows and Windshields Industry

Commercial Aircraft Windows and Windshields Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Cabin Windows Segment is Projected to Witness the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Aircraft Windows and Windshields Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cabin Windows

- 5.1.2. Cockpit Windshields

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Latin America

- 5.2.3. Asia Pacific

- 5.2.4. Europe

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Aircraft Windows and Windshields Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cabin Windows

- 6.1.2. Cockpit Windshields

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Latin America Commercial Aircraft Windows and Windshields Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cabin Windows

- 7.1.2. Cockpit Windshields

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Commercial Aircraft Windows and Windshields Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cabin Windows

- 8.1.2. Cockpit Windshields

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Europe Commercial Aircraft Windows and Windshields Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cabin Windows

- 9.1.2. Cockpit Windshields

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Commercial Aircraft Windows and Windshields Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cabin Windows

- 10.1.2. Cockpit Windshields

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tech-Tool Plastics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saint-Gobain SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LP Aero Plastics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aerospace Plastic Components

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PPG Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gentex Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Llamas Plastics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lee Aerospace

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VT San Antonio AerospaceNagia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Plexiweiss GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Control Logistics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NORDAM Group Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GKN Aerospace

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Air-Craftglass Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Tech-Tool Plastics Inc

List of Figures

- Figure 1: Global Commercial Aircraft Windows and Windshields Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Latin America Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Latin America Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Latin America Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Latin America Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Commercial Aircraft Windows and Windshields Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Commercial Aircraft Windows and Windshields Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Mexico Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Latin America Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: China Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Germany Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Commercial Aircraft Windows and Windshields Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: United Arab Emirates Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Saudi Arabia Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Qatar Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Commercial Aircraft Windows and Windshields Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aircraft Windows and Windshields Industry?

The projected CAGR is approximately 11.29%.

2. Which companies are prominent players in the Commercial Aircraft Windows and Windshields Industry?

Key companies in the market include Tech-Tool Plastics Inc, Saint-Gobain SA, LP Aero Plastics Inc, Aerospace Plastic Components, PPG Industries Inc, Gentex Corporation, Llamas Plastics Inc, Lee Aerospace, VT San Antonio AerospaceNagia, Plexiweiss GmbH, Control Logistics Inc, NORDAM Group Inc, GKN Aerospace, Air-Craftglass Inc.

3. What are the main segments of the Commercial Aircraft Windows and Windshields Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.45 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Cabin Windows Segment is Projected to Witness the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2021, Airbus and Gentex agreed to offer Gentex Dimmable Aircraft Windows for the A350-1000 and A350-900. The manufacturer claims that these new windows will be able to go fully dark twice as fast and will offer 100% darker solutions than any predecessors. It will also offer technology that blocks out heat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Aircraft Windows and Windshields Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Aircraft Windows and Windshields Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Aircraft Windows and Windshields Industry?

To stay informed about further developments, trends, and reports in the Commercial Aircraft Windows and Windshields Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence