Key Insights

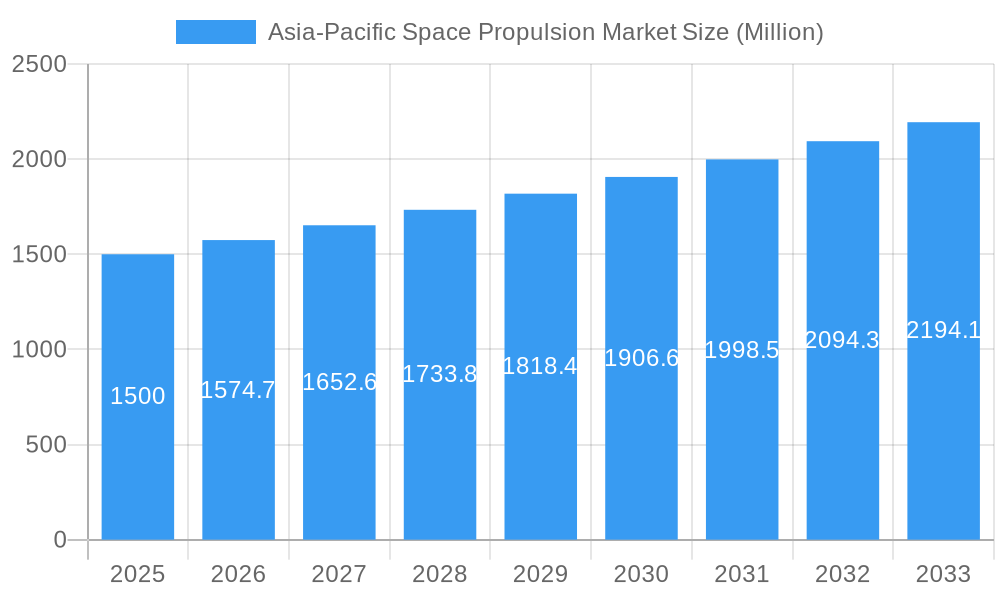

The Asia-Pacific space propulsion market is experiencing robust growth, driven by increasing government investments in space exploration programs across the region, particularly in China, India, Japan, and South Korea. The burgeoning commercial space sector, with companies launching satellites for communication, earth observation, and navigation, further fuels this expansion. Technological advancements in electric propulsion systems, offering higher efficiency and lower fuel consumption compared to traditional gas-based and liquid fuel systems, are reshaping the market landscape. This shift towards electric propulsion is particularly pronounced in smaller satellite launches, where cost-effectiveness is paramount. While the market faces restraints such as high development costs for advanced propulsion technologies and the stringent regulatory environment surrounding space launches, the overall outlook remains positive. The projected Compound Annual Growth Rate (CAGR) of 4.96% suggests a considerable increase in market value over the forecast period (2025-2033). This growth is anticipated to be spearheaded by the expanding satellite constellations for various applications, requiring numerous launches and subsequently, a high demand for reliable and efficient propulsion systems. The dominance of key players like Space Exploration Technologies Corp (SpaceX) and other established aerospace companies underscores the competitiveness within the industry, fostering innovation and driving down costs in the long term.

Asia-Pacific Space Propulsion Market Market Size (In Billion)

The segment analysis reveals significant contributions from various countries within the Asia-Pacific region. China's ambitious space program is expected to contribute heavily to market growth, followed by India's expanding space capabilities and Japan's established aerospace industry. Australia, South Korea, Singapore, and New Zealand also contribute to the market, although their share might be comparatively smaller. The propulsion technology segment is poised for diversification, with electric propulsion slowly gaining traction alongside traditional gas-based and liquid fuel systems. Future growth will largely depend on technological advancements, government policies encouraging space exploration, and the continued expansion of the commercial satellite industry. Collaboration among nations and private entities in the region will likely further accelerate market growth, positioning the Asia-Pacific region as a major player in the global space propulsion industry.

Asia-Pacific Space Propulsion Market Company Market Share

Asia-Pacific Space Propulsion Market Report: 2019-2033

Dive deep into the dynamic Asia-Pacific space propulsion market with this comprehensive report, projecting a market value of xx Million by 2033. This in-depth analysis covers market size, growth drivers, technological advancements, competitive landscape, and key players shaping the future of space exploration in the region. Ideal for investors, industry professionals, and strategic decision-makers, this report provides actionable insights to navigate this burgeoning market.

Asia-Pacific Space Propulsion Market Market Dynamics & Concentration

The Asia-Pacific space propulsion market is experiencing robust growth, driven by increasing government investments in space programs, a surge in satellite launches, and the rise of commercial space ventures. Market concentration is moderate, with a few key players holding significant market share, while numerous smaller companies contribute to innovation and niche applications. The market is witnessing increased M&A activity, with approximately xx deals recorded between 2019 and 2024, signaling consolidation and expansion strategies.

- Innovation Drivers: Advancements in electric propulsion technology, miniaturization of components, and the development of reusable launch vehicles are key drivers.

- Regulatory Frameworks: Government regulations and policies related to space exploration and commercial space activities significantly influence market growth. Varying regulatory landscapes across countries in the Asia-Pacific region impact market dynamics.

- Product Substitutes: While few direct substitutes exist for space propulsion systems, the development of alternative technologies (e.g., advanced materials, improved energy sources) influences the adoption of different propulsion methods.

- End-User Trends: Growing demand from government space agencies, commercial satellite operators, and new space companies is pushing market growth.

- M&A Activities: The moderate level of M&A activity indicates a dynamic market with companies pursuing strategic partnerships and acquisitions to expand their market share and technological capabilities. Market share data for key players is presented within the full report.

Asia-Pacific Space Propulsion Market Industry Trends & Analysis

The Asia-Pacific space propulsion market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors. Increased investment in space infrastructure, growing demand for high-throughput satellites, and the emergence of new space applications (e.g., Earth observation, navigation) are significantly contributing to market expansion. Technological advancements, such as the development of more efficient and reliable electric propulsion systems, are enhancing market penetration. The rise of commercial space travel and the increasing privatization of space exploration are also contributing to the overall market growth. Market penetration is estimated at xx% in 2025, projected to increase to xx% by 2033. The competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, fostering innovation and driving market expansion.

Leading Markets & Segments in Asia-Pacific Space Propulsion Market

The Asia-Pacific region is a dynamic and rapidly evolving landscape for space propulsion, with China and India standing out as the dominant forces. Their leadership is underpinned by substantial and sustained government investments in ambitious national space programs, fueling innovation and expansion. Japan and South Korea are also pivotal players, contributing significantly to the regional market's growth through their advanced technological capabilities and strategic initiatives. Within the propulsion technology spectrum, liquid fuel systems currently command the largest market share, owing to their proven reliability and high thrust capabilities, essential for heavy-lift launch vehicles. However, the electric propulsion segment is experiencing exceptional growth, driven by its superior fuel efficiency, extended mission lifespans, and remarkable versatility for a wide array of satellite applications, from station-keeping to deep-space exploration.

Key Market Drivers and Segment Strengths:

- China: A formidable market driver characterized by massive government funding, aggressive long-term space exploration objectives, and a highly developed domestic space industry capable of end-to-end solutions.

- India: A rapidly ascending power propelled by escalating space program ambitions, a reputation for highly cost-effective space launch services, and an increasingly active and innovative private sector contributing to advancements in propulsion.

- Japan: A leader in technological sophistication, boasting advanced research and development capabilities, robust private sector engagement, and a strategic focus on Earth observation, telecommunications, and scientific missions.

- South Korea: Demonstrating significant growth through substantial investments in indigenous satellite technology, fostering vital international partnerships, and prioritizing space capabilities for national security and defense applications.

- Electric Propulsion Segment: Its rapid ascent is attributed to unparalleled fuel efficiency, enabling longer and more complex missions; extended operational lifespans for satellites; and exceptional adaptability to diverse mission profiles, including small satellites and deep-space probes.

- Liquid Fuel Segment: Continues its dominance due to its inherent high thrust capabilities, well-established and mature technology base, and its essential suitability for the immense power requirements of large launch vehicles and upper stages.

For an in-depth understanding of market dominance, competitive dynamics, and nuanced regional variations, refer to the comprehensive analysis presented in the full report.

Asia-Pacific Space Propulsion Market Product Developments

The Asia-Pacific space propulsion market showcases significant product innovations focusing on higher efficiency, improved reliability, and reduced cost. Electric propulsion systems are seeing substantial advancements, with miniaturization and increased thrust capabilities becoming key focal points. The development of reusable propulsion systems and the integration of advanced materials are enhancing performance and lowering operational costs. This innovation is driving the adoption of new propulsion technologies across various applications, including communication satellites, Earth observation satellites, and deep space exploration missions.

Key Drivers of Asia-Pacific Space Propulsion Market Growth

Several factors propel the growth of the Asia-Pacific space propulsion market. Firstly, significant government investments in space exploration programs are fueling demand for advanced propulsion systems. Secondly, the expanding commercial space sector and the growing number of satellite launches are creating a robust market for propulsion technologies. Thirdly, technological advancements, such as the development of electric propulsion and reusable launch systems, are driving cost reductions and efficiency improvements.

Challenges in the Asia-Pacific Space Propulsion Market Market

The Asia-Pacific space propulsion market faces certain challenges. Stringent regulatory frameworks and licensing requirements can increase costs and slow down market entry. Supply chain disruptions, particularly for specialized materials and components, can impact production and delivery timelines. Furthermore, intense competition among established players and the emergence of new entrants create price pressures and necessitate continuous innovation to maintain a competitive edge. The impact of these challenges varies considerably between countries within the region.

Emerging Opportunities in the Asia-Pacific Space Propulsion Market

Several emerging opportunities promise long-term growth for the Asia-Pacific space propulsion market. Advancements in electric propulsion, such as higher power and thrust levels, offer enhanced capabilities for various missions. Strategic partnerships between government agencies and private companies are fostering innovation and accelerating market development. Expansion into new applications, including space tourism and in-space servicing, presents new revenue streams and growth avenues.

Leading Players in the Asia-Pacific Space Propulsion Market Sector

Key Milestones in Asia-Pacific Space Propulsion Market Industry

- November 2022: The successful launch of NASA's Space Launch System (SLS) for the Artemis I mission, utilizing Northrop Grumman Corporation's advanced five-stage solid rocket boosters, underscored the maturity and reliability of existing, high-performance propulsion technologies.

- December 2022: GKN Aerospace securing a critical contract with ArianeGroup to supply essential components for the next-generation Ariane 6 launchers highlighted significant ongoing investment and commitment to European space propulsion technology, with potential ripple effects on the broader global supply chain and future regional launch capabilities.

- February 2023: Thales Alenia Space's award of a contract by the Korea Aerospace Research Institute (KARI) to provide electric propulsion systems for the GEO-KOMPSAT-3 (GK3) satellite served as a clear indicator of the accelerating adoption and growing demand for efficient electric propulsion solutions within the Asia-Pacific region, particularly for advanced geostationary missions.

Strategic Outlook for Asia-Pacific Space Propulsion Market Market

The Asia-Pacific space propulsion market is poised for continued expansion, driven by increasing government spending, technological advancements, and the growing commercial space sector. Strategic partnerships, investments in research and development, and the focus on sustainable and cost-effective solutions will be crucial for companies seeking to capitalize on future market opportunities. The market presents significant potential for growth and innovation, attracting significant investments and technological advancements in the coming years.

Asia-Pacific Space Propulsion Market Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

Asia-Pacific Space Propulsion Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Space Propulsion Market Regional Market Share

Geographic Coverage of Asia-Pacific Space Propulsion Market

Asia-Pacific Space Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing investments in space startups

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Space Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Safran SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moog Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ariane Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sitael S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thale

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Asia-Pacific Space Propulsion Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Space Propulsion Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 2: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 4: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Space Propulsion Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Asia-Pacific Space Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Honeywell International Inc, Safran SA, Moog Inc, Ariane Group, Sitael S p A, Thale, Northrop Grumman Corporation.

3. What are the main segments of the Asia-Pacific Space Propulsion Market?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing investments in space startups.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.December 2022: GKN Aerospace contracted with ArianeGroup to supply the next stage of the Ariane 6 turbine and Vulcain nozzle. The contract covers the manufacturing and supply of units for 14 Ariane 6 launchers, which are expected to go into production by 2025. GKN Aerospace is currently focused on industrializing and integrating novel and innovative technologies into the Ariane 6 product.November 2022: Two Northrop Grumman Corporation five-stage solid rocket boosters helped launch the first flight of NASA's Space Launch System "SLS"; as part of the Artemis I mission. This is the first in a series of Artemis missions focused on deep space exploration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Space Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Space Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Space Propulsion Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Space Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence