Key Insights

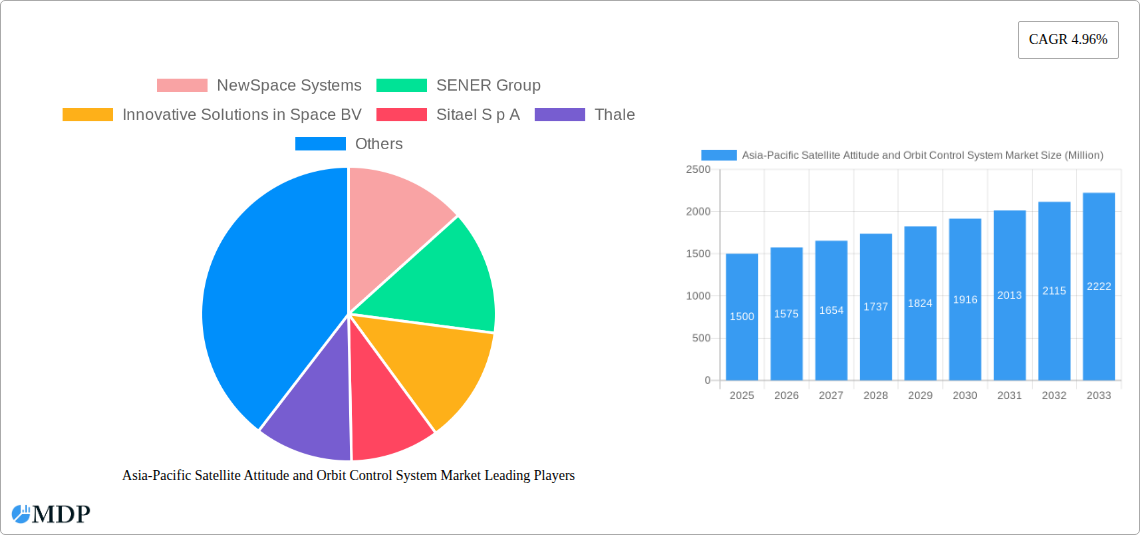

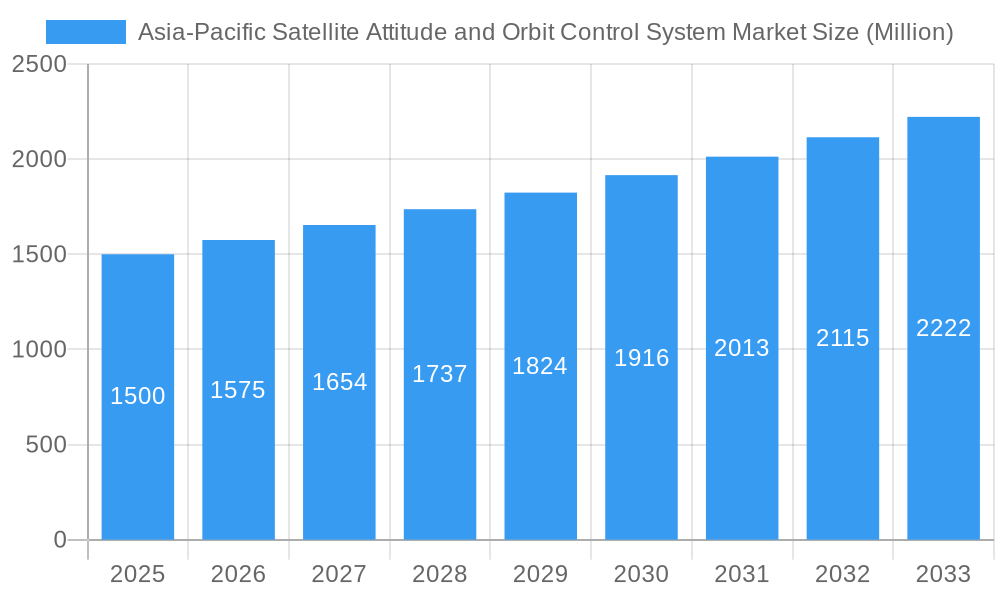

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is poised for substantial expansion, propelled by the escalating demand for satellite-based services across critical sectors including telecommunications, Earth observation, and navigation. The region's robust space programs and significant investments from both governmental and commercial entities are key growth drivers. With a projected compound annual growth rate (CAGR) of 4.96%, the market is set for continued strong performance. Market segmentation indicates that the 100-500kg satellite mass category is anticipated to hold a significant share, owing to the widespread adoption of mid-sized communication and Earth observation satellites. Demand is robust across Low Earth Orbit (LEO), Geostationary Earth Orbit (GEO), and Medium Earth Orbit (MEO) classifications, underscoring the diverse applications of these systems. Leading companies such as NewSpace Systems, SENER Group, and AAC Clyde Space are instrumental in driving technological advancements and market growth. Key contributors to the market's dynamism include China, Japan, India, and South Korea, fueled by their substantial investments in space exploration and technological innovation, creating a competitive environment with ample growth opportunities. The commercial sector leads end-user applications, with military and government sectors also making significant contributions. Growth is further stimulated by the trend towards satellite miniaturization, increasing the demand for more compact and efficient AOCS solutions, though cost-effectiveness in this technologically sophisticated domain remains a consideration.

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Size (In Million)

The forecast period of 2025-2033 presents significant opportunities for the Asia-Pacific AOCS market. This optimistic outlook is supported by advancements in miniaturization technologies and enhanced sensor capabilities, which contribute to improved performance and cost reductions. Governmental initiatives supporting space exploration and technological innovation within leading economies in the region further bolster this upward trajectory. Key challenges may include the high development and deployment costs of advanced AOCS systems, potential supply chain disruptions, and the imperative for continuous technological innovation to maintain competitiveness in the rapidly evolving space technology landscape. Intense competition among established players and emerging NewSpace companies is expected to foster innovation and potentially influence pricing dynamics.

Asia-Pacific Satellite Attitude and Orbit Control System Market Company Market Share

Asia-Pacific Satellite Attitude and Orbit Control System Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market, offering invaluable insights for stakeholders across the aerospace and defense industries. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report covers market dynamics, trends, leading players, and future opportunities. The market is segmented by satellite mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg), orbit class (LEO, MEO, GEO), end-user (Commercial, Military & Government, Other), and application (Communication, Earth Observation, Navigation, Space Observation, Others). The report projects a market value of xx Million by 2033, driven by significant technological advancements and increasing demand for satellite-based services.

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Dynamics & Concentration

The Asia-Pacific Satellite AOCS market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Market concentration is influenced by factors such as technological expertise, manufacturing capabilities, and established customer relationships. Innovation is a crucial driver, with ongoing advancements in sensors, actuators, and control algorithms leading to improved system performance, miniaturization, and cost reduction. Regulatory frameworks, particularly those related to space debris mitigation and spectrum allocation, play a significant role in shaping market growth. The presence of substitute technologies, such as alternative navigation and guidance systems, also influences market dynamics. End-user trends, particularly the growing demand for smaller, more agile satellites in the commercial and government sectors, are shaping market demands. M&A activities have been relatively limited in recent years, with a recorded xx M&A deals in the historical period (2019-2024), indicating a relatively stable market structure. Key metrics like market share are detailed within the full report.

Asia-Pacific Satellite Attitude and Orbit Control System Market Industry Trends & Analysis

The Asia-Pacific Satellite AOCS market is experiencing robust growth, driven by a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, the increasing adoption of small satellites for various applications, such as Earth observation, communication, and navigation, is driving demand for miniaturized and cost-effective AOCS systems. Technological disruptions, including the development of advanced sensors, actuators, and control algorithms, are further enhancing system performance and reliability. Consumer preferences are shifting towards higher precision, lower power consumption, and improved system autonomy. Competitive dynamics are characterized by both established players and new entrants vying for market share, resulting in continuous product innovation and price competition. Market penetration is expected to increase significantly in the coming years, particularly in emerging economies with expanding space programs. The full report details a more granular analysis of these trends, encompassing specifics such as market penetration rates and regional variations.

Leading Markets & Segments in Asia-Pacific Satellite Attitude and Orbit Control System Market

Within the Asia-Pacific region, [Country Name] currently holds the dominant position in the Satellite AOCS market, driven by strong government support for space exploration and robust commercial activities. Other key markets include [Country Name] and [Country Name].

Dominant Segments:

- Satellite Mass: The 10-100kg segment is currently the fastest-growing segment, reflecting the trend towards miniaturization in the satellite industry.

- Orbit Class: The LEO (Low Earth Orbit) segment dominates the market due to the increasing number of LEO constellations for communication and Earth observation.

- End-User: The Commercial sector is the largest end-user segment, followed by the Military & Government sector.

- Application: Communication and Earth Observation are the leading application segments, driving substantial demand for AOCS systems.

Key Drivers:

- Robust government investment in space programs and infrastructure.

- Growing private sector involvement in the satellite industry.

- Expanding telecommunications and navigation needs.

Asia-Pacific Satellite Attitude and Orbit Control System Market Product Developments

Recent product innovations have focused on miniaturization, increased precision, improved reliability, and reduced power consumption. New AOCS systems are incorporating advanced sensors, such as star trackers and inertial measurement units (IMUs), along with sophisticated control algorithms to enhance performance and autonomy. These advancements are improving the market fit for smaller satellites and expanding the range of applications for AOCS technologies. The focus is on creating systems that are more cost-effective, easier to integrate, and capable of handling the demands of increasingly complex satellite missions.

Key Drivers of Asia-Pacific Satellite Attitude and Orbit Control System Market Growth

Several factors fuel the growth of the Asia-Pacific Satellite AOCS market. Technological advancements, particularly in miniaturization and improved sensor technology, are enabling the development of more compact and efficient systems. Economic factors, including rising government spending on space programs and increased private investment in satellite technologies, are driving market expansion. Furthermore, supportive regulatory frameworks and policies encouraging space exploration are creating a favorable environment for market growth.

Challenges in the Asia-Pacific Satellite Attitude and Orbit Control System Market Market

The market faces several challenges, including stringent regulatory hurdles for space launch and operation, potentially impacting project timelines and costs. Supply chain disruptions can lead to delays and increased costs, while intense competition among established and emerging players puts pressure on pricing and profit margins. These factors can collectively impact market growth and profitability.

Emerging Opportunities in Asia-Pacific Satellite Attitude and Orbit Control System Market

The Asia-Pacific Satellite AOCS market presents significant long-term growth opportunities. Technological breakthroughs in areas such as AI-powered autonomous control and advanced sensor technologies will create new market segments and expand applications. Strategic partnerships between established players and innovative startups will facilitate faster product development and market penetration. Expanding market penetration into emerging economies in the Asia-Pacific region will offer significant growth potential.

Leading Players in the Asia-Pacific Satellite Attitude and Orbit Control System Market Sector

Key Milestones in Asia-Pacific Satellite Attitude and Orbit Control System Market Industry

- November 2022: Jena-Optronik GmbH's star sensors were used in NASA's Artemis I mission, showcasing the reliability and precision of their technology.

- December 2022: Jena-Optronik's ASTRO CL star trackers were selected for Maxar's new proliferated LEO satellite platform.

- February 2023: Jena-Optronik was chosen by Airbus OneWeb Satellites to provide AOCS sensors for their ARROW family of small satellites.

Strategic Outlook for Asia-Pacific Satellite Attitude and Orbit Control System Market Market

The Asia-Pacific Satellite AOCS market holds substantial future potential, driven by continuous technological advancements, increasing satellite deployments, and growing demand across diverse applications. Strategic partnerships, investments in R&D, and focus on miniaturization and cost reduction will be key success factors for players seeking to capitalize on this growth. The market's long-term outlook remains optimistic, with significant opportunities for expansion and innovation.

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

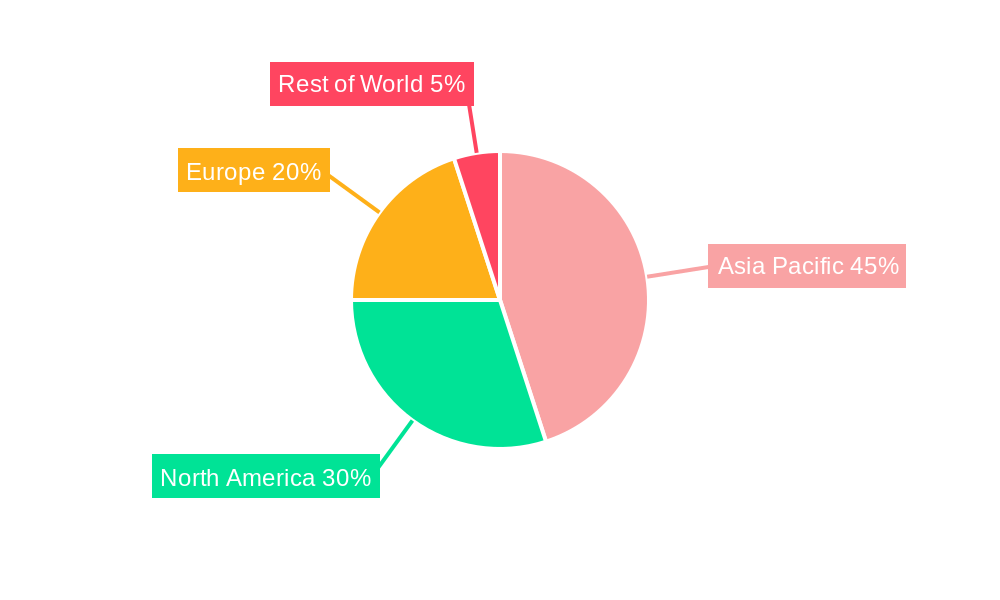

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of Asia-Pacific Satellite Attitude and Orbit Control System Market

Asia-Pacific Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innovative Solutions in Space BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sitael S p A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jena-Optronik

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AAC Clyde Space

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, Innovative Solutions in Space BV, Sitael S p A, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence