Key Insights

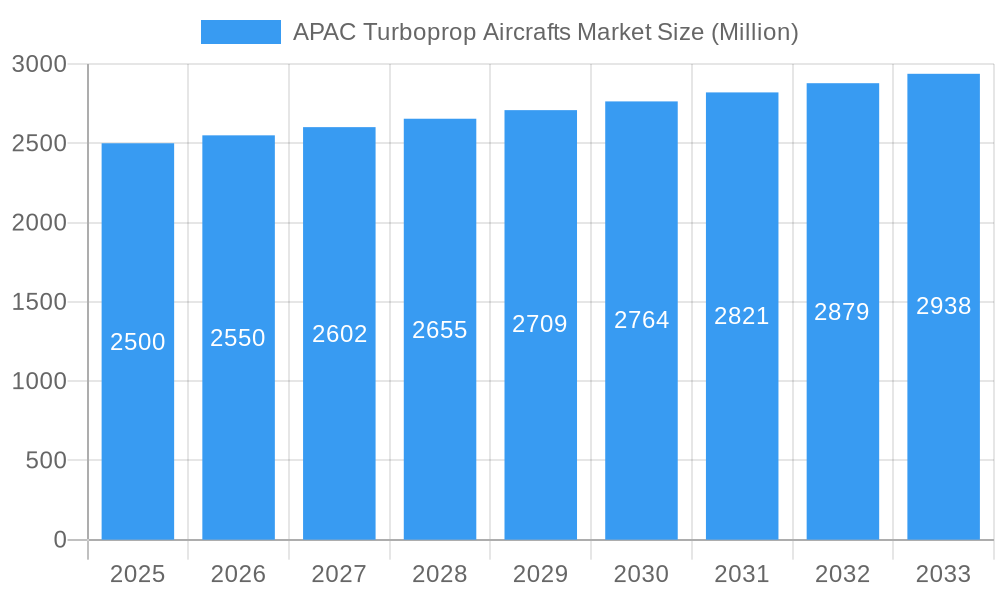

The Asia-Pacific (APAC) turboprop aircraft market is experiencing robust growth, driven by increasing demand for regional air connectivity, infrastructure development, and the rising popularity of short-haul flights. The market's Compound Annual Growth Rate (CAGR) exceeding 2.00% indicates a consistent upward trajectory, projected to continue through 2033. Key market drivers include the expanding middle class in countries like China and India, leading to increased air travel demand. Furthermore, government initiatives promoting regional connectivity and tourism are bolstering the market. The segments within the APAC turboprop aircraft market show varying growth rates; Commercial aviation likely holds the largest market share due to the rising need for efficient regional transportation networks. Military aviation contributes significantly, fueled by modernization efforts and border security requirements. General aviation also shows promise, with increasing private aircraft ownership and flight training activities. Major players like Textron, Lockheed Martin, Airbus, and others are strategically investing in research and development, enhancing aircraft technology and fuel efficiency to compete effectively in this dynamic market. Constraints like fluctuating fuel prices and potential geopolitical instability could impact growth, but overall, the APAC turboprop aircraft market presents substantial opportunities for growth and innovation in the coming years.

APAC Turboprop Aircrafts Market Market Size (In Billion)

The competitive landscape is dominated by established international players and regional manufacturers. The strategic partnerships, mergers, and acquisitions within the industry are reshaping the market dynamics. While China and India are major contributors to the market's expansion, other APAC nations are also experiencing growth, fueled by investments in infrastructure and air travel liberalization. This diversified growth across the region promises sustained expansion for the foreseeable future. The focus on sustainability and the adoption of eco-friendly technologies will likely influence future market trends, with manufacturers increasingly focusing on reducing carbon footprints and operational costs. The integration of advanced avionics and improved safety features will also be a key differentiator in the market, driving adoption and improving profitability for operators.

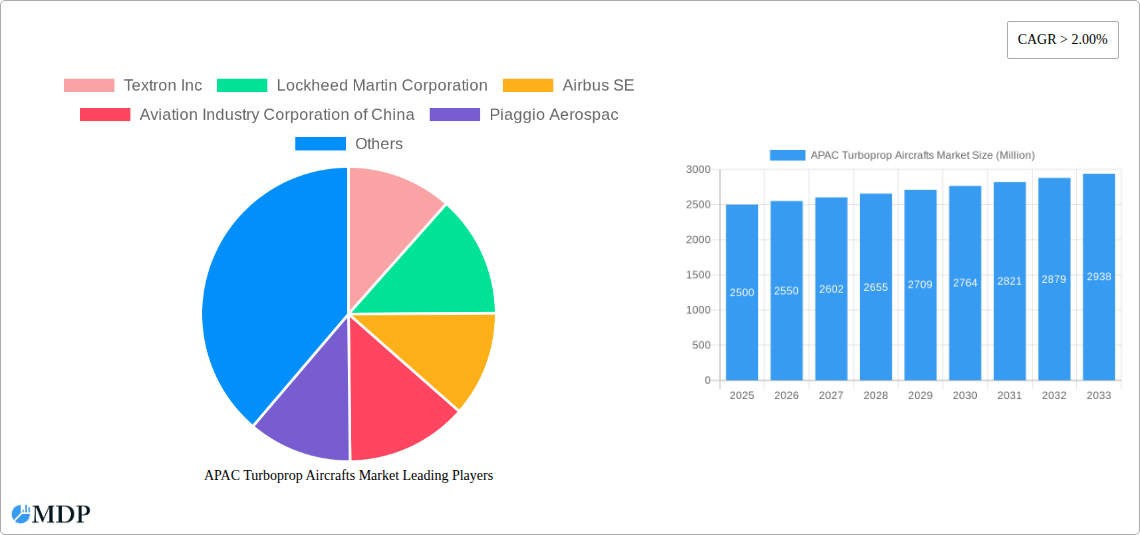

APAC Turboprop Aircrafts Market Company Market Share

Unlock the Potential: A Comprehensive Analysis of the APAC Turboprop Aircraft Market (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Turboprop Aircraft Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. Benefit from detailed segmentation by application (Commercial Aviation, Military Aviation, General Aviation) and gain a competitive edge with actionable intelligence.

APAC Turboprop Aircrafts Market Market Dynamics & Concentration

The APAC turboprop aircraft market is characterized by moderate concentration, with key players like Textron Inc, Lockheed Martin Corporation, Airbus SE, and Aviation Industry Corporation of China holding significant market share. The market’s dynamic nature is shaped by several factors:

- Innovation Drivers: Continuous advancements in turboprop engine technology, focusing on fuel efficiency and reduced emissions, are driving market growth. Furthermore, the development of advanced avionics and flight control systems is enhancing aircraft performance and safety.

- Regulatory Frameworks: Stringent safety regulations and environmental policies implemented across APAC nations influence aircraft design and operation, impacting market dynamics. These regulations are expected to drive adoption of more fuel-efficient and environmentally friendly turboprop aircraft.

- Product Substitutes: Competition from other aircraft types, such as helicopters and smaller regional jets, presents a challenge, although turboprops maintain a strong advantage in specific applications like short-haul regional connectivity.

- End-User Trends: The rising demand for regional air connectivity, particularly in less-developed areas with shorter runways, fuels the growth of the turboprop aircraft market. Increased tourism and business travel also contribute to this demand.

- M&A Activities: The market has witnessed a moderate number of mergers and acquisitions (M&A) deals in the historical period (2019-2024), approximately xx deals. These activities are expected to continue, driven by the need for consolidation and expansion in the market. Market share among top five players is estimated at approximately xx% in 2025.

APAC Turboprop Aircrafts Market Industry Trends & Analysis

The APAC turboprop aircraft market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by:

- Increasing Air Travel Demand: The burgeoning middle class in several APAC countries is driving a significant increase in air travel demand, particularly in regional routes.

- Government Initiatives: Several governments in the region are investing in infrastructure development, including airport expansion and improvement of regional air connectivity, creating a favorable environment for turboprop aircraft operators.

- Technological Advancements: The development of more fuel-efficient engines and advanced avionics systems is enhancing the cost-effectiveness and operational efficiency of turboprop aircraft. Market penetration of these newer technologies is estimated to reach xx% by 2033.

- Competitive Dynamics: Intense competition among major manufacturers is driving innovation and price reductions, making turboprop aircraft more accessible to operators. However, the market is also witnessing new entrants and strategic partnerships. This contributes to a competitive landscape with diverse offerings and pricing strategies.

Leading Markets & Segments in APAC Turboprop Aircrafts Market

Within the APAC region, xx is projected as the leading market for turboprop aircraft in 2025, driven by:

- Robust Economic Growth: Strong economic growth in xx fuels air travel demand and infrastructure development.

- Government Support: Government initiatives promoting regional connectivity and tourism boost the adoption of turboprop aircraft.

- Favorable Regulatory Environment: A supportive regulatory environment simplifies aircraft operations and encourages market expansion.

Segment Dominance: The Commercial Aviation segment is expected to dominate the market throughout the forecast period, accounting for approximately xx% of the total market share in 2025. This is driven by the significant demand for regional air travel and the cost-effectiveness of turboprop aircraft for shorter routes.

- Commercial Aviation: Growth driven by increasing passenger traffic on regional routes and the expansion of low-cost carriers.

- Military Aviation: Demand driven by modernization programs and the need for versatile aircraft for surveillance and transport operations.

- General Aviation: Growth fueled by rising private air travel and the use of turboprops for various applications, such as cargo transport and aerial surveys.

APAP Turboprop Aircrafts Market Product Developments

Recent years have seen significant advancements in turboprop aircraft technology, particularly in engine efficiency and avionics. Manufacturers are focusing on developing lighter, more fuel-efficient engines, incorporating advanced materials and design techniques to enhance performance. These innovations cater to the growing demand for environmentally friendly and cost-effective air travel, increasing the market appeal of updated turboprop models.

Key Drivers of APAC Turboprop Aircrafts Market Growth

The APAC turboprop aircraft market is propelled by several key growth drivers:

- Rising disposable incomes: The growth of the middle class in APAC is fueling demand for air travel.

- Government investments in infrastructure: Airport expansions and improved regional connectivity are boosting the market.

- Technological advancements: Improved engine efficiency and avionics are making turboprops more attractive.

Challenges in the APAC Turboprop Aircrafts Market Market

Challenges facing the market include:

- High initial investment costs: The acquisition of new turboprop aircraft can be expensive for smaller operators.

- Maintenance and operational costs: These costs can represent a significant burden on profitability.

- Competition from other aircraft types: Turboprops face competition from regional jets and helicopters. This competition is estimated to reduce the market share of turboprops by approximately xx% by 2033.

Emerging Opportunities in APAC Turboprop Aircrafts Market

Emerging opportunities include:

- Expansion into underserved markets: Many regions in APAC still lack adequate air connectivity, presenting substantial market potential.

- Technological innovations: Further advancements in engine technology and avionics will enhance market competitiveness.

- Strategic partnerships: Collaborations between manufacturers and operators can foster market growth.

Leading Players in the APAC Turboprop Aircrafts Market Sector

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- Aviation Industry Corporation of China

- Piaggio Aerospac

- Pilatus Aircraft Ltd

- DAHER

- ATR

- Piper Aircraft Inc

Key Milestones in APAC Turboprop Aircrafts Market Industry

- 2020: Introduction of a new fuel-efficient turboprop engine by xx manufacturer.

- 2022: xx airline expands its turboprop fleet to cater to increased regional demand.

- 2023: xx government announces subsidies to support the adoption of advanced turboprop aircraft.

Strategic Outlook for APAC Turboprop Aircrafts Market Market

The APAC turboprop aircraft market presents substantial growth potential driven by increasing air travel demand, infrastructure development, and technological advancements. Strategic partnerships, market expansion into underserved areas, and continued focus on improving operational efficiency and environmental sustainability will be key factors in shaping the future of this dynamic market. The market is anticipated to reach a value of approximately xx Million by 2033.

APAC Turboprop Aircrafts Market Segmentation

-

1. Application

- 1.1. Commercial Aviation

- 1.2. Military Aviation

- 1.3. General Aviation

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia-Pacific

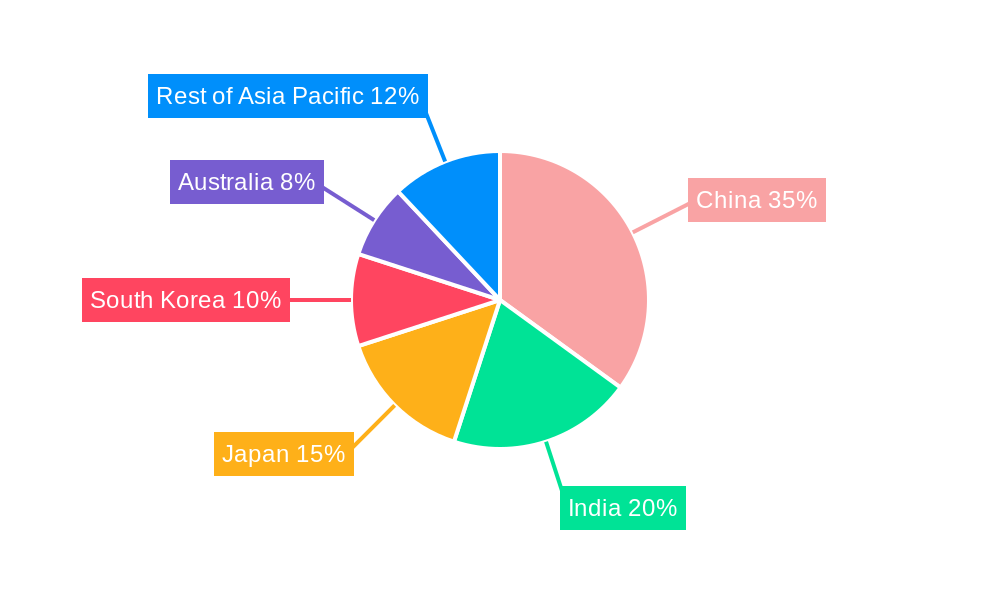

APAC Turboprop Aircrafts Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

APAC Turboprop Aircrafts Market Regional Market Share

Geographic Coverage of APAC Turboprop Aircrafts Market

APAC Turboprop Aircrafts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aviation Segment Expected to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Turboprop Aircrafts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aviation

- 5.1.2. Military Aviation

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aviation Industry Corporation of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Piaggio Aerospac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pilatus Aircraft Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DAHER

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ATR

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Piper Aircraft Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Global APAC Turboprop Aircrafts Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Geography 2025 & 2033

- Figure 5: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Turboprop Aircrafts Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the APAC Turboprop Aircrafts Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Aviation Industry Corporation of China, Piaggio Aerospac, Pilatus Aircraft Ltd, DAHER, ATR, Piper Aircraft Inc.

3. What are the main segments of the APAC Turboprop Aircrafts Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aviation Segment Expected to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Turboprop Aircrafts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Turboprop Aircrafts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Turboprop Aircrafts Market?

To stay informed about further developments, trends, and reports in the APAC Turboprop Aircrafts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence