Key Insights

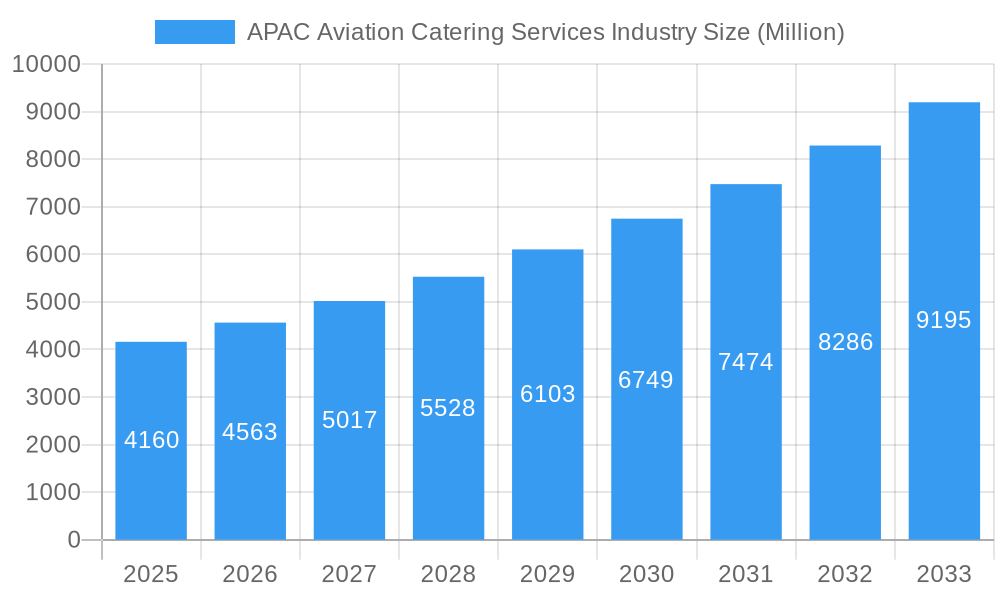

The Asia-Pacific (APAC) aviation catering services market, valued at $4.16 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.76% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning air travel sector within APAC, fueled by rising disposable incomes and increased tourism, significantly boosts demand for in-flight meals and beverages. A shift towards premium travel experiences, with passengers increasingly opting for business and first-class flights, further fuels market growth. Furthermore, the growing preference for diverse and customized meal options, catering to various dietary restrictions and preferences, presents lucrative opportunities for catering providers. The increasing adoption of advanced technologies, such as automated meal preparation systems and optimized logistics, enhances efficiency and reduces operational costs, contributing to market expansion. However, factors such as fluctuating fuel prices, stringent regulatory compliance requirements, and the potential impact of global economic uncertainties pose challenges to the industry's sustained growth. Competition among established players and the emergence of new entrants also contribute to a dynamic and evolving market landscape.

APAC Aviation Catering Services Industry Market Size (In Billion)

Segmentation analysis reveals a diverse market structure. The full-service carrier segment likely holds a larger market share compared to low-cost carriers, reflecting a higher demand for premium catering services on long-haul flights. Within seating classes, business and first-class segments likely command higher average revenue per passenger, contributing significantly to overall market value. Specific food types such as meals and bakery & confectionery items likely constitute a substantial portion of the market, driven by passenger preferences and in-flight meal offerings. Within the APAC region, countries like India, China, and Japan are expected to be key growth drivers, reflecting the significant size and rapid growth of their respective aviation industries. The substantial "Rest of Asia Pacific" segment underscores the considerable market potential across emerging economies in the region. The forecast period of 2025-2033 promises considerable market expansion, creating opportunities for both established players and new entrants. However, the industry will need to adapt to changing consumer preferences and navigate the challenges posed by global economic and geopolitical uncertainties.

APAC Aviation Catering Services Industry Company Market Share

SEO-Optimized Report Description: APAC Aviation Catering Services Industry (2019-2033)

This comprehensive report provides a detailed analysis of the Asia-Pacific Aviation Catering Services industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils market dynamics, growth drivers, challenges, and emerging opportunities within this dynamic sector. The report leverages rigorous data analysis and expert insights to forecast market trends and provide actionable recommendations for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

APAC Aviation Catering Services Industry Market Dynamics & Concentration

The APAC aviation catering services market is characterized by a moderately concentrated landscape, with a few dominant global players such as Gate Gourmet, SATS, and Emirates Flight Catering consistently securing significant market share. The combined market share of the top five players in 2024 was estimated at xx%, indicating a consolidated but not entirely saturated market. Market concentration is significantly influenced by the substantial capital investment required for large-scale operations, the critical importance of economies of scale in cost management, robust brand recognition built over years of service, and the necessity of an extensive, efficient network reach across numerous airports and flight routes.

Innovation is a primary driver shaping the market, with a strong emphasis on advancements in meal preparation techniques, the development of sustainable and functional packaging solutions, and the optimization of delivery systems to ensure freshness and punctuality. Furthermore, stringent regulatory frameworks concerning food safety, hygiene standards, and quality control have a profound impact on operational costs, compliance requirements, and the overall feasibility of new market entrants.

Emerging competitive pressures stem from the rise of product substitutes, including sophisticated in-flight meal delivery services offered by third-party providers and the increasing trend of airlines opting for simplified catering models. End-user preferences are evolving rapidly, with a growing demand for diverse dietary options (e.g., vegan, gluten-free, halal), a strong preference for healthier ingredients, and a desire for personalized meal choices that cater to individual tastes and special occasions. The historical period (2019-2024) witnessed a dynamic market with approximately xx M&A deals, a testament to the ongoing consolidation and strategic realignment within the industry. The forecast period is expected to see a continued upward trend in M&A activity, fueled by airlines and catering providers seeking expansion opportunities, synergistic operational efficiencies, and enhanced market penetration.

- Key Players: Gate Gourmet, SATS, Emirates Flight Catering, Cathay Pacific Catering, Jetfinity, Newrest Group, LSG Sky Chefs, Flying Food Group, Air China Limited, Journey Group Inc.

- Market Share Concentration (2024): Top 5 players - xx%

- M&A Activity (2019-2024): xx deals

APAC Aviation Catering Services Industry Trends & Analysis

The APAC aviation catering services market is experiencing robust growth, fueled by the burgeoning air travel sector. The increasing number of passengers and the expansion of airline networks across the region contribute significantly to market expansion. Technological advancements, such as automated meal preparation systems and advanced packaging techniques, are streamlining operations and enhancing efficiency. Changing consumer preferences, including the demand for healthier and more diverse meal options, are shaping the product landscape. Intense competition among catering providers is driving innovation and service improvements. The market exhibits a significant growth opportunity in the low-cost carrier segment, where cost-effective solutions are in high demand. The estimated market size in 2025 is xx Million, with a projected CAGR of xx% from 2025 to 2033. Market penetration remains relatively high in major aviation hubs, leaving opportunities for expansion in secondary and tertiary markets.

Leading Markets & Segments in APAC Aviation Catering Services Industry

China and India dominate the APAC aviation catering services market, driven by significant air passenger growth and expanding domestic airline networks. Within the segment analysis:

- Food Type: Meals represent the largest segment, followed by bakery and confectionary. The demand for specialized diets (vegetarian, vegan, halal) is on the rise.

- Flight Type: Full-service carriers contribute significantly to the market volume due to higher onboard meal provisions. Low-cost carriers offer a growing yet cost-sensitive segment.

- Aircraft Seating Class: Business and First Class segments demand higher quality and customized meals, commanding premium pricing. Economy class remains the largest volume segment.

Key Drivers:

- China: Rapid economic growth, expansion of domestic air travel, and increasing disposable incomes.

- India: Rising middle class, increased tourism, and growth of budget airlines.

- Southeast Asia: Increasing regional air connectivity and tourism.

APAC Aviation Catering Services Industry Product Developments

Recent product innovations are at the forefront of enhancing the passenger experience and operational sustainability. A significant focus is placed on developing eco-friendly and sustainable packaging solutions, utilizing biodegradable or recyclable materials to minimize environmental impact. The market is also witnessing a surge in personalized meal options, meticulously tailored to accommodate a wide array of dietary needs, allergies, religious restrictions, and specific consumer preferences, often enabled by advanced ordering and customization platforms.

Improvements in meal presentation are equally critical, with catering services investing in aesthetically pleasing designs and higher-quality ingredients to elevate the perceived value of in-flight dining. Technological advancements are revolutionizing production processes, including the adoption of automated meal assembly systems that boost efficiency and precision, and the implementation of advanced food preservation techniques that extend shelf life while maintaining nutritional integrity and taste. These innovations not only enhance the competitive advantage by improving operational efficiency and reducing waste but also directly appeal to a broader and more discerning range of consumer preferences, ultimately contributing to customer satisfaction and loyalty.

Key Drivers of APAP Aviation Catering Services Industry Growth

Several factors fuel the growth of the APAC aviation catering services market:

- Growth in Air Passenger Traffic: The significant rise in air passenger numbers across APAC is a major driver.

- Expansion of Airline Networks: The expansion of both full-service and low-cost carriers contributes to increased demand.

- Technological Advancements: Automation and improved food preservation technologies enhance efficiency and reduce costs.

- Rising Disposable Incomes: Increased purchasing power drives demand for higher quality and more diverse meal options.

Challenges in the APAC Aviation Catering Services Industry Market

The APAC aviation catering services industry faces a complex web of challenges that impact profitability and operational effectiveness. A paramount concern is the unwavering necessity of maintaining stringent food safety and hygiene standards across a multitude of diverse operational environments, from bustling international hubs to remote regional airports, each with its unique logistical and regulatory demands.

The industry is also susceptible to significant economic volatilities, particularly the impact of fluctuating fuel prices, which directly influence transportation costs for ingredients and finished meals, and consequently, overall operational expenses. Navigating the landscape of intense competition from both established, large-scale players with extensive global networks and agile new entrants offering innovative solutions presents a continuous strategic hurdle.

Furthermore, the industry is vulnerable to external disruptions such as supply chain interruptions, which can arise from geopolitical events, natural disasters, or trade disputes, leading to ingredient shortages or delivery delays. Labor shortages, especially skilled culinary staff and logistics personnel, can also significantly affect operational efficiency and service quality. The quantifiable impact of these challenges is evident in the often-volatile profit margins and the sustained pressure to manage and mitigate increased operational costs.

Emerging Opportunities in APAC Aviation Catering Services Industry

Significant growth opportunities exist in expanding into secondary and tertiary airports, partnering with airlines to offer customized meal solutions, and leveraging technology for personalized ordering and delivery systems. Strategic partnerships with technology providers and sustainable sourcing initiatives provide avenues for growth and improved profitability. Expansion into the burgeoning e-commerce sector for pre-ordered in-flight meals presents an exciting avenue.

Leading Players in the APAC Aviation Catering Services Industry Sector

- Gate Gourmet (Gate Group)

- SATS

- Emirates Flight Catering Company LLC

- Cathay Pacific Catering Services (HK) Limited

- Jetfinity

- Newrest Group Services

- LSG Sky Chefs (LSG Group)

- Flying Food Group LLC

- Air China Limited

- Journey Group Inc

Key Milestones in APAC Aviation Catering Services Industry Industry

- 2020: Increased focus on hygiene protocols due to the COVID-19 pandemic.

- 2021: Adoption of contactless delivery systems in some major airports.

- 2022: Investments in sustainable packaging solutions by key players.

- 2023: Several M&A activities aimed at market consolidation.

- 2024: Introduction of personalized meal ordering apps by certain airlines.

Strategic Outlook for APAC Aviation Catering Services Industry Market

The APAC aviation catering services market is strategically positioned for robust and sustained growth, driven by a confluence of favorable factors including the projected increase in air travel passenger volumes across the region, ongoing technological advancements in food production and logistics, and the steady rise in disposable incomes, which often correlates with increased spending on premium in-flight services.

Key strategic opportunities lie in embracing and leading the charge towards greater sustainability across the entire value chain, from sourcing to waste management. The demand for personalization in meal offerings is expected to grow exponentially, requiring innovative approaches to customization and dietary inclusivity. Furthermore, continued investment in and adoption of technological innovation will be crucial for optimizing operational efficiency, enhancing food quality, and improving the overall passenger experience. To maintain a competitive edge in this dynamic and evolving industry, strategic initiatives such as expansion into underserved or emerging markets and the formation of strategic partnerships with airlines, technology providers, and other industry stakeholders will be indispensable.

APAC Aviation Catering Services Industry Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and Confectionary

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Flight Type

- 2.1. Full-service Carriers

- 2.2. Low-cost Carriers

-

3. Aircraft Seating Class

- 3.1. Economy Class

- 3.2. Business Class

- 3.3. First Class

-

4. Geography

- 4.1. India

- 4.2. China

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

APAC Aviation Catering Services Industry Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

APAC Aviation Catering Services Industry Regional Market Share

Geographic Coverage of APAC Aviation Catering Services Industry

APAC Aviation Catering Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Meals Segment is Projected to Occupy the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and Confectionary

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Flight Type

- 5.2.1. Full-service Carriers

- 5.2.2. Low-cost Carriers

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.3.1. Economy Class

- 5.3.2. Business Class

- 5.3.3. First Class

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. India APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and Confectionary

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Flight Type

- 6.2.1. Full-service Carriers

- 6.2.2. Low-cost Carriers

- 6.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.3.1. Economy Class

- 6.3.2. Business Class

- 6.3.3. First Class

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. China APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and Confectionary

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Flight Type

- 7.2.1. Full-service Carriers

- 7.2.2. Low-cost Carriers

- 7.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.3.1. Economy Class

- 7.3.2. Business Class

- 7.3.3. First Class

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. Japan APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 8.1.1. Meals

- 8.1.2. Bakery and Confectionary

- 8.1.3. Beverages

- 8.1.4. Other Food Types

- 8.2. Market Analysis, Insights and Forecast - by Flight Type

- 8.2.1. Full-service Carriers

- 8.2.2. Low-cost Carriers

- 8.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 8.3.1. Economy Class

- 8.3.2. Business Class

- 8.3.3. First Class

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 9. South Korea APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 9.1.1. Meals

- 9.1.2. Bakery and Confectionary

- 9.1.3. Beverages

- 9.1.4. Other Food Types

- 9.2. Market Analysis, Insights and Forecast - by Flight Type

- 9.2.1. Full-service Carriers

- 9.2.2. Low-cost Carriers

- 9.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 9.3.1. Economy Class

- 9.3.2. Business Class

- 9.3.3. First Class

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. India

- 9.4.2. China

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 10. Rest of Asia Pacific APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 10.1.1. Meals

- 10.1.2. Bakery and Confectionary

- 10.1.3. Beverages

- 10.1.4. Other Food Types

- 10.2. Market Analysis, Insights and Forecast - by Flight Type

- 10.2.1. Full-service Carriers

- 10.2.2. Low-cost Carriers

- 10.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 10.3.1. Economy Class

- 10.3.2. Business Class

- 10.3.3. First Class

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. India

- 10.4.2. China

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gate Gourmet (Gate Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SATS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emirates Flight Catering Company LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cathay Pacific Catering Services (HK) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jetfinity

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Newrest Group Services

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LSG Sky Chefs (LSG Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flying Food Group LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Air China Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Journey Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gate Gourmet (Gate Group)

List of Figures

- Figure 1: Global APAC Aviation Catering Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: India APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 3: India APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 4: India APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 5: India APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 6: India APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 7: India APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 8: India APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 9: India APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: India APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: India APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: China APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 13: China APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 14: China APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 15: China APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 16: China APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 17: China APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 18: China APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 19: China APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: China APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: China APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Japan APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 23: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 24: Japan APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 25: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 26: Japan APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 27: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 28: Japan APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 29: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Japan APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 33: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 34: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 35: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 36: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 37: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 38: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 39: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 2: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 3: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 4: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 7: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 8: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 9: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 12: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 13: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 14: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 17: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 18: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 19: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 22: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 23: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 24: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 27: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 28: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 29: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Aviation Catering Services Industry?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the APAC Aviation Catering Services Industry?

Key companies in the market include Gate Gourmet (Gate Group), SATS, Emirates Flight Catering Company LLC, Cathay Pacific Catering Services (HK) Limited, Jetfinity, Newrest Group Services, LSG Sky Chefs (LSG Group), Flying Food Group LLC, Air China Limited, Journey Group Inc.

3. What are the main segments of the APAC Aviation Catering Services Industry?

The market segments include Food Type, Flight Type, Aircraft Seating Class, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.16 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Meals Segment is Projected to Occupy the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Aviation Catering Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Aviation Catering Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Aviation Catering Services Industry?

To stay informed about further developments, trends, and reports in the APAC Aviation Catering Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence