Key Insights

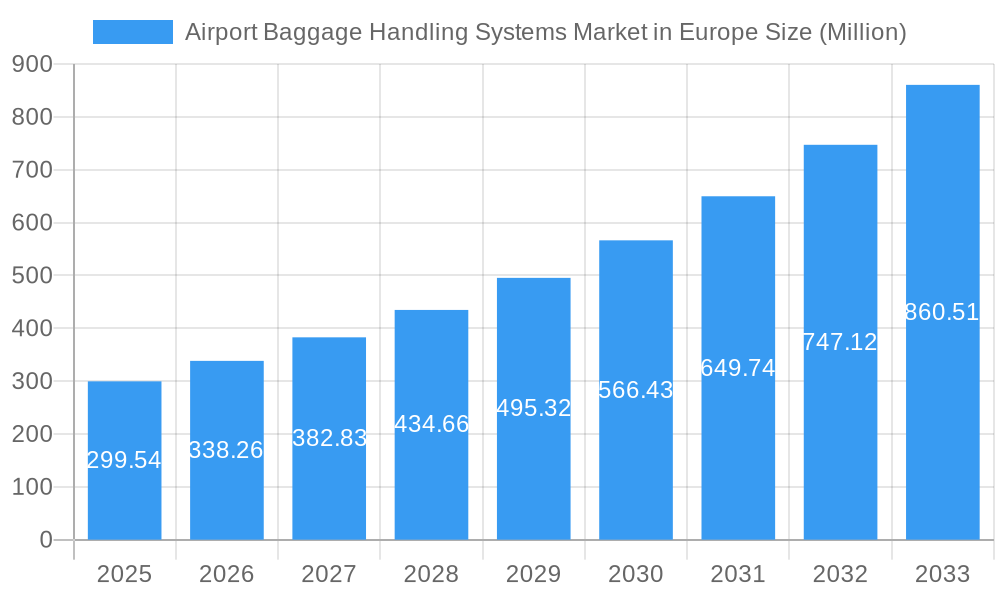

The European airport baggage handling systems market is experiencing robust growth, projected to reach \$299.54 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.14% from 2025 to 2033. This expansion is driven by several key factors. Increasing passenger traffic at major European airports necessitates efficient and automated baggage handling solutions to manage the growing volume. Furthermore, a strong emphasis on improving passenger experience, reducing delays, and enhancing security protocols fuels demand for advanced baggage handling systems. Technological advancements, such as the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies for improved tracking and real-time monitoring, are also significantly contributing to market growth. The market is segmented by airport capacity, with larger airports (above 40 million passengers annually) representing a substantial portion of the market due to their higher volume requirements. Competition is fierce, with major players like Vanderlande Industries B.V., Siemens AG, and Daifuku Co. Ltd. vying for market share through technological innovation and strategic partnerships. Growth is particularly strong in countries like Germany, France, and the UK, reflecting the high concentration of major international airports and consistent investment in infrastructure upgrades.

Airport Baggage Handling Systems Market in Europe Market Size (In Million)

The market's growth, however, is not without its challenges. High initial investment costs for advanced systems can be a barrier for smaller airports. Furthermore, the need for ongoing maintenance and skilled technicians poses an operational hurdle. Regulatory compliance and security concerns are also important factors influencing market dynamics. Despite these constraints, the long-term outlook for the European airport baggage handling systems market remains positive, driven by sustained passenger growth, technological advancements, and the imperative to optimize airport operations for efficiency and enhanced passenger satisfaction. The market's geographic distribution reflects the density of major airports in Western Europe, which are driving significant demand. Continued investment in infrastructure modernization and expansion of existing airports throughout Europe will underpin sustained market growth well into the forecast period.

Airport Baggage Handling Systems Market in Europe Company Market Share

Airport Baggage Handling Systems Market in Europe: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Airport Baggage Handling Systems market in Europe, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, trends, leading players, and future opportunities. The market is segmented by airport capacity (Up to 15 Million, 15-25 Million, 25-40 Million, Above 40 Million), providing granular analysis for informed strategic planning. The report includes detailed financial projections, CAGR estimations, and competitive landscaping, ensuring a complete understanding of this dynamic sector.

Airport Baggage Handling Systems Market in Europe Market Dynamics & Concentration

The European airport baggage handling systems market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors such as technological advancements, stringent regulatory frameworks, and increasing demand for efficient and automated systems. The market share of the top five players is estimated at approximately xx%, with Vanderlande Industries B V, BEUMER Group, Alstef Group SAS, and Daifuku Co Ltd holding prominent positions. Innovation drivers, including AI-powered solutions and improved baggage tracking, are reshaping the market. Furthermore, evolving regulatory compliance requirements, particularly concerning security and safety, are driving investment in advanced systems. Product substitutes, while limited, include manual baggage handling, but automation is becoming increasingly prevalent due to efficiency and cost-effectiveness. End-user trends, driven by passenger volume growth and enhanced passenger experience expectations, are pushing demand for higher-capacity and more reliable systems. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, largely focused on enhancing technological capabilities and expanding geographical reach.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Drivers: AI, improved baggage tracking, and automation.

- Regulatory Frameworks: Stringent safety and security standards driving market growth.

- Product Substitutes: Limited, with manual handling gradually being replaced by automation.

- End-User Trends: Increasing passenger volume driving demand for high-capacity systems.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Airport Baggage Handling Systems Market in Europe Industry Trends & Analysis

The European airport baggage handling systems market is demonstrating impressive growth, propelled by a confluence of escalating air passenger traffic, substantial investments in the modernization of existing airport infrastructure, and the accelerated adoption of cutting-edge technologies. The market is anticipated to achieve a Compound Annual Growth Rate (CAGR) of approximately **8.5%** during the forecast period spanning from 2024 to 2032. This robust expansion is underpinned by several pivotal trends: a surging demand for highly efficient and dependable baggage handling solutions across European airports, a pronounced increase in the deployment of automated systems aimed at curtailing operational expenditures and bolstering security protocols, the imperative to adhere to stringent regulatory mandates, and continuous technological innovations in areas such as Artificial Intelligence (AI), the Internet of Things (IoT), and advanced robotics. While advanced baggage handling systems have already achieved significant market penetration in major European aviation hubs, a considerable and largely untapped growth potential exists within smaller and regional airports. Evolving consumer expectations are increasingly prioritizing expedited baggage processing and minimized waiting times, thereby fueling the demand for innovative and highly efficient systems. The competitive landscape is characterized by intense rivalry, with established market leaders making substantial investments in Research and Development (R&D) and strategically expanding their service portfolios to maintain their dominant positions.

Leading Markets & Segments in Airport Baggage Handling Systems Market in Europe

The United Kingdom and Germany are presently at the forefront of the European airport baggage handling systems market. This leadership is attributed to their exceptionally high air passenger volumes and their well-developed, sophisticated aviation infrastructure. France, alongside other prominent European economies, also presents substantial and lucrative market opportunities. The ongoing development and upgrade of baggage handling systems are critical for these nations to manage increasing passenger flows and enhance operational efficiency.

Segment Analysis by Airport Capacity:

- Up to 15 Million Passengers: This segment is exhibiting steady and consistent growth, primarily propelled by strategic modernization initiatives undertaken by smaller and regional airports seeking to improve their handling capabilities and passenger experience.

- 15-25 Million Passengers: This category holds significant growth potential as medium-sized airports are actively undertaking upgrades and expansions to accommodate rising passenger numbers and implement more advanced baggage handling technologies.

- 25-40 Million Passengers: Airports within this capacity range demonstrate a strong market presence, driven by continuous expansion projects and dedicated efforts to enhance the efficiency and reliability of their baggage handling operations.

- Above 40 Million Passengers: This segment represents the highest demand for highly sophisticated, integrated, and exceptionally efficient baggage handling systems. Major aviation hubs fall into this category, offering the greatest growth potential due to ongoing capacity expansions and the need for state-of-the-art solutions to manage immense passenger volumes.

Key Drivers for Dominant Regions:

- United Kingdom: Characterized by exceptionally high passenger volumes and robust, ongoing investment in airport infrastructure development and modernization.

- Germany: Benefits from a strong, well-established aviation sector and a highly efficient national logistics network, supporting advanced infrastructure development.

- France: Driven by significant, large-scale modernization projects at its major international airports, aiming to integrate the latest baggage handling technologies.

Airport Baggage Handling Systems Market in Europe Product Developments

Recent product developments in the European airport baggage handling systems market focus on enhancing automation, improving baggage tracking capabilities, and integrating advanced security features. Innovations like AI-powered baggage sorting, real-time tracking systems, and self-service baggage drop-off kiosks are enhancing efficiency and passenger experience. These advancements are tailored to meet the evolving needs of airports of various capacities, focusing on improved throughput, reduced operational costs, and increased security. The market favors systems offering flexible scalability to adapt to fluctuating passenger volumes and future expansion plans.

Key Drivers of Airport Baggage Handling Systems Market in Europe Growth

Several factors are driving the growth of the European airport baggage handling systems market. Technological advancements, such as the adoption of automated guided vehicles (AGVs) and advanced robotics, are enhancing efficiency and reducing operational costs. Economic factors like increasing air passenger traffic and growing airport infrastructure development are creating significant demand. Stringent regulatory requirements related to aviation safety and security are also prompting the adoption of advanced systems and upgrades to existing infrastructure. The increasing focus on improving passenger experience through faster baggage handling processes also contributes to market growth.

Challenges in the Airport Baggage Handling Systems Market in Europe Market

Despite the positive growth outlook, the market faces several challenges. Regulatory hurdles and compliance requirements can increase project costs and timelines. Supply chain disruptions and material cost fluctuations can impact project budgets and delivery schedules. Intense competition among established players can compress margins. Additionally, the integration of new technologies into existing infrastructure can be complex and costly, posing a barrier to adoption in some cases. These challenges collectively impact market expansion and profitability.

Emerging Opportunities in Airport Baggage Handling Systems Market in Europe

The trajectory of the European airport baggage handling systems market is exceptionally promising, with a multitude of exciting opportunities on the horizon. Groundbreaking technological advancements, particularly the deep integration of AI and machine learning algorithms, are set to create more intelligent, predictive, and exceptionally efficient baggage handling systems. Strategic collaborations and partnerships between leading system integrators and proactive airport operators are crucial for facilitating seamless implementation, ensuring interoperability, and delivering optimized, end-to-end baggage management solutions. The expansion of market reach into smaller and underserved regional airports represents a significant area of untapped potential, offering substantial growth prospects. Furthermore, the escalating demand for self-service baggage check-in solutions and enhanced passenger baggage tracking capabilities will serve as significant catalysts for market expansion and innovation.

Leading Players in the Airport Baggage Handling Systems Market in Europe Sector

- Vanderlande Industries B V

- Ammega Group BV

- BB Computerteknikk AS

- BEUMER Group

- Alstef Group SAS

- Siemens AG

- Lift All A

- Daifuku Co Ltd

- SITA

- PSI Logistics GmbH

Key Milestones in Airport Baggage Handling Systems Market in Europe Industry

- March 2023: Alstef Group successfully secured a significant contract valued at USD 11.06 million to supply a state-of-the-art baggage handling system for Sofia Airport's Terminal 2. This milestone underscores the persistent and robust demand for modern, high-performance baggage handling solutions across the continent.

- December 2022: Alstef Group was awarded a contract to comprehensively upgrade Strasbourg Airport's baggage handling system, ensuring its compliance with the rigorous EASA Standard 3.1. This development highlights the critical importance of adhering to stringent regulatory standards and maintaining operational excellence in the European aviation sector.

Strategic Outlook for Airport Baggage Handling Systems Market in Europe Market

The European airport baggage handling systems market is poised for sustained and significant growth, driven by a dynamic interplay of continuous technological innovation, consistently rising passenger numbers, and an unwavering focus on elevating airport efficiency and enhancing the overall passenger experience. The cultivation of strategic partnerships, substantial and ongoing investments in cutting-edge R&D, and a dedicated commitment to delivering bespoke, customized solutions meticulously tailored to the unique operational requirements of individual airports will be absolutely paramount for achieving success and maintaining a competitive edge in this rapidly evolving market. The market is exceptionally well-positioned for continued expansion, exhibiting strong growth potential and promising substantial returns in the forthcoming years.

Airport Baggage Handling Systems Market in Europe Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 - 25 million

- 1.3. 25 - 40 million

- 1.4. Above 40 Million

Airport Baggage Handling Systems Market in Europe Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Airport Baggage Handling Systems Market in Europe Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market in Europe

Airport Baggage Handling Systems Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Airport Baggage Handling Systems Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 - 25 million

- 5.1.3. 25 - 40 million

- 5.1.4. Above 40 Million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vanderlande Industries B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ammega Group BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BB Computerteknikk AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BEUMER Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alstef Group SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lift All A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daifuku Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SITA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PSI Logistics GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vanderlande Industries B V

List of Figures

- Figure 1: Airport Baggage Handling Systems Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Airport Baggage Handling Systems Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Europe Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market in Europe?

The projected CAGR is approximately 13.14%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market in Europe?

Key companies in the market include Vanderlande Industries B V, Ammega Group BV, BB Computerteknikk AS, BEUMER Group, Alstef Group SAS, Siemens AG, Lift All A, Daifuku Co Ltd, SITA, PSI Logistics GmbH.

3. What are the main segments of the Airport Baggage Handling Systems Market in Europe?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 299.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. Under the contract, the company will supply, install, and maintain the baggage handling solution with a capacity of up to 2,400 bags per hour.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market in Europe?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence