Key Insights

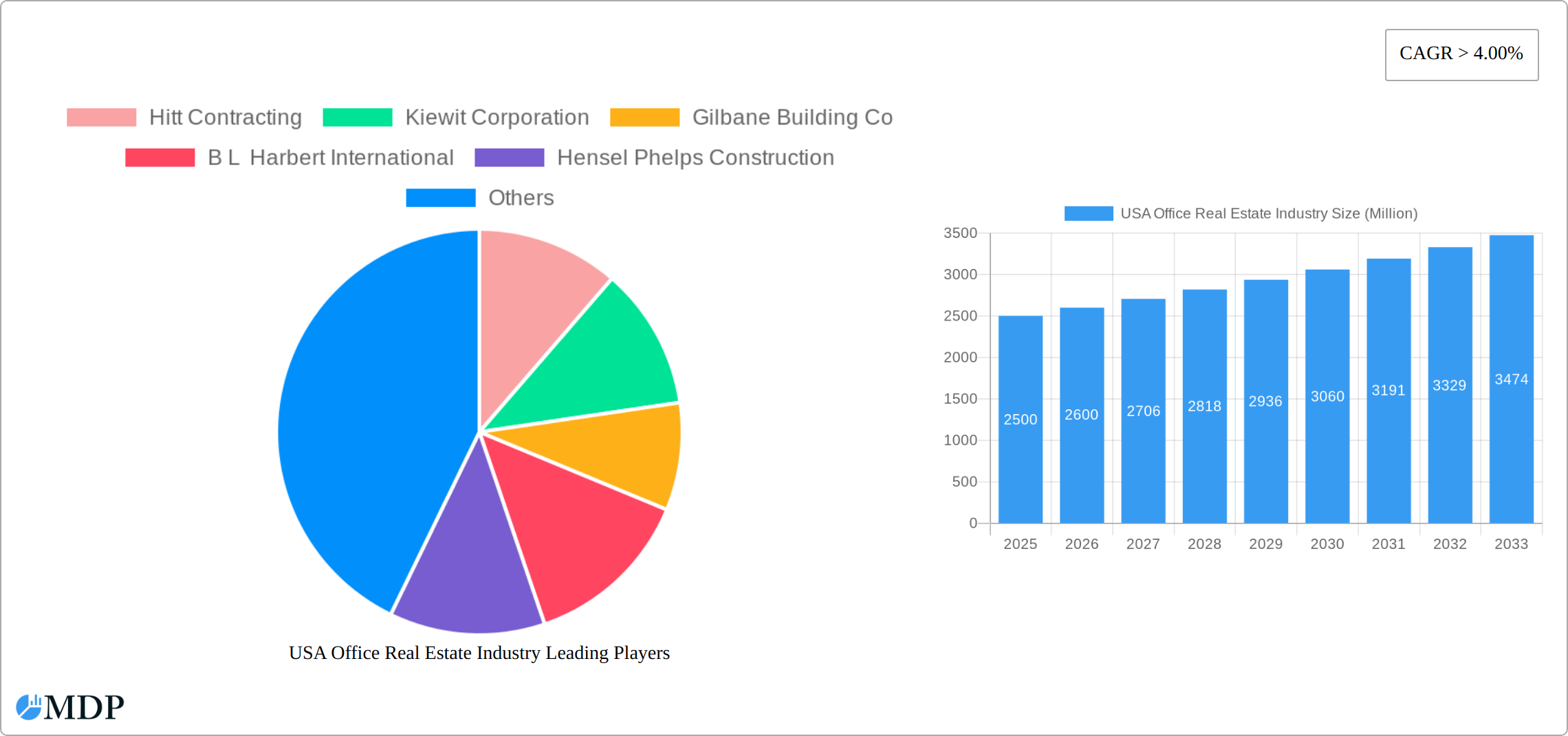

The US office real estate market, currently experiencing a robust expansion, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning Information Technology and IT Enabled Services (IT and ITES) sector, coupled with steady expansion in the Banking, Financial Services, and Insurance (BFSI) industries, drives significant demand for office space. Furthermore, the consulting sector's consistent growth contributes to this positive market trajectory. While the manufacturing sector's contribution may be comparatively less dramatic, it still constitutes a notable segment within the overall market. Regional variations exist, with the Northeast, West, and South likely exhibiting stronger growth compared to the Midwest, reflecting varying economic activities and population shifts. Major players such as Hitt Contracting, Kiewit Corporation, and others are well-positioned to capitalize on this expansion, engaging in both new construction and renovation projects to meet the evolving demands of businesses. However, potential restraints include economic downturns, shifts in remote work trends, and fluctuations in interest rates influencing construction financing.

The market segmentation reveals significant opportunities. The IT and ITES sector, with its dynamic and expanding nature, is expected to dominate the demand, followed by BFSI and consulting. Geographic segmentation highlights regional disparities in growth; understanding these differences allows for targeted investment strategies. Predicting precise market size figures requires further granular data; however, extrapolating from the provided 4%+ CAGR and considering the industry's current trends, a considerable expansion is expected throughout the forecast period, creating lucrative opportunities for investors and developers. The ongoing demand for modern, efficient, and technologically advanced office spaces, coupled with a focus on sustainability, will continue to shape this evolving market. This necessitates a strategic approach by stakeholders to navigate the evolving landscape and seize opportunities effectively.

USA Office Real Estate Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the USA office real estate industry, offering invaluable insights for investors, developers, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market dynamics, key trends, and future potential of this dynamic sector. The report projects a market valued at $XX Million in 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

USA Office Real Estate Industry Market Dynamics & Concentration

The USA office real estate market is characterized by moderate concentration, with a few major players commanding significant market share. While precise figures are proprietary, we estimate that the top 10 players account for approximately XX% of the market in 2025. Innovation is driven by technological advancements in building design, construction materials, and property management systems, alongside increasing demand for sustainable and smart office spaces. Regulatory frameworks, including zoning laws and environmental regulations, significantly influence development and investment decisions. Product substitutes, such as co-working spaces and remote work arrangements, present ongoing competitive pressures. End-user trends reflect a shift towards flexible lease terms, amenity-rich environments, and technologically advanced workspaces. Mergers and acquisitions (M&A) activity has been substantial, with an estimated XX M&A deals in the historical period (2019-2024), further shaping market consolidation.

- Market Share (Estimated 2025): Top 10 players – XX%

- M&A Deal Count (2019-2024): XX

- Key Innovation Drivers: Smart building technologies, sustainable construction, flexible workspace designs.

- Regulatory Influences: Zoning regulations, environmental impact assessments, building codes.

USA Office Real Estate Industry Industry Trends & Analysis

The US office real estate market is undergoing a profound transformation, marked by evolving work paradigms and shifting tenant priorities. While the expansion of pivotal sectors like Information Technology (IT) and Banking, Financial Services, and Insurance (BFSI) continues to fuel demand in prime metropolitan hubs, the landscape is being reshaped by technological advancements. The pervasive adoption of remote and hybrid work models is not merely altering space utilization but is also fundamentally redefining office design, emphasizing flexibility, collaboration, and employee well-being. Consequently, a heightened focus on sustainability, encompassing energy efficiency and green building certifications, is becoming a non-negotiable expectation from occupiers and investors alike. This dynamic environment fosters intense competition among developers, who are increasingly differentiating themselves by offering attractive lease terms, enhanced amenities, and spaces that actively promote a healthy and productive work environment.

Leading Markets & Segments in USA Office Real Estate Industry

The Northeast and West regions continue to anchor the US office real estate market's vitality, benefiting from strong economic foundations and a dense ecosystem of high-growth industries. Within this dynamic, the Information Technology (IT and ITES) and BFSI sectors remain dominant forces, driving substantial investment and demand for sophisticated office accommodations. These sectors are not only expanding their physical footprints but are also seeking spaces that foster innovation, collaboration, and a compelling employee experience.

- Dominant Regions: Northeast, West

- Key Growth Drivers (Northeast): A robust financial services sector, coupled with established and expanding technology innovation hubs, underpins sustained demand.

- Key Growth Drivers (West): Rapid technological innovation and a high concentration of forward-thinking companies create a fertile ground for office space absorption.

- Leading Sectors: Information Technology (IT and ITES), Banking, Financial Services, and Insurance (BFSI).

- Dominant Sector Analysis: The IT sector's relentless innovation and growth, particularly in major tech cities, fuel a continuous need for cutting-edge office environments. Simultaneously, the BFSI sector's resilience and ongoing expansion reflect its integral role in the national economy, driving demand for secure and well-equipped corporate spaces.

USA Office Real Estate Industry Product Developments

Recent product innovations include the development of smart building technologies that optimize energy consumption and enhance tenant experience. Advances in sustainable building materials and construction techniques are gaining traction, aligning with growing environmental concerns. Flexible workspace configurations, designed to cater to the evolving needs of hybrid work models, are becoming increasingly prevalent, offering a competitive advantage in attracting and retaining tenants. The market fit for these innovations is strong, reflecting a broader industry trend toward sustainable, technologically advanced, and adaptable office spaces.

Key Drivers of USA Office Real Estate Industry Growth

The growth trajectory of the USA office real estate industry is being propelled by a confluence of influential factors. Technological advancements, including the integration of the Internet of Things (IoT) and sophisticated smart building technologies, are revolutionizing operational efficiency, enhancing predictive maintenance, and delivering superior tenant experiences through intuitive building management systems. Furthermore, robust economic expansion in key metropolitan areas continues to generate sustained demand for prime office locations. Complementing these organic growth drivers, favorable government policies and targeted incentives aimed at promoting sustainable development and urban revitalization are creating an environment conducive to new construction and redevelopment projects.

Challenges in the USA Office Real Estate Industry Market

Navigating the current USA office real estate market presents several significant challenges. Stringent regulatory frameworks and protracted permitting processes can introduce considerable delays and escalate development costs. Persistent supply chain disruptions, particularly within the construction sector, continue to impact material availability and drive up procurement expenses. The competitive intensity among developers and landlords is placing downward pressure on rental rates and occupancy levels, necessitating strategic adaptation. The cumulative impact of these challenges on market growth in 2025 is estimated to result in a revenue reduction of approximately XX Million.

Emerging Opportunities in USA Office Real Estate Industry

The future of the USA office real estate industry is ripe with opportunities, driven by technological innovation and evolving market demands. Breakthroughs in building automation and advanced data analytics are paving the way for smarter, more efficient, and tenant-centric buildings, improving everything from energy consumption to space utilization. The rise of strategic partnerships between developers, cutting-edge technology providers, and agile property management firms is fostering the creation of innovative, integrated solutions. Moreover, the expansion into secondary and tertiary markets, accelerated by the widespread adoption of remote and hybrid work models, presents compelling opportunities for growth and diversification as businesses seek talent and operational hubs beyond traditional gateway cities.

Leading Players in the USA Office Real Estate Industry Sector

- Hitt Contracting

- Kiewit Corporation

- Gilbane Building Co

- B L Harbert International

- Hensel Phelps Construction

- Ryan Companies US Inc

- Skanska USA Inc

- Turner Construction Company Inc

- Trammell Crow Company

- Clayco Inc

- Dpr Construction

- PCL Construction Enterprises

- Structure Tone LLC

- List Not Exhaustive

Key Milestones in USA Office Real Estate Industry Industry

- 2020: Increased focus on sustainable building practices.

- 2021: Significant growth in adoption of smart building technologies.

- 2022: Several large-scale M&A transactions reshape the market landscape.

- 2023: Rise of flexible workspace solutions to accommodate hybrid work models.

- 2024: Increased focus on tenant well-being and building occupant health.

Strategic Outlook for USA Office Real Estate Industry Market

The future of the USA office real estate market is promising, with substantial growth potential driven by technological innovation, economic expansion, and evolving tenant demands. Strategic opportunities lie in adopting sustainable practices, embracing smart building technologies, and adapting to the changing dynamics of hybrid work models. The market is expected to continue its evolution, with a focus on creating more flexible, amenity-rich, and technologically advanced workspaces to meet the evolving needs of businesses and their employees.

USA Office Real Estate Industry Segmentation

-

1. Sector

- 1.1. Information Technology (IT and ITES)

- 1.2. Manufacturing

- 1.3. BFSI (Banking, Financial Services, and Insurance)

- 1.4. Consulting

- 1.5. Other Services

USA Office Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Office Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increase in Leasing Volumes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Information Technology (IT and ITES)

- 5.1.2. Manufacturing

- 5.1.3. BFSI (Banking, Financial Services, and Insurance)

- 5.1.4. Consulting

- 5.1.5. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Information Technology (IT and ITES)

- 6.1.2. Manufacturing

- 6.1.3. BFSI (Banking, Financial Services, and Insurance)

- 6.1.4. Consulting

- 6.1.5. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Information Technology (IT and ITES)

- 7.1.2. Manufacturing

- 7.1.3. BFSI (Banking, Financial Services, and Insurance)

- 7.1.4. Consulting

- 7.1.5. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Information Technology (IT and ITES)

- 8.1.2. Manufacturing

- 8.1.3. BFSI (Banking, Financial Services, and Insurance)

- 8.1.4. Consulting

- 8.1.5. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Information Technology (IT and ITES)

- 9.1.2. Manufacturing

- 9.1.3. BFSI (Banking, Financial Services, and Insurance)

- 9.1.4. Consulting

- 9.1.5. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Information Technology (IT and ITES)

- 10.1.2. Manufacturing

- 10.1.3. BFSI (Banking, Financial Services, and Insurance)

- 10.1.4. Consulting

- 10.1.5. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Northeast USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 15. West USA Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Hitt Contracting

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Kiewit Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Gilbane Building Co

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 B L Harbert International

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hensel Phelps Construction

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ryan Companies US Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Skanska USA Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Turner Construction Company Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Trammell Crow Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Clayco Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Dpr Construction

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 PCL Construction Enterprises

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Structure Tone LLC**List Not Exhaustive

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Hitt Contracting

List of Figures

- Figure 1: Global USA Office Real Estate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states USA Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states USA Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America USA Office Real Estate Industry Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America USA Office Real Estate Industry Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America USA Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America USA Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America USA Office Real Estate Industry Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America USA Office Real Estate Industry Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America USA Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America USA Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe USA Office Real Estate Industry Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe USA Office Real Estate Industry Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe USA Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe USA Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa USA Office Real Estate Industry Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa USA Office Real Estate Industry Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa USA Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa USA Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific USA Office Real Estate Industry Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific USA Office Real Estate Industry Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific USA Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific USA Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global USA Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global USA Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global USA Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global USA Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Northeast USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Southeast USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Midwest USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southwest USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global USA Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global USA Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global USA Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global USA Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global USA Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 21: Global USA Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global USA Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 32: Global USA Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global USA Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 40: Global USA Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific USA Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Office Real Estate Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the USA Office Real Estate Industry?

Key companies in the market include Hitt Contracting, Kiewit Corporation, Gilbane Building Co, B L Harbert International, Hensel Phelps Construction, Ryan Companies US Inc, Skanska USA Inc, Turner Construction Company Inc, Trammell Crow Company, Clayco Inc, Dpr Construction, PCL Construction Enterprises, Structure Tone LLC**List Not Exhaustive.

3. What are the main segments of the USA Office Real Estate Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Increase in Leasing Volumes.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Office Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Office Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Office Real Estate Industry?

To stay informed about further developments, trends, and reports in the USA Office Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence