Key Insights

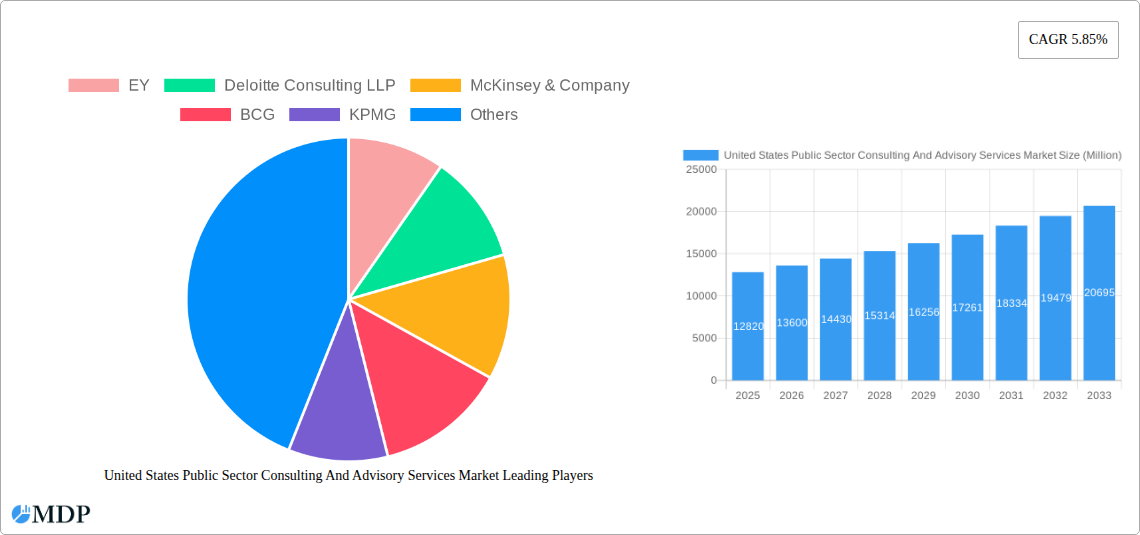

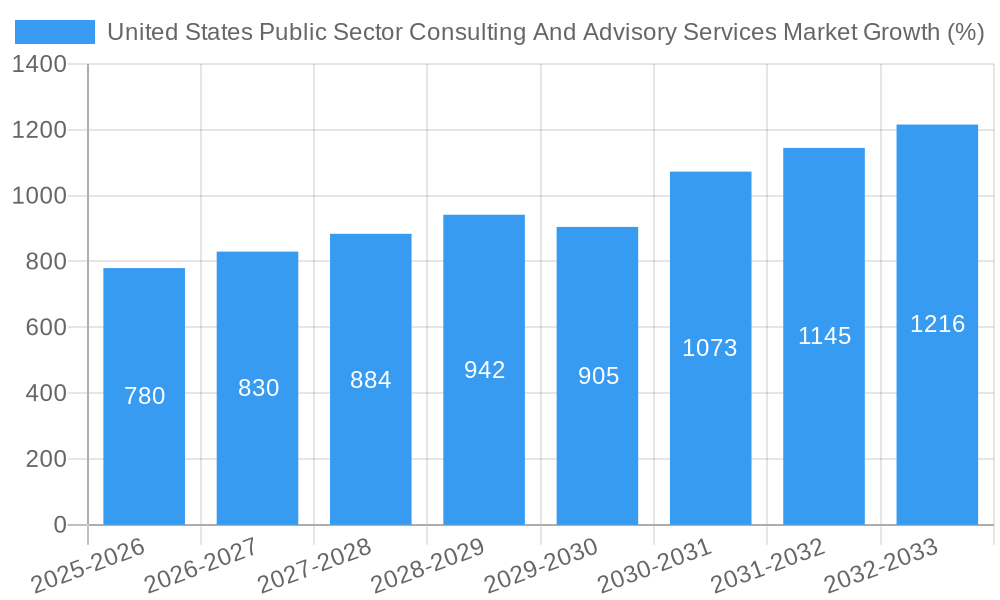

The United States Public Sector Consulting and Advisory Services market is a substantial and rapidly growing sector, projected to reach \$12.82 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.85% from 2025 to 2033. This growth is fueled by several key drivers. Increasing government spending on infrastructure projects, coupled with the ongoing digital transformation initiatives within various government agencies, are creating a significant demand for expert consulting services. Furthermore, the need for improved efficiency and cost optimization within public sector organizations is driving the adoption of advanced analytical tools and strategies, further boosting market expansion. The heightened focus on cybersecurity and data privacy, along with the complexity of regulatory compliance, also contribute to the market’s growth trajectory. Major players, including EY, Deloitte, McKinsey, BCG, KPMG, Bain & Company, Accenture, Grant Thornton, PwC, and GEP, are fiercely competing in this lucrative space, constantly innovating their service offerings to cater to the evolving needs of government agencies at all levels – federal, state, and local.

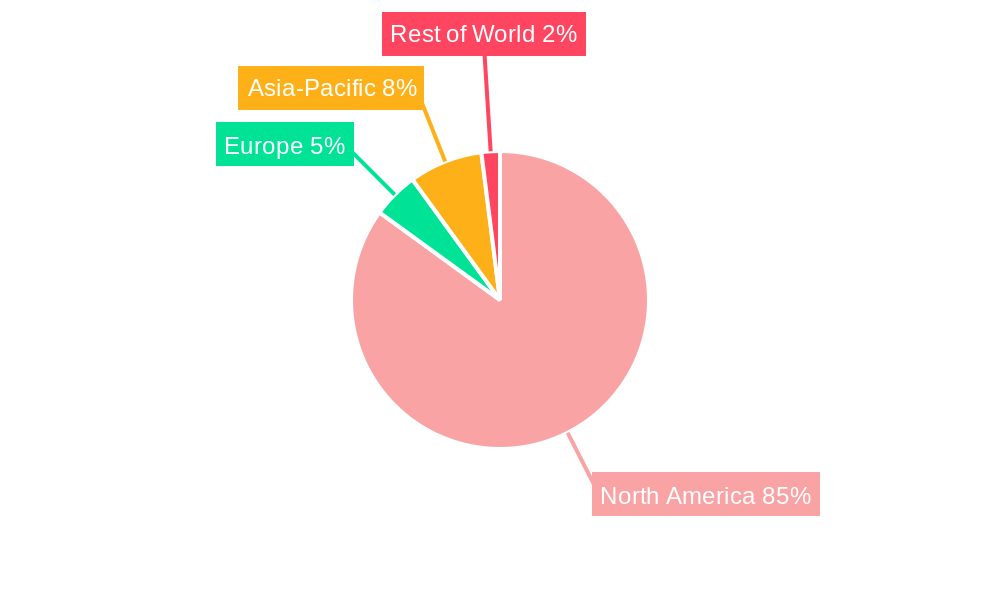

The market segmentation is expected to be diverse, encompassing specialized areas such as financial advisory, management consulting, IT consulting, and risk management. While precise segment breakdown data isn't provided, we can reasonably assume that financial advisory and IT consulting are the largest segments based on current trends in public sector spending and technological advancements. The market's geographic distribution is likely heavily concentrated in major metropolitan areas and states with substantial public sector budgets. However, growth is anticipated across various regions as government bodies across the US increasingly recognize the value of external consulting expertise to address complex challenges and streamline operations. Despite this positive outlook, potential restraints could include budget constraints in certain government sectors, bureaucratic processes, and the challenges associated with integrating new technologies into existing systems. The overall market outlook remains strong, promising continued expansion in the coming years.

United States Public Sector Consulting and Advisory Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Public Sector Consulting and Advisory Services market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, key players, emerging trends, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

United States Public Sector Consulting And Advisory Services Market Market Dynamics & Concentration

The US public sector consulting and advisory services market is characterized by a high degree of concentration, with a few major players dominating the landscape. These leading firms, including EY, Deloitte Consulting LLP, McKinsey & Company, BCG, KPMG, Bain & Company, Accenture, Grant Thornton, PwC, and GEP (list not exhaustive), compete intensely for lucrative government contracts and advisory engagements. Market share is largely influenced by firm reputation, specialized expertise, and existing client relationships. The market exhibits a high barrier to entry due to the requirement for extensive experience, specialized knowledge of government regulations, and strong network within the public sector.

Market concentration is further amplified by continuous mergers and acquisitions (M&A) activity. The number of M&A deals in the period 2019-2024 averaged xx per year, indicating a high level of consolidation. This trend is expected to continue, driven by the desire for increased market share, expansion of service offerings, and access to specialized expertise. These M&A activities significantly shape market dynamics, leading to shifts in market share and competitive landscapes. Innovation drivers include the increasing adoption of advanced technologies like AI and data analytics for enhancing efficiency and decision-making within the public sector. Regulatory frameworks, such as those related to procurement and data privacy, also heavily influence market operations. The availability of substitute services, although limited, places some pressure on pricing strategies. End-user trends show increasing demand for customized solutions tailored to specific agency needs, emphasizing the importance of agility and adaptability for consulting firms.

United States Public Sector Consulting And Advisory Services Market Industry Trends & Analysis

The US public sector consulting and advisory services market is experiencing robust growth, driven by several key factors. Increased government spending on infrastructure projects, coupled with a growing focus on digital transformation and cybersecurity, fuels significant demand for specialized consulting services. Technological disruptions, such as the rise of cloud computing and AI, are reshaping how government agencies operate, creating opportunities for firms offering expertise in these areas. The market exhibits a shift towards outcome-based contracting, where payment is contingent on the achievement of specific results, demanding greater accountability and performance measurement from consulting firms. This trend is stimulating innovation and encouraging the adoption of more data-driven approaches. The heightened focus on cybersecurity within government agencies, due to increasing cyber threats, is pushing substantial investments in protective measures, further contributing to market growth.

Consumer preferences – in this case, government agencies – lean towards firms with a proven track record, extensive experience working with similar organizations, and a deep understanding of the complexities of public sector operations. Competitive dynamics are defined by intense competition, price pressures, and the need for continuous innovation to stay relevant. Market penetration is high among large consulting firms, while smaller niche players focus on specific sectors or services within the public sector. The market is expected to maintain its growth trajectory, driven by sustained government investment in infrastructure modernization, digital transformation, and public safety initiatives.

Leading Markets & Segments in United States Public Sector Consulting And Advisory Services Market

The US federal government constitutes the largest segment of the market.

- Key Drivers for Federal Government Dominance:

- High budgetary allocations for various programs and initiatives.

- Stringent regulatory frameworks demanding specialized expertise.

- Increased focus on digital transformation and cybersecurity initiatives.

- Complex procurement processes requiring skilled consulting support.

State and local governments also represent a substantial segment, with varying levels of spending based on individual budgetary priorities. The healthcare segment is experiencing rapid growth due to increasing demand for improvement in healthcare management, technological upgrades, and efficient healthcare delivery systems. The defense and security sector drives significant demand for strategic planning and technological support services due to high-level national security priorities. Specific regions experiencing notable growth include areas with significant infrastructure investments (e.g., California and the Northeast) and those undergoing substantial digital transformation efforts.

United States Public Sector Consulting And Advisory Services Market Product Developments

Recent product innovations focus on leveraging advanced analytics, AI, and machine learning to provide data-driven insights and predictive modeling for government agencies. Applications span various areas, including budget optimization, program evaluation, and risk management. Competitive advantages are increasingly determined by the ability to integrate new technologies, offer comprehensive solutions, and establish strong partnerships within the government sector.

Key Drivers of United States Public Sector Consulting And Advisory Services Market Growth

Technological advancements, particularly in areas like AI, cloud computing, and cybersecurity, are driving considerable market growth by enabling more effective and efficient government operations. Government investment in infrastructure upgrades and modernization programs provides ample opportunities for consulting firms. Regulatory changes and the increasing focus on transparency and accountability also stimulate demand for specialized advisory services.

Challenges in the United States Public Sector Consulting And Advisory Services Market Market

Regulatory hurdles and stringent procurement processes can create obstacles for firms seeking to enter or expand within the market. The intense competition among established players and the emergence of new entrants creates downward pressure on pricing and profitability. Maintaining a highly skilled workforce with expertise in both public sector operations and advanced technologies presents a significant challenge for many firms.

Emerging Opportunities in United States Public Sector Consulting And Advisory Services Market

Technological breakthroughs in areas like AI and data analytics offer significant opportunities to create tailored solutions addressing specific government needs. Strategic partnerships between consulting firms and technology providers are opening up avenues for delivering innovative solutions and enhancing service offerings. The expansion into emerging areas such as smart city initiatives and sustainable development presents a vast growth potential.

Leading Players in the United States Public Sector Consulting And Advisory Services Market Sector

- EY

- Deloitte Consulting LLP

- McKinsey & Company

- BCG

- KPMG

- Bain & Company

- Accenture

- Grant Thornton

- PwC

- GEP

Key Milestones in United States Public Sector Consulting And Advisory Services Market Industry

- November 2023: Bain Capital announced its plans to acquire Guidehouse for USD 5.3 Billion, significantly impacting the market landscape and strengthening Bain Capital's presence in the public sector consulting space.

- October 2023: Accenture acquired Comtech Group, expanding its capabilities in infrastructure project management within the US public sector.

Strategic Outlook for United States Public Sector Consulting And Advisory Services Market Market

The US public sector consulting and advisory services market is poised for continued growth, driven by persistent government investment in infrastructure, digital transformation, and cybersecurity. Strategic opportunities lie in leveraging advanced technologies to enhance service offerings, establishing strong partnerships with technology providers, and expanding into new and emerging areas within the public sector. Firms that can effectively adapt to evolving government needs and demonstrate a commitment to delivering measurable results will be best positioned for success in this dynamic and competitive market.

United States Public Sector Consulting And Advisory Services Market Segmentation

-

1. Type

- 1.1. Policy Analysis Services

- 1.2. Bond Issuance Services

- 1.3. Major Project Advisory Services

- 1.4. Program Evaluation Services

- 1.5. Financial Management Advisory Services

- 1.6. Other Types

-

2. Applications

- 2.1. Central

- 2.2. State

- 2.3. Urban Local Bodies

- 2.4. Other Applications

-

3. Project Size

- 3.1. Large Scale Projects

- 3.2. Mid-small Scale Projects

United States Public Sector Consulting And Advisory Services Market Segmentation By Geography

- 1. United States

United States Public Sector Consulting And Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consulting Firms and AI

- 3.3. Market Restrains

- 3.3.1. Consulting Firms and AI

- 3.4. Market Trends

- 3.4.1. Consulting Firms and AI

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Public Sector Consulting And Advisory Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Policy Analysis Services

- 5.1.2. Bond Issuance Services

- 5.1.3. Major Project Advisory Services

- 5.1.4. Program Evaluation Services

- 5.1.5. Financial Management Advisory Services

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Central

- 5.2.2. State

- 5.2.3. Urban Local Bodies

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Project Size

- 5.3.1. Large Scale Projects

- 5.3.2. Mid-small Scale Projects

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EY

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deloitte Consulting LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 McKinsey & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BCG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KPMG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bain & Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Accenture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grand Thornton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PwC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEP**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EY

List of Figures

- Figure 1: United States Public Sector Consulting And Advisory Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Public Sector Consulting And Advisory Services Market Share (%) by Company 2024

List of Tables

- Table 1: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 6: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Applications 2019 & 2032

- Table 7: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Project Size 2019 & 2032

- Table 8: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Project Size 2019 & 2032

- Table 9: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 14: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Applications 2019 & 2032

- Table 15: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Project Size 2019 & 2032

- Table 16: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Project Size 2019 & 2032

- Table 17: United States Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Public Sector Consulting And Advisory Services Market?

The projected CAGR is approximately 5.85%.

2. Which companies are prominent players in the United States Public Sector Consulting And Advisory Services Market?

Key companies in the market include EY, Deloitte Consulting LLP, McKinsey & Company, BCG, KPMG, Bain & Company, Accenture, Grand Thornton, PwC, GEP**List Not Exhaustive.

3. What are the main segments of the United States Public Sector Consulting And Advisory Services Market?

The market segments include Type, Applications, Project Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Consulting Firms and AI: Revolutionizing Government Services; Government Agencies Navigate Rising Cyber Threats Through Tech Integration.

6. What are the notable trends driving market growth?

Consulting Firms and AI: Revolutionizing Government Services.

7. Are there any restraints impacting market growth?

Consulting Firms and AI: Revolutionizing Government Services; Government Agencies Navigate Rising Cyber Threats Through Tech Integration.

8. Can you provide examples of recent developments in the market?

November 2023: Bain Capital announced its plans to acquire Guidehouse, a prominent government and business consulting firm, in a significant USD 5.3 billion deal set for October 2023. Notably, Guidehouse's clientele includes significant government bodies like the US Department of Defense and Homeland Security, alongside a host of state and local entities and businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Public Sector Consulting And Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Public Sector Consulting And Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Public Sector Consulting And Advisory Services Market?

To stay informed about further developments, trends, and reports in the United States Public Sector Consulting And Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence