Key Insights

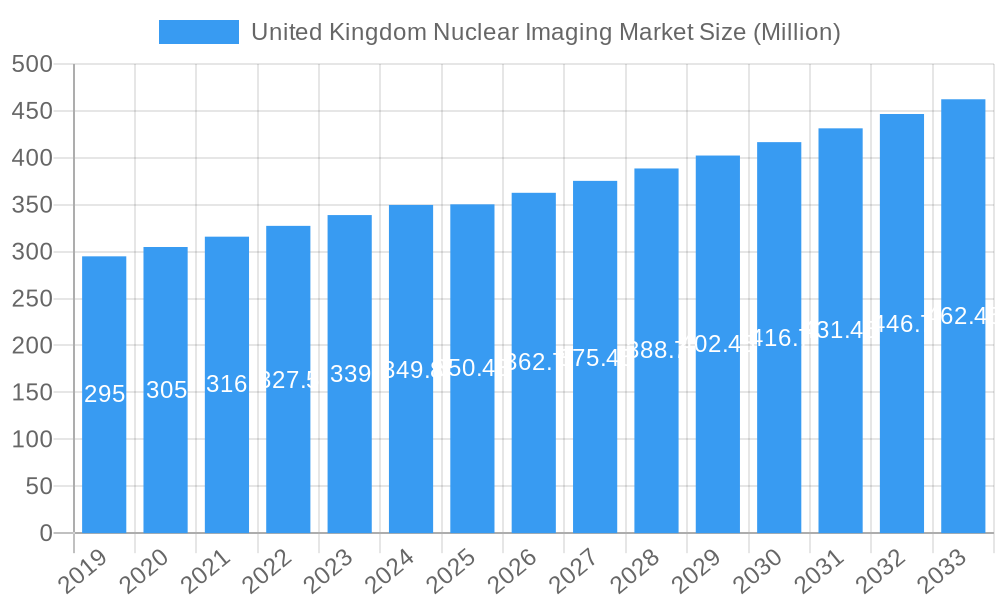

The United Kingdom Nuclear Imaging Market is poised for steady expansion, projected to reach £350.43 million by 2025. This growth is underpinned by a CAGR of 3.66%, indicating a consistent upward trajectory over the forecast period. A primary driver for this market is the increasing demand for advanced diagnostic tools, particularly in oncology and cardiology, where nuclear imaging plays a crucial role in early detection, staging, and treatment monitoring. The rising prevalence of chronic diseases, coupled with an aging population, further fuels the need for sophisticated imaging solutions. Furthermore, advancements in radiopharmaceutical development and imaging technology, including the integration of artificial intelligence for image analysis, are enhancing diagnostic accuracy and patient outcomes, thereby stimulating market growth. The growing adoption of SPECT and PET imaging techniques across various medical disciplines, from neurology to thyroid disorders, is a significant factor contributing to the market's expansion.

United Kingdom Nuclear Imaging Market Market Size (In Million)

The market dynamics are shaped by both growth drivers and certain restraining factors. While technological innovation and increasing healthcare expenditure are propelling the market forward, the high cost associated with advanced nuclear imaging equipment and radiopharmaceuticals, along with stringent regulatory approvals, can present challenges. However, the significant clinical benefits offered by nuclear imaging, including non-invasive diagnostic capabilities and the potential for personalized medicine, are expected to outweigh these restraints. The market is segmented into essential components: Equipment, encompassing SPECT and PET radioisotopes, and Applications, covering SPECT applications in cardiology, neurology, thyroid, and other areas, as well as PET applications in oncology and other fields. Key industry players, including Siemens Healthineers, GE Healthcare, and Canon Medical Systems Corporation, are actively investing in research and development to introduce novel solutions and expand their market presence within the UK.

United Kingdom Nuclear Imaging Market Company Market Share

United Kingdom Nuclear Imaging Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a meticulous analysis of the United Kingdom's nuclear imaging market, forecasting robust growth and offering strategic insights for stakeholders. Covering the historical period from 2019 to 2024 and projecting expansion through 2033 with a base and estimated year of 2025, this report delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and critical milestones. For businesses seeking to capitalize on the expanding healthcare sector, understanding the nuances of nuclear imaging – from advanced SPECT and PET applications to the latest radiopharmaceutical innovations – is paramount. We anticipate the market to reach XX Million by 2033, driven by increasing adoption of advanced diagnostic and therapeutic radiotracers.

United Kingdom Nuclear Imaging Market Market Dynamics & Concentration

The United Kingdom nuclear imaging market exhibits a moderate to high concentration, with several multinational corporations and specialized regional players vying for market share. Innovation is a primary driver, fueled by advancements in radioisotope production, detector technology, and artificial intelligence integration for image analysis. The regulatory framework, primarily governed by the Medicines and Healthcare Products Regulatory Agency (MHRA), plays a crucial role in approving new diagnostic agents and imaging equipment, influencing market entry and product adoption. While there are limited direct product substitutes for certain nuclear imaging procedures, the increasing prevalence of alternative diagnostic modalities like advanced MRI and CT scans presents a competitive pressure. End-user trends indicate a growing demand for earlier disease detection, personalized medicine, and minimally invasive diagnostic tools, all of which favor nuclear imaging's capabilities. Mergers and acquisitions (M&A) activities, though not at an extremely high frequency, are strategic in nature, often aimed at consolidating portfolios, acquiring novel technologies, or expanding geographical reach. For instance, recent acquisitions have focused on enhancing radiopharmaceutical capabilities and diagnostic imaging portfolios, reflecting a trend towards integrated solutions. M&A deal counts have been in the low single digits annually, but their impact is significant on market structure.

United Kingdom Nuclear Imaging Market Industry Trends & Analysis

The United Kingdom nuclear imaging market is experiencing dynamic growth, driven by an escalating demand for sophisticated diagnostic and therapeutic solutions across various medical disciplines. The compound annual growth rate (CAGR) is projected to be robust, standing at an estimated XX% between 2025 and 2033. This expansion is underpinned by several key trends. Firstly, the increasing prevalence of chronic diseases, particularly cancer, cardiovascular conditions, and neurological disorders, necessitates advanced imaging techniques for accurate diagnosis, staging, and treatment monitoring. Nuclear imaging, with its functional and metabolic insights, is at the forefront of addressing these needs. Secondly, technological advancements are continuously enhancing the capabilities and accessibility of nuclear imaging. Innovations in SPECT and PET scanner technology, including improved sensitivity, resolution, and patient comfort, are driving adoption. The development of novel radiotracers, particularly those targeting specific molecular pathways, is revolutionizing diagnostic accuracy and opening new therapeutic avenues. For example, the introduction of new PET tracers for oncology has significantly improved early tumor detection and characterization, leading to more precise treatment planning.

Furthermore, government initiatives and healthcare policies aimed at improving patient outcomes and enhancing diagnostic infrastructure contribute significantly to market growth. Increased investment in research and development by both public and private entities is fostering a pipeline of innovative products and applications. The growing trend towards personalized medicine also plays a crucial role, as nuclear imaging allows for the assessment of individual patient responses to therapy and the selection of the most effective treatment strategies. This patient-centric approach is a major catalyst for the adoption of advanced nuclear imaging techniques. The competitive landscape is characterized by a blend of established global players and emerging specialized companies, all striving to differentiate through technological innovation, product efficacy, and strategic partnerships. Market penetration is steadily increasing, especially in major urban centers and specialized medical institutions, as the benefits of nuclear imaging become more widely recognized and its integration into routine clinical practice expands. The shift towards theranostics – combining diagnostic imaging with targeted radionuclide therapy – is another significant trend reshaping the market, offering a more holistic approach to disease management.

Leading Markets & Segments in United Kingdom Nuclear Imaging Market

Within the United Kingdom nuclear imaging market, the Equipment segment is currently the dominant force, driven by substantial investment in advanced imaging devices such as SPECT and PET scanners. This dominance is further bolstered by the PET Applications, particularly Oncology, which represents the largest and fastest-growing application segment. The increasing incidence of various cancers and the demand for precise tumor detection, staging, and treatment response assessment are key economic policies and infrastructure drivers supporting this segment's growth. Nuclear medicine departments in leading hospitals and specialized cancer centers are continuously upgrading their PET imaging capabilities, contributing to the equipment market's expansion.

The Diagnostic Radioisotope segment, specifically PET Radioisotopes, is also experiencing significant growth, intrinsically linked to the expansion of PET applications. Isotopes like Fluorine-18 (F-18) FDG remain crucial, but the development and adoption of new PET tracers for specific indications, such as PSMA (prostate-specific membrane antigen) ligands for prostate cancer, are creating new market opportunities and driving demand for these specialized radioisotopes. The United Kingdom's commitment to advancing radiopharmaceutical research and production infrastructure, including the establishment of cyclotron facilities and radiopharmacies, is a critical factor enabling this growth.

In terms of applications, SPECT Applications continue to hold a substantial share, particularly in Cardiology and Neurology, where SPECT imaging remains a cornerstone for diagnosing and managing heart disease and various neurological conditions like Alzheimer's and Parkinson's. The established clinical utility and cost-effectiveness of SPECT, especially with readily available radioisotopes like Technetium-99m, ensure its continued relevance. However, the rapid advancements and growing clinical evidence for PET in oncology and neurology are gradually shifting the market dynamics.

The Other SPECT Applications and Other PET Applications segments, encompassing areas like thyroid disorders, infectious diseases, and inflammatory conditions, also contribute to market diversification. The increasing understanding of the role of nuclear imaging in these less common but clinically significant areas is gradually expanding the market reach. The UK's robust healthcare system, with its emphasis on research-driven clinical practice and a well-established network of diagnostic imaging centers, provides fertile ground for the growth of all these segments.

United Kingdom Nuclear Imaging Market Product Developments

Product development in the United Kingdom nuclear imaging market is characterized by a relentless pursuit of enhanced diagnostic accuracy, therapeutic efficacy, and improved patient experience. Innovations in radiotracer development are a significant focus, with a strong emphasis on targeted therapies and diagnostics for oncology. Companies are investing in novel radioligands that can precisely identify cancer cells and deliver therapeutic radiation, moving towards theranostic approaches. Furthermore, advancements in detector technology for SPECT and PET scanners are yielding higher resolution images, faster scan times, and reduced radiation doses for patients. The integration of artificial intelligence (AI) and machine learning algorithms into image analysis software is another key trend, aiding in earlier and more accurate diagnoses. These technological leaps offer a competitive advantage by enabling more precise disease characterization and personalized treatment strategies.

Key Drivers of United Kingdom Nuclear Imaging Market Growth

The United Kingdom nuclear imaging market's growth is propelled by a confluence of factors.

- Increasing prevalence of chronic diseases: Rising rates of cancer, cardiovascular diseases, and neurological disorders necessitate advanced diagnostic and monitoring tools, where nuclear imaging excels.

- Technological advancements: Continuous innovation in SPECT and PET equipment, along with the development of novel radiotracers, enhances diagnostic accuracy and expands therapeutic applications.

- Growing focus on personalized medicine: Nuclear imaging's ability to assess molecular pathways and treatment response aligns perfectly with the demand for tailored patient care.

- Supportive government initiatives: Investments in healthcare infrastructure and research funding by the UK government foster the adoption of advanced medical technologies.

- Expansion of radiopharmaceutical development: The UK's commitment to R&D in radiopharmaceuticals is creating a robust pipeline of diagnostic and therapeutic agents.

Challenges in the United Kingdom Nuclear Imaging Market Market

Despite the promising outlook, the United Kingdom nuclear imaging market faces several challenges.

- High cost of equipment and radiopharmaceuticals: The substantial capital investment required for advanced imaging systems and the production of specialized radiotracers can be a barrier to widespread adoption, particularly for smaller healthcare facilities.

- Limited availability of skilled personnel: A shortage of trained nuclear medicine physicians, technologists, and radiopharmacists can hinder the efficient utilization of existing and new imaging technologies.

- Complex regulatory pathways: Navigating the approval processes for new radiopharmaceuticals and imaging devices, while essential for safety, can be time-consuming and resource-intensive.

- Supply chain complexities for radioisotopes: Ensuring a consistent and timely supply of short-lived radioisotopes, which are crucial for nuclear imaging, presents logistical challenges.

- Reimbursement policies: Evolving reimbursement structures for novel nuclear imaging procedures can impact market penetration and profitability.

Emerging Opportunities in United Kingdom Nuclear Imaging Market

The United Kingdom nuclear imaging market is ripe with emerging opportunities, primarily driven by innovation and unmet clinical needs. The burgeoning field of theranostics, which combines diagnostic imaging with targeted radionuclide therapy, presents a significant growth avenue. As more targeted radioligands are developed for various cancers, the integration of diagnostic and therapeutic applications will become increasingly prominent. Furthermore, the expansion of nuclear imaging into less traditional applications, such as infectious disease imaging and inflammatory conditions, offers new markets. The increasing use of artificial intelligence (AI) in image analysis and workflow optimization is another key opportunity, promising to improve efficiency and diagnostic accuracy. Strategic partnerships between equipment manufacturers, radiopharmaceutical developers, and academic research institutions are crucial for accelerating innovation and bringing novel solutions to the market.

Leading Players in the United Kingdom Nuclear Imaging Market Sector

- BWX Technologies Inc

- Bayer AG

- Bracco Group

- Siemens Healthineers

- MR SOLUTION LTD

- GE Healthcare

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- NOVARTIS AG (ADVANCED ACCELERATOR APPLICATIONS)

- Curium

- Fujifilm Holdings Corporation

Key Milestones in United Kingdom Nuclear Imaging Market Industry

- September 2021: Advanced Accelerator Applications (AAA) was granted a Promising Innovative Medicine (PIM) designation by the UK's MHRA for 177Lu-PSMA-617, an investigational radioligand therapy for prostate cancer.

- January 2021: Blue Earth Diagnostics, a UK-based company of the Bracco Group, acquired the license for an exclusive radiopharmaceutical therapeutic technology from Scintomics GmbH and the Technical University of Munich (TUM), expanding its oncology portfolio.

Strategic Outlook for United Kingdom Nuclear Imaging Market Market

The strategic outlook for the United Kingdom nuclear imaging market is exceptionally strong, driven by ongoing technological advancements and a clear clinical need for improved diagnostic and therapeutic capabilities. The continued evolution of theranostics, coupled with the development of novel radiotracers targeting specific disease pathways, will be major growth accelerators. Furthermore, the integration of AI and machine learning into imaging workflows promises to enhance efficiency and accuracy, driving wider adoption. Strategic collaborations between industry players, research institutions, and healthcare providers will be crucial for navigating regulatory landscapes and facilitating market penetration. As the UK healthcare system continues to prioritize early disease detection and personalized treatment, the demand for advanced nuclear imaging solutions is set to experience sustained and robust growth, creating significant opportunities for market participants.

United Kingdom Nuclear Imaging Market Segmentation

-

1. Product

- 1.1. Equipment

-

1.2. Diagnostic Radioisotope

- 1.2.1. SPECT Radioisotopes

- 1.2.2. PET Radioisotopes

-

2. Application

-

2.1. SPECT Applications

- 2.1.1. Cardiology

- 2.1.2. Neurology

- 2.1.3. Thyroid

- 2.1.4. Other SPECT Applications

-

2.2. PET Applications

- 2.2.1. Oncology

- 2.2.2. Other PET Applications

-

2.1. SPECT Applications

United Kingdom Nuclear Imaging Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Nuclear Imaging Market Regional Market Share

Geographic Coverage of United Kingdom Nuclear Imaging Market

United Kingdom Nuclear Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer and Cardiac Disorders; Technological Advancements in Nuclear Imaging

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Oncology Holds Significant Share in Application Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Nuclear Imaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipment

- 5.1.2. Diagnostic Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SPECT Applications

- 5.2.1.1. Cardiology

- 5.2.1.2. Neurology

- 5.2.1.3. Thyroid

- 5.2.1.4. Other SPECT Applications

- 5.2.2. PET Applications

- 5.2.2.1. Oncology

- 5.2.2.2. Other PET Applications

- 5.2.1. SPECT Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BWX Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bracco Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Healthineers

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MR SOLUTION LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GE Healthcare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canon Medical Systems Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NOVARTIS AG (ADVANCED ACCELERATOR APPLICATIONS)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Curium

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Fujifilm Holdings Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BWX Technologies Inc

List of Figures

- Figure 1: United Kingdom Nuclear Imaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Nuclear Imaging Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Nuclear Imaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United Kingdom Nuclear Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United Kingdom Nuclear Imaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Nuclear Imaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: United Kingdom Nuclear Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United Kingdom Nuclear Imaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Nuclear Imaging Market?

The projected CAGR is approximately 3.66%.

2. Which companies are prominent players in the United Kingdom Nuclear Imaging Market?

Key companies in the market include BWX Technologies Inc, Bayer AG, Bracco Group, Siemens Healthineers, MR SOLUTION LTD, GE Healthcare, Koninklijke Philips NV, Canon Medical Systems Corporation, NOVARTIS AG (ADVANCED ACCELERATOR APPLICATIONS), Curium, Fujifilm Holdings Corporation.

3. What are the main segments of the United Kingdom Nuclear Imaging Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 350.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer and Cardiac Disorders; Technological Advancements in Nuclear Imaging.

6. What are the notable trends driving market growth?

Oncology Holds Significant Share in Application Segment.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In September 2021, Advanced Accelerator Applications (AAA) was granted a Promising Innovative Medicine (PIM) designation for 177Lu-PSMA-617, an investigational radioligand therapy by United Kingdom's medicines regulator, the Medicines and Healthcare Products Regulatory Agency (MHRA) for the treatment of certain adults with prostate cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Nuclear Imaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Nuclear Imaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Nuclear Imaging Market?

To stay informed about further developments, trends, and reports in the United Kingdom Nuclear Imaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence