Key Insights

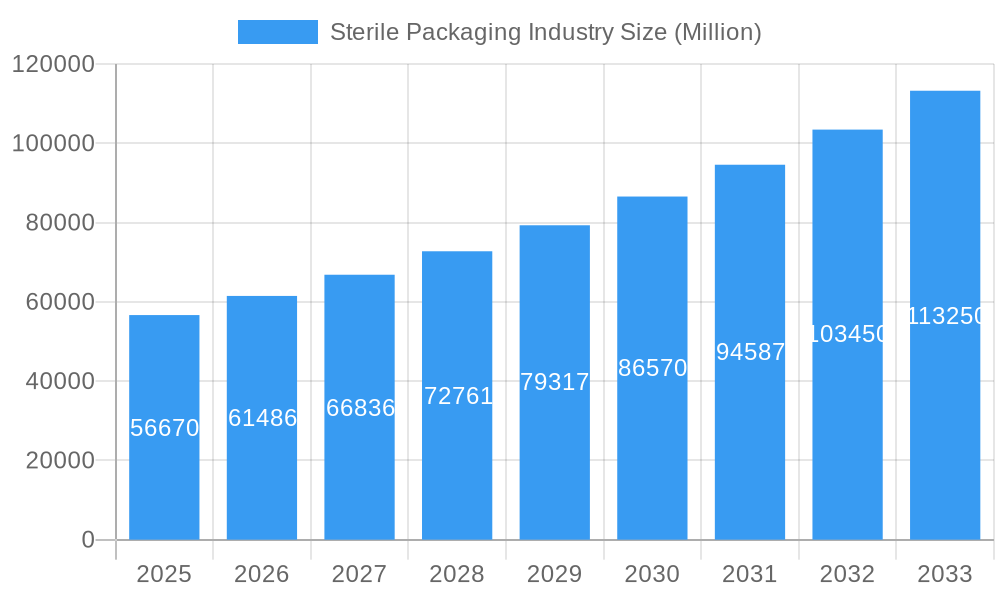

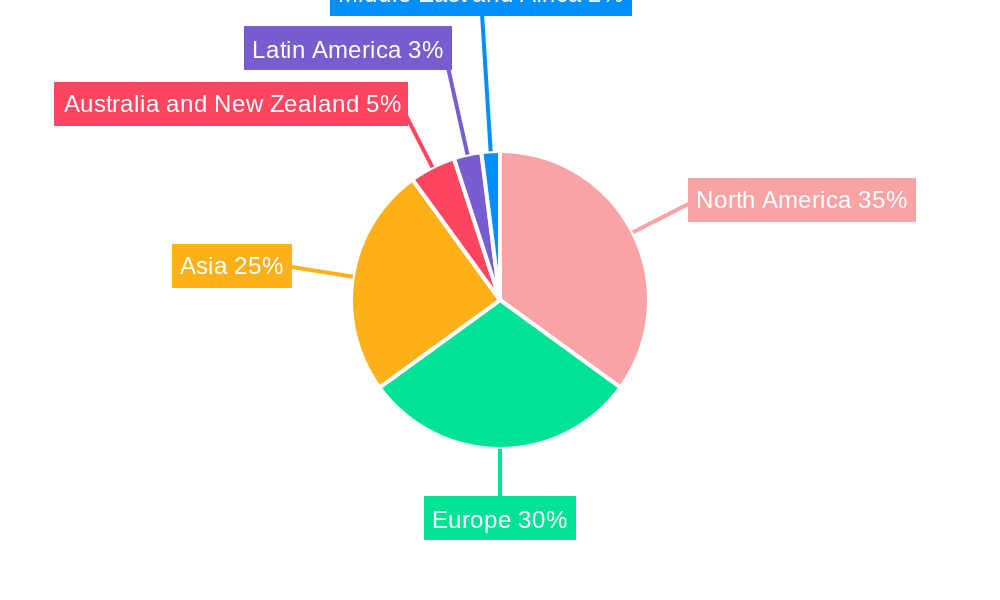

The sterile packaging market, valued at $56.67 billion in 2025, is projected to experience robust growth, driven by the increasing demand for sterile medical devices and pharmaceuticals globally. A compound annual growth rate (CAGR) of 8.46% from 2025 to 2033 indicates a significant expansion of this market, reaching an estimated $110 billion by 2033. Key growth drivers include the rising prevalence of chronic diseases necessitating sterile drug delivery systems, stringent regulatory requirements for maintaining product sterility, and the increasing adoption of advanced packaging technologies like modified atmosphere packaging (MAP) and aseptic processing. The pharmaceutical segment dominates the application landscape, followed by surgical and medical appliances, and in vitro diagnostics (IVD). Plastic, particularly PVC and HDPE, remains the dominant material type due to its cost-effectiveness and barrier properties. However, growing environmental concerns are prompting a shift towards sustainable alternatives like paper and paperboard, leading to innovation in biodegradable and recyclable sterile packaging solutions. Market segmentation by product type reveals high demand for thermoform trays, sterile bottles and containers, and pre-filled syringes. Geographic analysis reveals that North America and Europe currently hold significant market shares, though rapidly developing economies in Asia are projected to demonstrate substantial growth in the coming years, driven by rising healthcare expenditure and infrastructure development. Competition is intense, with numerous established players and emerging companies vying for market share through product innovation and strategic partnerships.

Sterile Packaging Industry Market Size (In Billion)

The competitive landscape is dynamic, with both established multinational corporations and specialized packaging companies vying for market dominance. Leading players are focusing on strategic partnerships, acquisitions, and research and development to innovate and expand their product portfolios, catering to the evolving needs of healthcare providers and pharmaceutical manufacturers. The market's growth is, however, subject to certain restraints including fluctuating raw material prices, stringent regulatory approvals, and the potential for supply chain disruptions. Furthermore, the development and adoption of novel, environmentally friendly materials and sustainable packaging solutions will play a critical role in shaping the future trajectory of the sterile packaging market. The increasing emphasis on patient safety and product integrity will continue to fuel demand for high-quality, reliable sterile packaging solutions across various healthcare settings.

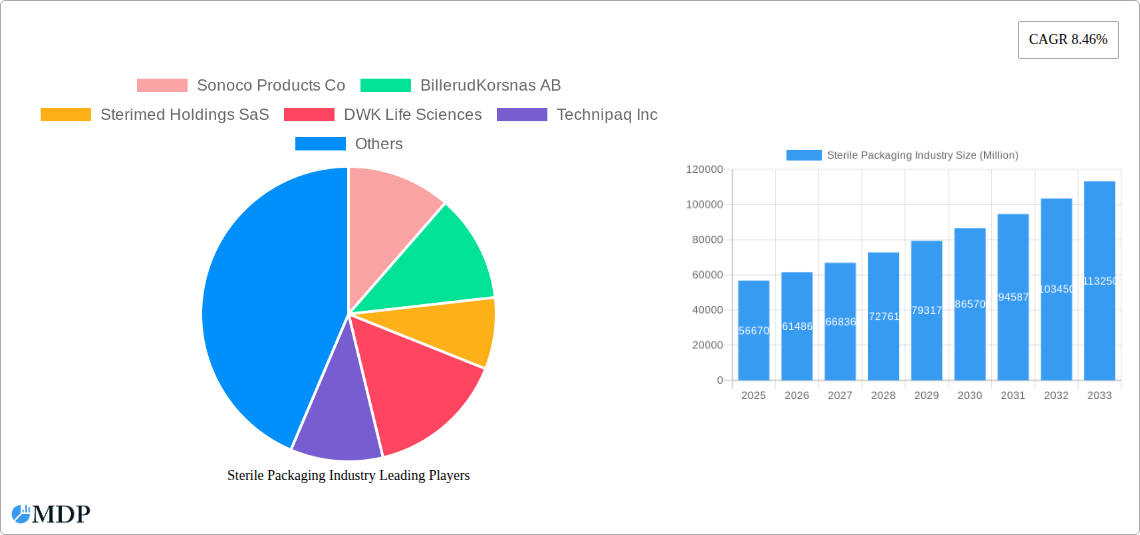

Sterile Packaging Industry Company Market Share

Sterile Packaging Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Sterile Packaging industry, covering market dynamics, leading players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Sterile Packaging Industry Market Dynamics & Concentration

The Sterile Packaging market is characterized by a moderately concentrated landscape, with several key players holding significant market share. Sonoco Products Co, Amcor, and Sealed Air Corporation are among the leading companies, collectively accounting for an estimated xx% of the global market in 2025. However, the industry is witnessing increased competition from smaller, specialized players focusing on niche segments and innovative packaging solutions.

Market concentration is influenced by several factors:

- Innovation: Continuous innovation in materials, sterilization techniques, and packaging designs drives market growth and influences competitive dynamics.

- Regulatory Frameworks: Stringent regulatory requirements for sterile packaging, particularly within the pharmaceutical and medical device sectors, create barriers to entry and impact market consolidation.

- Product Substitutes: The availability of alternative packaging materials and technologies influences market share and drives innovation.

- End-User Trends: Growing demand for advanced packaging solutions from healthcare providers and pharmaceutical companies shapes market trends.

- M&A Activities: The industry has witnessed a moderate level of mergers and acquisitions (M&As) in recent years, with approximately xx M&A deals recorded between 2019 and 2024. These deals primarily aimed at expanding market reach, acquiring specialized technologies, or enhancing production capabilities.

Sterile Packaging Industry Industry Trends & Analysis

The Sterile Packaging market is experiencing robust growth, driven by factors such as the increasing demand for sterile medical devices, the expansion of the pharmaceutical industry, and advancements in packaging technologies. The global market size is expected to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration of innovative packaging solutions, such as pre-filled syringes and advanced barrier films, is steadily increasing, driven by the growing need for improved product sterility and extended shelf life. Technological disruptions, like the adoption of automation and smart packaging technologies, are revolutionizing manufacturing processes and enhancing supply chain efficiency. Consumer preferences are shifting towards sustainable and eco-friendly packaging options, creating opportunities for biodegradable and recyclable materials. The competitive landscape is becoming more intense as new entrants with specialized technologies and innovative products enter the market. This dynamic environment necessitates agile strategies for both established and emerging companies.

Leading Markets & Segments in Sterile Packaging Industry

The pharmaceutical segment dominates the Sterile Packaging market, accounting for approximately xx% of the total market value in 2025. Within product types, Thermoform Trays, Sterile Bottles and Containers, and Pouches and Bags hold the largest market shares due to their widespread use in various applications. Geographically, North America and Europe are the leading markets, driven by robust healthcare infrastructure and high healthcare spending.

Key Drivers by Segment:

- Pharmaceutical: High demand for sterile drug packaging, stringent regulatory compliance, and a focus on extended shelf life drive this segment's dominance.

- Surgical and Medical Appliances: Growing demand for single-use medical devices and improved sterilization techniques fuel the growth of this segment.

- In Vitro Diagnostics (IVD): The rise in point-of-care diagnostics and personalized medicine is driving growth in this segment.

Regional Dominance:

- North America: Strong pharmaceutical and medical device industries, advanced healthcare infrastructure, and stringent regulatory compliance contribute to the region's dominance.

- Europe: A large and well-established healthcare sector, along with a focus on innovation and sustainability, drives market growth in this region.

Sterile Packaging Industry Product Developments

Recent innovations in sterile packaging encompass advancements in barrier film technology, the development of sustainable and eco-friendly materials, and the integration of smart packaging features for enhanced traceability and product security. These developments aim to improve product sterility, extend shelf life, and enhance supply chain efficiency. The market is witnessing a shift towards pre-filled syringes and other advanced delivery systems that require specialized packaging solutions. These solutions address the growing demand for convenient and safe drug administration methods.

Key Drivers of Sterile Packaging Industry Growth

The Sterile Packaging market’s growth is driven by several factors: the expanding pharmaceutical and medical device industries, the increasing demand for sterile healthcare products, technological advancements in packaging materials and sterilization techniques, and stringent regulatory requirements promoting enhanced safety and hygiene. Government initiatives to improve healthcare infrastructure and bolster pharmaceutical manufacturing further boost market expansion.

Challenges in the Sterile Packaging Industry Market

The industry faces challenges including stringent regulatory compliance requirements, supply chain disruptions impacting raw material availability and cost, and intense competition from both established players and emerging market entrants. These factors can impact production costs and market profitability. Fluctuations in raw material prices also present a significant challenge.

Emerging Opportunities in Sterile Packaging Industry

Significant growth opportunities exist in the development and adoption of sustainable and eco-friendly packaging materials, the integration of smart packaging technologies for enhanced traceability and security, and expansion into emerging markets with growing healthcare sectors. Strategic partnerships and collaborations offer potential avenues for growth.

Leading Players in the Sterile Packaging Industry Sector

- Sonoco Products Co

- BillerudKorsnas AB

- Sterimed Holdings SaS

- DWK Life Sciences

- Technipaq Inc

- Sealed Air Corporation

- Beacon Converting Inc

- Tekni-Plex Inc

- Amcor Group GmbH

- 3M Company

- Sigma Medical Supplies Corporation

- Wipak Group

- Charter Next Generation

- Paxxus Inc

- Spectrum Plastics Group

- Dupont De Nemours Inc

- Oliver Healthcare Packaging

- Steripack Group Limited

- Nelipak Healthcare Packaging

- Riverside Medical Packaging Company Ltd

- Berry Global Inc

- Placon Corporation

Key Milestones in Sterile Packaging Industry Industry

- April 2024: Berry Global Group, Inc. announces a significant investment to boost healthcare production capacity by up to 30% across three European sites, enhancing its responsiveness to pharmaceutical manufacturing needs.

- February 2024: Riverside Medical Packaging Company Ltd. strategically demerges its medical device packaging machinery manufacturing arm, Shawpack, to strengthen its core medical device packaging business.

Strategic Outlook for Sterile Packaging Industry Market

The Sterile Packaging market is poised for sustained growth, driven by technological advancements, evolving healthcare needs, and expanding global markets. Companies should focus on developing sustainable solutions, embracing automation, and strategically partnering to capitalize on the significant market potential. Strategic investments in R&D and a proactive approach to regulatory compliance will be crucial for success in this competitive landscape.

Sterile Packaging Industry Segmentation

-

1. Material Type

-

1.1. Plastic

- 1.1.1. Polypropylene (PP)

- 1.1.2. Polyester

- 1.1.3. Polystyrene (PS)

- 1.1.4. Polyviny

- 1.2. Paper and Paperboard

- 1.3. Glass

- 1.4. Other Material Types

-

1.1. Plastic

-

2. Product Type

- 2.1. Thermoform Trays

- 2.2. Sterile Bottles and Containers

- 2.3. Pouches and Bags

- 2.4. Blisters Packs

- 2.5. Vials and Ampoules

- 2.6. Pre-Filled Syringes

- 2.7. Wraps

-

3. Application Type

- 3.1. Pharmaceutical

- 3.2. Surgical and Medical Appliances

- 3.3. In Vitro Diagnostics (IVD)

- 3.4. Other Applications

-

4. Sterilization Type

- 4.1. Chemical Sterilization

- 4.2. Radiation Sterilization

- 4.3. Pressure/Temperature Sterilization

Sterile Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Sterile Packaging Industry Regional Market Share

Geographic Coverage of Sterile Packaging Industry

Sterile Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations Toward Infection Control Expected to Aid Demand for Sterile-based Products; Recent Increase in Utilization Capacity; Material Advancements in the Field of Plastics

- 3.3. Market Restrains

- 3.3.1. Stringent Laws and Regulations Pertaining to Plastic Packaging Industry; Competition From Flexible Plastic Packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Polypropylene (PP)

- 5.1.1.2. Polyester

- 5.1.1.3. Polystyrene (PS)

- 5.1.1.4. Polyviny

- 5.1.2. Paper and Paperboard

- 5.1.3. Glass

- 5.1.4. Other Material Types

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Thermoform Trays

- 5.2.2. Sterile Bottles and Containers

- 5.2.3. Pouches and Bags

- 5.2.4. Blisters Packs

- 5.2.5. Vials and Ampoules

- 5.2.6. Pre-Filled Syringes

- 5.2.7. Wraps

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Pharmaceutical

- 5.3.2. Surgical and Medical Appliances

- 5.3.3. In Vitro Diagnostics (IVD)

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 5.4.1. Chemical Sterilization

- 5.4.2. Radiation Sterilization

- 5.4.3. Pressure/Temperature Sterilization

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.1.1. Polypropylene (PP)

- 6.1.1.2. Polyester

- 6.1.1.3. Polystyrene (PS)

- 6.1.1.4. Polyviny

- 6.1.2. Paper and Paperboard

- 6.1.3. Glass

- 6.1.4. Other Material Types

- 6.1.1. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Thermoform Trays

- 6.2.2. Sterile Bottles and Containers

- 6.2.3. Pouches and Bags

- 6.2.4. Blisters Packs

- 6.2.5. Vials and Ampoules

- 6.2.6. Pre-Filled Syringes

- 6.2.7. Wraps

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Pharmaceutical

- 6.3.2. Surgical and Medical Appliances

- 6.3.3. In Vitro Diagnostics (IVD)

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 6.4.1. Chemical Sterilization

- 6.4.2. Radiation Sterilization

- 6.4.3. Pressure/Temperature Sterilization

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.1.1. Polypropylene (PP)

- 7.1.1.2. Polyester

- 7.1.1.3. Polystyrene (PS)

- 7.1.1.4. Polyviny

- 7.1.2. Paper and Paperboard

- 7.1.3. Glass

- 7.1.4. Other Material Types

- 7.1.1. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Thermoform Trays

- 7.2.2. Sterile Bottles and Containers

- 7.2.3. Pouches and Bags

- 7.2.4. Blisters Packs

- 7.2.5. Vials and Ampoules

- 7.2.6. Pre-Filled Syringes

- 7.2.7. Wraps

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Pharmaceutical

- 7.3.2. Surgical and Medical Appliances

- 7.3.3. In Vitro Diagnostics (IVD)

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 7.4.1. Chemical Sterilization

- 7.4.2. Radiation Sterilization

- 7.4.3. Pressure/Temperature Sterilization

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.1.1. Polypropylene (PP)

- 8.1.1.2. Polyester

- 8.1.1.3. Polystyrene (PS)

- 8.1.1.4. Polyviny

- 8.1.2. Paper and Paperboard

- 8.1.3. Glass

- 8.1.4. Other Material Types

- 8.1.1. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Thermoform Trays

- 8.2.2. Sterile Bottles and Containers

- 8.2.3. Pouches and Bags

- 8.2.4. Blisters Packs

- 8.2.5. Vials and Ampoules

- 8.2.6. Pre-Filled Syringes

- 8.2.7. Wraps

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Pharmaceutical

- 8.3.2. Surgical and Medical Appliances

- 8.3.3. In Vitro Diagnostics (IVD)

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 8.4.1. Chemical Sterilization

- 8.4.2. Radiation Sterilization

- 8.4.3. Pressure/Temperature Sterilization

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Australia and New Zealand Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.1.1. Polypropylene (PP)

- 9.1.1.2. Polyester

- 9.1.1.3. Polystyrene (PS)

- 9.1.1.4. Polyviny

- 9.1.2. Paper and Paperboard

- 9.1.3. Glass

- 9.1.4. Other Material Types

- 9.1.1. Plastic

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Thermoform Trays

- 9.2.2. Sterile Bottles and Containers

- 9.2.3. Pouches and Bags

- 9.2.4. Blisters Packs

- 9.2.5. Vials and Ampoules

- 9.2.6. Pre-Filled Syringes

- 9.2.7. Wraps

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Pharmaceutical

- 9.3.2. Surgical and Medical Appliances

- 9.3.3. In Vitro Diagnostics (IVD)

- 9.3.4. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 9.4.1. Chemical Sterilization

- 9.4.2. Radiation Sterilization

- 9.4.3. Pressure/Temperature Sterilization

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Latin America Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.1.1. Polypropylene (PP)

- 10.1.1.2. Polyester

- 10.1.1.3. Polystyrene (PS)

- 10.1.1.4. Polyviny

- 10.1.2. Paper and Paperboard

- 10.1.3. Glass

- 10.1.4. Other Material Types

- 10.1.1. Plastic

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Thermoform Trays

- 10.2.2. Sterile Bottles and Containers

- 10.2.3. Pouches and Bags

- 10.2.4. Blisters Packs

- 10.2.5. Vials and Ampoules

- 10.2.6. Pre-Filled Syringes

- 10.2.7. Wraps

- 10.3. Market Analysis, Insights and Forecast - by Application Type

- 10.3.1. Pharmaceutical

- 10.3.2. Surgical and Medical Appliances

- 10.3.3. In Vitro Diagnostics (IVD)

- 10.3.4. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 10.4.1. Chemical Sterilization

- 10.4.2. Radiation Sterilization

- 10.4.3. Pressure/Temperature Sterilization

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Middle East and Africa Sterile Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Material Type

- 11.1.1. Plastic

- 11.1.1.1. Polypropylene (PP)

- 11.1.1.2. Polyester

- 11.1.1.3. Polystyrene (PS)

- 11.1.1.4. Polyviny

- 11.1.2. Paper and Paperboard

- 11.1.3. Glass

- 11.1.4. Other Material Types

- 11.1.1. Plastic

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Thermoform Trays

- 11.2.2. Sterile Bottles and Containers

- 11.2.3. Pouches and Bags

- 11.2.4. Blisters Packs

- 11.2.5. Vials and Ampoules

- 11.2.6. Pre-Filled Syringes

- 11.2.7. Wraps

- 11.3. Market Analysis, Insights and Forecast - by Application Type

- 11.3.1. Pharmaceutical

- 11.3.2. Surgical and Medical Appliances

- 11.3.3. In Vitro Diagnostics (IVD)

- 11.3.4. Other Applications

- 11.4. Market Analysis, Insights and Forecast - by Sterilization Type

- 11.4.1. Chemical Sterilization

- 11.4.2. Radiation Sterilization

- 11.4.3. Pressure/Temperature Sterilization

- 11.1. Market Analysis, Insights and Forecast - by Material Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Sonoco Products Co

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BillerudKorsnas AB

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sterimed Holdings SaS

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DWK Life Sciences

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Technipaq Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sealed Air Corporatio

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Beacon Converting Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tekni-Plex Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Amcor Group GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 3M Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sigma Medical Supplies Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Wipak Group

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Charter Next Generation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Paxxus Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Spectrum Plastics Group

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Dupont De Nemours Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Oliver Healthcare Packaging

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Steripack Group Limited

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Nelipak Healthcare Packaging

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Riverside Medical Packaging Company Ltd

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 Berry Global Inc

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.22 Placon Corporation

- 12.2.22.1. Overview

- 12.2.22.2. Products

- 12.2.22.3. SWOT Analysis

- 12.2.22.4. Recent Developments

- 12.2.22.5. Financials (Based on Availability)

- 12.2.1 Sonoco Products Co

List of Figures

- Figure 1: Global Sterile Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Sterile Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Sterile Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Sterile Packaging Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Sterile Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Sterile Packaging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 7: North America Sterile Packaging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 8: North America Sterile Packaging Industry Revenue (Million), by Sterilization Type 2025 & 2033

- Figure 9: North America Sterile Packaging Industry Revenue Share (%), by Sterilization Type 2025 & 2033

- Figure 10: North America Sterile Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Sterile Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Sterile Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Sterile Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Sterile Packaging Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Sterile Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Sterile Packaging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Europe Sterile Packaging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Sterile Packaging Industry Revenue (Million), by Sterilization Type 2025 & 2033

- Figure 19: Europe Sterile Packaging Industry Revenue Share (%), by Sterilization Type 2025 & 2033

- Figure 20: Europe Sterile Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Sterile Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Sterile Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 23: Asia Sterile Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Asia Sterile Packaging Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 25: Asia Sterile Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Asia Sterile Packaging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 27: Asia Sterile Packaging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 28: Asia Sterile Packaging Industry Revenue (Million), by Sterilization Type 2025 & 2033

- Figure 29: Asia Sterile Packaging Industry Revenue Share (%), by Sterilization Type 2025 & 2033

- Figure 30: Asia Sterile Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Sterile Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Sterile Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 33: Australia and New Zealand Sterile Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 34: Australia and New Zealand Sterile Packaging Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Australia and New Zealand Sterile Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Australia and New Zealand Sterile Packaging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 37: Australia and New Zealand Sterile Packaging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 38: Australia and New Zealand Sterile Packaging Industry Revenue (Million), by Sterilization Type 2025 & 2033

- Figure 39: Australia and New Zealand Sterile Packaging Industry Revenue Share (%), by Sterilization Type 2025 & 2033

- Figure 40: Australia and New Zealand Sterile Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Australia and New Zealand Sterile Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Sterile Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 43: Latin America Sterile Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 44: Latin America Sterile Packaging Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 45: Latin America Sterile Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Latin America Sterile Packaging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 47: Latin America Sterile Packaging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 48: Latin America Sterile Packaging Industry Revenue (Million), by Sterilization Type 2025 & 2033

- Figure 49: Latin America Sterile Packaging Industry Revenue Share (%), by Sterilization Type 2025 & 2033

- Figure 50: Latin America Sterile Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Latin America Sterile Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Middle East and Africa Sterile Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 53: Middle East and Africa Sterile Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 54: Middle East and Africa Sterile Packaging Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Sterile Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 56: Middle East and Africa Sterile Packaging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 57: Middle East and Africa Sterile Packaging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 58: Middle East and Africa Sterile Packaging Industry Revenue (Million), by Sterilization Type 2025 & 2033

- Figure 59: Middle East and Africa Sterile Packaging Industry Revenue Share (%), by Sterilization Type 2025 & 2033

- Figure 60: Middle East and Africa Sterile Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Sterile Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 5: Global Sterile Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 9: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 10: Global Sterile Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 15: Global Sterile Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 19: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 20: Global Sterile Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 22: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 24: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 25: Global Sterile Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 27: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 29: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 30: Global Sterile Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Sterile Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 32: Global Sterile Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Sterile Packaging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 34: Global Sterile Packaging Industry Revenue Million Forecast, by Sterilization Type 2020 & 2033

- Table 35: Global Sterile Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sterile Packaging Industry?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Sterile Packaging Industry?

Key companies in the market include Sonoco Products Co, BillerudKorsnas AB, Sterimed Holdings SaS, DWK Life Sciences, Technipaq Inc, Sealed Air Corporatio, Beacon Converting Inc, Tekni-Plex Inc, Amcor Group GmbH, 3M Company, Sigma Medical Supplies Corporation, Wipak Group, Charter Next Generation, Paxxus Inc, Spectrum Plastics Group, Dupont De Nemours Inc, Oliver Healthcare Packaging, Steripack Group Limited, Nelipak Healthcare Packaging, Riverside Medical Packaging Company Ltd, Berry Global Inc, Placon Corporation.

3. What are the main segments of the Sterile Packaging Industry?

The market segments include Material Type, Product Type, Application Type, Sterilization Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations Toward Infection Control Expected to Aid Demand for Sterile-based Products; Recent Increase in Utilization Capacity; Material Advancements in the Field of Plastics.

6. What are the notable trends driving market growth?

Pharmaceutical Sector to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Stringent Laws and Regulations Pertaining to Plastic Packaging Industry; Competition From Flexible Plastic Packaging.

8. Can you provide examples of recent developments in the market?

April 2024 - Berry Global Group, Inc. has invested in additional assets and manufacturing capacity to increase its healthcare production capacity by up to 30% at three European sites. and Berry’s strategically located sites in France and Italy ( are close to pharma manufacturing sites and filling site centers, allowing for quick response times and localized service.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sterile Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sterile Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sterile Packaging Industry?

To stay informed about further developments, trends, and reports in the Sterile Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence