Key Insights

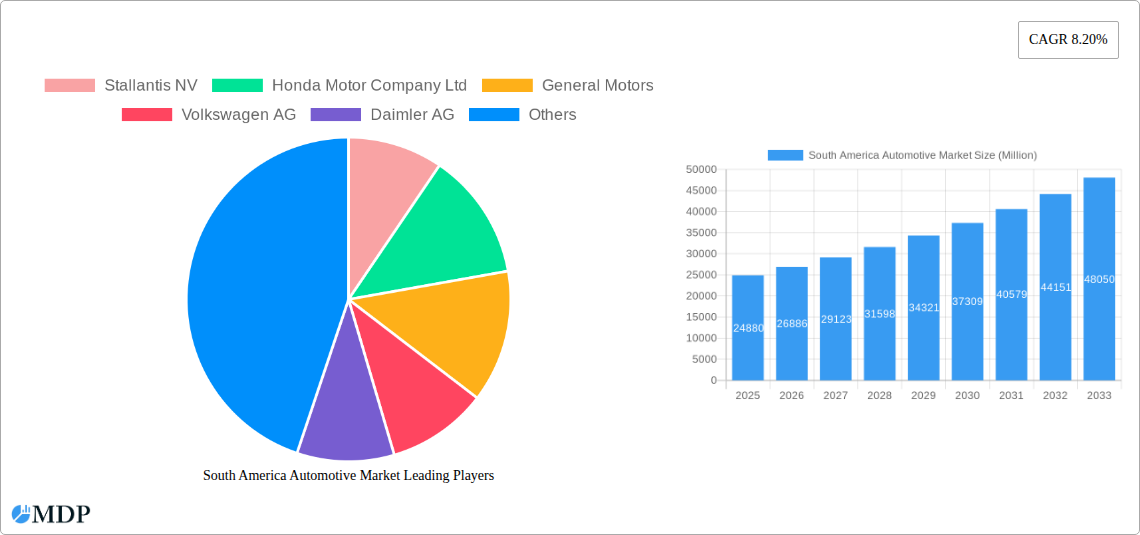

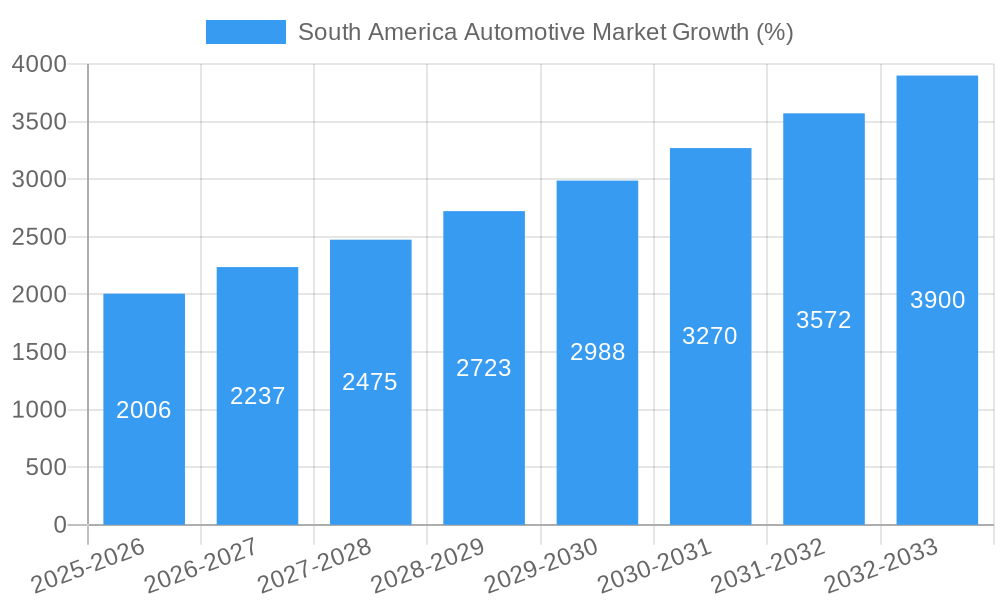

The South American automotive market, valued at $24.88 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.20% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, rising disposable incomes across several South American nations, particularly in urban centers, are boosting demand for personal vehicles, especially passenger cars. Secondly, government initiatives promoting infrastructure development and improving transportation networks are creating a favorable environment for automotive sales. The increasing adoption of electric vehicles (EVs), albeit from a relatively low base, represents a significant emerging trend, driven by environmental concerns and government incentives aimed at reducing carbon emissions. However, economic volatility and fluctuations in currency exchange rates present challenges to sustained growth. Furthermore, the market faces constraints from high import tariffs on vehicles and components, impacting pricing and competitiveness. The market segmentation reveals a diverse landscape, with Brazil and Argentina representing the largest national markets, and passenger cars comprising the dominant vehicle type, followed by commercial vehicles and two-wheelers. The competitive landscape is intensely dynamic, featuring both established global players like Toyota, Volkswagen, and General Motors, and strong regional players.

The forecast period (2025-2033) suggests continued expansion, with the market size exceeding $45 billion by 2033. This projection considers various factors, including the expected increase in overall economic activity across the region, evolving consumer preferences, and the anticipated gradual increase in the adoption of alternative fuel vehicles. While challenges remain, such as navigating the complex regulatory landscape and ensuring sufficient charging infrastructure for EVs, the long-term growth trajectory for the South American automotive market remains positive. The market’s performance will significantly depend on the stability of regional economies and the success of government policies in encouraging both domestic production and the adoption of advanced automotive technologies.

South America Automotive Market: 2019-2033 Forecast Report

Dive deep into the dynamic South American automotive landscape with this comprehensive market analysis covering the period 2019-2033. This report provides actionable insights for industry stakeholders, including manufacturers, investors, and policymakers, offering a detailed examination of market trends, leading players, and future growth prospects. We project a robust market evolution, fueled by significant investments and technological advancements. Our analysis incorporates granular data across key segments, countries, and automotive types, providing a 360° view of this vital market.

South America Automotive Market Dynamics & Concentration

The South American automotive market, valued at xx Million USD in 2024, exhibits a moderately concentrated structure with several multinational players holding significant market share. Market leaders like Stellantis NV, Honda Motor Company Ltd, and General Motors dominate various segments, but regional players and emerging brands are increasingly challenging their dominance. Innovation in electric vehicles (EVs) and connected car technologies is a key driver, alongside evolving regulatory frameworks focusing on emissions standards and safety regulations. The market experiences significant fluctuations due to macroeconomic factors, such as currency exchange rates and fluctuating fuel prices. Product substitution is a growing concern with the rise of ride-sharing services and public transportation. Consumer trends are shifting towards SUVs and smaller, more fuel-efficient vehicles due to rising fuel costs and urban congestion.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2024.

- M&A Activity: A total of xx M&A deals were recorded in the South American automotive sector between 2019 and 2024, primarily driven by expansion and technology acquisition.

- Innovation Drivers: Electrification, autonomous driving, and connectivity are key technological advancements driving market transformation.

- Regulatory Framework: Stringent emission norms and safety standards are reshaping product development strategies.

South America Automotive Market Industry Trends & Analysis

The South American automotive market is characterized by dynamic growth patterns, driven by diverse factors. While historical growth (2019-2024) exhibited a fluctuating CAGR of xx%, the forecast period (2025-2033) anticipates a more stable CAGR of xx%, reaching a projected market size of xx Million USD by 2033. Key growth drivers include rising disposable incomes, expanding middle class, and improved infrastructure in key markets like Brazil and Argentina. Technological disruptions, particularly the increased adoption of EVs, are gradually changing the industry landscape. Consumer preferences are shifting towards SUVs and crossovers, while fuel efficiency and safety remain prominent concerns. Competitive dynamics are intensifying, with both global and regional players vying for market share. Market penetration of EVs is expected to increase from xx% in 2024 to xx% by 2033.

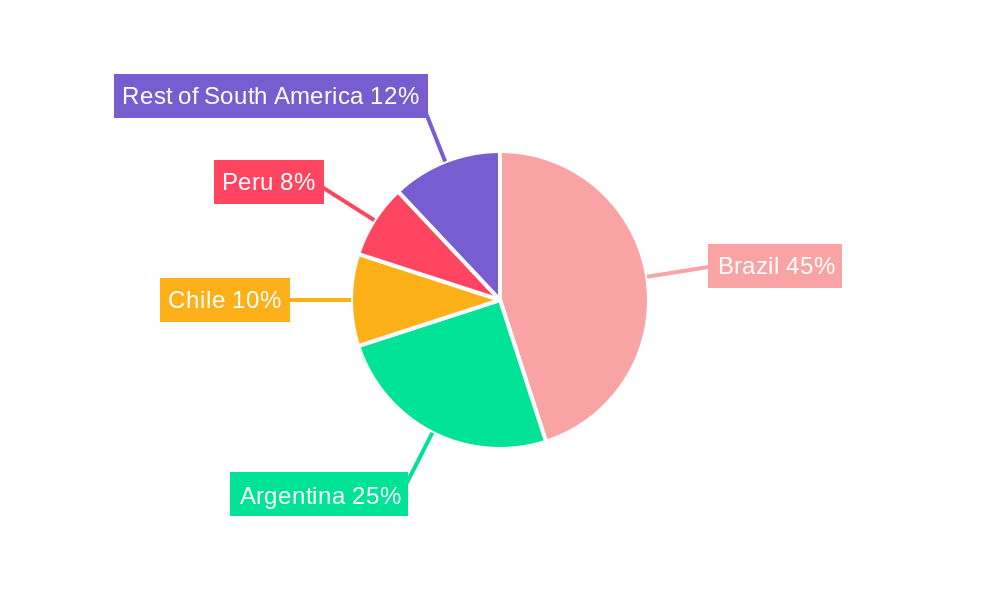

Leading Markets & Segments in South America Automotive Market

Brazil remains the dominant market in South America, accounting for approximately xx% of the total market volume in 2024, followed by Argentina (xx%) and Chile (xx%). The passenger car segment holds the largest market share, while the commercial vehicle segment is experiencing steady growth driven by infrastructure development and e-commerce expansion.

By Fuel Type: Gasoline-powered vehicles still dominate the market, but the EV segment is expected to see significant growth due to government incentives and growing environmental awareness.

By Country:

- Brazil: Strong domestic production, large population, and government support for the automotive industry.

- Argentina: Growing economy and increasing demand for passenger and commercial vehicles.

- Chile: Relatively smaller market but with high per capita income and robust economic growth.

- Peru: Emerging market with rising demand, primarily driven by urbanisation and improving infrastructure.

- Rest of South America: This region exhibits diverse growth patterns, influenced by individual country-specific economic conditions.

By Vehicle Type:

- Passenger Cars: Dominates the market due to rising individual vehicle ownership and expanding middle class.

- Commercial Vehicles: Growth is driven by infrastructure development, logistics sector expansion, and e-commerce boom.

- Two-Wheelers: High demand in urban areas for commuting and last-mile delivery.

South America Automotive Market Product Developments

Significant advancements in automotive technology are shaping the South American market. Manufacturers are focusing on improving fuel efficiency, incorporating advanced safety features, and developing electric and hybrid vehicle models to cater to the growing demand for sustainable transportation. The integration of connected car technologies is also gaining traction, offering features like infotainment systems, navigation, and remote diagnostics. This focus on technological advancements and enhanced features positions automakers to better meet evolving consumer preferences.

Key Drivers of South America Automotive Market Growth

Several factors contribute to the positive outlook for the South American automotive market. Government incentives promoting local production and EV adoption stimulate growth, while economic expansion in key countries fuels demand. Improved infrastructure projects and rising urbanization contribute to increased vehicle ownership. Technological advancements, particularly in fuel efficiency and safety features, attract consumers.

Challenges in the South America Automotive Market

Several factors pose challenges to the South American automotive sector. Economic instability in some countries leads to fluctuating demand, while import tariffs and regulatory complexities hinder market entry. Supply chain disruptions can impact production and lead to price increases. Intense competition, particularly from established global players, puts pressure on margins. The relatively underdeveloped charging infrastructure for EVs presents a barrier to broader EV adoption.

Emerging Opportunities in South America Automotive Market

Long-term growth prospects are fueled by technological advancements such as the development of affordable EVs and autonomous driving technologies. Strategic partnerships between global manufacturers and local companies are creating synergies and market penetration. Expanding into underserved markets within South America presents significant growth potential. The focus on sustainable transportation and infrastructure development offers further opportunities for environmentally friendly vehicle technologies.

Leading Players in the South America Automotive Market Sector

- Stallantis NV

- Honda Motor Company Ltd

- General Motors

- Volkswagen AG

- Daimler AG

- Hyundai Motor Company

- Nissan Motor Company Ltd

- Toyota Motor Corp

- Groupe Renault

- Kia Motor Corporation

- Ford Motor Company

Key Milestones in South America Automotive Market Industry

- April 2022: Nissan Motor Co. invested USD 276.12 Million in its Brazilian plant, signaling commitment to the market.

- January 2022: Link invested USD 265 Million in a new EV factory in Mexico, indicating the growing interest in the region.

- January 2022: Great Wall Motors announced a USD 1.81 Billion investment in Brazilian EV manufacturing, highlighting the shift towards electric mobility. These investments significantly impact market dynamics, driving production capacity and technological advancements.

Strategic Outlook for South America Automotive Market

The South American automotive market holds immense long-term potential driven by expanding economies, favorable demographics, and technological innovation. Strategic opportunities exist in capitalizing on the growing EV market, investing in local manufacturing capabilities, and creating strong distribution networks. Companies that successfully adapt to evolving consumer preferences, navigate regulatory landscapes, and address supply chain challenges will be best positioned for growth in this dynamic market.

South America Automotive Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Two-wheelers

-

2. Fuel Type

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Electric Vehicle

- 2.4. Other Fuel Types

South America Automotive Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Automotive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth And Stability; Othe Market Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Of Vehicles To End Users; Other Market Restraints

- 3.4. Market Trends

- 3.4.1 Brazil

- 3.4.2 Argentina

- 3.4.3 and Chile

- 3.4.4 to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Automotive Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Two-wheelers

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Electric Vehicle

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Brazil South America Automotive Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Automotive Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Automotive Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Stallantis NV

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Honda Motor Company Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Motors

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volkswagen AG

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Daimler AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hyundai Motor Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Nissan Motor Company Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toyota Motor Corp

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Groupe Renault

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kia Motor Corporatio

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Ford Motor Company

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Stallantis NV

List of Figures

- Figure 1: South America Automotive Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Automotive Market Share (%) by Company 2024

List of Tables

- Table 1: South America Automotive Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Automotive Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: South America Automotive Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: South America Automotive Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Automotive Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Automotive Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: South America Automotive Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: South America Automotive Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Colombia South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Peru South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Venezuela South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Ecuador South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bolivia South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Paraguay South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Uruguay South America Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Automotive Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the South America Automotive Market?

Key companies in the market include Stallantis NV, Honda Motor Company Ltd, General Motors, Volkswagen AG, Daimler AG, Hyundai Motor Company, Nissan Motor Company Ltd, Toyota Motor Corp, Groupe Renault, Kia Motor Corporatio, Ford Motor Company.

3. What are the main segments of the South America Automotive Market?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth And Stability; Othe Market Drivers.

6. What are the notable trends driving market growth?

Brazil. Argentina. and Chile. to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Cost Of Vehicles To End Users; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

April 2022: Nissan Motor Co. invested 1.3 billion reais (USD276.12 million) in its plant in Resende, Brazil, and in launching new products between 2023 and 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Automotive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Automotive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Automotive Market?

To stay informed about further developments, trends, and reports in the South America Automotive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence