Key Insights

The Saudi Arabian facility management (FM) market is experiencing robust growth, projected to reach a substantial market size, driven by the Kingdom's ambitious Vision 2030 initiatives. This plan emphasizes infrastructure development, diversification of the economy, and the growth of key sectors like tourism, healthcare, and real estate. These factors are significantly boosting demand for efficient and comprehensive FM services across various sectors, including commercial, industrial, and governmental entities. The market is segmented by facility type (in-house vs. outsourced), service offering (hard vs. soft FM), and end-user industry. While outsourced facility management currently holds a larger market share, in-house management is also growing, particularly among larger organizations with internal expertise. The increasing complexity of modern infrastructure and the need for specialized skills are driving demand for outsourced providers, especially in areas like smart building technology integration and sustainability management. This trend is further fuelled by the increasing adoption of technology such as IoT and AI-based solutions in FM operations. The market also witnesses a steady demand for soft FM services, including cleaning, security, and catering, reflective of overall economic activity and the expansion of built infrastructure.

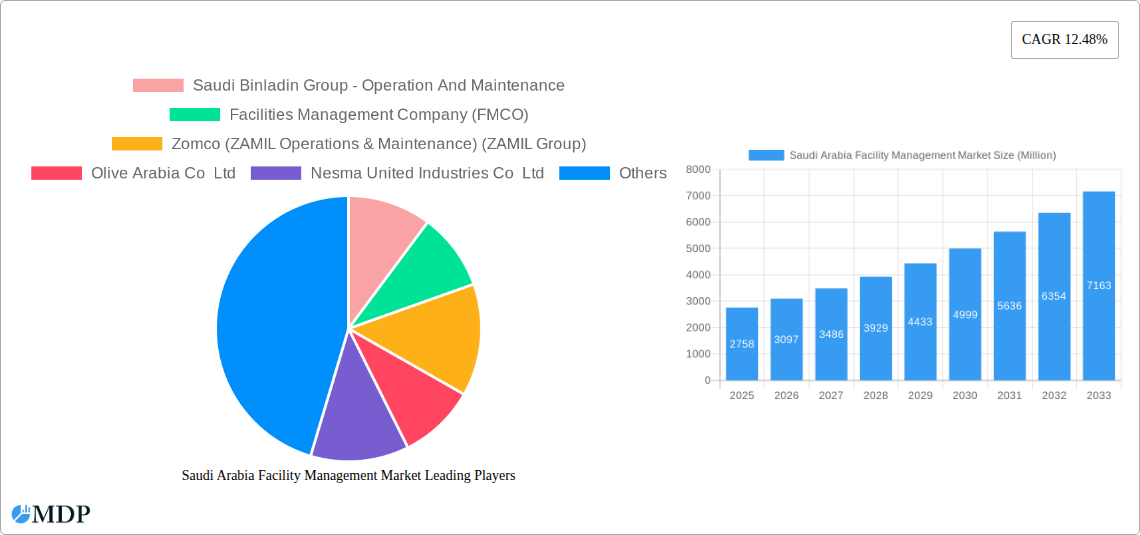

The market's growth is expected to continue at a Compound Annual Growth Rate (CAGR) of 12.48% from 2025 to 2033, indicating substantial investment potential. However, challenges remain. Maintaining a skilled workforce, particularly in specialized areas, poses an ongoing challenge. Furthermore, regulatory changes and economic fluctuations could influence market growth. Nevertheless, the long-term outlook for the Saudi Arabian FM market is positive, particularly with the government's continued commitment to major infrastructure projects and investments in sustainable development. Key players in the market, including both international and local companies, are strategically positioned to capitalize on these growth opportunities through mergers and acquisitions, technological advancements, and expansion into new service offerings.

Saudi Arabia Facility Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia Facility Management Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. The analysis incorporates detailed segmentation by facility management type (in-house vs. outsourced), offering type (hard vs. soft), and end-user industry (commercial, industrial, government, etc.). The report leverages extensive data and market intelligence to project a robust forecast for the coming decade. Key players like Saudi Binladin Group, FMCO, and Zomco are analyzed to uncover market concentration and competitive strategies. This report is indispensable for understanding and navigating the evolving landscape of Saudi Arabia's burgeoning facility management sector.

Saudi Arabia Facility Management Market Market Dynamics & Concentration

The Saudi Arabia facility management market exhibits a moderately concentrated structure, with a few large players holding significant market share. Saudi Binladin Group, FMCO, and Zomco (ZAMIL Operations & Maintenance) are among the key players, while a significant number of smaller, specialized firms also contribute. The market is driven by several factors, including:

- Innovation: Technological advancements in building automation, smart technologies, and sustainable practices are driving innovation within the sector. Integration of IoT devices and AI-powered solutions is improving operational efficiency and reducing costs.

- Regulatory Framework: Government regulations promoting sustainable building practices and energy efficiency are creating a favorable environment for the growth of the market. Stricter building codes are also driving demand for professional facility management services.

- Product Substitutes: While there are limited direct substitutes, the market faces indirect competition from in-house teams that manage facilities internally. The cost-effectiveness and specialized expertise of outsourced facility management are crucial factors that encourage companies to seek external services.

- End-User Trends: A rising emphasis on workplace experience and employee satisfaction within organizations is fostering a strong demand for high-quality facility management services. The focus on employee well-being is significantly impacting facility management choices.

- M&A Activities: The market has witnessed a moderate level of M&A activity in recent years, with larger firms acquiring smaller companies to expand their service offerings and market reach. The exact number of M&A deals in the last 5 years is xx, leading to an estimated xx% market share consolidation.

Saudi Arabia Facility Management Market Industry Trends & Analysis

The Saudi Arabia facility management market is experiencing robust growth, driven by significant infrastructural developments, increasing urbanization, and a growing emphasis on sustainability. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Several key trends are shaping the market:

- Market Growth Drivers: Large-scale government projects, such as Neom and Vision 2030 initiatives, are creating immense opportunities for the facility management sector. The growing commercial and retail sectors, driven by increased tourism and economic diversification, are also major drivers of market expansion.

- Technological Disruptions: The adoption of smart building technologies, including Building Management Systems (BMS), IoT sensors, and AI-powered analytics, is revolutionizing facility operations. This enhances efficiency, reduces operational costs, and improves energy management.

- Consumer Preferences: End-users are increasingly demanding integrated and sustainable facility management solutions that prioritize operational efficiency, cost optimization, and environmental responsibility. There is a higher focus on quality assurance and transparent service delivery.

- Competitive Dynamics: The market is characterized by both intense competition among established players and a rise of specialized service providers. Differentiation based on technology adoption, service quality, and sustainability initiatives is paramount for success. Market penetration rates vary across segments, with outsourced facility management demonstrating significant growth compared to in-house solutions.

Leading Markets & Segments in Saudi Arabia Facility Management Market

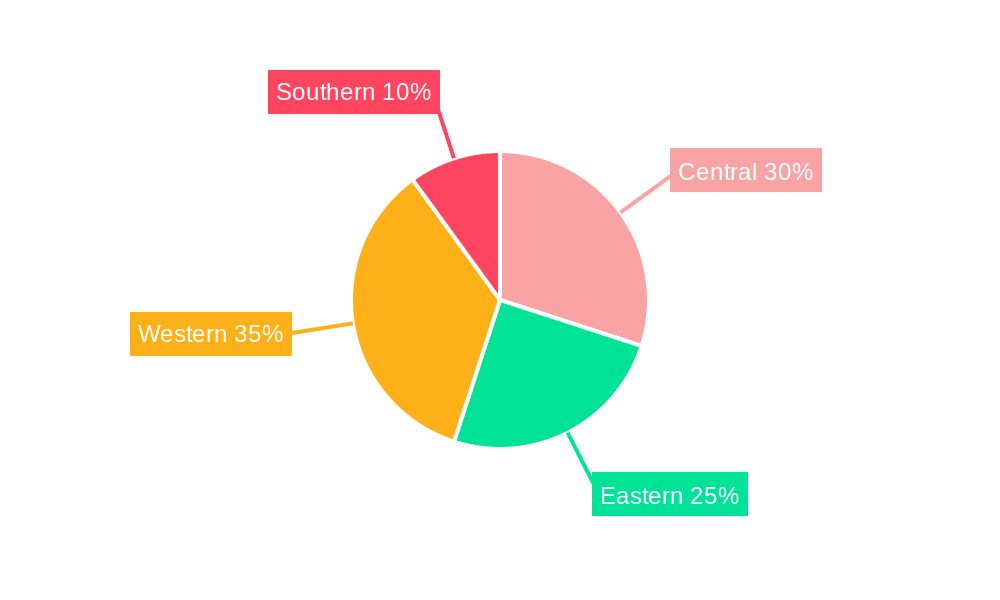

The Saudi Arabia facility management market is geographically concentrated in major urban centers, including Riyadh, Jeddah, and Dammam, owing to high population density, significant infrastructure development, and commercial activity. The market is segmented as follows:

- By Type of Facility Management: Outsourced facility management is expected to dominate the market due to cost-effectiveness and access to specialized expertise. In-house facility management will still hold a sizeable market segment, particularly for large corporations with extensive in-house capabilities.

- By Offering Type: Hard facility management (related to building maintenance and infrastructure) currently holds a larger market share compared to soft facility management (services like cleaning and security). However, soft facility management is experiencing faster growth due to increasing focus on employee well-being and hygiene standards.

- By End-user Industry: The Commercial and Retail sector is currently the largest end-user segment, driven by the expansion of shopping malls, office spaces, and hospitality venues. The Government, Infrastructure, and Public Entities sector displays significant growth potential, fueled by ongoing investments in infrastructure development and public services.

Key drivers influencing segment dominance include:

- Economic Policies: Government initiatives promoting diversification and private sector growth positively impact the facility management sector across all end-user industries.

- Infrastructure Development: Major infrastructure projects drive demand for facility management services, particularly in the construction, transportation, and energy sectors.

Saudi Arabia Facility Management Market Product Developments

Recent product innovations focus on integrating smart technologies, including IoT-enabled sensors and AI-powered predictive maintenance tools. This allows for proactive maintenance, minimizes downtime, and enhances energy efficiency. The market is also witnessing the development of integrated facility management platforms that streamline operations and optimize resource allocation. This approach offers competitive advantages by providing comprehensive and customized solutions, delivering improved performance and cost savings to clients.

Key Drivers of Saudi Arabia Facility Management Market Growth

The Saudi Arabia facility management market's growth is propelled by:

- Technological advancements: Adoption of smart technologies and data analytics significantly improves efficiency and reduces operational costs.

- Economic growth: The Kingdom's Vision 2030 strategy fuels investments in infrastructure and real estate, bolstering demand for facility management services.

- Government regulations: Emphasis on sustainability and building codes drives the need for professional facility management services.

Challenges in the Saudi Arabia Facility Management Market Market

Challenges include:

- Regulatory hurdles: Navigating complex regulatory requirements for licensing and compliance can be demanding for businesses.

- Supply chain issues: Maintaining a reliable supply chain for maintenance materials and skilled labor can be challenging.

- Competition: The market's competitive landscape requires businesses to deliver high-quality services at competitive prices. These factors collectively impact market profitability, requiring businesses to continuously improve efficiency and adapt to changing market conditions.

Emerging Opportunities in Saudi Arabia Facility Management Market

Long-term growth opportunities stem from expanding into new sectors like healthcare and education, leveraging technological advancements such as AI and machine learning for predictive maintenance and enhanced security, and developing strategic partnerships with construction companies and real estate developers to deliver integrated solutions. The potential for green building certifications and sustainable facility management is also significant.

Leading Players in the Saudi Arabia Facility Management Market Sector

- Saudi Binladin Group - Operation And Maintenance

- Facilities Management Company (FMCO)

- Zomco (ZAMIL Operations & Maintenance) (ZAMIL Group)

- Olive Arabia Co Ltd

- Nesma United Industries Co Ltd

- Initial Saudi Group (Alesayi Holding )

- Almajal G4S (Allied Universal)

- Samama Holding Group

- Jash Holding LLC

- EMCOR Saudi Company Limited

- El Seif Operation and Maintenance (ESOM)

- Musanadah Facilities Management Company (Alturki Holding)

- Al Yamama Company

- Khidmah Saudi Arabia (Aldar Properties PJSC)

- Al Suwaidi Holding Company KSA

- Seder Services Co

- ENGIE Solutions (Engie Group)

- Enova Facilities Management Services LLC

- Tamimi Group

- SETE Energy Saudia for Industrial Projects Ltd (SETE Saudia)

Key Milestones in Saudi Arabia Facility Management Market Industry

- June 2024: National Building and Marketing Co. (NBM) secured a SAR 350 million (USD 93.33 million) contract for the Granada Riyadh Project, showcasing significant investment in infrastructure development.

- January 2024: The Saudi Green Initiative's USD 186 billion allocation highlights the growing focus on sustainability and its impact on the facility management sector, driving demand for green building solutions and environmentally conscious practices.

Strategic Outlook for Saudi Arabia Facility Management Market Market

The Saudi Arabia facility management market holds significant future potential, driven by continued investments in infrastructure, urbanization, and a growing emphasis on sustainability. Strategic opportunities lie in adopting cutting-edge technologies, focusing on providing integrated and customized solutions, and capitalizing on the growth of key sectors like healthcare and education. Companies that can effectively adapt to technological advancements, prioritize sustainable practices, and offer superior customer service will be best positioned for long-term success.

Saudi Arabia Facility Management Market Segmentation

-

1. Service Type

-

1.1. Hard Service

- 1.1.1. Asset Management

- 1.1.2. MEP and HVAC Services

- 1.1.3. Fire Systems and Safety

- 1.1.4. Other Hard FM Services

-

1.2. Soft Service

- 1.2.1. Office Support and Security

- 1.2.2. Cleaning Services

- 1.2.3. Catering Services

- 1.2.4. Other Soft FM Services

-

1.1. Hard Service

-

2. Offering Type

- 2.1. In-House

-

2.2. Outsourced

- 2.2.1. Single FM

- 2.2.2. Bundled FM

- 2.2.3. Integrated FM

-

3. End-user Industry

- 3.1. Commercial, Retail, and Restaurants

- 3.2. Manufacturing And Industrial

- 3.3. Government, Infrastructure, And Public Entities

- 3.4. Institutional

- 3.5. Other End-user Industries

Saudi Arabia Facility Management Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Infrastructure Development and Growing Real Estate Sector; Increasing Outsourcing Trend and Supporting Government Initiatives; Emphasis on Green and Sustainable Building Practices

- 3.3. Market Restrains

- 3.3.1. ; High cost of development

- 3.4. Market Trends

- 3.4.1. In-house Facility Management to be the Fastest-growing Type of FM

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Hard Service

- 5.1.1.1. Asset Management

- 5.1.1.2. MEP and HVAC Services

- 5.1.1.3. Fire Systems and Safety

- 5.1.1.4. Other Hard FM Services

- 5.1.2. Soft Service

- 5.1.2.1. Office Support and Security

- 5.1.2.2. Cleaning Services

- 5.1.2.3. Catering Services

- 5.1.2.4. Other Soft FM Services

- 5.1.1. Hard Service

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. In-House

- 5.2.2. Outsourced

- 5.2.2.1. Single FM

- 5.2.2.2. Bundled FM

- 5.2.2.3. Integrated FM

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial, Retail, and Restaurants

- 5.3.2. Manufacturing And Industrial

- 5.3.3. Government, Infrastructure, And Public Entities

- 5.3.4. Institutional

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Central Saudi Arabia Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Saudi Binladin Group - Operation And Maintenance

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Facilities Management Company (FMCO)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Zomco (ZAMIL Operations & Maintenance) (ZAMIL Group)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Olive Arabia Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nesma United Industries Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Initial Saudi Group (Alesayi Holding )

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Almajal G4S (Allied Universal)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Samama Holding Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Jash Holding LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 EMCOR Saudi Company Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 El Seif Operation and Maintenance (ESOM

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Musanadah Facilities Management Company (Alturki Holding)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Al Yamama Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Khidmah Saudi Arabia (Aldar Properties PJSC)

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Al Suwaidi Holding Company KSA

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Seder Services Co

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 ENGIE Solutions (Engie Group)

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Enova Facilities Management Services LLC

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Tamimi Group

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 SETE Energy Saudia for Industrial Projects Ltd (SETE Saudia)

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Saudi Binladin Group - Operation And Maintenance

List of Figures

- Figure 1: Saudi Arabia Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Facility Management Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Saudi Arabia Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Saudi Arabia Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Saudi Arabia Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Facility Management Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 12: Saudi Arabia Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 13: Saudi Arabia Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Saudi Arabia Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Facility Management Market?

The projected CAGR is approximately 12.48%.

2. Which companies are prominent players in the Saudi Arabia Facility Management Market?

Key companies in the market include Saudi Binladin Group - Operation And Maintenance, Facilities Management Company (FMCO), Zomco (ZAMIL Operations & Maintenance) (ZAMIL Group), Olive Arabia Co Ltd, Nesma United Industries Co Ltd, Initial Saudi Group (Alesayi Holding ), Almajal G4S (Allied Universal), Samama Holding Group, Jash Holding LLC, EMCOR Saudi Company Limited, El Seif Operation and Maintenance (ESOM, Musanadah Facilities Management Company (Alturki Holding), Al Yamama Company, Khidmah Saudi Arabia (Aldar Properties PJSC), Al Suwaidi Holding Company KSA, Seder Services Co, ENGIE Solutions (Engie Group), Enova Facilities Management Services LLC, Tamimi Group, SETE Energy Saudia for Industrial Projects Ltd (SETE Saudia).

3. What are the main segments of the Saudi Arabia Facility Management Market?

The market segments include Service Type, Offering Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Infrastructure Development and Growing Real Estate Sector; Increasing Outsourcing Trend and Supporting Government Initiatives; Emphasis on Green and Sustainable Building Practices.

6. What are the notable trends driving market growth?

In-house Facility Management to be the Fastest-growing Type of FM.

7. Are there any restraints impacting market growth?

; High cost of development.

8. Can you provide examples of recent developments in the market?

June 2024: National Building and Marketing Co. (NBM), based in Saudi Arabia, recently inked a significant deal valued at SAR 350 million (USD 93.33 million) with Al-Fayzia Real Estate Development Co. The contract, specifically for the 'Granada Riyadh Project,' entails NBM overseeing infrastructure and superstructure development. This includes constructing, finishing, and supplying all building materials, managing administrative tasks, and ensuring all services are in place for the project's investment readiness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Facility Management Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence