Key Insights

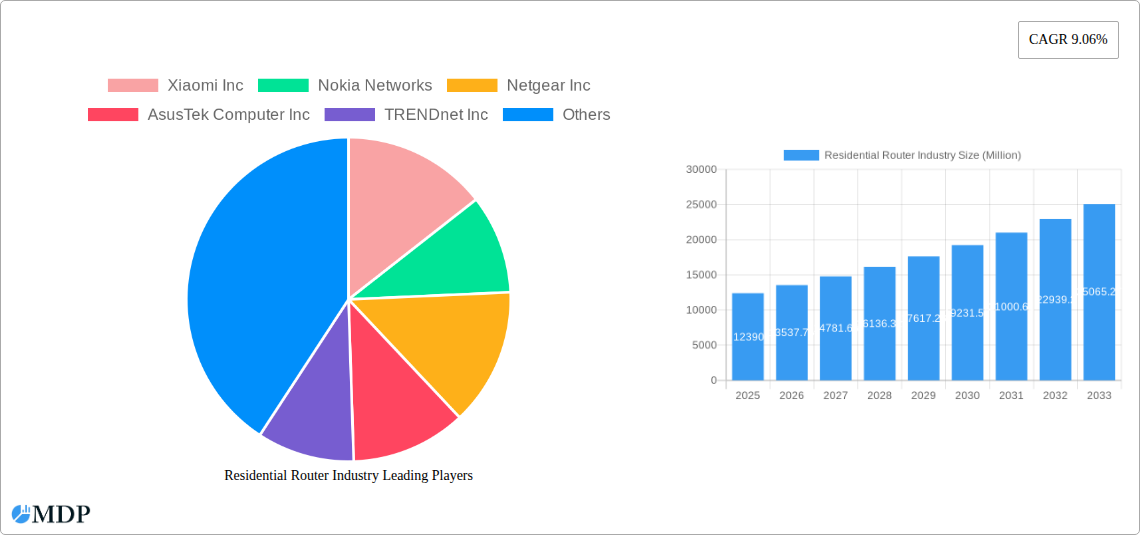

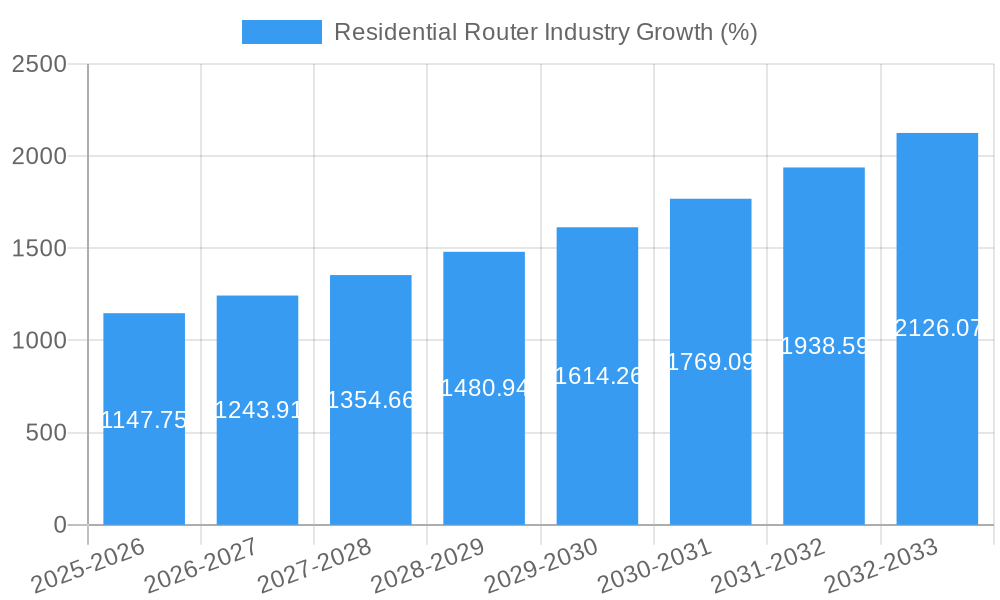

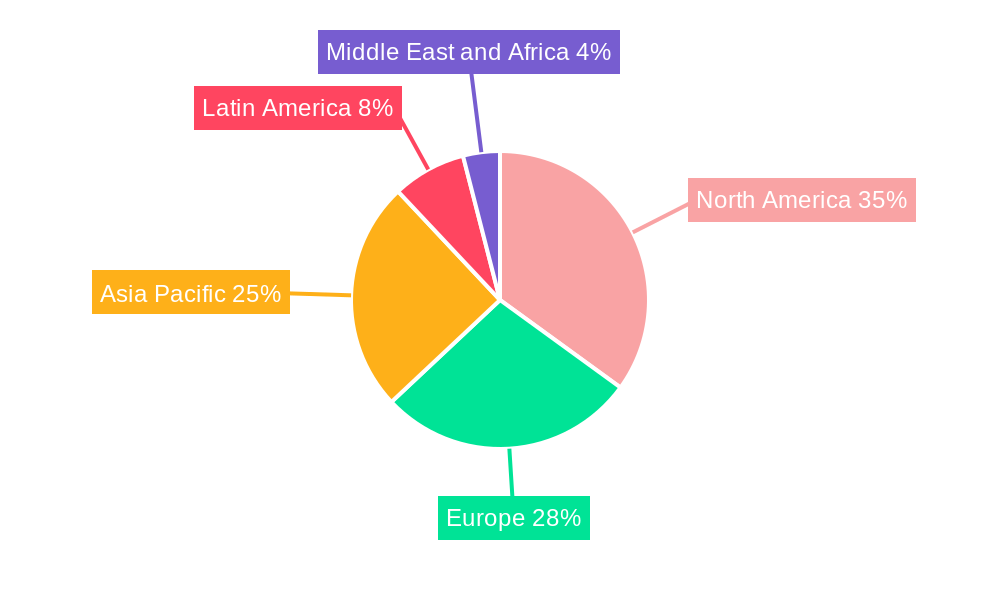

The residential router market, valued at $12.39 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.06% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing penetration of smart home devices necessitates robust and reliable internet connectivity, driving demand for advanced routers capable of handling multiple devices and high bandwidth applications. The proliferation of high-speed internet plans, such as fiber optic and 5G, further fuels market growth as consumers upgrade their routers to take full advantage of these faster connections. Furthermore, the rising adoption of Wi-Fi 6 and Wi-Fi 6E technologies offers improved network performance, speed, and capacity, attracting consumers and driving market expansion. Key players like Xiaomi, TP-Link, Netgear, and Asustek are constantly innovating, offering feature-rich routers with enhanced security protocols and mesh networking capabilities, adding to market dynamism. The market is segmented by connectivity type (wired and wireless), with wireless routers dominating due to their convenience and flexibility. Growth is expected across all geographic regions, with North America and Asia Pacific anticipated to be leading markets, driven by high internet penetration and technological advancements. However, potential restraints include price sensitivity in certain markets and the increasing maturity of the router technology itself, potentially leading to slower growth in the later years of the forecast period.

The competitive landscape is characterized by both established players and emerging brands. Established companies leverage their brand recognition and extensive distribution networks to maintain market share. Simultaneously, smaller, more agile players are introducing innovative and cost-effective solutions, particularly in the areas of mesh networking and smart home integration. The continuous evolution of networking technologies, coupled with increasing consumer demand for seamless connectivity across multiple devices, will continue to drive innovation and competition within the residential router market. Future growth will hinge on the ability of manufacturers to adapt to evolving technological standards and consumer preferences, focusing on delivering high-performance, secure, and user-friendly networking solutions. The market is expected to see continued consolidation, with larger players potentially acquiring smaller companies to expand their product portfolios and market reach.

Residential Router Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Residential Router Industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, technological advancements, and future growth potential. The global residential router market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Residential Router Industry Market Dynamics & Concentration

The residential router market is characterized by a moderate level of concentration, with several key players holding significant market share. Market share is dynamically shifting due to continuous innovation and evolving consumer preferences. While exact figures are proprietary, we estimate that the top five players (Xiaomi Inc, TP-Link Technologies Co Ltd, Netgear Inc, AsusTek Computer Inc, and D-Link Corporation) collectively hold approximately xx% of the global market share in 2025.

Several factors influence market dynamics:

- Innovation Drivers: The continuous evolution of Wi-Fi standards (e.g., Wi-Fi 6E, Wi-Fi 7) drives innovation, leading to faster speeds, enhanced security, and improved network management capabilities. Mesh networking technology is also gaining significant traction.

- Regulatory Frameworks: Government regulations concerning data privacy and security standards impact the design and features of residential routers.

- Product Substitutes: While limited, alternatives like integrated modem-router combinations from ISPs pose some competitive pressure.

- End-User Trends: Increasing smart home adoption and the proliferation of IoT devices are key drivers of demand for advanced routers.

- M&A Activities: The number of mergers and acquisitions (M&A) in the industry has been moderate in recent years, at approximately xx deals annually during the historical period (2019-2024), primarily focused on smaller companies being acquired by larger players to expand product portfolios or technology.

Residential Router Industry Industry Trends & Analysis

The residential router market is experiencing robust growth, driven by several factors. The global market size reached xx Million in 2024 and is projected to reach xx Million in 2025, driven by increasing internet penetration, particularly in emerging economies. The market is witnessing a surge in demand for high-performance routers equipped with advanced features such as Wi-Fi 6 and Wi-Fi 6E capabilities to handle the growing number of connected devices in homes. The rising adoption of smart home technologies and the proliferation of IoT devices have further intensified the demand for advanced routing solutions capable of efficiently managing bandwidth allocation and ensuring seamless network connectivity.

Technological advancements such as mesh networking technology and the integration of AI-powered features are transforming the market landscape, enabling more efficient and intelligent network management. Moreover, the transition from traditional wired connections to wireless connectivity (Wi-Fi) continues to drive market expansion. Consumer preferences lean towards routers offering greater speed, range, security, and ease of use. The competitive landscape is highly dynamic, with major players constantly striving to differentiate their product offerings through innovation and strategic partnerships.

Leading Markets & Segments in Residential Router Industry

The Wireless segment dominates the residential router market, accounting for approximately xx% of the market share in 2025. This is driven by the convenience, flexibility, and improved speeds offered by wireless technologies. Key regions driving growth include North America, Europe, and Asia-Pacific.

Key Drivers for Wireless Segment Dominance:

- Convenience and Flexibility: Wireless routers provide easy setup and mobility.

- Technological Advancements: Continuous improvements in Wi-Fi standards (Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7) lead to enhanced performance and speed.

- Increased Smartphone and IoT Device Usage: The proliferation of smartphones and IoT devices increases reliance on wireless connectivity.

Geographic Dominance Analysis:

North America remains a leading market due to high internet penetration rates and early adoption of new technologies. Asia-Pacific is demonstrating rapid growth, fueled by rising disposable incomes and increased internet usage in developing economies. Europe shows steady growth with strong demand in major markets. Government initiatives promoting broadband infrastructure development play a critical role in shaping regional market dynamics.

Residential Router Industry Product Developments

Recent product innovations focus on higher Wi-Fi speeds (Wi-Fi 6E, Wi-Fi 7), enhanced security features, mesh networking capabilities, and improved network management tools. These advancements cater to the growing demand for seamless connectivity in homes with numerous smart devices and high bandwidth needs. Features like built-in VPN support, advanced parental controls, and AI-powered network optimization are becoming increasingly common. The market's focus on better performance and better user experiences makes for a highly competitive landscape.

Key Drivers of Residential Router Industry Growth

Several factors contribute to the growth of the residential router industry:

- Technological Advancements: Development of higher-speed Wi-Fi standards (Wi-Fi 6, Wi-Fi 7) and mesh networking technologies significantly enhances network performance and range.

- Economic Factors: Increasing disposable incomes and rising internet penetration drive consumer demand.

- Regulatory Support: Government initiatives promoting broadband infrastructure contribute to market expansion. For instance, many governments are enacting policies to improve broadband access in underserved areas, creating higher demand.

Challenges in the Residential Router Industry Market

The residential router industry faces challenges:

- Intense Competition: The market is highly competitive with numerous established and emerging players, leading to price wars and margin compression.

- Supply Chain Disruptions: Global supply chain bottlenecks can impact the availability of components and increase manufacturing costs. This can be quantified by increased lead times and higher prices for raw materials.

- Regulatory Hurdles: Compliance with data privacy and security regulations adds complexity and cost to product development. This adds to development cost and delays product time to market.

Emerging Opportunities in Residential Router Industry

Several opportunities exist in the residential router market:

The integration of advanced features, such as AI-powered network management and cybersecurity enhancements, presents significant opportunities. Strategic partnerships with smart home device manufacturers to create seamless integrated solutions will be critical. Expanding into emerging markets with increasing internet penetration offers substantial growth potential.

Leading Players in the Residential Router Industry Sector

- Xiaomi Inc

- Nokia Networks

- Netgear Inc

- AsusTek Computer Inc

- TRENDnet Inc

- TP-Link Technologies Co Ltd

- D-Link Corporation

- Linksys Group (Foxconn)

- Google Inc

- Synology Inc

Key Milestones in Residential Router Industry Industry

- March 2023: NETGEAR launched its first Wi-Fi 7-capable router, significantly increasing peak data rates and impacting high-bandwidth applications.

- March 2023: Siemens launched the first 5G industrial router, expanding the applicability of router technology beyond the residential sector.

- January 2023: Synology expanded its Wi-Fi 6 router line, strengthening its position in the market by providing improved performance and security.

Strategic Outlook for Residential Router Industry Market

The residential router market is poised for sustained growth, driven by technological innovations and increasing demand for high-speed, secure connectivity. Strategic partnerships, expansion into emerging markets, and investment in research and development of next-generation technologies (e.g., Wi-Fi 7, LiFi) will be crucial for success. The market's future depends on continued innovation in speed, security, and user experience.

Residential Router Industry Segmentation

-

1. Connectivity Type

- 1.1. Wired

- 1.2. Wireless

-

2. Standard

- 2.1. 802.11b/g/n

- 2.2. 802.11ac

- 2.3. 802.11ax

Residential Router Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Residential Router Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Connected Devices and Proliferating Smart Homes Market; Growth in IP Traffic

- 3.3. Market Restrains

- 3.3.1. Growing Threat of Video Content Piracy and Security Threat of User Database Due to Spyware

- 3.4. Market Trends

- 3.4.1. Wireless Connectivity to Witness the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Standard

- 5.2.1. 802.11b/g/n

- 5.2.2. 802.11ac

- 5.2.3. 802.11ax

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 6. North America Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Standard

- 6.2.1. 802.11b/g/n

- 6.2.2. 802.11ac

- 6.2.3. 802.11ax

- 6.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 7. Europe Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Standard

- 7.2.1. 802.11b/g/n

- 7.2.2. 802.11ac

- 7.2.3. 802.11ax

- 7.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 8. Asia Pacific Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Standard

- 8.2.1. 802.11b/g/n

- 8.2.2. 802.11ac

- 8.2.3. 802.11ax

- 8.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 9. Latin America Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Standard

- 9.2.1. 802.11b/g/n

- 9.2.2. 802.11ac

- 9.2.3. 802.11ax

- 9.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 10. Middle East and Africa Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Standard

- 10.2.1. 802.11b/g/n

- 10.2.2. 802.11ac

- 10.2.3. 802.11ax

- 10.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 11. North America Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 Rest of Europe

- 13. Asia Pacific Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Residential Router Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Xiaomi Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Nokia Networks

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Netgear Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 AsusTek Computer Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 TRENDnet Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 TP-Link Technologies Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 D-Link Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Linksys Group (Foxconn)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Google Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Synology Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Xiaomi Inc

List of Figures

- Figure 1: Global Residential Router Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Residential Router Industry Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 13: North America Residential Router Industry Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 14: North America Residential Router Industry Revenue (Million), by Standard 2024 & 2032

- Figure 15: North America Residential Router Industry Revenue Share (%), by Standard 2024 & 2032

- Figure 16: North America Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Residential Router Industry Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 19: Europe Residential Router Industry Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 20: Europe Residential Router Industry Revenue (Million), by Standard 2024 & 2032

- Figure 21: Europe Residential Router Industry Revenue Share (%), by Standard 2024 & 2032

- Figure 22: Europe Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Residential Router Industry Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 25: Asia Pacific Residential Router Industry Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 26: Asia Pacific Residential Router Industry Revenue (Million), by Standard 2024 & 2032

- Figure 27: Asia Pacific Residential Router Industry Revenue Share (%), by Standard 2024 & 2032

- Figure 28: Asia Pacific Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Residential Router Industry Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 31: Latin America Residential Router Industry Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 32: Latin America Residential Router Industry Revenue (Million), by Standard 2024 & 2032

- Figure 33: Latin America Residential Router Industry Revenue Share (%), by Standard 2024 & 2032

- Figure 34: Latin America Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Residential Router Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Residential Router Industry Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 37: Middle East and Africa Residential Router Industry Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 38: Middle East and Africa Residential Router Industry Revenue (Million), by Standard 2024 & 2032

- Figure 39: Middle East and Africa Residential Router Industry Revenue Share (%), by Standard 2024 & 2032

- Figure 40: Middle East and Africa Residential Router Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Residential Router Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Router Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Router Industry Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 3: Global Residential Router Industry Revenue Million Forecast, by Standard 2019 & 2032

- Table 4: Global Residential Router Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Residential Router Industry Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 22: Global Residential Router Industry Revenue Million Forecast, by Standard 2019 & 2032

- Table 23: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Canada Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Residential Router Industry Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 27: Global Residential Router Industry Revenue Million Forecast, by Standard 2019 & 2032

- Table 28: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Europe Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Residential Router Industry Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 33: Global Residential Router Industry Revenue Million Forecast, by Standard 2019 & 2032

- Table 34: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Asia Pacific Residential Router Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Residential Router Industry Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 40: Global Residential Router Industry Revenue Million Forecast, by Standard 2019 & 2032

- Table 41: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Residential Router Industry Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 43: Global Residential Router Industry Revenue Million Forecast, by Standard 2019 & 2032

- Table 44: Global Residential Router Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Router Industry?

The projected CAGR is approximately 9.06%.

2. Which companies are prominent players in the Residential Router Industry?

Key companies in the market include Xiaomi Inc, Nokia Networks, Netgear Inc, AsusTek Computer Inc, TRENDnet Inc, TP-Link Technologies Co Ltd, D-Link Corporation, Linksys Group (Foxconn), Google Inc, Synology Inc.

3. What are the main segments of the Residential Router Industry?

The market segments include Connectivity Type, Standard.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Connected Devices and Proliferating Smart Homes Market; Growth in IP Traffic.

6. What are the notable trends driving market growth?

Wireless Connectivity to Witness the Market Growth.

7. Are there any restraints impacting market growth?

Growing Threat of Video Content Piracy and Security Threat of User Database Due to Spyware.

8. Can you provide examples of recent developments in the market?

March 202: NETGEAR launched its first Wi-Fi 7-capable router, claiming to be the world's fastest consumer-grade networking device capable of 19 Gbps peak data rate. The router will support low-latency AR/VR gaming, UHD Zoom calls, and 8k simultaneous streaming. It is designed to house antennas for 360-degree coverage of up to 3,500 square feet. For additional coverage, two or more RS700 units can mesh together.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Router Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Router Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Router Industry?

To stay informed about further developments, trends, and reports in the Residential Router Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence