Key Insights

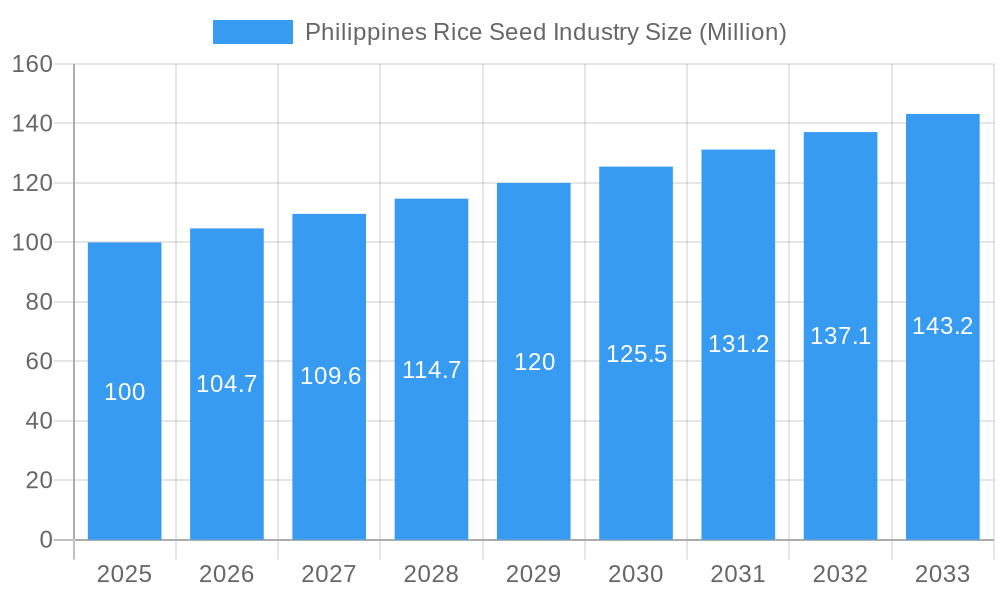

The Philippines rice seed market, valued at approximately $576.53 million in 2025, is poised for substantial expansion. Driven by escalating demand for high-yield, disease-resistant rice varieties, the market is projected to grow at a compound annual growth rate (CAGR) of 3.55% from 2025 to 2033. Key growth drivers include a rising population, increased rice consumption, and technological advancements in hybrid rice breeding for enhanced yield and pest resistance. Government initiatives supporting sustainable agriculture and seed producers further bolster industry growth. Prominent players such as DCM Shriram Ltd (Bioseed), SL Agritech Corporation (SLAC), Bayer AG, and Syngenta Group are actively shaping the competitive landscape. Challenges like climate change and seed-borne diseases may present hurdles, but the dominance of hybrid rice seeds, alongside significant market shares for open-pollinated and hybrid derivative varieties, indicates strong market potential.

Philippines Rice Seed Industry Market Size (In Million)

The competitive environment features a blend of domestic and international participants focused on product innovation, strategic alliances, and technological advancements. Success in this expanding market will hinge on enhancing seed quality, promoting climate resilience, and optimizing distribution networks. The Philippines' unique agricultural landscape will continue to influence regional demand for specific rice seed types. The 2025-2033 forecast period offers significant opportunities for companies to invest in R&D, strengthen distribution, and meet the evolving needs of Filipino farmers.

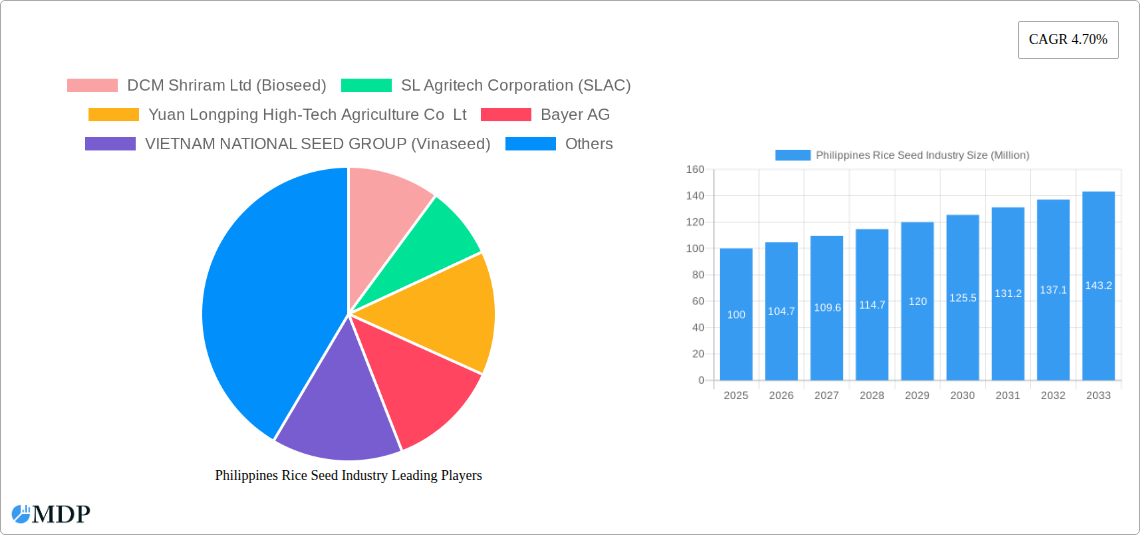

Philippines Rice Seed Industry Company Market Share

Philippines Rice Seed Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Philippines rice seed industry, covering market dynamics, leading players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry stakeholders, investors, and researchers seeking to understand and capitalize on opportunities within this dynamic sector. The report uses millions (M) for all values.

Philippines Rice Seed Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market trends impacting the Philippines rice seed industry. The market exhibits a moderately concentrated structure, with key players holding significant market shares. However, the presence of numerous smaller players and the potential for new entrants suggests a dynamic competitive landscape.

Market Concentration:

- The top five players account for approximately xx% of the market share in 2025.

- The market is characterized by both domestic and international players.

- Consolidation through mergers and acquisitions (M&A) is a potential trend. The number of M&A deals in the historical period (2019-2024) was xx.

Innovation Drivers:

- The demand for high-yielding, disease-resistant, and climate-resilient rice varieties drives innovation in breeding technologies.

- Development of hybrid rice seeds and other improved traits remains a key focus.

- Public-private partnerships, like the Bioseed-IRRI collaboration, play a crucial role in fostering innovation.

Regulatory Frameworks:

- The regulatory environment influences seed production, distribution, and trade.

- Compliance with phytosanitary regulations is essential.

- Government policies and incentives impact industry growth.

Product Substitutes:

- The primary substitute for improved rice seeds is traditional open-pollinated varieties.

- The competitive advantage of improved seeds is their superior yield and quality.

- The introduction of genetically modified (GM) rice remains a sensitive issue.

End-User Trends:

- Farmers increasingly demand high-yielding, quality seeds.

- Growing awareness of climate change impacts drives demand for climate-resilient varieties.

- Government initiatives to promote improved seed adoption influence end-user behaviour.

M&A Activities:

- M&A activities in the sector have been relatively low in recent years but are expected to increase.

- Acquisitions by larger companies are aimed at consolidating market share and broadening product portfolios.

- Strategic partnerships between domestic and international companies are emerging.

Philippines Rice Seed Industry Industry Trends & Analysis

The Philippines rice seed industry is experiencing significant growth driven by various factors including increasing demand for high-quality rice, technological advancements in breeding and seed production, and supportive government policies.

The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) was xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Market penetration of hybrid rice seeds is currently at xx% and is expected to reach xx% by 2033. Key factors driving this growth include:

- Increasing rice consumption and population growth are primary drivers of demand.

- Government initiatives to improve agricultural productivity and ensure food security boost the industry.

- Technological advancements such as marker-assisted selection and genetic engineering are enabling the development of superior rice varieties.

- Climate change adaptation strategies drive demand for climate-resilient seed varieties.

- Rising farmer income and improved access to credit enhance the adoption of improved seeds.

- Competitive dynamics amongst seed companies encourage innovation and efficiency.

Leading Markets & Segments in Philippines Rice Seed Industry

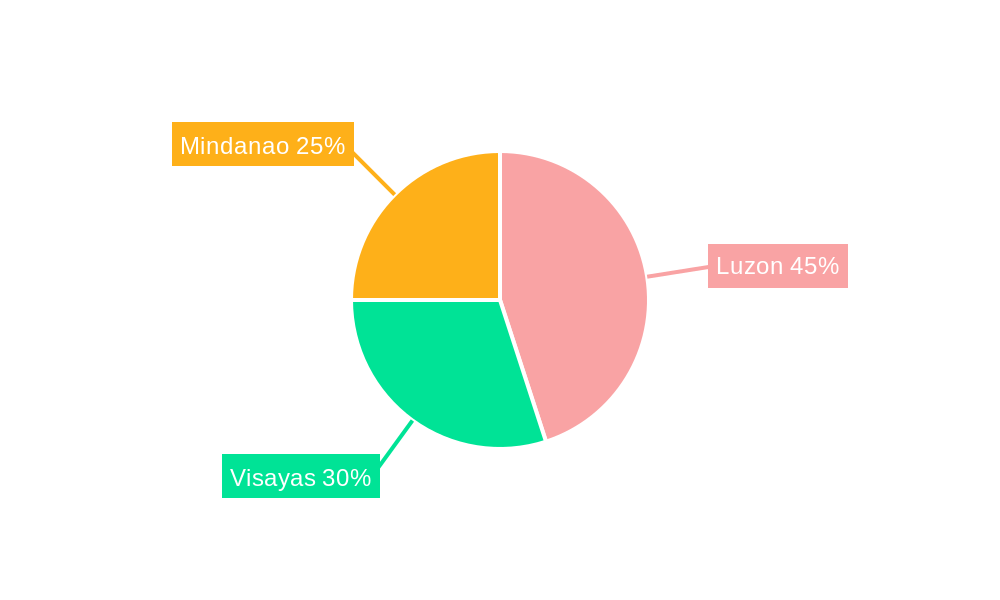

The Philippines rice seed market is dominated by Luzon region due to high rice production and concentration of farming activities. High-yielding hybrid rice varieties constitute a major segment, driven by increasing farmer preference for superior productivity and consistent returns.

Key Drivers for Hybrid Rice Segment Dominance:

- High Yield Potential: Hybrid rice significantly outperforms traditional varieties in yield.

- Improved Quality: Hybrids often exhibit better grain quality, leading to increased market value.

- Disease Resistance: Many hybrid varieties offer improved resistance to common rice diseases, minimizing losses.

- Government Support: Government programs and subsidies often promote the adoption of hybrid rice.

- Technological Advancements: Continuous improvements in hybrid rice breeding enhance its attributes.

Analysis of Other Segments:

- Open Pollinated Varieties & Hybrid Derivatives: These varieties maintain market presence due to lower cost and familiarity.

- Other Traits (e.g., drought tolerance, salinity tolerance): Increasingly crucial in the face of climate change, driving market expansion.

Regional Dominance:

- Luzon region exhibits the highest demand due to intense rice cultivation and higher farmer incomes.

- Other regions like Visayas and Mindanao lag in adoption but are showing increasing demand.

Philippines Rice Seed Industry Product Developments

Recent product innovations focus on developing climate-resilient hybrid rice varieties with enhanced disease resistance, improved grain quality, and higher yields. Companies are leveraging advanced breeding technologies like marker-assisted selection and genomic selection to accelerate the development process. The market is witnessing a shift towards high-value, customized seed solutions tailored to specific agro-climatic conditions and farmer needs. This offers companies a competitive edge by satisfying specific market demands and improving adoption rates.

Key Drivers of Philippines Rice Seed Industry Growth

Several factors fuel the growth of the Philippines rice seed industry. These include advancements in breeding technologies leading to improved rice varieties with better yield and disease resistance. Furthermore, government support through subsidies and extension services promotes seed adoption. Economic growth and rising farmer incomes increase investment in high-quality seeds. Favorable climatic conditions and access to irrigation further enhance productivity.

Challenges in the Philippines Rice Seed Industry Market

The Philippines rice seed industry faces challenges including limited access to credit for farmers, restricting adoption of high-quality seeds. High production and distribution costs negatively impact affordability. The presence of counterfeit seeds undermines trust and reduces farmer profitability. Furthermore, stringent regulatory frameworks can pose hurdles for innovation and market entry. The overall impact of these challenges is an estimated xx M loss annually.

Emerging Opportunities in Philippines Rice Seed Industry

Significant opportunities exist in developing and commercializing high-yielding, climate-resilient, and nutrient-efficient rice varieties. Strategic partnerships between seed companies, research institutions, and government agencies can foster innovation and technology transfer. Expanding into new markets and exploring export potential can unlock further growth. Investment in seed production infrastructure and technology will improve efficiency and reduce costs.

Leading Players in the Philippines Rice Seed Industry Sector

- DCM Shriram Ltd (Bioseed)

- SL Agritech Corporation (SLAC)

- Yuan Longping High-Tech Agriculture Co Lt

- Bayer AG

- VIETNAM NATIONAL SEED GROUP (Vinaseed)

- Syngenta Group

- Advanta Seeds - UPL

- Corteva Agriscience

- SeedWorks International Pvt Ltd

Key Milestones in Philippines Rice Seed Industry Industry

- June 2021: Bioseed launched a Bio-Innovation Center in partnership with IRRI, focusing on research and innovation. This significantly boosted R&D capabilities.

- October 2022: SL Agritech Corporation raised USD 728 million through commercial papers, strengthening its financial position and allowing increased investment in seed production.

- November 2022: SLAC signed an MOA with BDAC for SL-8H F1 seed production, expanding its market reach and facilitating technological collaboration.

Strategic Outlook for Philippines Rice Seed Industry Market

The Philippines rice seed industry is poised for robust growth driven by technological advancements, rising demand for high-quality seeds, and supportive government policies. Companies that invest in R&D, adopt advanced breeding technologies, and build strong distribution networks are likely to succeed. Strategic partnerships and collaborations will be crucial for unlocking further growth potential. The focus on developing climate-smart varieties will be a key determinant of future market share.

Philippines Rice Seed Industry Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Other Traits

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Breeding Technology

-

2.1. Hybrids

- 2.1.1. Non-Transgenic Hybrids

- 2.1.2. Other Traits

- 2.2. Open Pollinated Varieties & Hybrid Derivatives

-

2.1. Hybrids

Philippines Rice Seed Industry Segmentation By Geography

- 1. Philippines

Philippines Rice Seed Industry Regional Market Share

Geographic Coverage of Philippines Rice Seed Industry

Philippines Rice Seed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Rice Seed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Other Traits

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.2.1. Hybrids

- 5.2.1.1. Non-Transgenic Hybrids

- 5.2.1.2. Other Traits

- 5.2.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.2.1. Hybrids

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DCM Shriram Ltd (Bioseed)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SL Agritech Corporation (SLAC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yuan Longping High-Tech Agriculture Co Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 VIETNAM NATIONAL SEED GROUP (Vinaseed)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanta Seeds - UPL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SeedWorks International Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 DCM Shriram Ltd (Bioseed)

List of Figures

- Figure 1: Philippines Rice Seed Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Philippines Rice Seed Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Rice Seed Industry Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 2: Philippines Rice Seed Industry Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 3: Philippines Rice Seed Industry Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 4: Philippines Rice Seed Industry Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 5: Philippines Rice Seed Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Philippines Rice Seed Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Philippines Rice Seed Industry Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 8: Philippines Rice Seed Industry Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 9: Philippines Rice Seed Industry Revenue million Forecast, by Breeding Technology 2020 & 2033

- Table 10: Philippines Rice Seed Industry Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 11: Philippines Rice Seed Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Philippines Rice Seed Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Rice Seed Industry?

The projected CAGR is approximately 3.55%.

2. Which companies are prominent players in the Philippines Rice Seed Industry?

Key companies in the market include DCM Shriram Ltd (Bioseed), SL Agritech Corporation (SLAC), Yuan Longping High-Tech Agriculture Co Lt, Bayer AG, VIETNAM NATIONAL SEED GROUP (Vinaseed), Syngenta Group, Advanta Seeds - UPL, Corteva Agriscience, SeedWorks International Pvt Ltd.

3. What are the main segments of the Philippines Rice Seed Industry?

The market segments include Breeding Technology, Breeding Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 576.53 million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: Agritech Corporation (SLAC) and the Bangladesh Agricultural Development Corp (BDAC) signed a memorandum of agreement (MOA) for the production of SL-8H F1 seeds. This agreement is a significant step in strengthening agricultural technology development and collaboration between the Philippines and Bangladesh.October 2022: SL Agritech Corporation (SLAC) has raised USD 728 million through the issuance of commercial papers. The funds generated from these issuances will be utilized to meet the company's short-term obligations and purchase rice and seed inventories from its contract growers.June 2021: Bioseed, a subsidiary of DCM Shriram, launched a Bio-Innovation Center through the IRRI (International Rice Research Institute) partnership. It is a new initiative focused on research products and innovations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Rice Seed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Rice Seed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Rice Seed Industry?

To stay informed about further developments, trends, and reports in the Philippines Rice Seed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence