Key Insights

The North American portable generator market, projected at $4.8 billion in the base year 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This growth is driven by escalating demand for reliable backup power solutions in residential areas, spurred by the increasing frequency of natural disasters and widespread use of sensitive electronics. Commercial and industrial sectors also significantly contribute, prioritizing operational continuity and disruption mitigation. Technological advancements, yielding quieter, more fuel-efficient, and eco-friendly models, further stimulate adoption. The market is segmented by power rating (under 5 kW, 5-10 kW, over 10 kW), fuel type (gas, diesel, other), and end-user (residential, commercial, industrial). Gas-powered generators currently lead due to cost-effectiveness, while diesel units are favored in industrial applications for their robust performance. The residential segment is a substantial market driver, reflecting strong consumer demand.

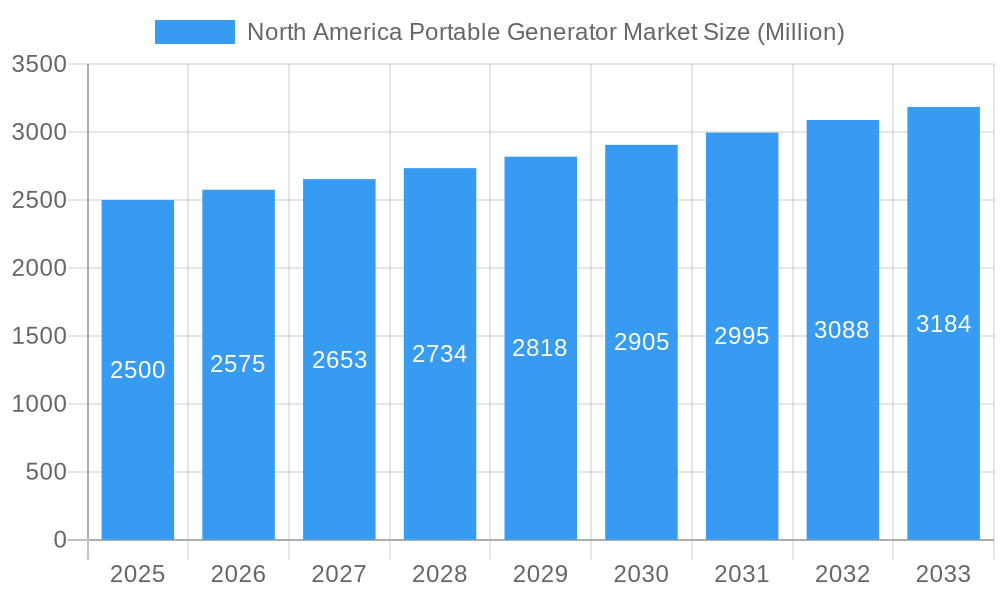

North America Portable Generator Market Market Size (In Billion)

Key market participants include established brands like Generac Holdings Inc., Kohler Power Systems, and Briggs & Stratton Corporation, alongside global leaders such as Caterpillar Inc. and Cummins Inc. These companies are focused on innovation and strategic collaborations to strengthen their market presence. Despite challenges posed by volatile fuel prices and stringent emission standards, the persistent need for dependable power backup is expected to ensure sustained market growth. The United States, a major component of the North American market, exhibits high adoption rates, significantly influencing the global portable generator landscape.

North America Portable Generator Market Company Market Share

North America Portable Generator Market Report: 2019-2033

Dive deep into the comprehensive analysis of the North America Portable Generator Market, projecting a robust growth trajectory from 2025 to 2033. This in-depth report provides invaluable insights into market dynamics, industry trends, leading segments, and key players shaping this dynamic sector. Benefit from detailed forecasts, competitive landscapes, and strategic recommendations tailored for informed decision-making. The report covers the period 2019-2033, with 2025 as the base and estimated year.

North America Portable Generator Market Market Dynamics & Concentration

The North American portable generator market exhibits a moderately concentrated landscape, with key players holding significant market share. Generac Holdings Inc, Kohler Power Systems, and others dominate the market, benefiting from established brand recognition and extensive distribution networks. Market concentration is influenced by factors including economies of scale, technological advancements, and intense competition. The market share of the top 5 players is estimated to be around xx% in 2025.

Innovation Drivers: Continuous innovation in fuel efficiency, power output, and emission reduction technologies are key drivers. The rising adoption of inverter generators contributes significantly to the market's growth.

Regulatory Frameworks: Stringent emission standards and safety regulations across North America are shaping product development and influencing market dynamics.

Product Substitutes: While portable generators serve a unique purpose, alternative power solutions like solar panels and UPS systems pose some level of substitution, particularly in specific applications.

End-User Trends: Increasing demand from residential, commercial, and industrial sectors fuels market expansion, driven by factors such as power outages, remote work trends, and industrial needs for backup power. Residential consumers represent the largest segment, followed by commercial and industrial users.

M&A Activities: The number of M&A deals in the portable generator market in North America has shown a fluctuating trend in the recent past, with xx deals recorded in 2024. Consolidation among players is likely to continue as companies seek to enhance market share and expand their product portfolios.

North America Portable Generator Market Industry Trends & Analysis

The North American portable generator market demonstrates substantial growth potential, driven by multiple factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by increasing concerns over power grid reliability, expanding construction activities, and rising demand for backup power in various sectors, particularly in regions prone to natural disasters.

Technological disruptions, including the advent of cleaner and more efficient fuel technologies and enhanced digital features (remote monitoring, control) are reshaping the market. Consumer preferences are shifting towards quieter, more fuel-efficient, and user-friendly models. The market penetration of inverter generators is rapidly increasing, signifying a major technological shift in consumer demand. Competitive dynamics remain intense, with established players facing pressure from new entrants offering innovative solutions.

Leading Markets & Segments in North America Portable Generator Market

Dominant Segments:

- Power Rating: The 5-10 kW segment holds the largest market share, driven by its versatility across diverse applications. The below 5 kW segment is experiencing substantial growth due to increasing demand for smaller, lighter units. The above 10 kW segment caters to heavy-duty applications.

- Fuel Type: Gasoline-powered generators currently dominate the market due to their wide availability and cost-effectiveness. However, diesel generators maintain a significant presence in industrial applications. The "other fuel types" segment, although smaller, is growing due to increasing adoption of propane generators for cleaner energy options.

- End User: The residential segment represents the largest share due to its broad base of individual homeowners, followed by the commercial and industrial sectors.

Key Drivers by Segment:

- Residential: Rising frequency of power outages, increasing awareness of backup power needs, and growing adoption of advanced home security systems are crucial drivers.

- Commercial: Demand is fueled by the need for continuous operations in critical commercial sectors and increased focus on business continuity plans.

- Industrial: Stable demand is driven by the requirement for reliable power in manufacturing, construction, and other industrial applications.

Regional dominance: The xx region in North America is expected to capture the largest market share because of xx.

North America Portable Generator Market Product Developments

Recent product innovations focus on enhanced fuel efficiency, reduced noise levels, and integration of advanced control features like remote monitoring and smart capabilities. The introduction of hydrogen fuel-cell technology represents a significant breakthrough, promising a cleaner and more sustainable alternative. Products featuring digital interfaces and smartphone connectivity are gaining popularity. Market fit is largely determined by the balance of power output, fuel efficiency, and price points, while keeping regulatory requirements in mind.

Key Drivers of North America Portable Generator Market Growth

Several factors contribute to the market's growth: increasing frequency of power outages and natural disasters necessitates backup power solutions. The growing construction and infrastructure development sectors require portable generators for various applications. Government initiatives promoting energy security and resilience are indirectly boosting demand. Technological advancements in fuel efficiency and emission reduction are making portable generators more environmentally friendly and attractive.

Challenges in the North America Portable Generator Market Market

The market faces challenges including fluctuating fuel prices and supply chain disruptions that affect manufacturing and product availability. Stringent environmental regulations and emission standards necessitate increased investment in R&D for cleaner technologies. Competition from alternative power sources like solar and battery storage presents a significant challenge to the dominance of portable generators, especially in certain consumer segments.

Emerging Opportunities in North America Portable Generator Market

The market presents several significant opportunities. Advances in battery technology and fuel cell technology open doors for more efficient and environmentally friendly generators. Strategic partnerships with renewable energy providers can broaden market reach and attract environmentally conscious customers. Expansion into new applications in sectors like emergency response and healthcare are expected to stimulate growth.

Leading Players in the North America Portable Generator Market Sector

Key Milestones in North America Portable Generator Market Industry

- January 2022: Honda announced the launch of its new EU32i portable generator, targeting the North American market.

- February 2022: MIT Lincoln Laboratory demonstrated a prototype portable hydrogen fuel generator for the USMC, showcasing potential technological advancements.

Strategic Outlook for North America Portable Generator Market Market

The North American portable generator market holds significant long-term growth potential. Strategic opportunities lie in developing environmentally friendly solutions, leveraging technological advancements in fuel cells and battery storage, and exploring innovative applications in emerging sectors. Companies focusing on innovation, sustainability, and strategic partnerships are positioned to capture a larger share of the market.

North America Portable Generator Market Segmentation

-

1. Power Rating

- 1.1. Below 5 kW

- 1.2. 5-10 kW

- 1.3. Above 10 kW

-

2. Fuel Type

- 2.1. Gas

- 2.2. Diesel

- 2.3. Other Fuel Types

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Portable Generator Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Portable Generator Market Regional Market Share

Geographic Coverage of North America Portable Generator Market

North America Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Regarding Natural Gas as a Clean and Reliable Fuel4.; Increasing Concerns Over Diesel Maintenance and Refueling Issues

- 3.3. Market Restrains

- 3.3.1 Lack of Gas Grid Connectivity Via Pipeline

- 3.3.2 Resulting in Hindered Fuel Supply

- 3.4. Market Trends

- 3.4.1. Diesel Fuel Type Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 5.1.1. Below 5 kW

- 5.1.2. 5-10 kW

- 5.1.3. Above 10 kW

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gas

- 5.2.2. Diesel

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Power Rating

- 6. United States North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 6.1.1. Below 5 kW

- 6.1.2. 5-10 kW

- 6.1.3. Above 10 kW

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gas

- 6.2.2. Diesel

- 6.2.3. Other Fuel Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Power Rating

- 7. Canada North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 7.1.1. Below 5 kW

- 7.1.2. 5-10 kW

- 7.1.3. Above 10 kW

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gas

- 7.2.2. Diesel

- 7.2.3. Other Fuel Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Power Rating

- 8. Rest of North America North America Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 8.1.1. Below 5 kW

- 8.1.2. 5-10 kW

- 8.1.3. Above 10 kW

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gas

- 8.2.2. Diesel

- 8.2.3. Other Fuel Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Power Rating

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Yamaha Motor Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Briggs & Stratton Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Atlas Copco AB

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eaton Corporation PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Caterpillar Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cummins Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kohler Power Systems

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Wacker Neuson SE

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Generac Holdings Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 General Electric Company*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Yamaha Motor Co Ltd

List of Figures

- Figure 1: North America Portable Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Portable Generator Market Share (%) by Company 2025

List of Tables

- Table 1: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 2: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 3: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 5: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: North America Portable Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America Portable Generator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 12: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 13: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 15: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 16: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: North America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 22: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 23: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 24: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 25: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: North America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: North America Portable Generator Market Revenue billion Forecast, by Power Rating 2020 & 2033

- Table 32: North America Portable Generator Market Volume K Unit Forecast, by Power Rating 2020 & 2033

- Table 33: North America Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 34: North America Portable Generator Market Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 35: North America Portable Generator Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: North America Portable Generator Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: North America Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Portable Generator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: North America Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Portable Generator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Portable Generator Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Portable Generator Market?

Key companies in the market include Yamaha Motor Co Ltd, Briggs & Stratton Corporation, Atlas Copco AB, Eaton Corporation PLC, Caterpillar Inc, Cummins Inc, Kohler Power Systems, Wacker Neuson SE, Generac Holdings Inc, General Electric Company*List Not Exhaustive.

3. What are the main segments of the North America Portable Generator Market?

The market segments include Power Rating, Fuel Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Regarding Natural Gas as a Clean and Reliable Fuel4.; Increasing Concerns Over Diesel Maintenance and Refueling Issues.

6. What are the notable trends driving market growth?

Diesel Fuel Type Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Gas Grid Connectivity Via Pipeline. Resulting in Hindered Fuel Supply.

8. Can you provide examples of recent developments in the market?

In February 2022, the Massachusetts Institute of Technology (MIT) Lincoln Laboratory conducted a demonstration for the USMC regarding the portable hydrogen fuel generator. This prototype device converts aluminum into hydrogen fuel by reacting with water in any form, even urine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Portable Generator Market?

To stay informed about further developments, trends, and reports in the North America Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence